DEX vs CEX: Understanding the Difference

DEX vs CEX has been a burning topic for an extended period among cryptocurrency traders and investors.

Decentralized Exchanges (DEX) and Centralized Exchanges (CEX) are the two contenders, each offering unique advantages, disadvantages, and some traits contributing to a hassle-free trading experience.

Blockchain enthusiasts are no strangers to the risks/scams associated with the centralized or decentralized exchange platforms, and past scams have only intensified these concerns.

The FTX Exchange, a reputable centralized exchange, shook the crypto community as it drained their funds; all while it was considered a reliable platform, this incident highlighted the vulnerabilities associated with even established exchanges. But that’s not all limited to centralized exchanges.

Sushiswap, a prominent decentralized exchange, shocked the crypto community with its exit scam. Users were left stunned as the project’s founder disappeared with millions of dollars in investors’ funds, eroding trust in DEXs. However, Sushiswap is still functional, and you can buy Sushiswap on Paybis.

As a newbie/established trader, it’s crucial to consider these alarming incidents. This article sheds light on CEXs, DEXs, DEX vs CEX, their differences, advantages, and disadvantages, helping you make alarmed decisions while navigating the cryptocurrency exchange landscape.

Table of contents

What is DEX?

As a newbie, you might have uncertainties and questions like “What is DEX?”

A decentralized exchange, or DEX, is a peer-to-peer marketplace that allows users to trade trustlessly.

DEXs allow users to retain control of their funds, and trades occur through smart contracts, enhancing security and privacy.

DEXs promote transparency and reduce reliance on centralized entities, offering a more decentralized and trustless trading experience.

Unlike centralized exchanges, DEXs work on a decentralized network. DEXs essentially eliminate the typical intermediaries seen in centralized exchanges like Binance, Kraken, and Coinbase.

Uniswap, PancakeSwap, and Sushiswap are some of the prominent decentralized exchanges that have gained prominence within the blockchain industry.

What is CEX?

Now, what is CEX? Centralized exchanges are digital platforms that facilitate cryptocurrency trading and serve as intermediaries between buyers and sellers. They use order books to match trades and act as custodians of users’ funds.

CEXs are prominent for their user-friendly interface and liquidity.

These centralized exchanges prefer to manage customers’ funds on their behalf by taking care of complexities such as private key management, security, and more for an improved user experience.

Binance, Kraken, and Coinbase are some of the prominent centralized exchanges that have gained prominence within the blockchain industry.

CEX and DEX Examples

Here are some of the primary examples of CEXs and DEXs.

Centralized Exchange (CEX) |

Decentralized Exchanges (DEX) |

| Paybis | Uniswap |

| Binance | PancakeSwap |

| KuCoin | Sushiswap |

| OKX | Osmosis DEX |

| Kraken | Curve Finance |

CEX vs DEX

Here are some arguments in favor of CEX vs DEX.

DEX vs CEX: The Differences

Although CEXs and DEXs are exchanges that facilitate cryptocurrency trading, both have their own traits. Understand the difference between DEX and CEX.

Centralized Exchange (CEX) |

Decentralized Exchanges (DEX) |

| CEXs are centralized and are operated by a single entity acting as an intermediary between buyers and sellers | DEX is decentralized and runs on decentralized blockchain networks, promoting peer-to-peer trading without intermediaries. |

| CEX charges higher transaction fees. | DEX provides lower transaction fees. |

| CEX requires users to deposit their assets into the exchange’s custody before trading. | DEXs provide users with complete control over their assets by using smart contracts. |

| CEX provides higher liquidity due to its centralized nature. | DEX provides lower liquidity compared to centralized exchanges. |

| CEX adheres to regulatory frameworks and implements Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. | DEX operates on a decentralized nature and does not adhere to regulatory compliances. |

