Telcoin: Crypto for the Masses

Crypto has come a long way since its beginnings, and it is much better known now than it was just five years ago. Yet it still remains a bit of a specialist product. How do you bring crypto to the masses – and should you?

Telcoin (TEL) has its own answer: tap into the infrastructure and user base that already exists and provide a clear improvement. This potentially could allow it to reach billions of people around the world, including the unbanked population.

This is another post in our series describing lesser-known coins that could potentially blow up in the future. These coins currently sit between the Top 100 and Top 200 cryptos by market cap, but there’s something about them that is worth a closer look.

So what makes Telcoin special, what it aim to do, what it need to do to get there ,and, of course, what this means for Telcoin price prediction? Let’s find out!

Table of contents

What is Telcoin?

As is often the case in the crypto world, Telcoin is both the crypto project and its native token TEL.

TEL is an ERC-20 token used to power the Telcoin network. It is one part of the Telcoin platform and is used to incentivize its users – basically, they receive TEL for running the platform.

The platform itself consists of several layers. There’s TELx, the underlying liquidity layer powering Telcoin-based products. This provides a user-owned liquidity engine that projects can tap into and use for their own needs.

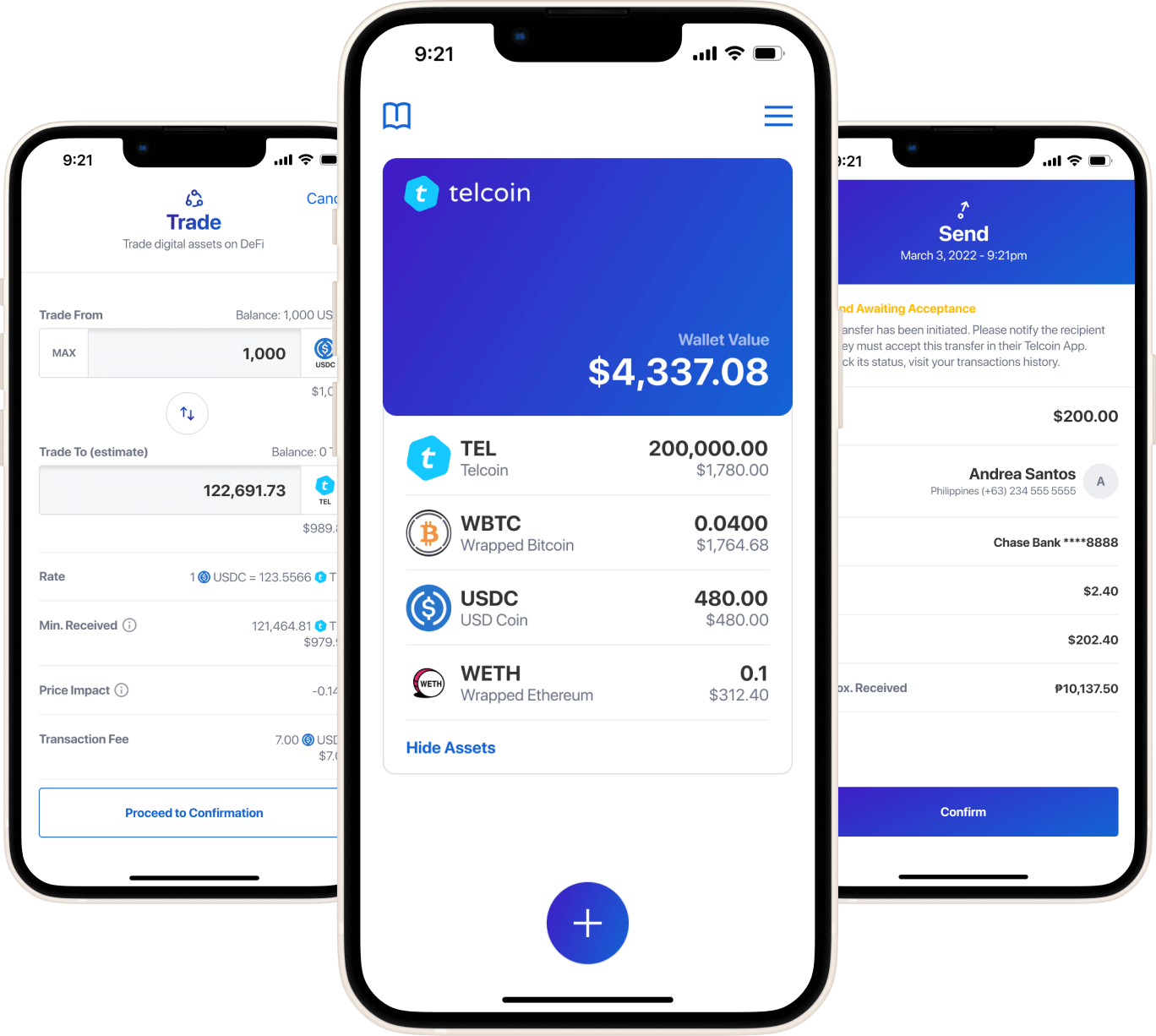

There’s also the application layer: a mobile app used to access the Telcoin platform and its products.

