How to Reverse Mpesa Transactions

M-Pesa, prevalently referred to as mpesa, has made it incredibly easy for people in Kenya, and other regions, to transact and manage money. And now, with Paybis, mpesa is also an avenue to buy cryptocurrency! For example, you buy Bitcoin with M-Pesa on Paybis.

It enables a seamless and secure mode of transferring money, and paying bills, significantly unifying the different financial needs under one service. As a result, mpesa, today, caters to over 56 million customers spanning across 7 countries.

However, while M-Pesa offers convenience and flexibility, it is not uncommon for users to experience transaction errors, such as sending money to the wrong till number or account. These inadvertent errors necessitate an understanding of how to reverse M-Pesa transactions to recover the sent funds effectively.

This article delves into the essential methods and steps on how to reverse mpesa transactions, exploring various scenarios where reversals may be needed, such as after 24 hours of the transaction and in cases where money is sent to the wrong account.

Table of contents

- What is Mpesa Reversal?

- How to Reverse Mpesa Money

- How to Reverse Mpesa Sent to Wrong Till Number?

- How to Reverse M-Pesa Transaction After 24 Hours?

- How Long Does It Take for Mpesa Reversal?

- Who Can Initiate the Mpesa Reversal?

- Are There Charges for Mpesa Reversal Service?

- Is Mpesa Reversal Guaranteed?

- Conclusion

- Frequently Asked Questions (FAQs)

What is Mpesa Reversal?

Mpesa reversal refers to the process of retracting a transaction made via mpesa, primarily when sent to an incorrect till number or account.

M-Pesa reversals work similarly to an authorization hold in digital payment systems, where funds are temporarily set aside before final settlement.

In Africa’s world of mobile transactions, where mpesa predominantly reigns, it’s vital to understand what mpesa reversals entail and why they are crucial in maintaining fluidity and security in your daily transactions.

This function is indispensable as it acts as a safety net for users, allowing them to rectify transaction errors, ensuring that their hard-earned money is not lost due to a simple mistake or oversight.

The understanding of mpesa reversal mechanisms provides users with peace of mind, knowing that in the event of a mishap, there is a reliable recourse available to reclaim their funds. It fosters trust and reliability in using mpesa services, encouraging more people to leverage this innovative financial solution.