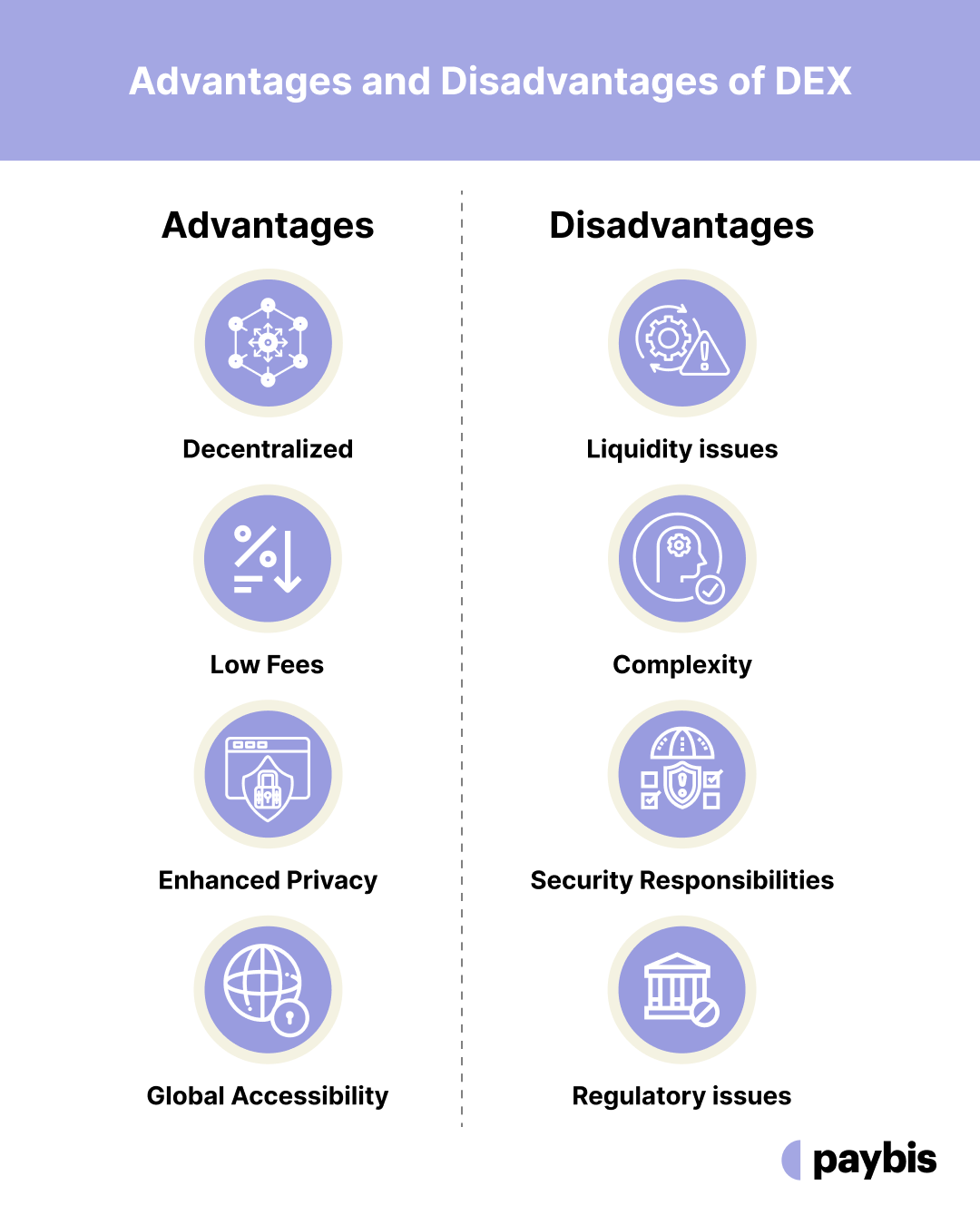

Advantages and Disadvantages of DEX

Advantages |

Disadvantages |

| Decentralized: DEXs are decentralized and offer users greater control over their assets. | Liquidity Issues: DEXs does not have sufficient liquidity for certain tokens. |

| Low Fees: DEXs are cost-efficient and offers lower fees on trades. | Complexity: DEX is complex for regular user understanding and could be challenging at times. |

| Enhanced Privacy: DEX offers an extra level of privacy. | Security Responsibilities: Users must be cautious enough to avoid phishing websites pretending to be a DEX. |

| Global Accessibility: DEXs can be accessed from anywhere around the globe. | Regulatory issues: DEXs are decentralized and do not adhere to any government regulation. |

