What To Look for When Choosing an On-Ramp for Your Business

The convergence of the TradFi ecosystem with that of digital assets is crucial for widespread adoption.

This synthesis is facilitated through crypto on/off-ramps, acting as a transformative channel between fiat and crypto spheres, enabling seamless transactions and fostering the integration of businesses into the blockchain ecosystem.

However, the labyrinth of choosing the right on-ramp is laden with ambiguity and myriad choices, leaving businesses adrift in a sea of uncertainty.

Different providers come with their unique selling propositions, each promising a tailored fit for diverse business needs while conveniently ignoring (or even masking) the product’s downsides. This puts business decision-makers in a tight spot.

Acknowledging this complexity, this article serves as a concise insightful guide to help businesses choose the right cryptocurrency on/off-ramp to integrate onto their website or app.

Table of contents

- White Label On/Off-Ramp Checklist for Businesses

- 1. Evaluate strategic foundations like operational markets and supported currencies

- 2. Understand if they can navigate the financial and compliance landscape

- 3. Check for robust security protocols and provider credibility

- 4. Look for ease of integration and UX customizability

- 5. Deep-dive into additional offerings from the provider

- 6. Check if they can adapt to a changing regulatory landscape

- More Reasons to Integrate Paybis

- Conclusion

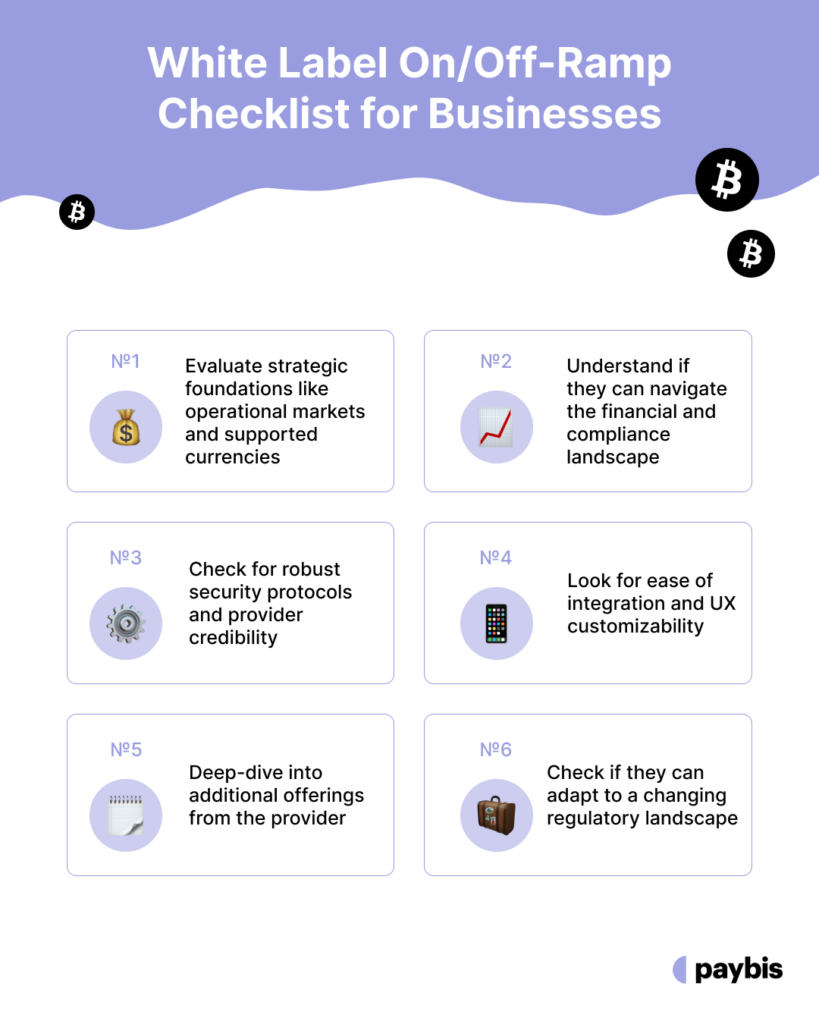

White Label On/Off-Ramp Checklist for Businesses

Use the following checklist when evaluating an on-ramp for your business:

- Evaluate strategic foundations like operational markets and supported currencies

- Understand if they can navigate the financial and compliance landscape

- Check for robust security protocols and provider credibility

- Look for ease of integration and UX customizability

- Deep-dive into additional offerings from the provider

- Check if they can adapt to a changing regulatory landscape

Now, let’s take a closer look at each of these.

