What Are Blockchain Forks? Hard Fork vs Soft Fork Explained

The blockchain technology, while revolutionary, is not without its complexities and challenges. One of the most critical aspects that both newcomers struggle with is understanding the concept of ‘forks’. Misunderstanding or lack of knowledge about forks can lead to confusion, mismanagement of digital assets, and missed opportunities.

Imagine a scenario where you’re invested in a cryptocurrency, and suddenly, there’s news of a ‘fork’. Without a clear understanding, you might be at risk of making uninformed decisions, potentially leading to financial loss or missing out on significant gains.

In this article, we explore what blockchain forks are, the different types of blockchain forks, and how they impact cryptocurrencies.

Table of contents

What is a Blockchain Fork?

A blockchain fork occurs when there are changes or updates in the protocol of a blockchain network, leading to a divergence in the blockchain. This can result in two separate paths — one following the old protocol, and the other following the new one.

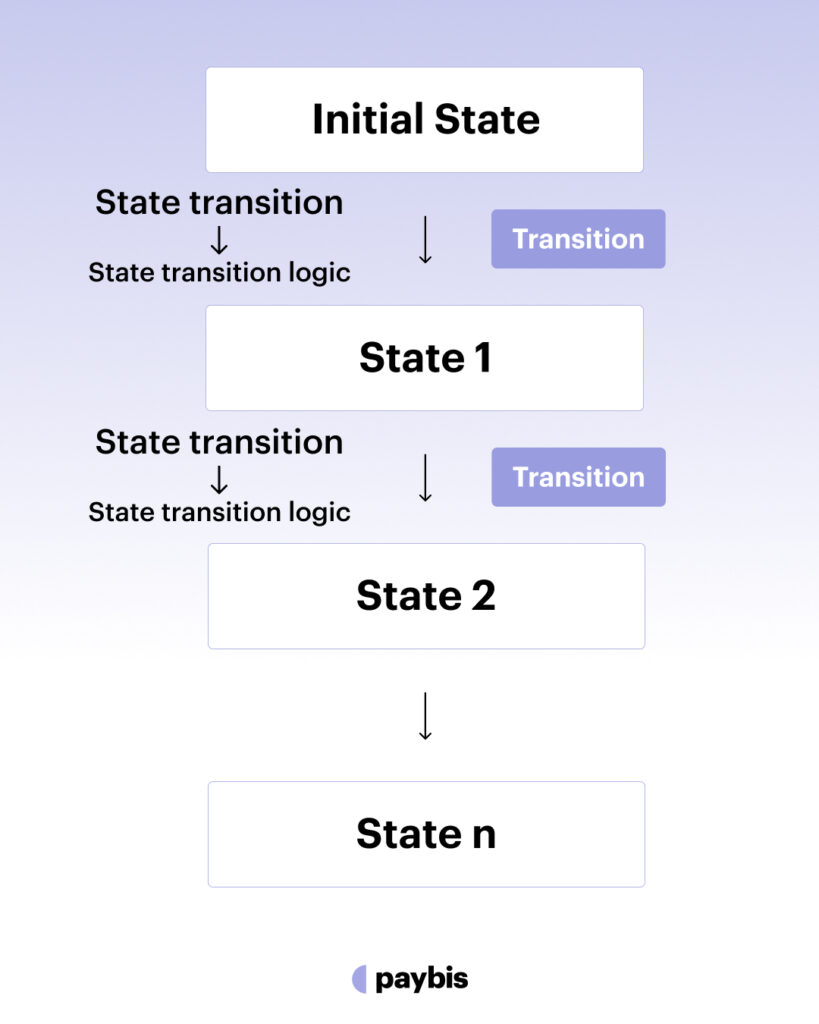

Blockchains are “state machines” and function on consensus. Every time there is an activity on a blockchain, its ‘state’ changes — whether or not this new state is legitimate depends on the agreement of miners/validators.

