How to Short Bitcoin: Comprehensive Guide to Short Selling BTC

A bull market is every investor’s favorite playground. Well, at least for those who are holding on to their crypto over long periods.

There are others who prefer to take advantage of the volatility that a crypto market offers and trade it using various strategies. Among them are those who eagerly wait for the price of Bitcoin to plummet.

As counterintuitive as it seems, there are different financial tools and techniques available to these traders which allow them to make money on a bearish price movement. One such tool is short selling Bitcoin, or ‘shorting’, as it is often called.

In this article, we will discuss what does shorting Bitcoin mean, how to short Bitcoin, and where to short BTC.

Table of contents

What Does Shorting Bitcoin Mean?

Shorting Bitcoin or any other tradable asset is a trading technique used to capitalize on declining price movements. In short selling, the trader borrows an asset (in this case, Bitcoins) from a lender and then sells it at its current market rate.

Once the price of Bitcoin drops to a desirable level, the trader buys back an equal amount of Bitcoins as they had sold earlier and returns the borrowed asset to the lender, thus covering their short position and making a profit.

How Does Shorting Bitcoin Work?

Buying low and selling high is the conventional way to make money in any trading market, regardless of its volatility. But, the price of Bitcoin is not always on an uptrend. It is volatile and has its fair share of decline in short time frames.

Bitcoin shorting works by selling high and buying low.

But how do you sell something you do not have? Through leverage.

Leverage refers to the use of borrowed funds (from a broker or exchange) to increase one’s buying power and potential profits. To open a leveraged short position, you need to borrow Bitcoins from an exchange or another market participant and immediately sell them at current prices in hopes of making a profit once their price drops.

When the price goes down as expected, the trader closes their short position by buying an equal number of Bitcoins and returning them to the lender. The trader then keeps the difference between the current market price and the price at which he sold the BTC earlier as his profit.

In simple words, when you short Bitcoin, you are betting that its value will decrease in order to make a profit.

Bitcoin Shorting Example

Let’s understand Bitcoin shorting with an example chart shown below.

The chart shows the price of BTC falling from $22,395.44 (denoted by a green horizontal line) to $20,173.57 (denoted by an orange horizontal line) on 13 September 2022.

Say a trader opened a short Bitcoin position at the green line and wants to short 10 BTC. The trader will first borrow 10 BTC (valued $223,954.4) from the lender (exchange or broker) and immediately sell it in the market. This would leave the trader with liquid funds of $223,954.4.

When BTC hits the orange line, the trader will use the liquidity they obtained by selling the BTC to buy back 10 Bitcoins from the market at a total cost of $201,735.7 and repay their debt to the lender.

In most cases, the lender also charges interest. This interest compound accrues over time. Hence, shorting Bitcoin is only done in short time frames. For the purposes of this explanation, assume there is no interest.

Therefore, after the debt is repaid, the trader gets to pocket the profits. In this case, the profit would be the difference between $223,954.4 and $201,735.7, which is $22,218.7.

If the trader were performing at 10x leverage, i.e., the trader opened a 10x short position with just 1 BTC, the profit would have been almost 100% for a nearly 10% change in price. This amplification of profits is a great beacon to attract passionate investors to this trading strategy.

However, it is crucial to recognize that this trading strategy also amplifies losses. Since an asset’s price can theoretically reach infinity, the risk component of shorting Bitcoin is infinite. Simply put, there is a possibility of losing an infinite amount of money.

Why Short Bitcoin?

Shorting Bitcoin can be an attractive strategy for traders who believe that the cryptocurrency is overvalued, facing regulatory challenges, or on the brink of a market correction.

However, given that shorting is a highly advanced and risky trading technique, we would encourage you to double check any trades your are about to place and consult financial experts.

Volatility and Market Cycles

Since the crypto market follows cycles, shorting Bitcoin can be a great way to benefit from the market’s cyclicality.

Many traders believe that every new bull run is followed by a bearish correction. By shorting BTC during the bearish phase, they can make suitable profits before the next bullish cycle kicks in and prices soar.

Risk Management and Hedging

Shorting Bitcoin can also be used as a risk management and hedging tool to mitigate losses.

For instance, if you are holding a long position of Bitcoins and you think its value may take a dive due to an external event such as a regulatory announcement or change in market sentiment, you may open a short position by borrowing Bitcoins from an exchange and immediately selling them at the current market rate.