1. Evaluate strategic foundations like operational markets and supported currencies

Wide Geographical Coverage

The ability of a crypto on/off-ramp to cast a wide net in terms of geographical coverage is a significant advantage.

For instance, Paybis, with its reach extending to over 180 countries, offers a quintessential example of extensive geographical coverage. Such expansive reach not only amplifies the potential user base but also escalates the global footprint of integrated businesses, making the services accessible to a diverse array of users worldwide.

As the geographical canvas broadens, so does the complexity associated with adhering to local compliance needs.

Each region, country, or even state can have their own specific rules and requirements that need careful attention and a deep understanding. This means that the companies providing on/off-ramp services should not only know these different sets of laws well but also be able to easily adjust to changing regulations.

Multi-Currency Support & Payment Orchestration

Beyond geographical considerations, the integration of a robust fiat and payment framework is crucial. The significance of supporting a broad spectrum of predominant fiat currencies such as USD, EUR, GBP, etc., cannot be overstated. This diversity in currency acceptance ensures that users across different regions can transact in their native or preferred currencies via local payment methods like Skrill, Neteller, Mobile Money and more; enhancing user convenience and fostering inclusivity.

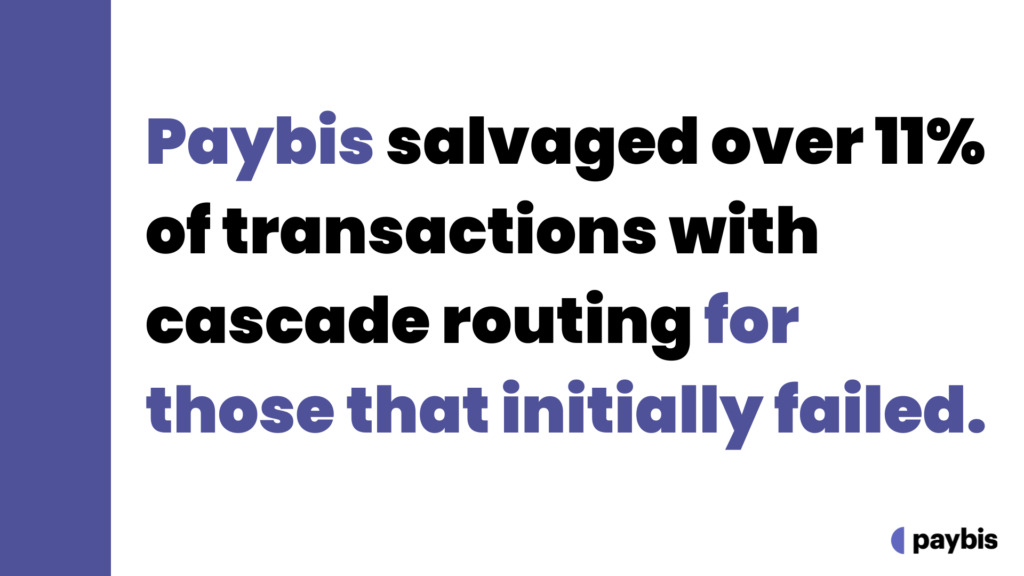

The essence of having a successful on-ramp lies not just in accommodating a variety of fiat currencies like USD, EUR, CNY, etc., but also in ensuring the seamless completion of transactions.

Paybis’ payment orchestration layer intelligently cascades failed card transactions to other aquirers by evaluating several parameters such as BIN, sender, and recipient country, availability of payment methods, and Merchant Identification Number (MID).

This alone empowered Paybis’ partners to increase successful transactions by over 11%.

Evaluating Rates with Precision

A deep dive into rates is crucial when evaluating on-ramps. This encompasses not only the transparent costs but also the hidden ones that are often overlooked.

A meticulous comparison and scrutiny of these fees among top providers are indispensable to unveil the true cost implications of integrating an on-ramp solution.

By dissecting the fee structures, businesses can ascertain the economic viability of partnering with an on-ramp provider. It is crucial to establish clear benchmarks for acceptable rate ranges, considering the balance between cost and value.