A blockchain fork happens when the miners or validators do not reach a consensus and choose to go their separate ways. This divergence can occur for various reasons, such as differing opinions on proposed upgrades, changes in the underlying protocol, or responses to security threats. When a fork happens, the blockchain effectively splits into two distinct chains, each with its own version of the transaction history after the point of the fork.

These forks fundamentally alter the trajectory of the blockchain. From that moment forward, each chain operates independently, governed by its own set of rules and consensus mechanisms. This can lead to the creation of two separate blockchains, each with its distinct characteristics, communities, and potentially differing objectives and use cases.

The process of forking underscores the decentralized and democratic nature of blockchain technology, where changes are subject to the collective decision of its participants. However, it also highlights potential challenges in governance and the difficulty in reaching a unanimous decision in a decentralized ecosystem. As a result, forks can have significant implications, not just technically, but also in terms of community dynamics and market impact.

Types of Blockchain Forks

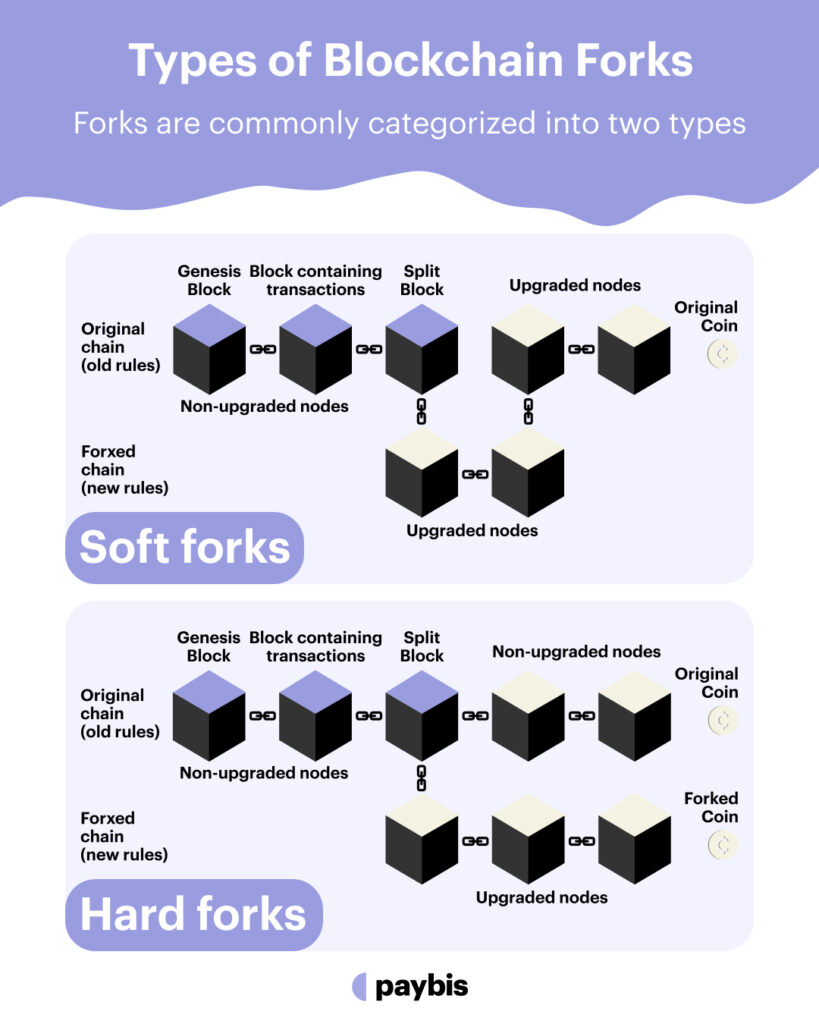

Forks are commonly categorized into two types:

- Soft forks

- Hard forks

What is Hard Fork?

Hard forks are major changes that not only leave the original framework intact but also lead the way for a new protocol altogether.

A non-backward-compatible upgrade that creates a permanent divergence from the previous version of the blockchain. Nodes running the old software will see the new transactions as invalid. To be successful, all nodes must upgrade to the new software.

