The History of Bitcoin – A detailed Analysis

The history of Bitcoin is short and filled with action, has already reshaped the way we experience digital currencies in its 11 years of existence.

But how did we get to where we are today?

What can we learn from the history of Bitcoin and how can it best help us prepare for the future?

In this article, Paybis will answer these questions by taking a deeper look into the events that shaped Bitcoin’s bi.

Table of contents

- How did Bitcoin start

- The origin of Bitcoin stretches back all the way to 2008, when the domain bitcoin.org is registered by an anonymous individual.

- Bitcoin early days – The Year 2010-2014

- 2010 – Introduction of Bitcoin Exchanges

- Bitcoin’s Price History

- By February 2011, Bitcoin achieves parity with the US dollar for the first time since its creation.

- Bitcoin block reward history

- Bitcoin’s Price History

- 2012 – Recovery despite hacking attempts

- Why is Bitcoin important?

- Bitcoin’s Price History

- 2013 – Bitcoin gains value as an asset and increases in value

- Bitcoin’s Price History

- Looking back to the history of Bitcoin, 2014 was a long and dreary year for investors.

- Bitcoin’s Price History

- Slow recovery and eventual worldwide recognition

- 2017 – Bitcoin goes mainstream

- The 2018 Bear Market and a new chapter for Bitcoin

- 2019 – Recovery is underway

- Bitcoin Historical Highs and Lows

- The All-Time Highs in the History of Bitcoin – Bull Markets

How did Bitcoin start

So how did Bitcoin start and when did Bitcoin come out?

The origin of Bitcoin stretches back all the way to 2008, when the domain bitcoin.org is registered by an anonymous individual.

A few months later, on the 31st of October 2008, a cryptography mailing list receives an email with a link to a paper authored by Satoshi Nakamoto.

Satoshi’s paper explained the methods and benefits of using a peer-to-peer network to generate what is his words could become “a system of electronic transactions without relying on trust”.

This idea outlined in the paper was not the first of its kind.

In the years prior, many people had attempted to create a form of digital money but failed to do so.

2009 – Bitcoin Genesis

The next step in the origin of Bitcoin was the 3rd of January 2009, Bitcoin finally came into existence. The open-source software generated and rewarded Bitcoins for a process known as mining.

This remarkable event in the history of Bitcoin signalizes the official start of the first decentralized digital currency.

Who mined the first Bitcoin block?

Satoshi Nakamoto successfully mined the first Bitcoin block (also known as Genesis Block) on January 3rd 2009. The Genesis block was hardcoded into the Bitcoin software and the 50 BTC that were created through it cannot be spent, due to the code’s structure. The reason behind this is unknown and just adds to the mystery of Satoshi’s story.During its first days, Bitcoin had no transactional value and a very limited audience, mainly consisted of cryptographers and programmers.

One of those programmers and early contributors to the project, Hal Finney, was the first person to receive Bitcoin.

On January 12th, 2009, Satoshi Nakamoto sends him 10 BTC as a test.

A few months later, in October 2009, the New Liberty Standard establishes the first-ever Bitcoin exchange rate, which at that time stated that $1 was worth 1,309.03 Bitcoins.

Bitcoin’s Price History

In 2009, Bitcoin got its first initial valuation, at $0.0007 per coin.Bitcoin early days – The Year 2010-2014

Bitcoin could now be exchanged and used as a payment method since it got an official valuation.

Because of this fact, many Bitcoin enthusiasts started looking for methods to exchange their holdings for other currencies.

Hence, the need for exchange platforms was born.

2010 – Introduction of Bitcoin Exchanges

A pivotal moment in the history of Bitcoin occurs on February 6th, 2010.

The very first Bitcoin exchange is established by Bitcointalk user dwdollar.

At the time of the exchange’s release, people could buy 1 Bitcoin for $0,05 using Paypal.

However, the good news didn’t last long as Bitcoin Market would soon have to remove Paypal from its Payment options.

The problems with the payment provider cause the exchange to decline in customer interest, and be overtaken by Mt. Gox.

Later that year, in May 2010, the first reported Bitcoin purchase takes place. Laszlo Hanyecz, a Florida-based programmer, exchanges 10,000 Bitcoins for two large pizzas.

Fun fact: The amount he spent would today be worth approximately 50.000.000 USD.

Looking back, one can see 2010 as the year where Bitcoin exchanges were introduced.

This, in turn, helped the digital currency gain momentum to eventually surpass $1 million in market capitalization.

