Top 11 crypto memes explained

If you’re new to crypto, it may feel a bit like being late to a party. Everybody’s got their own inside jokes, crypto humor and you don’t always understand them.

No worries – the Paybis team is here to give you a crash course in crypto memes so you can get all the punchlines in no time! And, what’s even better, crypto humor serves as a great introduction to some pretty important crypto concepts.

Let’s jump right in and learn more about crypto, one meme at a time!

Table of contents

HODL

Let’s start with the big one. You often hear crypto folks – us, for one – referring to HODL, especially when the crypto market gets somewhat volatile.

So, what is HODL?

HODL meaning is simple: keeping your crypto and waiting for it to increase in value, especially if crypto prices decline.

The meme initially started as a mistype in a whiskey-fuelled, misery-drenched, typo-ridden post in a Bitcoin forum back in 2013. Bitcoin rate has just had one of its flash crashes, so the original poster presented the perfect solution to his limited trading skills, announcing loud and proud: “I AM HODLING”. He then explained that, of course, he should have sold his BTC before the crash – but, since he’s not that good at predicting declines, he’s just keeping it now, rather than selling at a loss.

All the typos notwithstanding, the post actually contains solid advice. It may be tempting to try timing the market, selling right before the crash – but this is pretty hard to pull off. It’s even more tempting to sell right as the market’s crashing – but, if the rate recovers, you’ve sold at a loss.

We’re not providing any investment advice, but here’s one thing we can say: taking a long-term view on crypto has paid off before, so it may be a good idea to HODL crypto. If the gentleman heeded his own advice and actually did HODL Bitcoin, he no doubt has seen its price increase many times over. So maybe he wasn’t such a bad trader as he thought.

Buy the Dip

Trying to time the market brings us to the next meme – buying the dip.

“The dip” here refers to a drop in an asset’s value. When an asset declines, some investors, rather than selling or just HODLing it, actually buy more of it. The rationale here is that the price would soon rebound, leaving the investor with a nice profit.

Now, this isn’t something unique to the crypto market; stock traders have been using the buy the dip strategy for ages. It has, however, taken a new meaning in the crypto world, as it is still notorious for its wild swings. A single tweet can send the crypto rate lower, even if it’s generally on the rise. Once the initial shock passes, the rate may return to growth.

This, however, is far from certain. It is very much possible to buy the dip, only to see yet another dip following the first one. Paybis has prepared some useful guidelines for buying the dip, and it is a good idea to review them before doing this yourself.

Of course, even if the dip keeps dipping, it’s still possible to HODL and wait for your investment to recover in the long run.

Pump it/Dump it

One way to look at your failure to time the market is to imagine there’s a giant conspiracy underway to thwart your moves – whenever you buy the dip someone is there to dip it even lower.

Enter the Bogdanoff twins Igor and Grichka. You couldn’t imagine better supervillains even if you tried. Aristocratic background? Check – both twins hailed from a long line of European nobles, having spent their childhood in their grandmother’s castle in Southern France. Mad scientists? Check – they both had a PhD and had produced some highly controversial work. They even had the supervillain look nailed – yes, these photos are real, no Photoshop involved.

The crypto community has always had a thing for flashy personalities, so it just couldn’t pass the Bogdanoff brothers. Soon enough, the duo emerged as a crypto meme: arch-conspirators behind just about every major crypto move. If you would buy some crypto, Igor and Grichka would call their minions to dump it, so that it goes lower. Just as you sold it, they’d pump it – sometimes misspelled as “pamp it” – so that it goes back up again. So it’s really not your fault; the market is rigged against you.

Of course, none of this was meant to be taken seriously. It is, however, based on a very real fraudulent scheme called pump-and-dump, where people would buy up crypto to drive its price higher, only to sell massive amounts of it once it reaches the price they want. The massive sale crashes the market, leaving other investors with a worthless investment.

Now, even the Bogdanoff brothers could not pull this off with Bitcoin or Ethereum, but some smaller coins can be – and are – subject to pump-and-dump schemes. This once again shows why your own research is very important.

Sadly, the twins passed away in late 2021 and early 2022, within a week of each other. Rest assured, though: legends never really die.