Now that you know what is a hard fork, let’s look at soft cryptocurrency fork.

What is Soft Fork?

Soft forks are those small changes or upgrades accepted into the protocol.

A backward-compatible upgrade where the updated nodes can still interact with the non-updated nodes. Only a majority of the network’s hash power is required to enforce the new rules.

How Blockchain Forks Work

Blockchain forks are situations where the blockchain splits into two separate paths. This can happen for several reasons but usually boils down to changes in the underlying protocol rules.

Soft Forks

Imagine a highway with one lane. A soft fork is like adding a new lane alongside the existing one, without changing the original lane. Here’s how soft forks are implemented.

- Developers propose a change to the protocol.

- Miners vote on whether to adopt the change.

- If the majority vote agrees, the new rules go into effect.

- Nodes gradually upgrade to the new version.

Hard Forks

Now, imagine a junction where the highway splits in two. A hard fork is like this permanent division on the blockchain. Here’s how hard forks are implemented.

- Developers propose a change that is not backward compatible.

- The community debates and votes on the change.

- If there’s no consensus, the network forks into two chains.

- Users then choose which chain to support.

Soft Fork vs Hard Fork: Understanding Hard Forks

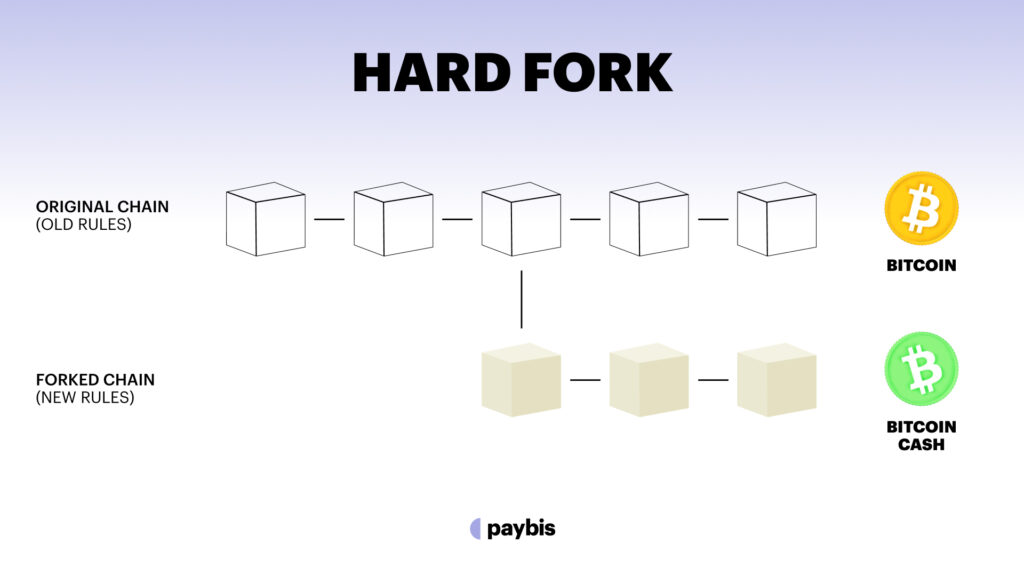

Hard forks are the major changes in the blockchain framework that lead to the creation of a new blockchain altogether. While this new blockchain is created, the older blockchain continues to exist.

So inherently, the users then decide which blockchain they want to use further depending on their preference.

Why Do Hard Forks Happen?

Hard forks happen when there is a need to make significant changes to the blockchain for various reasons. These hard forks are crucial because this is the only framework that can help resolve major conflicts amongst the users.

For example, in August 2017, SegWit was implemented that hard-forked the Bitcoin network.

A faction of the Bitcoin community wanted to increase the block limit size. This led to the Bitcoin community splitting into two. To resolve this conflict, Bitcoin was forked leading to the creation of Bitcoin Cash with a block size of 8 MB in comparison to 1 MB on the original blockchain.

Similarly, ETH 2.0 is also a result of a hard fork that holds significance. Such types of major conflicts need smart resolutions that can be only implemented through hard forks.