Bitcoin’s Price History

In 2010 Bitcoin saw an enormous increase in its valuation, going from $0.008 at the start of the year to $0.30 at the end of December, increasing the price per coin by x38 times.By February 2011, Bitcoin achieves parity with the US dollar for the first time since its creation.

1 Bitcoin is now officially worth $1.

It was one of the most historic moments in the Bitcoin value history. Never before had an experimental currency reached USD parity.

In the days that followed, the media publishes stories on Bitcoin, and the value of the growing currency increases dramatically.

In fact, the interest became so high that the official Bitcoin website had to be shut down temporarily.

Following the media attention, Bitcoin’s price skyrockets, reaching $36 by June.

Soon after its record highs, however, it crashes back down to about $10.

Many speculate that the reason behind this “crash” was a security breach that Mt. Gox suffered, compromising tens of thousands of accounts and their Bitcoins.

In November, another event comes to increase the scarcity of Bitcoin. The first-ever “Bitcoin halving occurs, driving the mining rewards from 50 to 25 BTC per block.

Bitcoin block reward history

What’s fascinating about Bitcoin mining is the way Satoshi Nakamoto planned to make the coin more valuable. Since Bitcoin is designed to have a maximum supply cap of 21 million units, the block reward halves every 280,000 blocks. The first “Halving” happened in November 2011, when the block reward for mining Bitcoin decreased from 50 to 25 BTC. In 2016, the mining rewards halved again, to its current reward of 12.5 BTC per block. The next BTC halving is projected to occur on 25 May 2020. This will decrease the reward to 6.25 Bitcoin per mined block.In case you are looking for more information about Bitcoin halving, click here.

What’s more, the bad news was yet to come.

The year ends with Bitcoin falling back to $2, dropping more than 90% in value within a few short months.

Bitcoin’s Price History

After its parity with the US dollar, Bitcoin got mainstream attention which helped its value to increase from $1 to $31 within 6 months. Unfortunately, the coin’s price fell back to $2 by the end of the year, signaling a negative public sentiment.2012 – Recovery despite hacking attempts

After Bitcoin’s crash in 2011, the market starts recovering and the price of Bitcoin returns to the $12-$13 range, even though Cyberattacks on exchanges continue.

Why is Bitcoin important?

By now, it was clear to most that Bitcoin is not going anywhere. So, what exactly makes BTC important: Bitcoin is a decentralized digital currency, which means that no government institution or bank has control over it. This is a revolutionary step towards privacy since financial institutions have always had control over the public’s finances, especially in 3rd world countries. Bitcoin has been built to act as an inflating currency, as there is a limited amount of coins (21.000.000) and halvings of mining rewards happening each 4th year (next one occurring in 2020). Transactions are completed instantly and recorded to a worldwide ledger known as Blockchain. As a result, transactions are fully transparent and one can revisit any transaction, between any Bitcoin wallet. The transaction fees are much lower compared to traditional bank transfers or money remittance services and do not require legal documentation.In September of the same year, another big event occurs.

5 well-known individuals in the crypto world, Gavin Andresen, Patrick Murck, Jon Matonis, Peter Vessenes, and Charlie Shrem decide to launch The Bitcoin Foundation.

The organization is created in an effort to promote the development and global growth of Bitcoin as a digital currency.

Furthermore, after all the negative media attention Bitcoin got in 2011, the price is slowly recovering.

The more great news comes when WordPress (which powers 43% of the internet) decides to start accepting Bitcoin as a payment method.

With the latest events fueling Bitcoin’s recovery, the year ends at the $13-$14 range and the general market sentiment has a positive outlook.

Bitcoin’s Price History

2012 starts with Bitcoin’s value sitting at a mere $2, more than 90% of its last all-time high. However, throughout the year, it manages to climb back up to $13, ending the year on a good note.2013 – Bitcoin gains value as an asset and increases in value

The economic problems of Cyprus lead to a sizeable levy collected from bank accounts of the country.

The wealthy start facing some serious concerns from the nation that was once considered a global tax haven.

In face of these uncertainties, people desperately start looking for solutions to preserve their capital.

As a result, many wealthy individuals discover Bitcoin and start buying in large amounts, driving its price from $80 to $260.

Bitcoin was now on its way to becoming more recognized and successful as both a wallet and a currency of exchange.

In November of the same year, the US Senate holds a hearing on Bitcoin, announced under the title “Beyond Silk Road: Potential Risks, Threats, and Promises of Virtual Currencies”.

While the hearing was mainly focused on the negative aspects of Bitcoin and its use on Silk Road, many of the Senators and panelists agree that Bitcoin is valuable and could hold a great promise.