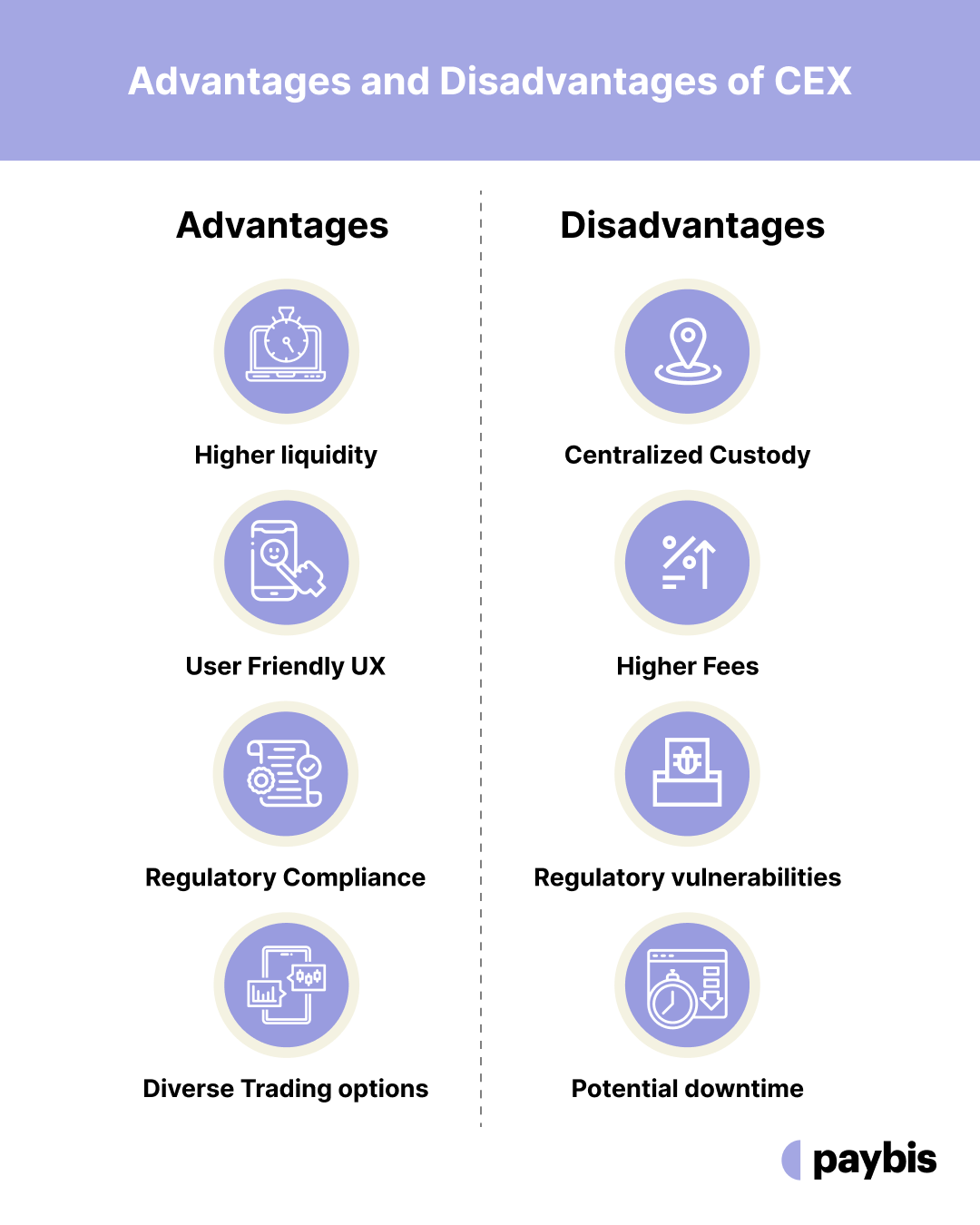

Advantages and Disadvantages of CEX

Advantages |

Disadvantages |

| CEX offers higher liquidity on its platform, enabling a hassle-free trade experience. | Centralized Custody: CEXs are centralized and have hold of their users’ funds. |