For instance, the integrated on-ramp should offer the flexibility to charge your customers a fee that’s lower than what it charges its direct customers. Without this provision, there’s a risk of customer poaching, where customers might bypass your business to purchase directly from the provider.

For partners of Paybis, rates begin at a competitive 0.49%. After integration, partners gain full flexibility on the fees charged to customers, with the option to adjust the fee according to the asset or payment method.

Regulatory Compliance

Beyond the financial aspects, the navigation through the complex maze of regulatory compliance is paramount.

Different jurisdictions impose varied licensing requirements and compliance norms. For instance, being registered with FINTRAC in Canada or with FinCEN in the U.S. is a requisite that on-ramp providers must fulfill to operate legitimately in these regions.

Going deeper, adherence to the EU’s Anti-Money Laundering Directives is another compliance cornerstone for on-ramp providers operating within European boundaries.

These directives lay down stringent protocols aimed at curbing money laundering and terrorist financing activities within the crypto space. Understanding and conforming to these regulations are vital to prevent legal ramifications and ensure the smooth and lawful functioning of the on-ramp services.

Paybis is compliant with all the laws in the regions it operates, including the UK, the US, and Canada.

When businesses integrate Paybis, we work closely to ensure all parties stay compliant and offload most of the legal work off of your shoulders to our experienced legal time.

3. Check for robust security protocols and provider credibility

Unpacking Security Protocols

PCI-DSS certification is a vital security standard to ensure the secure handling of credit card information. It’s not just about compliance but about forging a foundation of trust with users.

Implementing One-Time Password (OTP) login provides an extra layer of security, ensuring that only authorized individuals can access account details. Employing cold storage is vital as well, as it stores assets offline, reducing the vulnerability to online hacking attempts.

Paybis leaves no stone unturned when it comes to security. Most of the user funds are stored securely in cold storage vaults. Our data centers are also PCI-DSS certified, which means your customers’ data is always safe.

Analyzing Provider Reliability

Analyzing a provider’s reliability involves scrutinizing historical uptime statistics and operational transparency. High uptime and clear, accountable operations signify a dependable provider, essential for businesses in the dynamic crypto sphere.

Paybis stands out in this domain, exemplifying reliability with a proven track record since 2014, successfully catering to over $1.5 billion in cryptocurrency transactions in just the last three years, and powering industry giants like Simplex.

This operational history and the ability to maintain high service availability underscore Paybis’ credibility and commitment to the crypto industry.

For businesses seeking a trustworthy partner in the crypto space, a provider’s operational transparency, consistent service availability, and proven experience are paramount in making an informed choice, ensuring alignment with a partner that can genuinely resonate with their needs and uphold the industry standards.

4. Look for ease of integration and UX customizability

Integration Specifics

No matter how many bells and whistles the product has, if the integration is not buttery smooth, the road from there is only going to be bumpy — dev teams will have nightmares for every tweak they make to the product.

A detailed examination of API responsiveness, technical documentation, and provider support is crucial.

The API of Paybis On/Off-Ramp is structured around REST, HTTP, and JSON, offering clear and concise instructions to facilitate smooth integration, with the base URL accessed for both sandbox and production environments, ensuring secure API calls over HTTPS.

We will collaborate closely at each step to guarantee that the on/off-ramp operates on your website exactly as expected — as if your company crafted it independently.

Paybis offers seamless integration to both web and mobile applications, accommodating varied business and technical requirements of partners.

Its versatile compatibility with the existing infrastructure and the level of customizability it offers stand out, allowing businesses to adapt the solutions to their specific needs.

Advancing User Experience

Features like real-time transaction tracking, multi-lingual support, and intuitive interface designs play a significant role in providing a seamless user journey.

Paybis places a strong emphasis on refining UI/UX continuously, employing feedback mechanisms and user insights to make improvements and adaptations. Engineered meticulously from the ground up since 2014, Paybis’ partners get unparalleled freedom to customize their integration on the website/app.

Incorporating design customizability and branding is also essential, allowing businesses to align the solutions with their brand identity and enhance user interaction.

The Paybis on/off-ramp provides flexible UI-building options, including creating input fields for fiat or crypto amounts with or without quotes or offering predefined buttons for specific cryptocurrency amounts.

The incorporation of these elements, coupled with continuous improvements based on user insights, ensures a superior and personalized user experience, fostering customer satisfaction and long-term engagement.

