Everything You Need to Know About Litecoin Halving

Whether you’re just starting to get into cryptocurrencies, or you’re a seasoned crypto trader, you’ve probably heard about Bitcoin halving. But what about Litecoin halving? Ever since the first block halving event back in 2015, Litecoin started getting more attention from enthusiasts and investors.

Litecoin halving is a predetermined event and it’s crucial for the overall upkeep of cryptocurrency supply and demand balance. Regardless of your prior experience or knowledge, in this article, we’ll go over the basics: explain the halving process, and discuss why it’s an important process to understand.

Table of contents

Covering the Basics – What is Litecoin?

Litecoin (LTC), also known as the “silver to Bitcoin’s gold”, is a peer-to-peer cryptocurrency created by Charlee Lee in 2011. The purpose of introducing Litecoin was mainly to offer an alternative to Bitcoin, with faster transaction times, lower fees, and better accessibility for everyone.

To explain the silver and gold analogy, Bitcoin has a store of value, or “digital gold”, which is why it’s not as used for transactions as much as other cryptocurrencies. In contrast, Litecoin is the “digital silver”, designed for day-to-day transactions.

Just like Bitcoin (BTC), Litecoin operates on its own native, decentralized, and open-source blockchain. Litecoin was created off of Bitcoin’s codebase, so Litecoin’s code uses the same Proof-of-Work (PoW) consensus mechanism but with a different hashing algorithm, Scrypt.

Comparing Scrypt to the Bitcoin SHA-256 algorithm, Scrypt is less resource-intensive, allowing faster processing times. Additionally, unlike Bitcoin, which has a maximum supply of 21 million BTC, Litecoin has four times that amount, estimated to amount to 84 million LTC. That’s where Litecoin halving comes in.

What Exactly is Litecoin Halving?

Essentially, the Litecoin halving mechanism is a programmed and scheduled event, taking place every 4 years, or, every 840,000 blocks. To break this down, a new block is created every 2,5 minutes, which is four times faster than Bitcoin. This means that once the Litecoin block number reaches 840,000, a halving event occurs.

When Litecoin first appeared in 2011, the cryptocurrency offered 50 LTC for every mined block. Using this standard, the entire LTC supply would be mined at a rapid pace, resulting in digital assets being devalued. That’s why, 4 years later, in 2015, the first halving event happened, and 50 LTC became 25 LTC.

In short, the key purpose of Litecoin halving is to control the total supply of LTC tokens. Unlike fiat currencies which are easily influenced by central banks, crypto halving can help control the supply and mitigate inflation risks. Essentially, this creates scarcity, which theoretically can increase Litecoin’s value.

How Does Litecoin Halving Work?

Let’s bring back Bitcoin for comparison. Just like BTC, Litecoin also uses the PoW consensus mechanism for solving complex cryptographic problems to validate transactions and maintain the security of the blockchain itself.

For each successfully mined block, miners receive newly minted Litecoins. This means that during the first halving of 2015, the initial block reward of 50 LTC was reduced to 25. Then, in 2019 the 25 LTC was further reduced to 12,5 LTC.

Finally, the last Litecoin halving in 2023 meant that miners from then on would receive 6,25 LTC per block. While halving means that the amount of LTC is gradually reduced, it’s nonetheless crucial for maintaining the supply balance.

It’s a key strategic method, but the halving undoubtedly has an impact, on miners most of all. Since the first three halving events reduced the amount of LTC, many miners decided to abandon Litecoin mining and transition to other, more lucrative opportunities.

At the same time, those who remain or become a Litecoin miner are fully aware of the halving process and work towards the goal of receiving more as the price of LTC begins to grow. This “filtering effect” was actually an expected result of the halving, gathering people who value long-term sustainability.

Litecoin Halving History, In Chronological Order

Since Litecoin was first introduced into the crypto market, there were a total of 3 halving events, starting in 2015. To understand how these halvings came to be, and what happened in between them, let’s review the historical background.