How to Reverse Mpesa Money

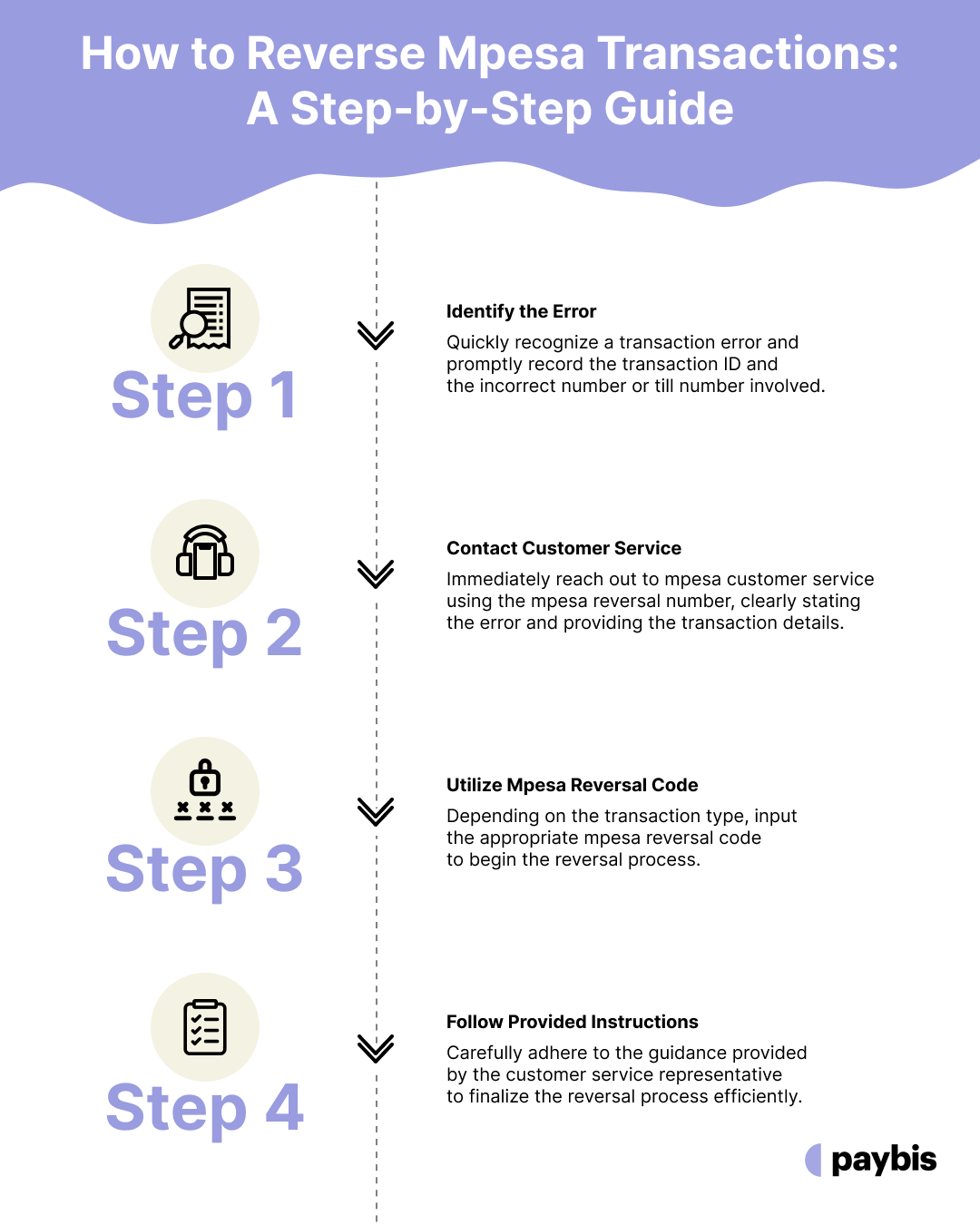

Navigating the reversal of mpesa transactions involves a series of steps that are straightforward and user-friendly.

Here’s a concise guide on how to reverse mpesa money:

- Identify the Error: As soon as you realize a transaction error, take note of the transaction ID and the erroneous number or till number involved.

- Contact Customer Service: Quickly contact the mpesa customer service through the provided mpesa reversal number, outlining the error and providing the necessary transaction details.

- Use the Mpesa Reversal Code: Depending on the nature of the transaction, you may need to use the designated mpesa reversal code to initiate the reversal process.

- Follow Instructions: Adhere strictly to the instructions given by the customer service representative to ensure a smooth reversal process.

Just as you want to avoid hidden fees in cryptocurrency transactions, understanding M-Pesa’s reversal fees and policies helps you manage your money more effectively.

How to Reverse Mpesa Sent to Wrong Till Number?

Sending money to the wrong M-Pesa till number can be frustrating. However, here are the steps on how to reverse mpesa send to the wrong till number:

Step 1: Check the SMS Confirmation

Once you realize that you’ve sent money to the wrong till number, immediately check the M-Pesa confirmation SMS.

This message will have the details of the transaction, including the till number and the amount sent.

Step 2: Call Safaricom Customer Care

You should promptly call Safaricom Customer Care by dialing 100 (prepaid) or 200 (postpaid) as soon as you realize the mistake.

Please note that time is crucial, so the sooner you report, the higher the chance of reversing the transaction.

Step 3: Provide Transaction Details

When you get through to a customer care representative, you will need to provide the details of the erroneous transaction. This will usually include:

- The transaction ID (from the confirmation SMS)

- The amount sent

- The wrong till number you sent the money to

Step 4: Follow Instructions

The customer care representative will guide you on the next steps.

They will usually initiate an investigation to ascertain whether a reversal is possible. They will also inform you of the expected duration for the resolution of your issue.

Step 5: Wait for Feedback

Once the investigation is initiated, you may need to be patient and wait for feedback from Safaricom. It can sometimes take a few days to resolve such issues.

Remember, while the Safaricom team will do their best to assist, the outcome will largely depend on the specific circumstances surrounding the transaction.

