Coinbase Alternative – Which Cryptocurrency Exchange to Choose?

If you are looking for a Coinbase alternative – this article is a must-read.

We will analyze the pros and cons of Coinbase for you to find a viable option with all of its benefits, coupled with suggestions of how and where to buy and sell cryptocurrency.

Coinbase is one of the oldest cryptocurrency exchanges around, and certainly one of the most popular.

But does that mean it is the fastest and safest option to buy and sell your Bitcoin together with other currencies?

Or is there another, perhaps better, Coinbase alternative?

In the last couple of years, the cryptocurrency space has made giant leaps towards mainstream adoption. As a result, Coinbase became the first fully regulated and licensed exchange.

And while the idea of a regulated exchange may seem like a great way to make the crypto space more stable and trustworthy, Coinbase soon started getting bad reviews from a large number of people.

Now, we are not implying that Coinbase should be avoided, nor do we have a negative opinion about their services. We simply set out to explore the exchange’s functionalities and share facts regarding buying & selling cryptocurrencies.

To find out more, keep on reading.

Table of contents

Why Consider a Coinbase Alternative?

The crypto space has evolved over the past two years more than it has done since its creation. With a 61% trading volume increase in 2018, there is certainly a higher demand for cryptocurrency exchanges.

And while Coinbase is currently the mainstream option for the public, and it provides a great service to assist mainstream adoption, we analyzed several aspects of using Coinbase and here they are:

- How Coinbase stores your funds

- Their customer support

- Country Presence

- Fund withdrawal

- Customer verification

- Last but not least, buying limits

After testing different features and talking with users – here are our findings.

1. Storing funds on Coinbase

You are probably familiar with the phrase “Not your keys, not your coins”.

Most exchanges have built-in cryptocurrency wallets where you can store your funds. This, however, also entails that the exchange will have access to your coins.

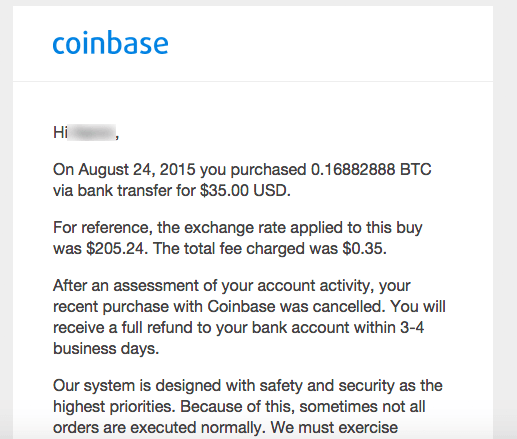

It has often been observed that, for a number of different reasons, Coinbase may (temporarily) close your account or cancel your purchases.

As a result, many users either lose access to their cryptocurrency or have their purchases canceled.

2. Customer support

Coinbase has a very detailed knowledge base, where users can find answers to their issues.

However, when questions do not fit the standard solving methods, things change.

Many users claim that they receive “canned responses” which do little good to the users.

Support tickets are usually answered by email within 48-72 hours which, for the world of crypto, can be a very long time.

For that reason, Coinbase also operates a phone line which, according to users of Coinbase, can be characterized as very poor, quality-wise.

The agents will spend little time to solve your problem and won’t get much done. In some cases, they may even give wrong answers that result in financial losses.

3. Country Presence

Coinbase is currently present in 103 countries from which 43 can buy cryptocurrencies and 39 can sell cryptocurrencies.

In total, all 103 of the supported countries are able to convert their cryptocurrencies to other digital coins.

While this number may sound like a lot, the ability to use FIAT in order to buy and sell crypto is very limited when looking at the demand from countries worldwide.

4. Fund withdrawals

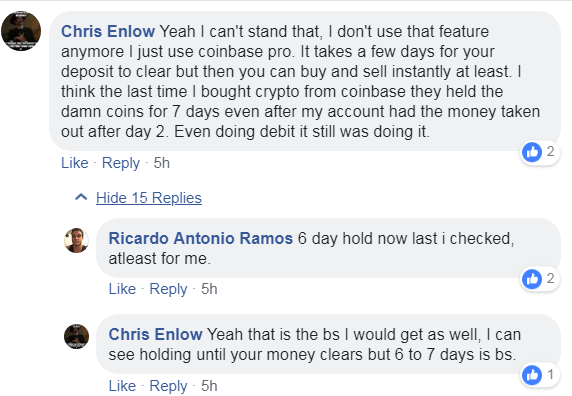

Coinbase users may often face unexpected delays in the withdrawals, especially in the US region. These delays affect all Coinbase assets and can take up to a week to solve.