To the Moon

While we’re on the subject of flashy personalities: even if you’re not into crypto, you’ve probably heard of Elon Musk. If you’re into crypto, you’ve heard about him a lot – and maybe follow him on Twitter.

His outspoken personality and a penchant for outlandish projects have made Elon Musk a pop culture icon. This, coupled with more than 73 million Twitter followers, has given him a notable reach. In other words, people expect him to push crazy ideas, and he’s happy to deliver.

At one point, Musk set his sights on Dogecoin (DOGE), a meme coin originally created as a parody of cryptocurrencies. The original creators – one of them also very active on Twitter – explicitly launched it as a joke, without any plans to become a real store of value.

Elon Musk, however, has a knack for taking funny ideas and making them real. In 2021, Musk’s company SpaceX announced that it will fund an upcoming satellite, appropriately named DOGE-1, with Dogecoin. The satellite indeed will reach the Moon and enter a stable lunar orbit – or, at least, that’s the plan. So “DOGE to the Moon” literally means sending DOGE to the literal Moon.

The Elon Musk – Dogecoin connection has proved to be very successful: you can literally pin Musk tweets to Dogecoin price spikes. It’s little wonder, then, that the “To the Moon meme” has since morphed into a battle cry of all the DOGE enthusiasts, affectionately known as the DOGE army. It now shows their belief that the Dogecoin rate will soon reach new heights.

Shitcoins

Talking about dog-related cryptos: the unlikely success of Dogecoin has inspired a whole new generation of meme coins. They often are variations of the same themes, such as Shiba Inu dogs, Moon, and Elon Musk. Some of them follow the same light-hearted approach of Dogecoin, while others are explicitly designed and promoted as high-risk, high-return investments.

Now, the crypto community is not known for mincing its words, so this kind of token is often referred to as “shitcoins”. The shitcoin meme is quite broad: what is a shitcoin depends on whom you ask. Basically, it’s any token that somebody believes to be a bad investment. You may find crypto enthusiasts arguing that any token other than Bitcoin falls in this category – and some might even argue this applies to fiat currencies such as the US dollar.

As noted, we do not offer any investment advice here at Paybis, so we’ll not make a shitcoins list. There are some things to consider, though.

Does the project have any utility? Does it aim to provide a service, solve a problem, or work as means of payment? If it has any value simply because people invest in it, you may well be dealing with a pump-and-dump scheme described above.

With excellent timing, even shitcoins can provide great returns – indeed, you could argue that’s their whole point. Still, if you prefer your tokens to be less of a gamble, you’ll probably want to evaluate your crypto projects a bit more carefully.

Time warp

Here’s a fun challenge: buy some crypto and forget about it. Don’t check its rate for, say, a week. Can you do it?

This may sound simple enough, but in practice, it proves to be quite challenging. Simply put, time seems to move faster in the crypto world. If a stock doubles its value within a year, it’s seen as very solid performance. If a crypto does the exact same thing, you’ll probably hear stories that it’s underperforming.

In a way, it’s understandable. Crypto is an emerging technology, and huge leaps not only are possible – they’re pretty much bound to happen. This, to a large extent, is what makes crypto so exciting.

Of course, this also means that pullbacks and corrections may get just as huge, which is yet another reason to check the rate more often.

If this works for you – great. If, however, you find yourself obsessing over the rate movements a bit too much, you may want to try cutting down. For example, you may consider uninstalling your crypto app from your smartphone. Paybis has a simple and convenient Bitcoin price tracker and a Bitcoin calculator. They do allow you to check the rate anytime you want it, but we’ve made them to be informative, rather than addictive. They’re there when you need them, and they don’t bombard you with notifications when you don’t.

And don’t worry – if there’s some really big move, you won’t miss it. After all, crypto promises to transform entire industries, and that should bring notable returns.

Where Lambo

Crypto provides some amazing technology, but let’s be honest here: there is no denying that the opportunity to make some serious money makes it all the more appealing.

As a result, different status symbols feature prominently in crypto memes – and, all the futuristic appeal of Tesla cars notwithstanding, a Lamborghini still is in a class of its own. Sorry, Elon.

