Top 5 crypto myths that beginners have

Crypto is a household name by now. We’ve all heard about Bitcoin millionaires, and we’ve also heard a fair share of warnings about crypto’s impending crash and burn.

Full disclosure first: we do have skin in the game. We’re Paybis, a leading crypto exchange – as such, we are crypto optimists who strongly believe that crypto has a future. Still, it’s not just a blind faith: there are good reasons to be optimistic about crypto, as we hope to explain.

Moreover, we welcome discussion and even criticism of crypto; after all, that’s what drives crypto projects forward. Still, much of the criticism is based on assumptions that are either no longer true or were never true in the first place.

So this blog post is our attempt to clear up some of the most common misconceptions and myths about crypto.

Let’s dive right in!

Table of contents

1. Crypto is synonymous with Bitcoin

Bitcoin is far from being the only game in town. Photo: Reuters

First things first: this is still probably the single biggest misconception about crypto.

There’s no question that Bitcoin has a venerable position in the crypto space. It’s the original crypto that got the ball rolling, and it remains the largest and most actively traded crypto in the world. And, as any crypto enthusiast will attest, its movements often move the crypto market in general. So you may be forgiven for thinking that, for all intents and purposes, crypto is synonymous with Bitcoin – but that simply is not the case.

Bitcoin hasn’t been the only game in town for ages. There are thousands of tokens collectively known as altcoins, that is, cryptos other than Bitcoin. They range from unknown upstarts to established cryptos in their own right.

And they’re no Bitcoin knockoffs, either. They bring their own unique proposals to the table, solving things Bitcoin never attempted to solve and finding new ways to use the blockchain technology.

Consider Ethereum, the second most popular crypto. It’s not a Bitcoin fork or an attempt to create a Bitcoin alternative. Rather, it has created a thriving ecosystem of blockchain-based projects ranging from financial products to mobile games.

This brings us to the second point.

2. Crypto has no real value

The mobile gaming sensation Axie Infinity uses crypto to introduce a new way of gaming. Screenshot: Axie Infinity

This is another common criticism of crypto – and, to answer it, we must first consider what makes “real value” and how important it is.

First of all, the very definition of fiat money, such as USD or EUR, is money not backed up by any physical commodity. Basically, it has value because people agree it has value.

This has even led to some heated debates as to whether fiat currency has any real value. It is a popular discussion in the crypto community, but it goes outside the scope of this article. For now, let’s consider one thing: does it have utility?

Fiat currency provides an agreed store of value, means of payment, and, more broadly speaking, enables the functioning of entire national economies. That clearly has some utility.

Now consider: if a crypto currency provides an agreed store of value, means of payment, and enables the functioning of entire decentralised economies – is it really that different?

And crypto clearly does just that. When it comes to crypto, you often hear about DeFi or decentralised finance. This refers to various projects that aim to move the traditional finance – currency exchanges, banking, investments – to blockchain. For example, there are projects right now that allow intrepid investors to trade derivatives, take out loans, and automatically find the best return on their investment.

It’s not just finance, either. The blockchain-based Axie Infinity has become a mobile gaming sensation that provides a unique model: play-to-earn, that is, players can actually monetize their in-game achievements and assets.

How about disrupting the online advertising industry? Another crypto, the Basic Attention Token or BAT, aims to do just that: it comes with its own browser that rewards people as they view ads.

And, if you’re a firm believer in the gold standard, there’s even a crypto backed up by and redeemable in gold.

Time will tell whether these projects reach their aims – or to what extent. It’s certain, however, that there are plenty of cryptos that provide a clear utility – which, in turn, translates into value.

3. Crypto is only used by criminals or scammers

Crypto exchanges, such as Paybis, follow stringent security checks to keep crypto safe.

This myth tends to surface whenever the debate moves to prohibiting crypto transactions. The reasoning often goes like this: crypto enables unrestricted, unregulated, and anonymous transfers, making it the perfect tool for criminals.

The truth is more nuanced than that.

First, the overwhelming majority of criminal transactions, scams, and money laundering are done in fiat money. Even if crypto was banned altogether, it would not solve the problem – arguably, it would not even make that much of a difference.

Second, it is true that any emerging technology – and crypto is still an emerging technology – will attract its share of criminals and scammers. Many people are still unfamiliar with it, which includes both the general public and law enforcement. Legislation may also be incomplete – or lacking altogether.

Once again, though, this is not something unique to crypto. Moreover, the crypto community is working hard to address these shortcomings, pass the necessary legislation, and educate the public – and this blog post is our own humble attempt to do just that.

And we’re getting there. Any reputable crypto exchange – including Paybis – has rigorous security procedures, thorough KYC checks, and dedicated anti-fraud teams. We take security just as seriously as the traditional financial institutions, if not moreso. We do it precisely because crypto has plenty of legitimate uses, and we aim to protect our customers.

Third, it’s worth noting that crypto transactions aren’t necessarily anonymous; rather, they’re pseudonymous. In a way, it’s even more transparent and traceable than traditional finance.

Say you want to check all transactions from a certain bank account during a certain period of time. At the very least, you would need to contact a bank and convince them you’ve got the proper authority to do so. In fact, transferring funds from one bank to another is a favourite and oft-used money laundering method; the chain gets so long, it’s almost impossible to trace.