| User-Friendly UX: CEX offers an intuitive interface and customer support. | Higher Fees: CEXs charge higher transaction fees. |

| Regulatory Compliance: CEXs adhere to government regulatory orders and are comparatively safe. | Regulatory vulnerabilities: CEXs may suffer operation halt and disruption of services according to regulatory changes. |

| Diverse Trading options: CEXs offers multiple trading options in a secure manner. | Potential downtime: CEXs are prone to downtime due to server issues resulting in service disruption. |

Mechanism Behind Centralized Exchange and Decentralized Exchange

A centralized exchange (CEX) functions similarly to a traditional financial institution, matching users’ buy and sell orders through an intermediary or an order book. It possesses users’ funds and follows regulatory rules.

A decentralized exchange (DEX) relies on smart contracts and automated market makers, DEX aggregators on the blockchain network, enabling direct peer-to-peer trading without intermediaries providing users control over their assets.

Let’s understand the entire mechanism behind the functioning of centralized and decentralized exchanges in detail.

How Do DEXs Work?

In a DEX, users retain control of their private keys and, hence, their funds, trading directly from their wallets. The core idea is to enable trading permissionless and trustless, relying on smart contracts deployed on a blockchain. Smart contracts automate the execution of trades, ensuring that the agreed-upon terms are met before finalizing the trade.

DEXs employ different mechanisms for order execution. One common approach is the Automated Market Maker (AMM) model. In this model, liquidity is provided by users who deposit their assets into liquidity pools. These pools are used to facilitate trading between different assets. Traders interact with these pools, buying or selling assets based on the available liquidity. The price of assets in AMM-based DEXs is determined by the ratio of assets in the pool, which fluctuates based on supply and demand.

Another method of order execution in DEXs is the order book model, similar to that of centralized exchanges. Users place limit orders, indicating their desire to buy or sell a certain asset at a specific price. These orders are broadcasted and stored off-chain or on a separate layer, and when a matching order is found, the trade is executed on-chain.

Liquidity remains a pivotal concern for DEXs. Liquidity in DEXs is fragmented, meaning it is spread across different liquidity pools or different DEX platforms, potentially leading to high slippage, especially for large orders. Slippage refers to the difference between the expected price of a trade and the executed price. The higher the liquidity, the lower the slippage. DEX users often have to consider liquidity and slippage while executing trades, especially in less liquid pools or pairs.

Learn what is a DEX and how do DEXs work.

How Do CEXs Work?

To start using a centralized exchange, a user typically has to register for an account. The user may be required to provide personal information and undergo a Know Your Customer (KYC) process. This is done to comply with regional regulations and anti-money laundering (AML) rules.

Centralized exchanges operate on an order-matching system. Users place orders to buy or sell cryptocurrencies at specific prices. These orders are represented in an order book, a dynamic list of buy and sell orders organized by price level. The basic order types are:

- Market Orders: These are buy or sell orders executed immediately at the current market price. They take liquidity out of the order book as they’re matched with the best available opposing orders (e.g., a market buy order would match with the lowest available sell order).

- Limit Orders: These are orders to buy or sell a cryptocurrency at a specific price or better. They provide liquidity to the order book. If there isn’t a matching order, the limit order remains in the order book until it is matched or canceled.

When a matching buy and sell order is found, the trade is executed, and the corresponding cryptocurrencies and funds change hands within the exchange’s internal ledger.

Learn more about how do CEXs work here.

Is Paybis DEX or CEX?

Paybis is what you call a crypto on/off-ramp. A crypto on-ramp is a platform that provides users easy fiat-to-crypto conversions, while a crypto off-ramp does the opposite, i.e., facilitates easy crypto-to-fiat conversions.

You can think of Paybis as a centralized exchange but without the complexities.