First Litecoin Halving

Quite quickly, Litecoin’s creator realized that there could be a potential problem with the increasing popularity of Litecoin. That’s when the halving strategy was introduced, further backed by LTC’s price surge in July 2015, before the first halving event on August 25th. In just 2 years, Litecoin’s price saw immense growth, totaling $357 in December 2017.

Second Litecoin Halving

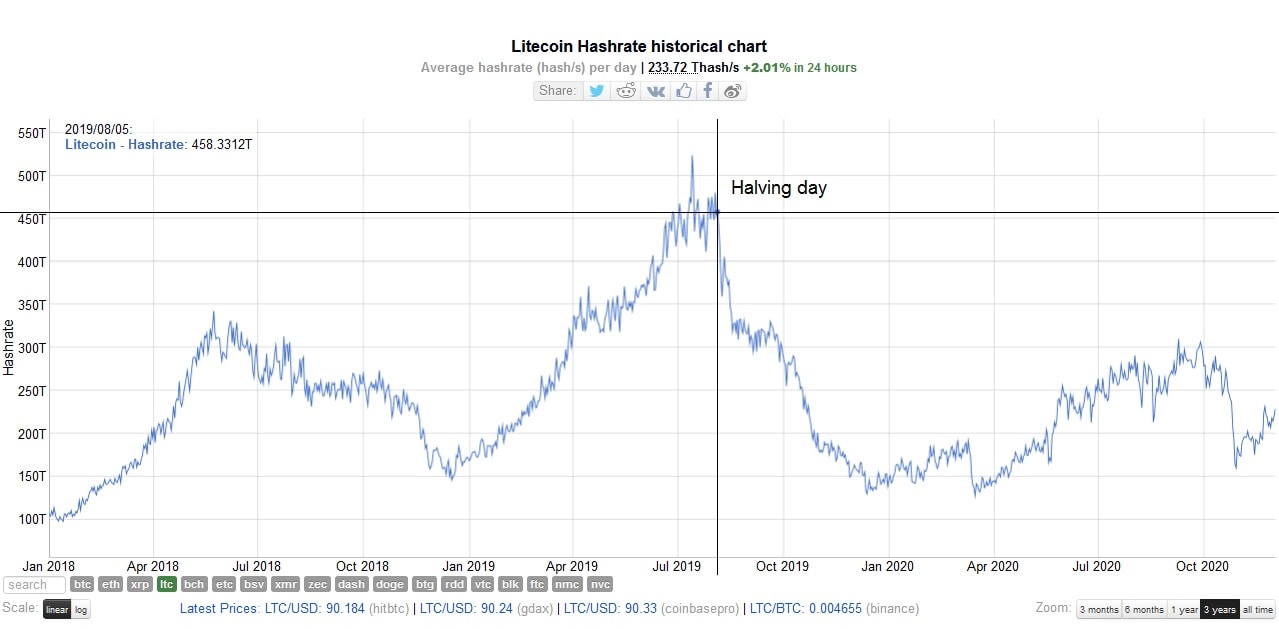

After the first halving event, the crypto market grew, resulting in a large number of cryptocurrencies becoming more valuable. Litecoin was halved for the second time on August 5, 2019. Unlike the first halving event, unfortunately, the second halving experienced a bearish market, which already influenced Litecoin’s price drop before the second halving event.

Third Litecoin Halving

After the last Litecoin halving event in 2019, the crypto market stabilized and allowed Litecoin to prepare for the third halving on August 2, 2023. It’s still too early to provide clear estimates on how the latest halving is influencing current Litecoin pricing, however, the price is somewhere between $70 to $80.

Why is Litecoin Halving Important?

- Creating scarcity and regulating LTC value. The main goal of Litecoin halving is to control how much LTC is being minted, thus creating balanced scarcity with moderately regulated LTC value fluctuations. This can ultimately lead to a somewhat steady increase in demand and LTC price.

