How to Use Crypto Wallet? A Detailed Guide for 2026

Using a crypto wallet should feel simple and secure, but reality is quite a bit different. People worry about setting it up wrong, losing access, or falling victim to scams. In 2026, with smarter hacks and more complex platforms, knowing how crypto wallets work, how to choose the right crypto wallet, and how to use it safely is essential.

This beginner’s guide gives clear, practical steps for choosing, setting up, and using a wallet with confidence, so you can avoid common risks and take full control of your crypto.

Key Takeaways:

- You don’t store Bitcoin itself in a wallet – you store private and public keys, and losing your private key means losing access forever.

- There are five main wallet types (paper, mobile, web, desktop, hardware), each balancing security and convenience differently.

- Hardware wallets offer the highest security, while mobile and web wallets are better for frequent, small transactions.

- Platforms like Paybis simplify buying, storing, and using crypto, giving users more control than traditional exchange wallets.

- Strong security habits, protecting keys, enabling 2FA, avoiding phishing, and backing up recovery phrases, are essential in 2026.

Table of contents

Why Do You Need a Bitcoin Wallet?

Bitcoin is a digital currency, and owning and storing it requires an entirely different approach than with traditional assets. Bitcoins don’t exist in physical shape or form, so they can’t be stored in a safe or vault. They exist as lines of code on the Blockchain and are already secured by the network.

Instead, it’s your private keys that are used to access your public Bitcoin address, sign for transactions, and authorise transactions that need to be securely stored in a wallet. Therefore, you will often encounter the phrase: “not your keys, not your crypto”, and with good reason.

Only the holder of the private key will be able to confirm the transaction when trying to send or spend Bitcoins, or other cryptos for that matter. Private keys are required to sign transactions, which prove ownership and authorize the transfer of funds.

If you lose access to your private key or recovery phrase, you may permanently lose access to your crypto assets. So, unless your public and private keys are safely stored in a hardware wallet, you will always be at risk of your funds being stolen.

Understanding Cryptocurrency Wallets

Cryptocurrency wallets work by using advanced cryptography to keep your digital assets safe and enable secure transactions on the blockchain. When you use a wallet to store crypto, you’re actually storing cryptographic keys – specifically, a private key and a public key.

The public key acts like your account number, allowing others to send you crypto, while the private key is the secret password that authorizes you to spend or transfer your funds. The wallet interacts with the blockchain network to sign and verify transactions, ensuring only you can move your assets.

It’s important to remember that the wallet doesn’t hold the coins themselves – it simply manages the keys that prove ownership and control of your crypto.

5 Main Types of Crypto Wallets

Choosing the best crypto wallet is essential for securely holding crypto assets. This section will help you select the best crypto wallet by explaining the main types of cryptocurrency wallets, each designed to store, manage, and access your crypto assets in different ways.

- Paper wallet: Physical printout of private/public keys (often as QR codes). They’re fully offline and immune to hacking, but vulnerable to physical damage or loss. Example: Generate via Bitaddress, then laminate or store in a safe/fireproof box.

- Mobile wallet: Smartphone apps for everyday crypto use, highly convenient but prone to hacking and device loss. Many mobile wallets are compatible with mobile devices and offer features like QR code scanning to send crypto and receive payments quickly. Best used for small amounts only. Examples: Coinomi, Enjin Wallet, Atomic Wallet, Mycelium.

- Web wallet: Online, third-party wallet where keys are stored on company servers. These are easy to access but require strong trust in the provider. Often linked to exchanges. Digital wallets connected to the internet are convenient for active trading or daily transactions, but may be less secure than cold storage. Examples: Paybis Wallet, Guarda, Blockchain.com, Freewallet.

- Desktop wallet: Software installed on a computer; more secure than mobile/web since you control the keys, but still exposed to malware and phishing. Some desktop wallets integrate with crypto exchanges for easier management of your crypto assets. Examples: Electrum, Bitcoin Core, Atomic Wallet, Armory, Exodus.

- Hardware wallet: Physical offline device storing private keys; most secure option with recovery via backup seed if lost/damaged. Hardware wallets are a form of cold storage, providing an extra layer of security for self-custody of your crypto assets.

Using multiple wallets can help you manage different cryptocurrencies and blockchain networks, allowing you to hold crypto securely and access a range of features depending on your needs.