Less than a month after the hearing, Bitcoin skyrockets to over $1000, eventually peaking at $1242, the highest price Bitcoin had ever reached until that point.

Unfortunately, the joy of Bitcoin investors does not last for long.

The price starts to decline, partially due to China’s ban on cryptocurrency trading, bringing the value of one Bitcoin back down to $839 before the end of the year.

Ironically, this is also the time the that term HODL is created.

Bitcoin’s Price History

2013 is a pivotal year in the History of Bitcoin’s value. The major cryptocurrency went from a mere $13 (January) to $1242 at its peak (November) and stabilizing at the $700-$800 range towards the end of the year.Looking back to the history of Bitcoin, 2014 was a long and dreary year for investors.

The year starts with multiple DDoS attacks on major exchanges and the uncertainty pushes the price of Bitcoin lower.

On the 24th of February, MT. Gox, the biggest exchange, shuts down unexpectedly, claiming to have lost more than 744.000 BTC in the process.

What’s more, Bitcoin’s value dropped another 36% in the next month and, by mid-December, falls to the $300 range.

This is also the time when Charlie Shrem, CEO of Bitcoin exchange BitInstant, is labeled as the “First Bitcoin Felon” in the history of Bitcoin due to his role in laundering money for Silk Road users.

He quickly surrenders $950,000 to the US government, pleading guilty for his charges to enter a plea bargain and avoid any time behind bars.

Bitcoin’s Price History

In 2014, Bitcoin starts the year about 40% percent lower than its all-time high, at $769, and consistently drops in value over the year, finally reaching $313 in December.Slow recovery and eventual worldwide recognition

At this point, Bitcoin is 5 years old. After two years of dreary market conditions, a slow and long recovery process starts.

2015 – Price recovery and exposure to the mainstream

In the first few days of 2015, and after a large cyberattack that cost Bitstamp almost 20,000 Bitcoins, we see the final value drop to $198 per coin.

And while the future of cryptocurrency seems uncertain, a VC backed startup called Coinbase announces the release of its own Bitcoin trading platform, leading to a quick 40% recovery in the coin’s price.

In November of the same year, the European Court of Justice rules that Bitcoin will not be subjected to value-added-tax (VAT) and classifies Bitcoin as a currency, instead of property/goods.

The positive sentiment helps Bitcoin reach a valuation of $461 per coin towards the end of the year, officially ending the long bear market of the years prior.

Bitcoin’s Price History

Bitcoin started the year at $313 in January, before finding its bottom at $198. The year ends with a value of $427 per coin in December of the same year.2016 – Second halving and further recognition

Bitcoin is increasingly recognized as a safe-haven asset in 2016. Unlinked to any fiat currency or another macroeconomic factor, more people start to see it as a good way to diversify a portfolio.

Unlinked to any fiat currency or another macroeconomic factor, more people start to see it as a good way to diversify a portfolio.

Several critics start comparing the digital currency to Gold and focus on its long term potential.

Following the attention as a potential investment, Bitcoin undergoes the most important event of the year. The second halving happens in July, dropping mining rewards from 25 to 12.5 coins per block.

Subsequently, major cryptocurrency exchange Bitfinex suffers a cyber-attack and loses almost 120,000 Bitcoins.

Unshaken by this event, Bitcoin continues to increase in value over time and breaks the $700 mark in November.

On top of that, some speculate that the election of Donald Trump in the United States (November), paired with the prior voting for Brexit in the UK (July) assisted in the coin’s growth as economic uncertainty sets in.

Bitcoin ends 2016 recovering to $807, and goes into 2017 with a generally positive sentiment.

Bitcoin’s Price History

The price of Bitcoin increases from $431 in January to $951 in December of the same year.2017 – Bitcoin goes mainstream

2017 was a major milestone in Bitcoin evolution as it saw notable growth and entered mainstream culture.

Of course, Bitcoin already had seen some notable growth before 2017. Remember how much was Bitcoin when it first came out? Well, on January 3, 2017, it broke the USD 1000 mark for the first time. This pushed it further in the spotlight.

The increase of Bitcoin’s popularity causes many users to become frustrated with the network during this time.

The number of people mining Bitcoin steadily increased and so did the fees.

As a result, more time is being spent to process Bitcoin transactions and users grew increasingly frustrated.

In August 2017, due to the reasons mentioned above, the Bitcoin network gets forked, creating Bitcoin Cash (BCH).

Each cryptocurrency wallet received an equal amount of Bitcoin Cash for each Bitcoin they held on, leading to one more event that made Bitcoin hit the front page news.