Can Hard Forks Happen Accidentally?

Yes, hard forks can happen accidentally. However, accidental hard forks are highly uncommon because they tend to require major changes at the protocol level.

For example, one of the most well-known examples of an accidental hard fork in blockchain history happened in March 2013 with Bitcoin caused by a bug in the Bitcoin software update 0.3.6. This bug led to inconsistencies in how the transactions were stored and retrieved causing a temporary blockchain split.

Before the fork, a new version of the Bitcoin software (version 0.8) was released. This version included several improvements and optimizations, one of which changed how large blocks were handled.

On March 11, 2013, a large block was created that was valid according to the new 0.8 version rules but was invalid for the older 0.7 version. This led to a split in the blockchain, with miners using version 0.8 on one side of the fork and those using version 0.7 on the other.

The issue was quickly noticed by the Bitcoin community. It was decided to revert back to the older 0.7 version for the sake of network stability and consistency. Miners using the 0.8 version had to downgrade their software and discard the blocks they had mined on the 0.8 chain. The situation was resolved within a few hours, and the Bitcoin network continued to operate on the 0.7 version until the compatibility issues could be fully addressed.

Accidental forks can happen when two miners stumble upon the same block simultaneously. When this happens, both miners continue mining on the same block on different chains till a subsequent block is added.

Advantages of Hard Forks

Hard forks are a significant occurrence for any blockchain that can define the future of the respective blockchain.

Implementing Major Changes

Hard forks are used when significant changes are necessary to fix critical security vulnerabilities, scalability limitations, or protocol flaws that soft forks cannot address due to backward compatibility constraints.

They can also help in adding major upgrades and new features that are not achievable through soft forks.

Resolving Community Disagreements

When a community cannot reach a consensus on a particular issue, a hard fork can provide a solution by creating two separate chains reflecting the preferences of specific groups.

Experimentation and Innovation

Hard forks can act as testing grounds for innovative ideas and features that may initially be too risky or disruptive for the main chain. This allows experimentation and potential breakthroughs without jeopardizing the stability of the core network.

Disadvantages of Hard Forks

Yes, hard forks are important to bring significant changes to the blockchain, but they come with certain disadvantages too.

Community Division

Hard forks can lead to splits in the community if a large faction disagrees with the changes caused by the hard fork. A segment of the community can choose to remain on the original chain, resulting in two competing versions of the blockchain with different values and functionalities. This can create confusion, and uncertainty, and harm the reputation of both chains.

Technical Challenges

Implementing a hard fork requires careful planning and coordination to ensure a smooth transition. Technical issues can arise during the split that can dwindle user confidence and compromise the network’s security.

Increased Network Vulnerability

The blockchain network becomes vulnerable to attacks during and after a hard fork, especially 51% attacks. As the hashing power is temporarily divided across two chains, it becomes easier for a malicious actor to gain control over one chain and manipulate its transactions for personal gains.

Replay Attacks

There’s always room for replay attacks (that attack involves capturing the details of this valid transaction and broadcasting it again on a different chain, trying to trick the network into thinking it’s a new transaction and rewarding the attacker with more cryptocurrency) with hard forks when a transaction gets broadcasted on both the chains making it get spent twice.

Soft Fork vs Hard Fork: Understanding Soft Forks

Soft forks refer to minor changes and upgrades to a blockchain that can be accessed on the older version without the urgent need to move to the new framework.

Why Do Soft Forks Happen?

Soft forks are essential for corrections, small upgrades, and adding new features without requiring a hard fork. These soft forks are the only viable framework for implementing smaller and less radical changes.

Advantages of Soft Forks

Soft forks have several advantages. From small protocol changes to incremental upgrades, these can be easily implemented on the blockchain protocol without disrupting the integrity of the protocol. Here are some of the core advantages of soft forks.

Backward Compatibility

Soft forks are minor changes and upgrades that don’t modify the original protocol. Hence, the nodes operating under the initial versions of the blockchain can continue validating and accepting blocks that are created under the new rules without the risk of network fragmentation and minimal disruption.