Crypto Wallet Comparison Table

| Wallet Type | Accessibility | Security | Internet Required | Best For |

| Paper Wallet | Low (manual use) | High (if well stored) | No | Long-term cold storage |

| Mobile Wallet | High (on-the-go use) | Medium (device risk) | Yes | Daily transactions, mobile users |

| Web Wallet | High (browser) | Low (custodial risk) | Yes | Quick access, beginner |

| Desktop Wallet | Medium (software use) | Medium to high | No (after setup) | Regular use with more control |

| Hardware Wallet | Low (manual setup) | High (offline) | No | Secure long-term holding |

How to Add Money to a Crypto Wallet With Paybis

We covered how Paybis is a better alternative to buying Bitcoin than most exchanges like Coinbase by making the process a lot more user-friendly, with full-on 24/7 customer support. Paybis also provides detailed information and support for each cryptocurrency transaction, helping users manage their crypto securely.

Once your purchase is complete, the Bitcoin that you purchased will be available to you for sending or spending. Sending cryptocurrency from your wallet is straightforward once your wallet is set up.

Storing Bitcoin in an External Wallet

- Step 1: After setting up your Bitcoin wallet, you will want to have your public key at hand in case you wish to receive transactions.

- Step 2: Start by creating an account on Paybis and going through the basic KYC verification to make sure your account is eligible for Bitcoin transfers.

- Step 3: Next, on the exchange’s home page, choose how you want to pay for your Bitcoin from all the options in the left column. In the right column, choose what cryptocurrency you wish to receive.

- Step 4: The central part of the page shows the amount of fiat currency you want to invest to buy Bitcoin. You can either type in the amount of fiat that you will be paying or the amount of Bitcoin you wish to receive, and the page will automatically fill in the missing values.

- Step 5: When you are happy with your choice, click on start transaction, and the system will ask you to specify your public Bitcoin address (this is your wallet address, which is used to receive payments). Type it in/paste it and follow the payment instructions.

Once the payment is complete and the transaction confirmed, the Bitcoin that you purchased will be available to you for sending or spending. A pretty simple task once the initial setup of private and public keys is done by installing your wallet.

Storing Bitcoin in Paybis Wallet

- Step 1: Open Paybis and go to the Crypto Wallets tab, and click Create wallet.

- Step 2: Log in to your Paybis account or sign up for free if it’s your first time.

- Step 3: Click on Add wallet and choose from any of the available cryptocurrencies.

- Step 4: Buy, sell, swap, and store your digital assets safely and easily with Paybis.

With Paybis, unlike other exchanges, your bought Bitcoin is sent directly to your personal wallet. Instead of the exchange wallet, it gives you full control of your funds.

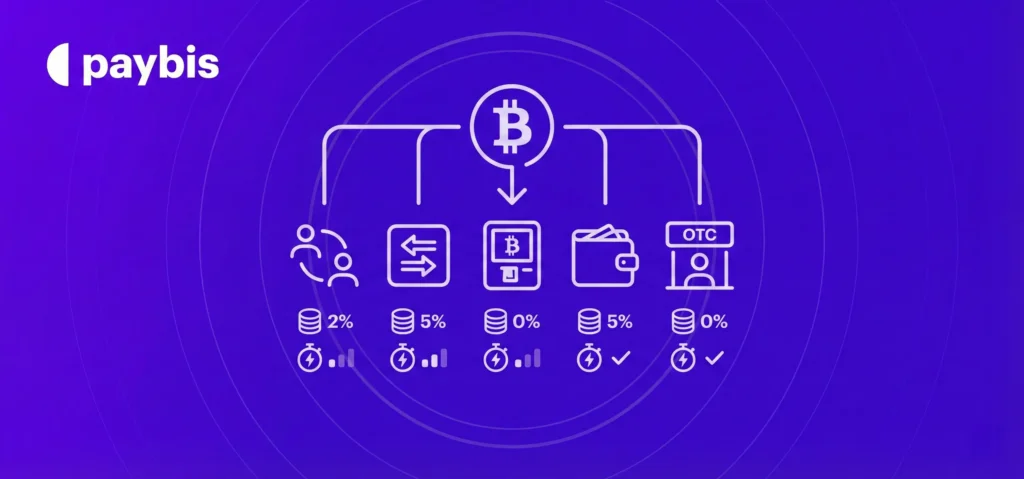

Alternative Ways of Adding Bitcoin to Your Wallet

Unfortunately, some countries aren’t as enthusiastic about Bitcoin as others. So you might have to take a more direct route in buying Bitcoin. You can, for example, opt to use a peer-to-peer service, like LocalBitcoins.

They offer a wide array of payment options, allowing you to purchase Bitcoin directly from a seller without the exchange middleman.

If you choose to use these and plan to trade in person, make sure to meet in a safe place. Keep in mind that this alternative is way more dangerous and prone to fraud. So always be careful who you are dealing with. Also, you will usually be paying a large premium fee for the Bitcoin you are buying.

Buying and Selling Digital Assets

To buy and sell digital assets like Bitcoin or Ethereum, you’ll need a crypto wallet that supports the specific coins you want to trade. Software wallets, such as mobile wallets or desktop wallets, allow you to store your private keys and interact directly with the blockchain.