The company has faced multiple allegations, like the one above. Users claim that during very volatile periods, like the bull run of 2017, customer funds often took very long to withdraw.

5. Customer verification

On top of that, the San-Fransisco based startup has quite some work to do when it comes to their verification system. According to users, there are many problems when it comes to ID verification.

But why is that?

According to Coinbase, one can verify his identity using the following documents:

- a Driver’s Licence

- a governmental ID

- a Passport

Coinbase has systems in place that automatically recognize and validate official documents for new accounts. However, many countries, still to this day, have different forms and variants of governmental IDs and driver’s licenses.

As a result, the system sometimes fails to realize the authenticity of an ID and asks for users to upload their documents again.

Another reason why this may be happening is that your country of residence is not the same as the country where your documents were issued. Coinbase is currently working on solving this issue.

Furthermore, in some cases, the verification process may be delayed, even if everything is done correctly. If that’s the case, it may take up to a few days to complete the process.

6. Credit card buying limits

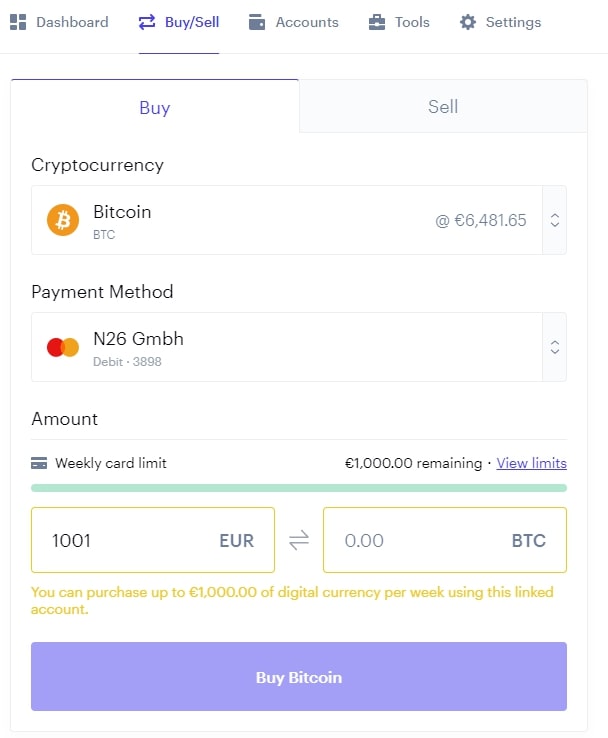

When it comes to credit card purchases, Coinbase allows users to buy up to $1000 per week, after going through ID verification.

For some, this limit might be somewhat small, especially if you are looking to invest larger amounts of money.

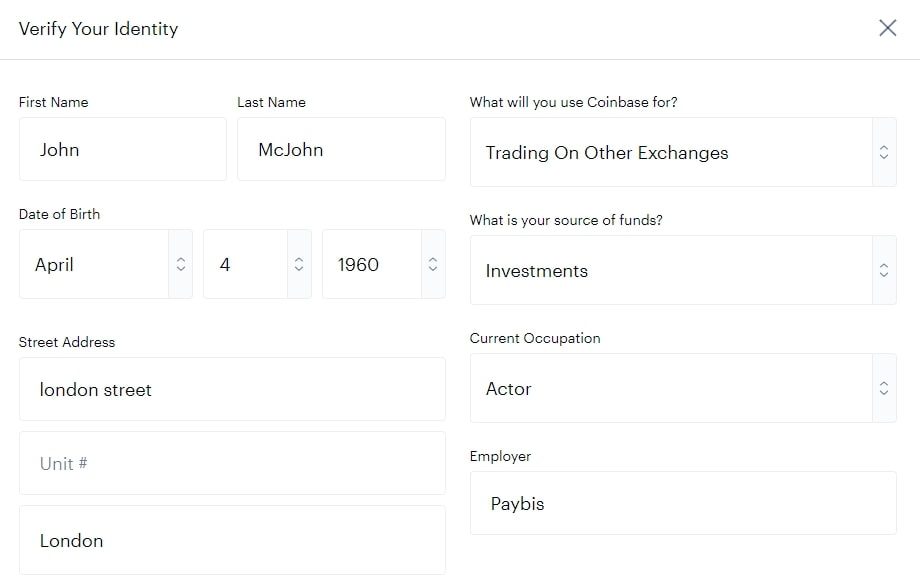

In order to lift these limits and make unlimited purchases with credit cards, Coinbase users are required to share their personal information, source of fund and even occupation:

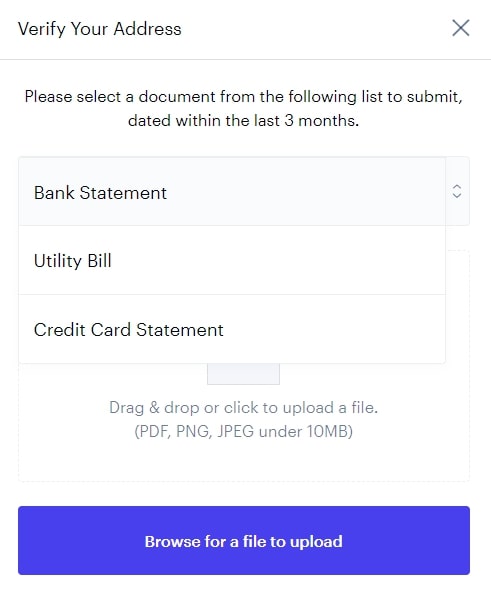

After that’s done, you will need to verify your address by submitting a bank statement, utility bill or credit card statement:

If you are a customer who prefers not to share these personals details in order to purchase cryptocurrencies, you are probably wondering what else is out there.

So, what is the best Coinbase alternative?

First off, there are many exchanges that help you purchase and sell your cryptocurrency faster while giving you back full control of your funds.

However, there are many more criteria, that separate the good from the great.

And the exchange that might fit the criteria, is Paybis.

So, let’s have a look at the aspects that would make you choose Paybis over Coinbase.

Why Should You Choose Paybis?

Founded in 2014, Paybis has quickly grown to become one of the top cryptocurrency exchanges.

Having said that, let’s analyze the benefits of using Paybis exchange for your future cryptocurrency purchases:

1. Easy, fast & secure

Paybis has a very simple interface that can be used by beginners all the way to advanced crypto enthusiasts.

On top of that, you will find information on steps to buy BTC with bank card or how to sell your Bitcoins for every payment option available. And if you still have questions, Paybis’ customer support can walk you through the process step by step.

2. 24/7 customer support

Paybis has a strong, multilingual support team that works around the clock to support all of the exchange’s users.

With a customer satisfaction rating of 9.3, according to Trustpilot, it is probably the best Coinbase alternative in Europe, always ready to solve any problem that may arise.

3. Country Presence

Paybis supports 180+ countries and allows users to exchange cryptocurrencies with more payment methods than any other exchange (14, including credit card, several digital wallets, and bank transfers)

On the contrary, Coinbase currently supports 41 countries and has only 3 payment methods available (wire transfer, credit card, debit card).

4. Fund withdrawal

Paybis will not hold your funds on its exchange. Instead, your funds are sent directly to the indicated wallet.

This will save you quite some time as you won’t need to go through a “withdrawal phase” as required by Coinbase.

5. Customer verification

When trying to make a purchase that requires ID verification, Paybis users will go through KYC. This process takes less than 5 minutes to complete.

And, if questions arise during the verification process, the Paybis live customer support will be there to assist you.

After you have gone through ID verification, or if you want to use payment methods that do not require ID verification, transactions will usually take 5 minutes to complete.

6. Credit card limits

Verified credit card purchases on Paybis allow for higher volumes. You are allowed to purchase $20000 per day or $50000 per month simply by verifying your governmental ID.

For more information on the limits and the verification process, click here.

So What It’s Going To Be?

While Coinbase exchange is popular when it comes to cryptocurrency investing, everyone’s needs are different.

Thus, occasionally an alternative solution might be necessary.

Below, you will find a table outlining the features we analyzed, and how both exchanges are living up to them.

Based on this information, you will be able to make an informed choice on which exchange to choose.

| Features | Coinbase | Paybis |

|---|---|---|

| Verification process | 1-3 days | 5-15 minutes |

| Customer support | Poor | Excellent |

| Supported countries | 103 | 180+ |

| Supported Payment Methods | 3 | 10 |

| Beginner friendly | Yes | Yes |

| Bitcoin buy methods | Wire transfer, bank transfer, credit card, cryptocurrency, Paypal (only for US customers) | Bank transfer, wire transfer, credit card, Perfect Money, Payeer, Neteller, Skrill, Advanced cash |

| Bitcoin sell methods | Bank transfer, Cryptocurrency, Paypal | Bank transfer, wire transfer, Perfect Money, Payeer, Neteller, Skrill, Advanced cash, Amazon gift card |

| Company launch | 2012 | 2014 |

| Customer satisfaction | Low | High |

We hope that the facts outlined above will help you choose the best exchange available.

And feel free to let us know what’s a must-have when choosing a cryptocurrency exchange?

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info