Smooth Implementation

All the soft forks don’t need simultaneous upgradation making them easier to implement and accepted by the community. As the majority of miners enforce the new rules gradually, the network easily accepts the changes reducing the risk of contentious situations or delays.

Enhanced Security

Soft forks can enhance the protocol’s security measures at times by introducing stricter validation rules or fixing vulnerabilities, Since these upgrades are also applied to the old nodes, the protocol becomes more resistant to malicious actors.

Room for Experimentation

Soft forks allow developers to experiment with new features and integrate them into the blockchain. Moreover, if the changes don’t seem viable, there is always room for reverting those changes to the original state.

Low Risk

Hard forks tend to cause permanent changes to the underlying framework with the risk of splitting the blockchain. However, soft forks don’t have any such risk and lower scope for disruption.

Disadvantages of Soft Forks

While there are no major risks to soft forks when compared with hard forks, there are certain disadvantages that you need to be aware of.

Low Scope

The intended changes through the soft fork need to be reversibility compatible to avoid permanent structural changes.

Scope for Replay Attacks

There is a little probability that the intended transactions get replicated on both the new and old chain which might leave scope for unexpected results.

Hard Fork vs Soft Fork: What’s the Difference??

Features |

Hard Forks |

Soft Forks |

| Split in Blockchain | Hard forks split the blockchain in two. | Soft forks don’t split the blockchain but change the original blockchain. |

| Compulsory upgradation | Users need to reach a consensus and adopt the new underlying framework to use the new chain. | Only the users who want to use the new features and upgrades need to upgrade their network. |

| Backward Compatibility | Hard forks are not backward compatible. | Soft forks are backward compatible and the older version can be reinstated when needed. |

| Computation power | Hard forks need high computational power to create a new side chain. | 51% hash power is sufficient for a soft fork in the majority of the cases. |

What Happens to Users’ Crypto When a Blockchain is Forked

When a blockchain is forked, the impact on users’ cryptocurrency holdings depends on the type of fork and how it is implemented.

Let’s try to understand this in both cases.

Soft Fork

As the soft forks are backward compatible, there is no significant direct impact of the fork on the users’ crypto.

Depending on the nature of the change, the market might react to the changes that can lead to fluctuations in crypto prices.

Hard Fork

In many cases, you might get equivalent amounts of crypto on both the old and the new chain after the fork occurs.

After the split in the blockchain, you need to decide on which blockchain you want to keep your crypto.

The fork can lead to a change in the value of your cryptocurrency. For example, the chain with larger user adoption & mining power, better features and future potential, and positive investor sentiment can lead to an increase in the price of your crypto and vice versa.

Note that when a hard fork occurs, the native tokens on the two forks are distinct. They may or may not be compatible with the same crypto wallet.

Final Thoughts

Forks in blockchains are necessary inconveniences.

In traditional systems, decisions about updates or changes are typically made by a centralized authority. In contrast, forks in a blockchain are a manifestation of decentralized governance.

Forks represent the community’s ability to propose, debate, and implement changes in the protocol. This process can lead to a more democratic and transparent system, where the direction of the blockchain is determined by its users and stakeholders.

Found this article insightful? Read more pieces like this one on Paybis.

FAQs

What are the two types of forks blockchain?

There are two main types of forks in the blockchain: a soft fork, which is a backward-compatible upgrade, and a hard fork, which is a non-backward-compatible upgrade, creating a permanent divergence from the previous version of the blockchain.

How to fork a cryptocurrency?

Forking a cryptocurrency involves copying the existing codebase, making modifications as needed, and then launching the new version. This process requires technical expertise in blockchain technology and consensus from the community or network participants.

What is forking in crypto?

Forking in cryptocurrency refers to the process of creating a new branch of a blockchain, either by modifying the existing code (soft fork) or creating a completely new version (hard fork). It’s often done to implement new features, fix vulnerabilities, or create a new cryptocurrency.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info