Diverse Payment Solutions: Boost Revenue with APMs

Reach new markets with over 50+ Alternative Payment Methods (APMs) tailored to different regions.

When it comes to handling payments, credit cards have long been the go-to method worldwide. However, this traditional approach may not always be universally effective, as different regions have unique preferences and needs when it comes to conducting transactions. In certain areas, alternative payment methods (APMs) offer greater efficiency and cost-effectiveness. These regions range from developing countries in Africa to well-established economies in Europe and North America.

To meet the global demand for diverse payment options, Paybis has introduced a wide range of Alternative Payment Methods into our white label on/off-ramp solution. With over 50+ payment options, Paybis proudly boasts the highest number of available APMs across all onramps, and we continue to add more on a regular basis. By partnering with us, businesses can tap into different customer segments and generate significant revenue streams from nearly all over the world.

Table of contents

APMs by Paybis

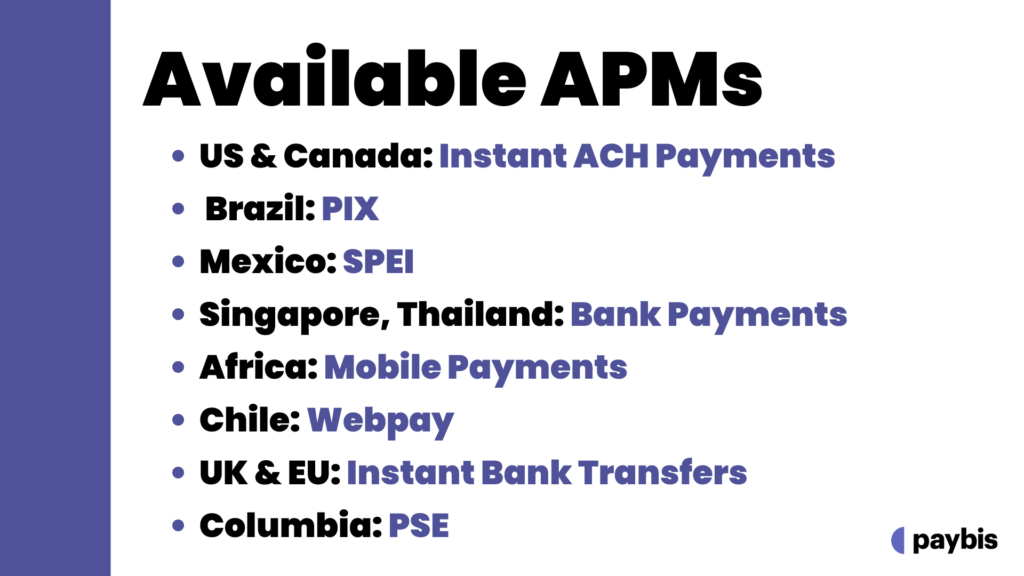

Below are some of the outstanding APMs we offer.

Instant Bank Transfer in the UK and Europe

While credit cards are widespread in Europe, a significant percentage of people prefer paying for goods and services via bank transfers due to lower fees. And when it comes to instant SEPA rails, transactions are approved almost instantly, making it an even better choice.

Instant Bank payments in the USA (ACH) and Canada

Even in countries where credit cards are prevalent, ACH plays a significant role in complementing existing payment options. ACH facilitates secure electronic bank-to-bank transfers, providing individuals and businesses with a convenient way to send and receive funds. Moreover, the fees associated with ACH transactions are typically much lower and approval rates are much higher than those for credit card payments.

Brazil and Latin America

The PIX payment system has gained immense popularity in Brazil, offering instant peer-to-peer transfers between individuals and businesses. Each Latin American region has its own preferred method, such as SPEI in Mexico, PSE in Colombia, and WebPay in Chile, to name a few.

Bank Payments in Singapore and Thailand

In Asia, credit cards are widely used, but bank payments are also highly popular. We offer bank transfers in local currencies for countries like Indonesia, Singapore, Thailand, Vietnam, and the Philippines, as well as the ability to pay with ThaiQR and other e-wallets.

Mobile Payments in Africa

Despite a large percentage of the unbanked population in Africa, nearly everyone owns a mobile phone that acts as a bank account, credit card, and phone simultaneously. Paybis provides a wide range of payment choices tailored to each African country.

Other Payment Methods

In addition to these APMs, we also support various other payment methods from various regions, including Apple Pay, Google Pay, AstroPay, Skrill, Neteller, and other e-wallets. By utilizing our solution, you can significantly increase your customer base, improve onboarding experiences, and boost revenue.

Main Regions

Now, let’s take a closer look at the main regions we cover, their demographics, and the adoption of cryptocurrencies.

Worldwide, credit cards are still the most preferable payment method, but our solution also gives access to Apple Pay/Google Pay, AstroPay, Skrill and Neteller. We also enable more efficient operations with domestic processing acquirers available in Europe, UK or USA, which allows to skyrocket approval rates, avoid cross-border transactions and process them cheaper in certain regions.

Europe

With 31 million crypto owners and relatively high income levels, credit cards are undoubtedly popular. However, some European countries still prefer alternative methods like Instant SEPA bank transfers, GBP payments via the Faster Payment Network, or Giropay in Germany. We continuously work on expanding our offering, and within the next three months, we will add more than 7 additional APMs in Europe, including Vipps, Blick, eps, iDEAL, PayNow, Bizum, Bancontact and Cartes Bancaires. This variety effectively complements credit card payments, providing greater approval rates and cost advantages in Europe and the UK.

North America

With 54 million crypto owners, North America is characterized by high living standards and significant purchasing power. While credit cards are prevalent, we offer something extraordinary for this region – instant bank payments (ACH Routing) in the US and instant bank payments in Canada. Our partners benefit from every possible payment method with full protection from fraud, no liabilities, and up to 95% approval of banking payments in the USA compared to credit cards. Additionally, we offer lower fees, increased payment approval rates, and the opportunity to drive sales to new heights – all with one simple integration.

South America

South America is a region where credit cards may not be as popular or effective, with around 33 million crypto users. In response to this, we offer local payment methods tailored to each country. People can perform transactions using methods that typically hold about an 80% share of the market. Paybis covers Brazil (PIX), Mexico (SPEI), Colombia (PSE), Chile (WebPAY), and AstroPay (LATAM countries), each one of them being a much more efficient payment method. This encourages people in the region to use APMs for small transactions and opens up new market opportunities.

Africa

Africa, with around 38 million crypto users, presents a unique landscape with limited credit card adoption and a large unbanked population. However, nearly everyone owns a mobile phone that serves as a bank account, credit card, and phone combined. To cater to the African region, we focus on mobile phone payments and will soon be releasing a wide range of options for various African countries. Users will be able to conduct payments from countries such as Burkina Faso, Cameroon, Egypt, Ghana, Kenya, Morocco, Nigeria, South Africa, Uganda, and many more.

Asia

Asia is a powerhouse in terms of cryptocurrency adoption, with a staggering 260 million crypto owners. Recognizing the significance of this region, we actively focus on its development. Bank payments play a significant role, and we offer bank payment solutions in multiple countries to ensure seamless transactions for users. Additionally, we connect with popular e-Money platforms to expand payment options even further.

Each market has its unique characteristics and requirements, necessitating a tailored solution. At Paybis, we understand the importance of focusing on your core strengths: creating brilliant products and attracting new clients. By integrating our solution, you can rely on us to open up new client segments and ensure a smooth, hassle-free experience, converting clients into revenue.

If you’re interested in learning more about how we can enhance your platform, please contact one of our sales agents.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info