5. Deep-dive into additional offerings from the provider

Dissecting Providers’ Offerings

A comprehensive scrutiny of the providers’ offerings is absolutely essential before boiling down on a while label crypto on/off-ramp.

Do a side-by-side comparison of the top providers. Look at their features, service, support, and ease of integration. Analyze their fee structure and keep an eye out for any hidden costs.

When dealing with large volumes, businesses may even want assurance from the provider that they hold enough liquidity to cater to a larger-than-usual demand, and that they have minimum withdrawal periods so customers can transact with peace of mind.

Emphasizing Technical Support

A provider’s capability to offer unfaltering technical support saves businesses invaluable time and resources.

It negates the need for hiring and training specialized teams, allowing organizations to leverage the profound knowledge of those who know the product inside out.

Technical support becomes the linchpin, addressing a spectrum of queries from a diverse user base, ranging from beginners to pros. Whether the questions are rudimentary or delve into complex aspects such as privacy, limits, and tech stack, availability and responsiveness of support are essential.

A 24×7 support framework is indispensable, ensuring seamless interaction and immediate resolution, thereby elevating the user experience and fostering user reliance and loyalty.

6. Check if they can adapt to a changing regulatory landscape

Proactive Regulatory Adherence

In an industry as dynamic and evolving as the blockchain and crypto space, having dedicated resources or teams to monitor global regulatory updates is imperative.

The volatile nature of global crypto regulations necessitates proactive compliance to prevent legal repercussions and foster trust with users.

To illustrate, various businesses have faced substantial fines, operational disruptions, and reputational damage due to non-compliance with existing regulations.

These cases emphasize the need for unwavering commitment to regulatory adherence, a critical factor in sustaining long-term business operations in the crypto industry.

Forward-Thinking Legal Compliance

Regulations like the EU’s MiCA (Markets in Crypto-assets Regulation) are paving the way for a more regulated crypto industry and legal teams have to be on their toes to tackle any compliance issues that may come their way.

The implications of such regulations necessitate a forward-thinking approach to legal compliance, emphasizing the need for businesses to stay well-informed and prepared.

It is crucial for businesses to develop adaptable strategies, continually update their operational models, and maintain open channels of communication with legal advisors to navigate emerging regulatory challenges effectively.

By anticipating and adapting to future requirements, businesses can secure a competitive advantage, ensuring their sustained growth and success in the continuously changing regulatory landscape of the crypto industry.

When businesses partner with Paybis to integrate our white-label solution, they also get the benefit of working closely with our legal team to resolve potential compliance issues.

More Reasons to Integrate Paybis

Paybis offers a host of reasons making it an ideal choice for integration:

- Established Track Record: Being in the business since 2014, Paybis has built a robust and reliable platform, demonstrating resilience and innovation in the dynamic crypto space.

- Extensive Customer Base: Serving over 1.8 million customers, Paybis has garnered substantial market experience and user insights, enabling continual refinement of services and customer experiences.

- Substantial Transaction Volume: With transactions worth billions processed, Paybis showcases its capability to handle high volumes, emphasizing its reliability and operational efficiency.

- Expert Support: The talented team at Paybis offers invaluable support, ensuring seamless integration and continuous assistance, optimizing your platform’s performance and user experience.

- Zero Chargeback Hassle: Paybis stands out with its no chargeback feature, where the Paybis team handles all chargeback issues, ensuring partners are never affected, which reinforces operational stability and peace of mind for partners.

These distinguishing features, coupled with Paybis’s commitment to compliance and user experience, make it a compelling choice for businesses aiming to integrate a trustworthy and efficient on/off-ramp provider.

Conclusion

In this industry, businesses must adopt a meticulous and visionary approach in their selection of on/off-ramp providers.

A thorough examination of provider offerings, compliance adherence, user experience refinement, and responsive support is vital for seamless integrations and enduring success.

Paybis, with its proven track record, established reliability, and commitment to user-centric design and proactive compliance, is an ideal partner in navigating the complexities of the crypto landscape.

Are you in search of a partner that brings a harmonious blend of innovation, reliability, and extensive industry experience? Consider Paybis as your on/off-ramp solution provider.

Get in touch with our sales team today and explore how Paybis can contribute to your business goals.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info