Paybis facilitates these on/off-ramp transactions by allowing users to buy and sell a variety of cryptocurrencies using various payment methods, including credit/debit cards and bank transfers. Users can exchange their fiat currency for cryptocurrencies (on-ramp) and vice versa (off-ramp).

Since it performs these services as a centralized entity, managing the transactions and the funds during the exchange process, it is classified as a centralized exchange (CEX).

However, unlike many other centralized exchanges, Paybis does not use users’ funds in any form for its own operations. Users can choose to withdraw their funds into their own third-party wallets right when they are performing transactions or choose to store them in Paybis Wallet where Paybis is the custodian.

Is Binance CEX or DEX?

Binance, founded by Changpeng Zhao in 2017, is a centralized exchange (CEX) where users can trade a vast array of cryptocurrencies. Binance handles the order book, holds users’ funds, and manages the trades in a centralized manner. This platform offers advanced trading features, high liquidity, and a user-friendly interface, making it suitable for both beginner and experienced traders.

Is KuCoin a CEX or DEX?

KuCoin is a centralized exchange (CEX). It acts as an intermediary to facilitate the trading of cryptocurrencies, managing users’ funds, maintaining the order book, and executing trades on behalf of the users.

In centralized exchanges like KuCoin, users deposit their funds into the exchange’s wallets, and the exchange is responsible for the security and management of these funds while they are being held.

Is Uniswap a DEX or CEX?

Uniswap is a decentralized exchange (DEX). It operates on the Ethereum blockchain and utilizes an automated market maker (AMM) model, allowing users to trade directly from their cryptocurrency wallets without the need to deposit funds on the platform.

In Uniswap, liquidity is provided by users who deposit their tokens into liquidity pools. These pools facilitate the swapping of tokens and enable users to earn fees from the trades that occur within the pool.

Uniswap’s decentralized nature allows users to retain control of their funds and private keys, enhancing security and aligning with the foundational principles of decentralization inherent to blockchain technology.

Buy Uniswap on Paybis.

Conclusion

Understanding DEX meaning, CEX meaning, and the fundamental differences, advantages, and disadvantages between CEX and DEX is paramount for anyone delving into the cryptocurrency world.

With incidents like the FTX collapse and the Sushiswap exit scam, centralized and decentralized platforms have vulnerabilities. Centralized exchanges like Paybis offer high liquidity and user-friendly interfaces and are subject to regulatory frameworks.

On the other hand, decentralized platforms like Uniswap provide enhanced privacy, control over assets, and transparent, trustless trading experiences. But to use them well, you need to be well-versed in the intricacies of blockchain and wallet security.

Each type of exchange offers unique benefits and disadvantages, and the choice between them often depends on individual preferences, trading strategies, and risk tolerance.

Whether you’re a seasoned trader or a crypto enthusiast exploring the fascinating world of digital assets, consider following the Paybis blog for the latest insights, tips, and updates on cryptocurrencies, exchanges, and the overall blockchain ecosystem.

FAQ

Which is better: DEX or CEX?

The answer to this question differs for individuals. However, comparatively speaking CEXs (Centralized Exchanges) provide convenience and liquidity but at the expense of control. In contrast, DEXs (Decentralized Exchanges) prioritize control, security, and privacy yet lack liquidity and usability.

Are CEXs more secure compared to DEXs?

There is no definitive answer to this question. While DEXs are more secure by design (as they use cryptography and smart contracts), users can find themselves victim to attacks like sandwich attacks and front running. CEXs, on the other hand, are less secure due to a central point of failure, but some have insurance for users’ funds and provide better UX.

Do DEXs require KYC?

Decentralized exchanges never ask for KYC as all transactions are entirely on-chain, and no fiat currency is involved. If any DEX is asking for KYC, please double-check for any scams.

Is trading free of cost on CEXs or DEXs?

Depending on the platform, DEXs and CEXs may charge a small fee for trading. Sometimes, these fees are waived off. For example, first-time users on Paybis enjoy a 0% Paybis fee on their first transaction.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info