Telcoin comes with its own app – although its availability remains limited. Picture: Telcoin

And finally, just like any ambitious crypto project, Telcoin has its own blockchain layer – or, in this case, an Ethereum sidechain called Rivendell. This is where we get to the TEL part in Telcoin: Rivendell is built specifically with mobile network operators in mind. MNOs can use Rivendell to provide blockchain-based products to their own customers.

For example, a mobile operator could use Rivendell to launch its own blockchain-based payment system – they wouldn’t have to build the platform themselves or become a licensed payment provider. Or, if they already have some sort of payment system, they can accept payments on the blockchain – in fact, this is a large part of Telcoin’s strategy and we’ll get to that later.

The platform itself is user-owned, so there isn’t a single company that could go bankrupt and take the network with it. There is, however, a company, also called Telcoin (you may start to see a pattern here) that develops the platform, launches new products on it, and promotes it.

It’s important to note that, just as the Telcoin platform is owned by its users and not the Telcoin company, owning TEL also does not come with any ownership claims in the Telcoin company. These are two separate entities.

What about those products that this platform enables? Telcoin has launched with two. There’s Send Money Smarter (SMS), an MNO-connected money transfer network currently used to send remittances, and there’s also a decentralized exchange that takes advantage of the TELx liquidity layer called TELxchange. Telcoin itself stresses that these are just launch products; other ambitious ideas are in the making and moving along.

Now that we know the basics, let’s check the Telcoin price history to see how the token has been doing so far.

Telcoin Price History: Launching with a Bang

The project itself was launched back in 2017. For the first years of its existence, the token attracted limited publicity, mostly trading in the USD 0.0002-USD 0.0008 range.

The release that put Telcom on the map was Version 3 (V3), released in June 2021. Among other things, it introduced the three products mentioned above.

Telcoin spiked ahead of V3, but its subsequent price action has followed the general trend in the crypto market. Graph: CoinMarketCap

The release actually attracted investors even before the launch, as TEL spiked all the way to USD 0.064483 on May 11, 2021. The price soon declined, but the rate saw several other spikes following the actual release.

However, the rate soon went South as the general sentiment in the crypto market soured. TEL did not surprise on the upside here: it entered the bearish territory along with the rest of the market, and by June 2022 it was trading below USD 0.002.

Of course, it still is a notable increase from the pre-V3 price, but those who bought into Telcoin at its height are now looking at 3000-1500% declines. What does it mean for TEL price prediction – is the token finished?

Telcoin Price Prediction 2025: Aiming for Disruption

One of the most important features of Telcoin may well be its customer-centric approach. As of February 2025, the price of Telcoin is $0.007853.

As much as we like crypto here at Paybis, we readily admit that much of it is geared toward enthusiasts with at least an intermediate level of technical knowledge. Learning how to use a particular crypto project sometimes feels like research in its own right.

Telcoin is refreshingly different. It has clearly identified its target audience, and accessibility guides much of its design. The focus on MNOs is a good example: they already reach billions of users, including the world’s unbanked population.

In fact, mobile payments are an important alternative to traditional banking in Africa and Southeast Asia. 84% of Internet users in Kenya reported they regularly made mobile payments in 2021, and the total transaction volume reached USD 55.1 billion.

Note that this isn’t a stopgap measure that only exists until enough people open bank accounts. Instead, this is a fully fledged network that provides numerous advantages over legacy banking solutions. Africa can effectively leapfrog the rest of the world in this area.

Telcoin’s launch product, the Send Money Smarter network, aims to tap into this market. Its first use is a remittances system called Telcoin Remittances – that is, a way for people abroad to send money to their families back home.

It currently has limited geographic availability – when we tried installing the Telcoin app, we got a message that it’s “temporarily restricting new wallet activations”. Still, if you live in the current target markets, you should be able to download it, register, and use it to send money abroad.

An important feature of Telcoin Remittances is that it uses the existing MNO infrastructure. The recipients receive their local currency using their country’s mobile payment network – they don’t receive crypto and they don’t have to worry about withdrawing or exchanging it.

Telcoin Price Prediction 2030: Building an Established Platform

Remittances is an obvious start, given Telcoin’s focus on mobile operators and the prevalence of mobile payments in African markets. But Telcoin doesn’t plan to stop there.

We already noted the decentralized exchange and the Rivendell sidechain. There’s another project worth mentioning: the Nebraska banking initiative.

On May 26, 2021, Nebraska adopted a law called the Nebraska Financial Innovation Act, co-authored by Telcoin. The law received overwhelming bipartisan support and allows Nebraskan financial institutions to operate state-regulated and overseen digital asset businesses. Basically, this means that at one point, Nebraskans would be able to open a crypto account in their local bank, knowing that it is fully regulated by their state.