- Controlling inflation. A direct result of controlling how much LTC is produced and released to the general market also helps with mitigating inflation risks. In the most basic sense, halving was introduced to mimic the process of the deflating price of gold. Maintaining a consistent schedule and halving LTC every 4 years helps to slow down the supply increase until it gradually reaches its maximum of 84 million.

- Creating Litecoin block rewards consistency and stability. Even though each halving means that the block reward amount gets reduced by 50%, the long-term effect of this strategy actually may very well benefit Litecoin miners. The halving process adds security over the already volatile nature of cryptocurrencies, so all interested individuals and minors know what to expect.

The Aftermath of Litecoin Halving

The impact of the three LTC halving events continued to be a subject of intense debate within the crypto industry. Despite the process already happening for nearly a decade, it’s still difficult to assess the situation.

Some analysts state that the halving events create artificial scarcity which could regulate and increase Litecoin’s price steadily over time. Other experts argue that Litecoin prices stabilize before the havings.

However, what really makes Litecoin halvings important should be looked at from the overall perspective of the crypto market. Litecoin is one of the first cryptocurrencies to implement the halving strategy.

It’s true that while industry experts are still debating the true long-term results, the fact that the strategy is already an effective method of bringing more certainty into the crypto market remains.

The Next Litecoin Halving Date

Current estimates show that the next halving event is expected to take place in 2027. The existing LTC block reward of 6.25 LTC will be reduced to 3.125 LTC per block. Today, roughly 75 million Litecoin tokens are circulating in the market. That means that the blockchain is around 9 million LTC away from reaching its maximum cap of 84 million.

If the existing schedule is maintained and Litecoin continues to be halved every 4 years, the maximum amount will be reached by 2142, which is quite some time away. In the meantime, investors and enthusiasts are already keeping a close eye on the status of LTC, in preparation for the fourth halving.

Staying On Top Of Crypto Exchanges with Paybis

For anyone invested in crypto, or those who are thinking of doing so, navigating critical events like LTC halving is important, but it can be tricky. That’s where exchange platforms like Paybis come in. With over 10 years of experience working in the crypto industry, our top experts and specialists created a platform that anyone can use, anywhere.

Whatever your crypto needs, our platform is designed to be as user-friendly as possible, allowing you to buy and sell crypto globally. We offer a wide range of cryptocurrencies and payment options, making it more convenient for both beginners and experienced crypto traders.

If you’re looking for trusted platforms to buy LTC before and after the halving events, Paybis provides a fast, easy, and efficient transaction process. So, whether you want to trade your LTC to USD, diversify your portfolio, or capitalize on Litecoin halving events, our platform can help you do that hassle-free.

FAQ

Will LTC go up after halving?

Generally, the purpose of Litecoin’s halving strategy is to create LTC scarcity and help regulate the Litecoin price changes. Historically, it has been reported that LTC prices would go up shortly after the halving, but there is no definitive outcome as halving remains a new strategy for controlling extreme crypto spikes.

However, if you want to track the price of Litecoin changes and current estimates, you can use our free LTC calculator.

What happens when LTC halves?

During a Litecoin halving, the standard block reward is cut in half by 50%. So, when the initial reward was 50 LTC, it was reduced to 25 LTC after the first halving in 2015. The block reward will continue to be reduced every 4 years.

Can LTC reach $1000?

There are several fundamental factors, like bullish conditions, increased Litecoin halving adoption, favorable policy introduction, and market sentiment that could potentially influence Litecoin price prediction.

However, at this time, there’s no definitive trajectory nor estimates on whether or not Litecoin can reach a price point of $1000. The highest LTC price was recorded in May of 2021 when LTC reached $412.

How are halving dates determined?

The Litecoin halving dates are determined by the speed at which blocks are created. Since a single LTC block is created in 2,5 minutes, this translates to around 567 blocks per day and 840,00 blocks per four years. Once this amount is reached, the halving takes place as stated in Litecoin’s protocol.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info