Bitcoin’s value eventually grows to $3000, with most investors being ecstatic about their profits.

In the last quarter of 2017, Bitcoin Gold goes live, pushing the price to new highs in the $7000 range.

However, Bitcoin does not show signs of slowing down.

The cryptocurrency keeps increasing in value until it reaches its new peak just below $20000.

More and more people and companies begin chasing the trend as the price just keeps increasing.

This was the highest moment, or as most call it “the peak”, of Bitcoin’s value history up to this point. The market seemed to gain so much popularity that cryptocurrency exchanges had to impose a temporary restriction on new sign-ups.

Unsurprisingly, things start to take a downturn towards the end of the year.

Bitcoin’s value goes into a tailspin after the 17th of December, with the release of CBOE Bitcoin futures.

This day would mark the official start of Bitcoin’s next bear market.

Bitcoin Value History

The digital currency started 2017 at $1025 (below its 2013 prices) and over the year reached a peak of $19795 (December) before dropping back down to $12770 in the last days of the year. Until now, this was the highest price in the history of Bitcoin.The 2018 Bear Market and a new chapter for Bitcoin

Bitcoin enters 2018 at $13062, approximately 30% below its all-time high.

Google, Twitter, and Facebook decide to temporarily ban cryptocurrency-related ads.

During the same time, hackers steal more than $130 million from cryptocurrency exchanges.

Many people start to compare this downturn in the market with the one that happened in 2011 and 2014, the dark times in the history of Bitcoin.

However, the volume of transactions keeps increasing and reaches a new record high.

According to Satoshi Capital Research, over $2 trillion worth of Bitcoin was traded in 2018, which as of Dec. 1 marked a 61% increase from the previous year.

This increase in Bitcoin volume shows that investor interest keeps on growing despite the conditions the market is facing.

On March 2018, Elizabeth Stark, CEO of Lightning Labs announced the initial release of the Lightning network.

This initial release had the intent of making the LN available to developers for testing on the Bitcoin’s main network.

A few days after its release, the Lightning network nodes suffer a DDoS attack, with 200 of them going offline.

Over the year, Bitcoin’s price continues to decline, losing more than 70% of its value, eventually falling to the mid $3000 range.

Bitcoin Price History

2018 was a difficult year when looking at Bitcoin’s price. The value of the digital currency dropped from $12770 all the way to the $3400 range at the end of December, reaching its lowest point at $3201.2019 – Recovery is underway

In 2019, Bitcoin reached $3201, the lowest level in this bear market.

In the second quarter of the year, the price showed signs of potential recovery, with a retraction back to the $5000 range.

As the year went on, we saw some incredible price jumps up to $13.000 per coin, if only for a brief amount of time. It worked in a positive manner, however, with the public “awakening” to the fact that Bitcoin is still here and stronger than ever.

Now, more than ever, people are building blockchain-related products and keep improving the cryptocurrency space.

With the year ending at a $7000-$8000 price range, all we can hope for is a stronger recovery with the 3rd halving event coming up.

Looking forward – Bitcoin 2020

2020 will be an exciting year for Bitcoin. Many new applications are entering the market and the public is now more aware than ever when it comes to Bitcoin’s potential.

And the fundamentals of Bitcoin, as always, remain the same.

If there is one thing we can learn from, it is history.

And looking at the wild journey that Bitcoin has encountered up to this moment, we are excited to see what the future brings.