This will protect your long position against losses should Bitcoin’s price fall and make you eligible to profit from a bearish swing in addition to your bullish gains.

Skepticism and Fundamental Analysis

Critics of Bitcoin often cite concerns over its intrinsic value, regulatory uncertainties, and environmental impact.

Shorting Bitcoin can be seen as a way for investors to express skepticism about the long-term viability and sustainability of the cryptocurrency.

By conducting a thorough fundamental analysis and considering these factors, traders may conclude that the current market sentiment surrounding Bitcoin is inflated, leading them to take a short position.

Increase Exposure to Investment

Shorting Bitcoin can be done through leveraged trading, which magnifies both potential profits and losses. Leveraged trading allows investors to trade with borrowed funds, amplifying their market exposure.

For example, a leveraged trading platform may offer 2x or 3x leverage, meaning that for every dollar invested, the investor gains exposure to $2 or $3 worth of Bitcoin.

While leveraged trading can amplify potential gains, it also heightens the risk of significant losses if the market moves against the investor’s position.

Risks and Considerations when Shorting BTC

Beware of Short Squeeze

Shorting Bitcoin can be a beneficial trading strategy if you believe its value will decline. However, there is always the risk of a short squeeze.

A short squeeze occurs when the price of an asset suddenly increases and forces those who are shorting it to close their positions quickly, resulting in further price hikes due to increased demand.

This creates a vicious cycle that can cause massive losses for traders who were hoping for the price to fall.

Below is an example of a Bitcoin short squeeze.

In the image, BTC jumped from $26,907.99 to $29,851.58 in hours (from 20 June 2023 to 21 June 2023). This is a 10.94% increase. However, for short positions that had taken a 10x leverage, this would translate to 109.4% loss.

Short Interest Rate (SIR)

The Short Interest Rate (SIR), also known as the lending rate, is one of the key factors to consider before shorting Bitcoin. SIR refers to the cost charged by exchanges or brokers for borrowing coins from them for selling them in hopes of making a profit when the asset price drops.

Higher SIR means higher costs and hence lower profits from shorting Bitcoin. On the other hand, lower SIR attracts more traders to open short positions in search of high returns.

That is why shorting Bitcoin is usually done on shorter time frames.

Infinite Risk

Shorting Bitcoin or any other asset carries an infinite risk.

If the price of Bitcoin were to suddenly skyrocket due to a whale entering the market, there is no limit as to how much you could potentially lose if your short position does not close in time.

This is why it’s important to keep track of market news and be prepared to jump out of a trade at a moment’s notice if the need arises.

How to Short Bitcoin?

There are several ways to bet against the price of Bitcoin and short the asset. The most common are the following:

- Shorting BTC with margin trading

- Shorting BTC with Futures trading

- Shorting BTC with CFD

Shorting BTC with Margin Trading

The most direct way to short Bitcoin is through a margin trading platform. This involves borrowing funds from the exchange and opening a position with leverage.

Margin trading allows traders to open positions with 2x, 3x, 5x or even 10x leverage which amplifies profits but also increases risk if the market does not move in their favor.

For example, if you have 1 BTC, you can short 10 BTC by taking 10x leverage. This means that the exchange or broker is lending you 10x the capital you have. Therefore, your profit (or loss) is amplified 10x for every percentage increase (or decrease) in the asset price.

But the assets are not loaned out for free. Borrowers have to deposit some amount as collateral known as “margin” – this is usually 50% of the borrowed amount. This acts as a guarantee to the borrower that you will be able to pay back the debt.

If the short trade does not go as planned and losses are exceeding your margin, the trader will receive a “margin call” and will be required to top up the margin or close the position. If a margin call is not addressed, then the trade might be liquidated automatically.

Shorting BTC with Futures Trading

Futures trading is another way to short Bitcoin without actually having to loan coins from an exchange or broker.

In this method, traders enter into an agreement to buy or sell Bitcoin (or any other asset) at a predetermined date in the future at a predetermined price. This allows traders to bet against Bitcoin’s price without having to borrow it from anyone else.

The futures contracts are settled on the expiration date based on the difference between the agreed-upon price and the spot market rate. If you have correctly predicted that Bitcoin’s value will be lower than what was agreed, then you will be able to reap profits.