Not so with crypto. It’s decentralised, so you don’t need to contact a bank or ask for permission: all transactions are permanently recorded and stored on the blockchain, and anyone can view them at any time. You can track an entire chain of transactions in seconds – or even automate it.

What you cannot do is connect a certain blockchain address to a real-world identity – since there’s no central authority, nobody’s checking your passport when you create a crypto wallet. We do, however, check your identity when you buy or sell crypto on our exchange. So rest assured: if the bad guys try to cash out some ill-gotten Bitcoins, our security team is ready and able to stop them.

4. Crypto is an environmental disaster

Between 40 to 75% of all Bitcoin is mined with renewable energy. Photo: GreenPowerCo

This argument is often repeated when discussing crypto mining.

Crypto networks need some way to validate transactions so that all network nodes recognise them as legitimate. This is known as a consensus mechanism, and there are several ways to achieve this.

One consensus mechanism is called Proof-of-Work, primarily used by older, more established networks, such as Bitcoin and Ethereum. As the name suggests, this requires would-be transaction validators to prove they’ve done a certain amount of work. The idea is that the effort needed to do this would remove any incentive to tamper with the blockchain.

This work usually involves solving mathematical equations that require massive computing power and lots of electricity – hence the common image of a crypto farm with thousands of mining rigs and a huge electricity bill.

Much of this energy, however, is renewable. Exact details of Bitcoin mining operations are hard to come by, due to its decentralised nature. Still, estimates suggest that between 40 to 75% of all Bitcoin is mined with renewable energy. Now, this does not solve the issue completely, but it goes a long way towards mitigating it.

Here’s what can solve the issue completely. Proof-of-Work is not the only way to mine crypto. Other, less energy intensive solutions are emerging and rapidly being adopted.

An increasingly popular consensus mechanism is known as Proof-of-Stake, and it works by requiring validators to own a certain amount of crypto themselves. If they were to tamper with the network, they would undermine the value of their own tokens; in other words, this incentivizes them to act in the best interest of the network.

The solution is much more energy efficient: it only uses a few percent of electricity necessary to run a similar PoW network. It is already used by some of the most popular cryptos out there, such as Polkadot, Solana, and Cardano, and Ethereum is working to transition from PoW to PoS. Once this transition is complete, Bitcoin will remain the only major holdout – and it’s not inconceivable that, at one point, Bitcoin switches as well.

Finally, let’s consider the alternatives. A 2021 study puts the energy consumption of traditional banking at 263.72 TWh per year, which is more than double that of Bitcoin’s – and remember, Bitcoin uses the energy-intensive PoW mechanism. In comparison: the PoS Cardano, currently the sixth largest crypto by market cap, uses mere 6 GWh per year. That’s gigawatts, not terawatts – or 0,0023% of what traditional banking burns up.

Granted, Cardano is also much smaller than the banking system – but it aims to do just about anything the traditional finance does, from fast and energy-efficient payments to savings and loans. Far from being an environmental disaster, crypto actually provides a way to build a more efficient, scalable, accessible and, yes, also more sustainable financial system.

5. It’s too late to buy crypto

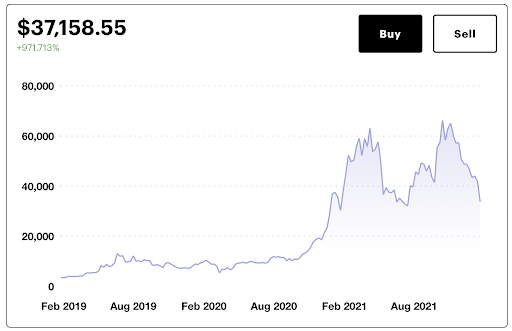

Crypto has seen its ups and downs before, so it helps to adopt a long-term perspective

Finally, we come to the belief that crypto has had its run; some diamond hands have made a fortune, but it’s too late to start now.

Now, it’s hard to predict the future – but it’s easy to look at the past. People have been having the same doubts for ages: in 2018, in 2017, even back in 2014. You probably know how that turned out.

Of course, the usual warning still applies – past performance is not indicative of future results, so take this with a grain of salt. Still, the fundamentals of crypto remain just as strong as they were in 2014.

Let’s recap what we’ve discussed so far. Far from being just Bitcoin, the crypto space has thousands of active projects. They already provide real utility which translates into value. The crypto community is aware of its risks, such as fraud and carbon footprint; it already has effective solutions to these issues, and it’s implementing them vigorously.

Now, whether crypto can reach its grand aims is still up for debate. There’s no denying that any investment comes with its own risks – and that clearly applies to investments that aim to disrupt entire industries. On the flip side, an ambitious investment also can provide a sizable return.

As noted, we’re crypto optimists here at Paybis – and we hope by now it’s a bit more clear why. Short-term volatility notwithstanding, crypto has the potential to change the way we do finance, browse the Internet, play games, and more. Therefore, we encourage you to approach crypto with a long-term view.

And, as far as long-term perspective goes, crypto isn’t finished – it’s just getting started.

So this is our attempt to clear up some common misconceptions. What do you think – does this answer the most common criticisms of crypto? Is there anything else you would add? Get in touch with us and, of course, feel free to share and discuss this post!

And, if you’ve decided to join the crypto community – of course, you can grab some crypto right here at Paybis.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info