How to Reverse M-Pesa Transaction After 24 Hours?

Wondering how to reverse Mpesa transaction after 24 hours?

Reversing an M-Pesa transaction after 24 hours might be more challenging, as it depends on the cooperation of the recipient and whether the funds are still available in their M-Pesa account.

However, the general process remains similar. Here’s what you can do:

Step 1: Contact Safaricom Customer Care

Call Safaricom Customer Care immediately, regardless of the elapsed time, by dialing 100 (prepaid) or 200 (postpaid).

Step 2: Provide Transaction Details

Provide all necessary details about the transaction to the customer care representative, including:

- Transaction ID (from the confirmation SMS)

- Amount sent

- Wrong till number/phone number to which the money was sent

Step 3: Await Investigation

The representative will likely initiate an investigation to determine whether a reversal is possible or not. They may also try to contact the unintended recipient to request their cooperation in refunding the money.

Step 4: Follow Up Regularly

If the issue is not resolved promptly, make sure to follow up regularly with customer care to check the status of your request.

After successfully reversing an M-Pesa transaction, you might want to explore safer options for digital payments. If you’re interested in cryptocurrency, you can buy Bitcoin with your bank account on Paybis with instant verification.

How Long Does It Take for Mpesa Reversal?

The time it takes for an M-Pesa reversal can vary widely depending on the circumstances surrounding the transaction, the cooperation of the recipient, and the responsiveness of Safaricom’s customer care team.

Here is a general guideline on the timeline:

Immediate to a Few Hours: If the recipient is cooperative and willing to reverse the transaction immediately, a reversal can be processed relatively quickly, sometimes within a few hours.

24 to 48 Hours: In cases where Safaricom’s intervention is required, it could take around 24 to 48 hours to investigate and process the reversal, especially if it is a straightforward case.

Several Days to Weeks: For more complex situations, especially where there are disputes or non-cooperation from the recipient, it could take several days to weeks to resolve. In some cases, it might require mediation or even legal action, extending the resolution time significantly.

What to Do to Minimize Time

- Promptly Report: As soon as you notice an erroneous transaction, report it to Safaricom Customer Care by dialing 100 or 200.

- Follow Up: Keep following up regularly with customer care if you don’t hear back within the expected timeline.

- Be Patient: Understand that while Safaricom will do its best to resolve the issue, some cases can be time-consuming, especially if they involve uncooperative recipients or disputes.

Remember, the resolution timeline is not fixed, and each case is unique, so the time frames mentioned are approximations and can vary depending on the specific circumstances.

While M-Pesa offers convenience for daily transactions, cryptocurrencies provide additional options for international transfers. Paybis allows you to buy Cardano (ADA) and other digital assets securely.

Who Can Initiate the Mpesa Reversal?

The process to reverse an M-Pesa transaction is typically initiated by the sender of the funds, who should follow the steps of contacting Safaricom Customer Care and providing the necessary details of the erroneous transaction.

However, the ultimate execution of a reversal can involve different parties, based on the nature of the transaction:

Sender

The sender can initiate a reversal by contacting Safaricom’s Customer Care immediately after realizing the mistake.

The sender needs to provide transaction details and follow the instructions given by the customer care representative.

Recipient

If the recipient is cooperative, they can send back the money directly to the sender without involving Safaricom, thus facilitating an immediate “reversal.”

In cases where Safaricom contacts the recipient for a reversal, the recipient’s consent is usually sought, and they can agree to the reversal.

Safaricom Customer Care

Upon receiving a reversal request, Safaricom can facilitate communication between the sender and the recipient and can help mediate the reversal process.

Safaricom can execute the reversal in cases where it’s clear that a mistake was made, and the recipient agrees to the reversal.

Safaricom’s Dispute Resolution Team

For more complex cases or disputes, Safaricom’s specialized teams may get involved to investigate and resolve the matter, often requiring detailed verification and possibly liaising with both parties to resolve the dispute.

Just as M-Pesa requires careful transaction management, cryptocurrency transactions also need proper security measures. Using a secure crypto wallet helps you manage your digital assets safely and avoid costly mistakes.