On one hand, it’s a great idea to approach any investment with a clear goal in mind – and a Lambo is very much a clear goal. On the other hand, it also helps to have realistic expectations.

As you learn more about crypto, you’ll hear plenty of promises that some token is going to explode by 1000% in a matter of weeks. Now, it has happened before – although it’s often been more of a spike, rather than a sustained increase. Still, it’s fair to say it’s more of a lucky break, rather than a baseline scenario.

Which is not to say that you’ll never reach your crypto goals. Quite the contrary – if you have a clear goal and work towards it, you’re much more likely to get there. Get ready to learn and do your own research: Crypto is not a foolproof get-rich-quick scheme. It is, however, an interesting and rewarding investment well worth your attention.

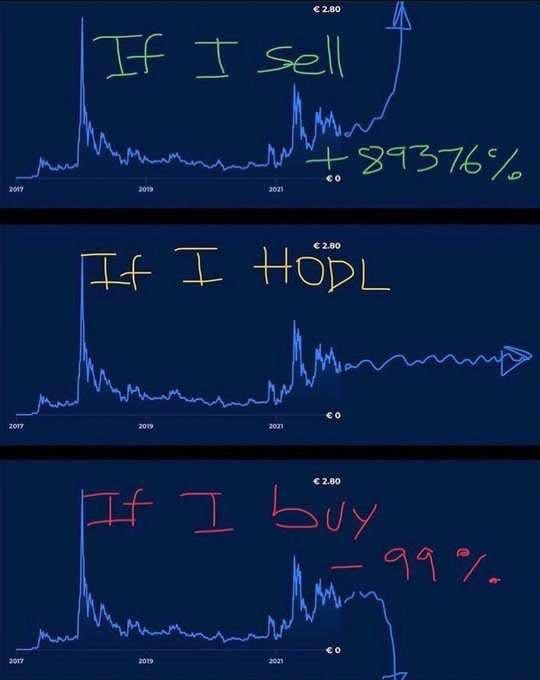

If I Sell, If I HODL, If I Buy

The meme is a humorous take on the volatility of meme coins.

It is a take on the ideology of people trying to time the market but, more often than not, getting it wrong.

Here, after the person sells their crypto, the price skyrockets. However, if they hold onto the coin, hoping for the price to go up, it is hovering around the same. And if they buy more meme coins, they could end up losing even more money.

The meme is funny because it captures the uncertainty and risk involved in trading cryptocurrencies without a proper strategy or fundamentals.

Cryptocurrencies are often very volatile, meaning their prices can fluctuate wildly in a short period of time. This makes it difficult to predict whether a coin will go up or down in value. As a result, trading without much knowledge can be a very risky proposition.

When trading meme coins, the meme highlights the fact that they are often not based on any real-world value. They are simply based on hype and speculation. This means that their prices can be driven up by even the smallest amount of news or social media attention. However, this also means that their prices can just as easily crash if the hype dies down.

The meme is a lighthearted way to poke fun at the risks of crypto trading. However, it also serves as a warning to those who are trying to time the crypto market without a solid foundation.

Waiting for the Bull Run

The image shows a human skeleton sitting on a bench in a park. The meme is a comic representation of the bearish scenario of crypto markets.

The image implies that the figure sitting on the bench is someone who invested in cryptocurrencies in a bear market and is still waiting for a bull run to occur.

It highlights the reality of how long some investors have been stuck in bearish cycles for, with no sign of when they may see their investments go up. This could be due to bad luck, lack of knowledge, or simply investing in the wrong coins.

The meme is a humorous reminder that crypto trading requires patience and strategy. There are no guarantees when it comes to the markets, so regardless of whether you’re bullish or bearish, you should always be prepared for volatility.

It also implies that investors should not get too attached to any coin or token. In the crypto world, things can change in an instant – so it’s important to always be prepared for the unexpected.

The meme is a funny way to remind traders of the risks and rewards associated with investing in cryptocurrencies. It serves as a reminder that even after years of waiting, fortunes can change in an instant when trading crypto.