This could be seen as a controversial move. The crypto space often says it aims to replace traditional banking, and its decentralized and deregulated nature is cited as one of the key advantages of crypto.

Still, we believe that the crypto world has room for different approaches. It’s already regulated – many crypto exchanges, including Paybis, are licensed and follow KYC requirements. Moreover, many experts see increased regulation as key to widespread adoption – simply put, the average customer is more inclined to trust regulated financial products. Given that Telcoin is going for widespread adoption by the general public, it makes sense that it helps draft the corresponding regulations.

Of course, Telcoin also aims to take advantage of the regulations it has helped introduce. It has established a company in Norfolk, Nebraska and it has already started offering banking-related services. For example, US customers can top up their Telcoin wallets from any US bank account using the Telcoin app – no need to make any bank transfers. This may not be the most exciting feature imaginable, but again, it may be seen as more of a launch product with other features in the making.

Estimates from the Best Telcoin Price prediction Tools

Now that we have sorted out the fundamentals, let’s try putting some numbers on those predictions.

As always, keep in mind that long-term price predictions are always difficult, and the price points tend to be all over the place. Here’s what we mean:

- Wallet Investor is extremely bearish: it marks TEL as a bad investment that is set to decline further. Its average price prediction for the end of 2025 is USD 0.00762, which would be an all-time low by a notable margin;

- Price Prediction is more optimistic: its average TEL price for 2025 stands at USD 0.0126, above its all-time high;

Keep in mind that these estimates are never meant to be rock-solid predictions; rather, they should be seen as food for thought and a starting point for doing your own research.

Telcoin price prediction today

What’s the bottom line here?

In a way, Telcoin’s fundamentals look like those of a larger coin. It has a solid platform complete with its own liquidity engine, ongoing development, and a working product that is being used right now. It also has a clear audience that could potentially be huge. It has even drafted legislation and taken advantage of it once it’s passed.

A remarkable feature often lacking in other crypto projects is Telcoin’s customer-centric approach. It has an app that should make it easy to use, and its launch product – remittances – has a clear use case.

The company behind Telcoin is well-funded, so it can focus on development without worrying too much about TEL price.

Finally, Telcoin is working on a number of projects that, when launched, could bring massive publicity. For example, if Telcoin eventually opens a regulated bank in Nebraska or signs an agreement with some major bank, this could easily put it in mainstream news. And in crypto, massive publicity often equals impressive price spikes.

Is it all smooth sailing to success, then? Not necessarily. For starters, the platform seems to have its fair share of growing pains. The Telcoin app has terrible user reviews, made worse by the fact that many would-be users cannot even install it.

Telcoin is also far from being the only crypto-token promising (and delivering) fast and cheap cross-border money transfers. It faces competition from larger and better-established tokens.

Another thing worth mentioning is that Telcoin relies heavily on leveraging the existing infrastructure, such as mobile network operators and traditional banking. It’s one of its selling points – it doesn’t have to build everything from scratch, and it can plug into existing user bases. Still, the legacy solutions may also hold it back.

The final decision is up to you – but, if you’re looking for a relatively unknown token with huge potential and a clear idea of how to realize it, Telcoin is worth your own research.

So this concludes our second overview of a lesser-known token. We’ll be back with a closer look at another ambitious upstart, so, as always, stay tuned!

FAQ

Can Telcoin just disappear at one point?

The Telcoin platform is in it for the long run. They’re well funded, the development process is ongoing, and the company is looking to launch new initiatives. Moreover, the platform itself is user-owned; it would not disappear even if the Telcoin company went out of business.

Is Telcoin a good investment?

It’s up to you to decide. Telcoin is built to be accessible and simple to use. This could potentially extend its reach well beyond crypto enthusiasts, with a corresponding increase in value. As with any project, however, there’s no guarantee that it will reach its aims.

Can Telcoin reach USD 1?

Technically, it’s possible. The maximum Telcoin supply stands at 100,000,000,000 tokens. At USD 1 each, it would make Telcoin the third largest crypto at the time of writing. Of course, Telcoin still has a long way to go to approach this mark.

Can I buy Telcoin without the Telcoin app?

Yes, TEL is an ERC-20 token, which means it can be stored in any ERC-20-compliant wallet. Even if you can’t set up the Telcoin app, you can still get your Telcoin in numerous crypto exchanges and store it in your own wallet.

Can I invest in the Telcoin company?

At the moment, Telcoin Pte. Ltd. and various related companies are privately owned, and ownership of TEL explicitly does not come with any stake in them. Of course, if you’re an angel investor, you can contact them directly. If you’re a retail investor and bullish about the project, TEL is your best option: if the company succeeds, TEL should follow.

Is Telcoin actually used to send remittances?

The product is up and running, and people in its current target markets can actually use it to send and receive remittances. As of 15.12.2021, Telcoin noted that the 24h volume on its Send Money Smarter network reached USD 511,471.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info