Are There Charges for Mpesa Reversal Service?

Typically, there are no additional charges levied by Safaricom for initiating a reversal request for an erroneous M-Pesa transaction. The process of contacting customer care and requesting a reversal is generally a part of Safaricom’s customer service.

However, a few points to note are:

- Recipient Refunds: If the recipient decides to refund the amount voluntarily, they might incur standard M-Pesa transaction charges when sending the money back.

- Initial Transaction Costs: Even if a reversal is successful, the transaction costs of the initial erroneous transaction are usually not refunded.

- Legal Costs: In cases where legal action becomes necessary, the sender will likely incur legal fees and associated costs.

Therefore, while the reversal process itself does not incur additional charges from Safaricom, the overall resolution may involve some costs, especially if it requires voluntary refunds or legal intervention.

Is Mpesa Reversal Guaranteed?

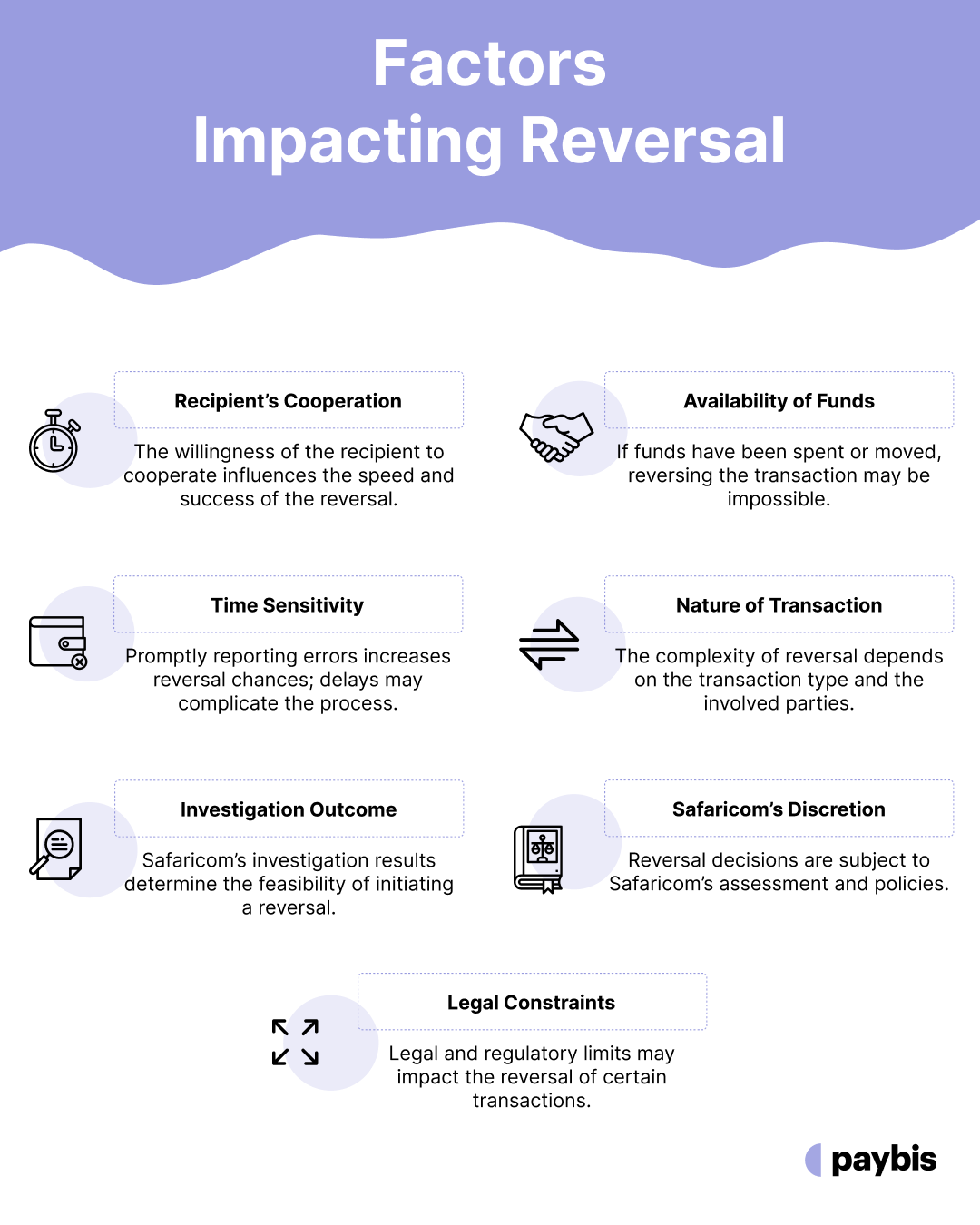

No, an M-Pesa reversal is not guaranteed. The ability to reverse a transaction largely depends on the cooperation of the recipient and the specific circumstances surrounding the transaction.

Here are a few factors that impact the likelihood and success of a reversal:

Recipient’s Cooperation

If the recipient is willing to cooperate and refund the money, the reversal process is likely to be smooth and quick.

If the recipient is uncooperative or unresponsive, it may be challenging to recover the funds.

Availability of Funds

If the received funds have been spent or transferred elsewhere, it may not be possible to reverse the transaction.

Time Sensitivity

Prompt reporting of the erroneous transaction increases the chances of a successful reversal.

Delays in reporting may complicate the reversal process, especially if the recipient is unwilling to cooperate or if the funds are no longer available.

Nature of the Transaction

Some transactions may be more complicated to reverse, depending on whether it was sent to a wrong number, paybill, or till number, and whether it involves businesses or individual users.

Investigation Outcome

Safaricom will typically conduct an investigation to verify the details and circumstances of the transaction.

The outcome of this investigation will influence whether or not a reversal will be initiated.

Safaricom’s Discretion

The decision to reverse a transaction is ultimately at Safaricom’s discretion, based on their assessment of the situation, terms and conditions, and applicable policies and regulations.

Legal Constraints

There may be legal and regulatory constraints that affect the ability to reverse certain transactions.

Conclusion