Shorting BTC with CFDs

Contracts for Difference (CFDs) are derivatives instruments that allow traders to speculate on the price movements of Bitcoin without actually owning it.

Instead of buying or borrowing Bitcoins, CFD’s traders can simply enter a contract with a broker and gain access to leverage in order to open a position.

Similar to futures trading, CFDs allow traders to speculate on the price direction of Bitcoin without having to own the underlying asset.

One major advantage of CFDs over margin and futures trading is that there are no expiration dates associated with the contracts.

This allows traders to keep their positions open for as long as they want without worrying about expiry dates or early liquidation due to low funds in their accounts.

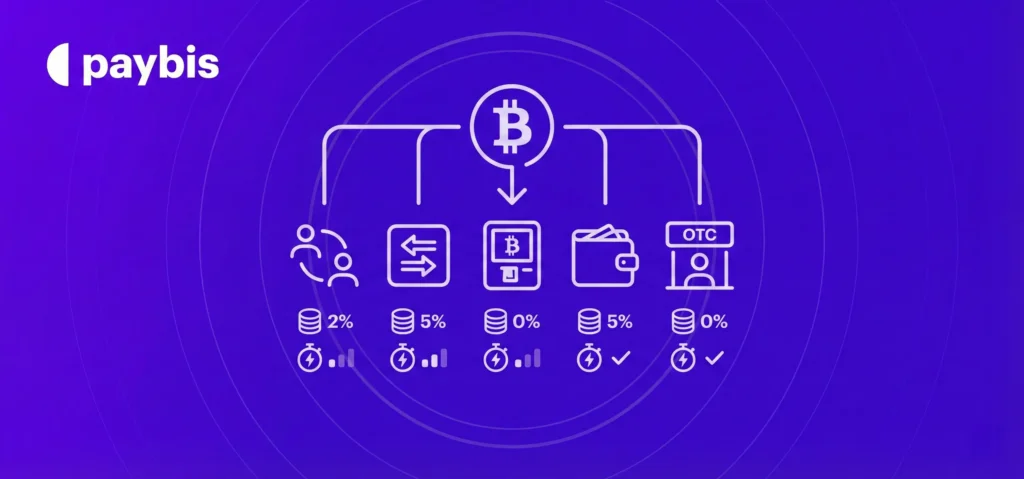

Where to Short Bitcoin?

Now you know how to short Bitcoin. But where to short Bitcoin?

Many cryptocurrency exchanges allow you to short Bitcoin. However, not all of them provide you with the same tools.

One exchange might only support margin trading, while another exchange might only provide you the option to short Ethereum, Bitcoin, and other crypto through futures trading.

Here is a list of popular exchanges where you can short Bitcoin:

- Binance

- Coinbase

- Gate.io

- OKX

- Huobi

- KuCoin

Click here to learn more about how to make money with crypto.

Conclusion

Shorting Bitcoin is among some of the advanced crypto investment strategies that can be extremely profitable if done correctly.

However, it is also a speculative and risky move. It carries the risk of infinite losses if the market does not move in your favor. Therefore, it is important to do your research before entering into any short position.

If you are a newbie to crypto, you can consider starting with small periodic investments to test out the waters. Learn more on “how often should I buy crypto.”

FAQ

How does shorting crypto work?

Shorting crypto involves borrowing coins from an exchange or broker and selling them in hopes of profiting when the coin’s value drops. The trader is betting against the asset and will buy back the coins at a lower price to make a profit.

What are some of the most common ways to short Bitcoin?

The most common ways to short Bitcoin are through margin trading, futures trading, and CFDs. Each has its own advantages and disadvantages that traders should consider before entering any position.

Is it hard to short crypto?

Shorting crypto is not difficult, but it does require a certain degree of skill and knowledge. You should familiarize yourself with the risks associated with shorting and be prepared to close out your positions if necessary. It is also a highly risky and advanced trading strategy.

Is shorting available on Paybis?

Not, yet. Paybis is built for simplicity and ease of use by abstracting away any complications. We also beleive that it is vital to understand the fundamentals of any project and asset before engaging in high-risk trading activities like shorting. At Paybis, you have the option to buy crypto quickly and hold for the long term. If you choose, you may withdraw crypto from Paybis to the platform where you’d like to open a short position.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info