So it’s important to stay up to date on the latest news, trends, and developments in the market. One of the ways you can stay updated in the crypto space is by following the Paybis blog.

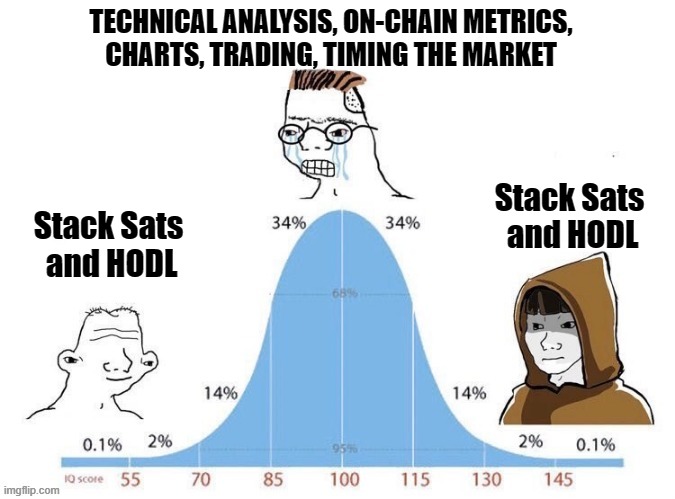

HODL Bitcoin Midwit Meme

This meme is popular among Bitcoin maximalists who have a strong opinion that Bitcoin is the only true cryptocurrency and rather than trading it, one can get the most value from holding it for the long term. Note that this does not reflect the opinion of Paybis in any manner.

The meme is implying that the midwits are the ones who are most likely to lose money in Bitcoin, because they are trying to use complex methods to do something that is actually very simple. The simple way to make money in Bitcoin is to just buy and hold, and the midwits are too smart for their own good.

The meme is also making fun of the fact that many people who try to use technical analysis and on-chain metrics to trade Bitcoin are actually just making things up. They don’t really understand how these methods work, but they think that they can use them to make a quick buck.

The meme is a humorous way of pointing out the futility of trying to use technical analysis and on-chain metrics to trade Bitcoin. The best way to make money in Bitcoin is to simply buy and hold, and the midwits are the ones who are most likely to lose money by trying to do anything else.

The meme is also making fun of the Dunning-Kruger effect, which is the tendency for people with low ability to overestimate their own ability. The meme is ultimately a joke, but it does raise some valid points about the difficulty of trading Bitcoin. It is important to remember that there is no surefire way to make money in Bitcoin, and that even the best traders can lose money.

Drake Meme

The Drake meme is popular in the cryptocurrency community and is used as a humorous way to compare two different trends of investment, solutions, and more.

In this example, we have Drake represented as being repulsive of complex crypto buying processes, which often result in declined transactions and poor user experience.

On the bottom, Drake is represented as though he is advocating for Paybis for those who want to effortlessly buy cryptocurrencies with fiat currency using their preferred payment methods.

The meme is a humorous way illustrating the ease of use and the user experience offered by Paybis. It implies that, with Paybis, you can have access to different payment methods and buy cryptocurrencies in a matter of minutes and without any complex processes.

It also implies that as long as you trust and choose the right platform, buying cryptocurrencies can be a breeze.

Conclusion

Crypto memes can be a fun and humorous way to capture the volatility of the crypto markets. They can not only provide entertainment but also serve as a reminder of the risks associated with trading cryptocurrencies.

The key takeaway is that, while investing in crypto can be rewarding if done right, it’s important to understand the fundamentals and do your own research before jumping in. The crypto markets can be unpredictable and high-risk, so it’s important to trade responsibly and with caution.

Finally, don’t forget to have some fun along the way!

Choose Paybis for Crypto Fundamentals

What is rekt? That is probably what you might be if you invest all your money solely based on memes.

Memes are a fun way to get involved in the crypto space and can provide some interesting insights, but investing solely based on short-term cultural trends on the internet is far from wise.

At Paybis, we constantly put out content on our blog that will take you one step closer to becoming a crypto guru. Learn the fundamentals of Web3 with Paybis and keep yourself from turning into the next meme.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info

I like this side

Best way to earn money