Mpesa has proven itself to be a useful tool that improves financial efficiency by making payments mobile-friendly and instant. With Paybis, people can even buy USDT with M-Pesa.

The service’s ubiquity makes it an integral component in the daily financial dealings of many, fostering a seamless experience in money management and bill payments. Despite its remarkable convenience, users are not immune to transactional errors, necessitating a reliable reversal mechanism to rectify inadvertent mistakes promptly.

While Safaricom provides a mechanism to attempt mpesa reversals and endeavors to assist customers in recovering mistakenly sent funds, there is no absolute guarantee that every reversal request will be successful.

Users are advised to double-check transaction details before confirming to minimize the risk of errors and to report any mistakes as quickly as possible to maximize the chances of a successful reversal.

Follow the Paybis blog to learn about more topics like this one, which will help keep your finances safe by guiding you in the right direction.

Frequently Asked Questions (FAQs)

What happens if I accidentally transfer money to the wrong account?

If you accidentally transferred money to the wrong account, you can quickly report the transaction and attempt for mpesa reversal by contacting Safaricom customer care.

Is there a time limit for M-Pesa reversals?

Yes, there is a time sensitivity for M-Pesa reversals, but no strict time limit is defined. However, promptness is crucial, as delaying the reporting of an erroneous transaction can significantly reduce the chances of a successful reversal, especially if the recipient is uncooperative or the funds have been spent.

What happens if the receiver will have used some or all of the amount when the reversal is done?

If the receiver has used some or all of the amount when a reversal is attempted, the reversal may not be successful. The ability to reverse the transaction significantly depends on the availability of funds in the recipient’s account. In such cases, the sender might need to seek alternative resolution methods, potentially involving mediation or legal action, to recover the funds.

How to cancel Mpesa reversal request?

To cancel an M-Pesa reversal request, you typically need to contact Safaricom Customer Care promptly. You can reach them by dialing 100 (prepaid) or 200 (postpaid) and explain the situation, requesting them to cancel the reversal. However, there’s no guarantee that the reversal request can be canceled, especially if the process has already been initiated or completed. The possibility of canceling a reversal would largely depend on the stage of the reversal process and Safaricom’s policies.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info