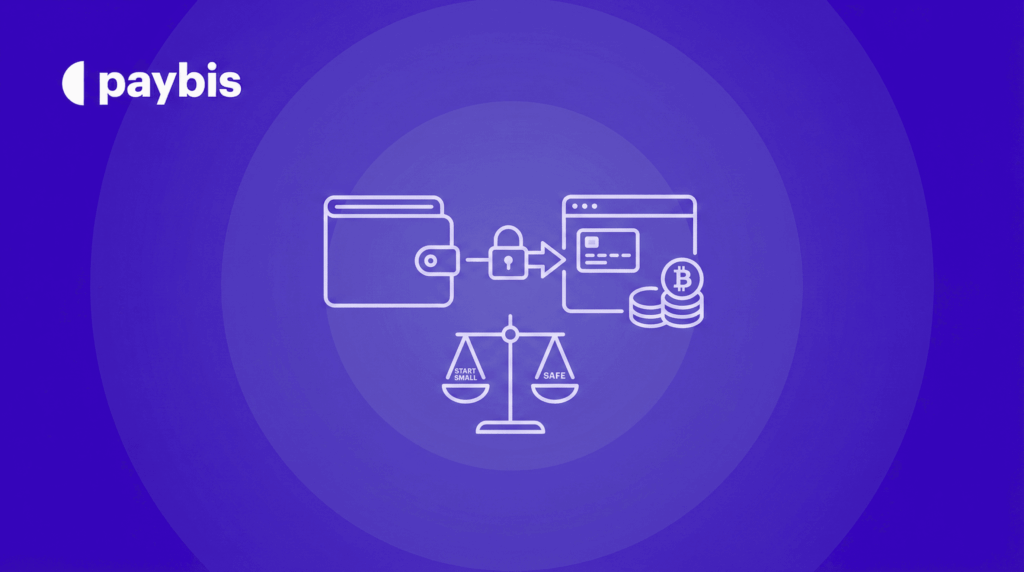

When purchasing crypto, you can choose between custodial wallets, where a third-party provider manages your keys, or non-custodial wallets, which give you complete control over your private keys and funds. For maximum security, always select a reputable wallet provider, enable two-factor authentication, and keep your wallet software updated to guard against online attacks.

Best Safety Practices

- Guard your private key at all costs: Never share it, email it, screenshot it, or store it online. Your private key has full access to your funds.

- Only share your public address: This is safe to send to others when receiving crypto and does not give access to your funds.

- Enable two-factor authentication (2FA): Always use 2FA on exchanges and wallet apps to reduce the risk of unauthorized access.

- Back up your keys securely: Keep offline backups (paper, hardware, or metal) in a safe location in case your device is lost, stolen, or damaged.

- Plan for emergency access: Make sure a trusted person or lawyer knows how to access your wallet in case something happens to you (e.g., via a will or secure instructions).

- Avoid phishing and fake sites: Always double-check URLs, use bookmarks, and never click unknown links related to your wallet or exchange.

- Research before choosing a wallet: Pick a wallet that matches your security needs, usage frequency, and technical comfort level.

To Sum Up

In 2026, using a crypto wallet is no longer just for tech experts – it’s a basic skill for anyone entering the digital asset space. But with that opportunity comes responsibility. Your wallet is your bank, your safe, and your proof of ownership all in one, and a single mistake can mean permanent loss.

By understanding how wallets work, choosing the right type for your needs, following proven security practices, and using trusted platforms like Paybis, you can confidently take control of your crypto. The key is simple – protect your private keys, stay alert to risks, and make security a habit.

FAQ

Which Bitcoin wallet is best for beginners?

Beginners in crypto should look for simplicity, security, accessibility, and availability. For that, we recommend trying out the Paybis Wallet. It’s clean, intuitive, easy to navigate, and widely accessible around the globe.

Moreover, Paybis is also an established crypto exchange platform, featuring multiple payment options and a long list of supported cryptocurrencies to choose from. So if you want to buy Bitcoin easily and be sure your digital currencies stay safe, try out Paybis.

How to set up a crypto wallet?

The setup process depends on the kind of wallet you choose, though today, the process of setting up a wallet is generally straightforward. For example, if you choose to buy cryptocurrencies on Paybis, you can easily create a Paybis Wallet for free.

You’ll be guided throughout the entire process, the only thing you have to keep in mind is your recovery phrase and store it at a secure location.

How do I choose a Bitcoin wallet?

The most important thing is to decide on the purpose of your crypto wallet. Once you have that narrowed down, you should look into security, usability, accessibility, technical background, and backup and recovery process.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info