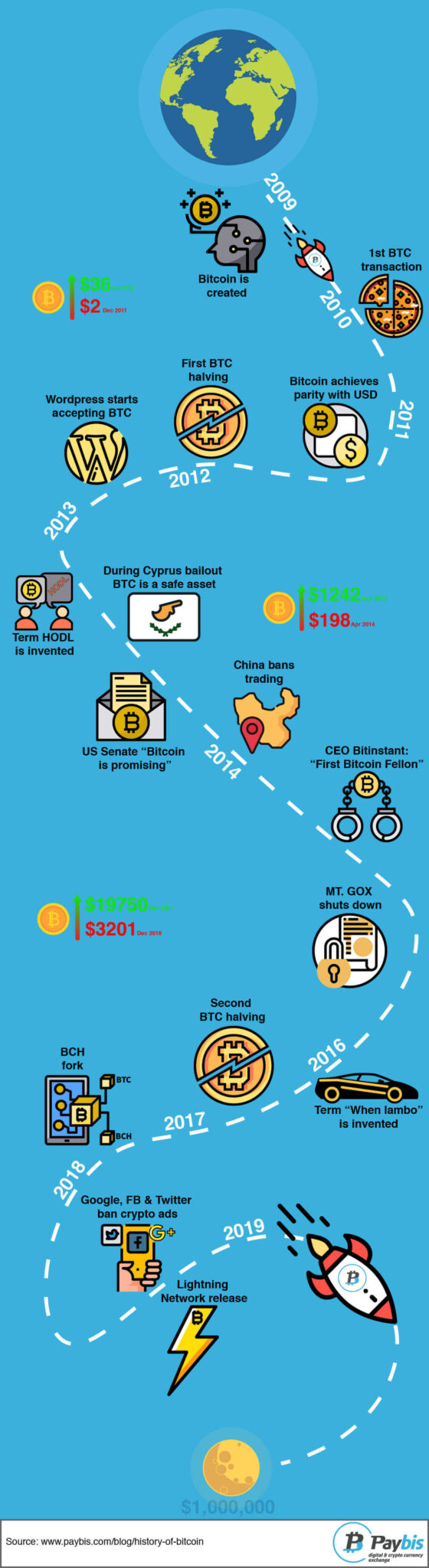

Thus, to summarize the Bitcoin history, we created an infographic with all the events in one place:

Bitcoin Historical Highs and Lows

So what are the most memorable price increases and decreases? Let’s take a deeper look.

The All-Time Lows in Bitcoin’s History – Bear Markets

By combining information collected from past events, one can easily see patterns in Bitcoin’s price action and timeframe thereof.

It might be interesting to know, Bitcoin has been declared dead hundreds of times, in its 10 years of existence.

The downturns in the market, also known as “bear markets” make up for long and stagnant times, driving its value down, sometimes as much as 90%.

So, down bellow we will take a look at all the bear markets of Bitcoin.

| Bear Markets | Price | Decrease | Timeframe |

|---|---|---|---|

| January 11th 2012 - July 11th 2012 | $7.08 to $4.22 | -40% | 185 days |

| August 7th, 2012 - December 6th, 2012 | $13.35 to $8.40 | -37% | 111 days |

| November 29th, 2013 - Jan 7th, 2015 | $1149.14 to $197.94 | -83% | 415 days |

| December 17th 2017 - (unknown)* | $19750 to $3201 | -83,7% | 363 days |

*Following the historic bull run of 2017, Bitcoin has crashed down to 83.7% during its lowest lows, reaching $3201 in December of 2018.

While a strong reversal seems to be forming since March 2019, raising Bitcoin above the $5000 level, we cannot yet say with certainty that this bear market is over.

For that reason, we have decided to present the bear market of 2018 as a subjective assumption in this part of the history of Bitcoin.

The All-Time Highs in the History of Bitcoin – Bull Markets

Now, to put a smile on your face, the highest highs of Bitcoin.

So, if the patterns you noticed throughout the article keep repeating in the future, the price of Bitcoin might soon see a new peak price.

Before that happens, let’s take a look at all the bull runs in the history of Bitcoin:

| Bull Markets | Price | Increase | Timeframe |

|---|---|---|---|

| October 8th 2010 - November 10th 2010 | $0.06 to $0.36 | 500% | 30 days |

| January 19th 2011 - Feb 14th 2011 | $0.31 to $1.06 | 241% | 26 days |

| April 26th 2011 - June 9th 2011 | $1.67 - $30 | 1671% | 44 days |

| March 18th 2013 - April 9th 2013 | $48 - $213 | 337% | 22 days |

| October 14th 2013 - December 1st 2013 | $136 - $1,142 | 739% | 48 days |

| April 1st 2017 - December 18th 2017 | $1083 - $19750 | 1700% | 260 days |

Makes you wonder, right?

Now the only question is – do you believe Bitcoin will see a new bull-market any time soon?

What is the price where you will throw in the towel and sell all your Bitcoin?

We would love to hear your thoughts on this. So, let us know by giving us your price prediction in the comment section below.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info

I mined Bitcoin in 2011 onwards from a link to my email address. I am now am trying to recover them how do you recover them from an account that is 10 years old and not been used since. I have contacted crypto.com and they said I probably did it on a platform. What platforms was there at the time and how do I get on to them so I can look for my coins. Would it be a dormant account and were do I look. Can you help me please.

Sorry, there’s not much we can do to help here as we’re not sure what exactly did you do. Was it a link someone sent you to mine Bitcoin? If so, it’s possible you may have fallen victim to a scam.

If you had set up a mining rig and successfully mined some Bitcoin, it should be in the wallet you provided. If you have the wallet but not the password, there are wallet recovery services that may be able to help you. If you’re not sure what your wallet address was, it’s probably impossible to recover it.