Ethereum Classic vs Ethereum – Differences & Investment Tips

Most new investors will often get confused when they come across Ethereum and Ethereum Classic. What makes them different? Why is one more valuable than the other? Which one is best to buy? What is Ethereum anyways? If you’re pondering the same questions, you’ve come to the right place.

In this article, we give a complete breakdown of Ethereum vs Ethereum Classic in a short-form read. We help you understand their main differences and the events that shaped them. Read on to discover a little more crypto history and learn how to make better investment decisions.

Table of contents

What is Ethereum?

Ethereum is the second-largest cryptocurrency and the first to implement smart contract technology. Launched in 2016, Ethereum made it possible for blockchain developers to create decentralized applications of all types, expanding its initial use case of digital payments.

Even since its launch, the project has seen significant growth and is now the underlying foundation for a major part of the crypto economy. This includes most NFTs, dApps, blockchain-based games, as well as cryptocurrency tokens.

The expansion of Ethereum’s utility has also been beneficial for the value of its token. In 2021, the Ethereum price peaked at nearly $5000 after a long recovery from its previous lows.

Additionally, many believe that the current bear market, paired with the network’s recent upgrades, makes Ethereum one of the most undervalued investment opportunities.

The DAO hack

When comparing Ethereum classic vs Ethereum, it’s important to know that both versions were originally one and only later split as the result of a hard fork. The story behind the split centers itself around the first-ever DAO.

Most investors nowadays are familiar with the concept of Decentralized Autonomous Organizations. The same was not true back in 2016. Back in the day, The DAO was launched and quickly grew to be the “next big thing”. Similar to successful DAOs today, the project had thousands of contributors who invested their money to receive voting rights on multiple Ethereum projects. Being the first of its kind, The DAO opened the door to new automation concepts related to employment, investing, as well as voting.

And then, suddenly, it got hacked. Due to the project’s vulnerabilities, hackers drained 3,6 million ETH tokens using a recursive function withdrawal. The blow was so significant that Ethereum lost one-third of its value, damaging the project’s security and reputation.

In their attempt to roll back the major issues created on the network, Ethereum developers cast a Hard Fork Proposal up for voting. The majority of investors agreed to the proposal and it was decided to migrate into a new token. Naturally, the Ethereum community followed the new chain, and the newly forked token became the Ethereum we all know today.

What is Ethereum Classic?

So, what is Ethereum Classic? In short, it is the pre-forked Ethereum token that remained the same following the DAO hack. It is not compatible with any upgrades of the later Ethereum version, as well as hard forks, which we discuss below. The old token, now known as ETC, was primarily adopted and promoted by idealists, meaning those who, above all, support decentralization.

Ethereum Classic has had a turbulent history. Its price has never reached that of Ethereum, and there have been several 51% attacks on the chain. However, despite all that, it has managed to survive and has experienced several growth phases. That said, the sentiment has always favored Ethereum over its predecessor, mainly due to community support and value.

Both Ethereum and Ethereum Classic can be obtained by most cryptocurrency exchanges, including Paybis.

The Merge & the ETHW fork

Ethereum recently shifted to a PoS consensus mechanism in an upgrade primarily known as the Merge, or ETH 2.0. Merging into a Proof of Stake blockchain reduced the energy consumption of the chain by 99%. This made it no longer possible to mine Ethereum, forcing miners to look for an alternative solution.

Chandler Guo, a prominent Chinese Angel investor, decided to tackle the issue by forking Ethereum and maintaining the original PoW mechanism. The new token is known as EthereumPoW (ETHW) and is a direct competitor to Ethereum Classic due to its similarities.

Chandler #Guo revealed that in just four days following The Merge, the #ETH proof-of-work chain “already has two DEXs, two bridges and two NFT exchanges” already launched. #hardfork https://t.co/3lAVHfjL1h

— Bitcoin News (@BTCTN) September 23, 2022

While investors feel that the ETHW fork is unnecessary, miners need an alternative coin to mine. Current data points that this is actually bullish for Ethereum Classic. We are still in the early “post Merge” days, but ETC still beats ETHW in terms of smart contracts by a large margin. All in all, we expect the upgrade to become a catalyst for increased mining activity for Ethereum Classic.

Ethereum vs Ethereum Classic – Main Differences

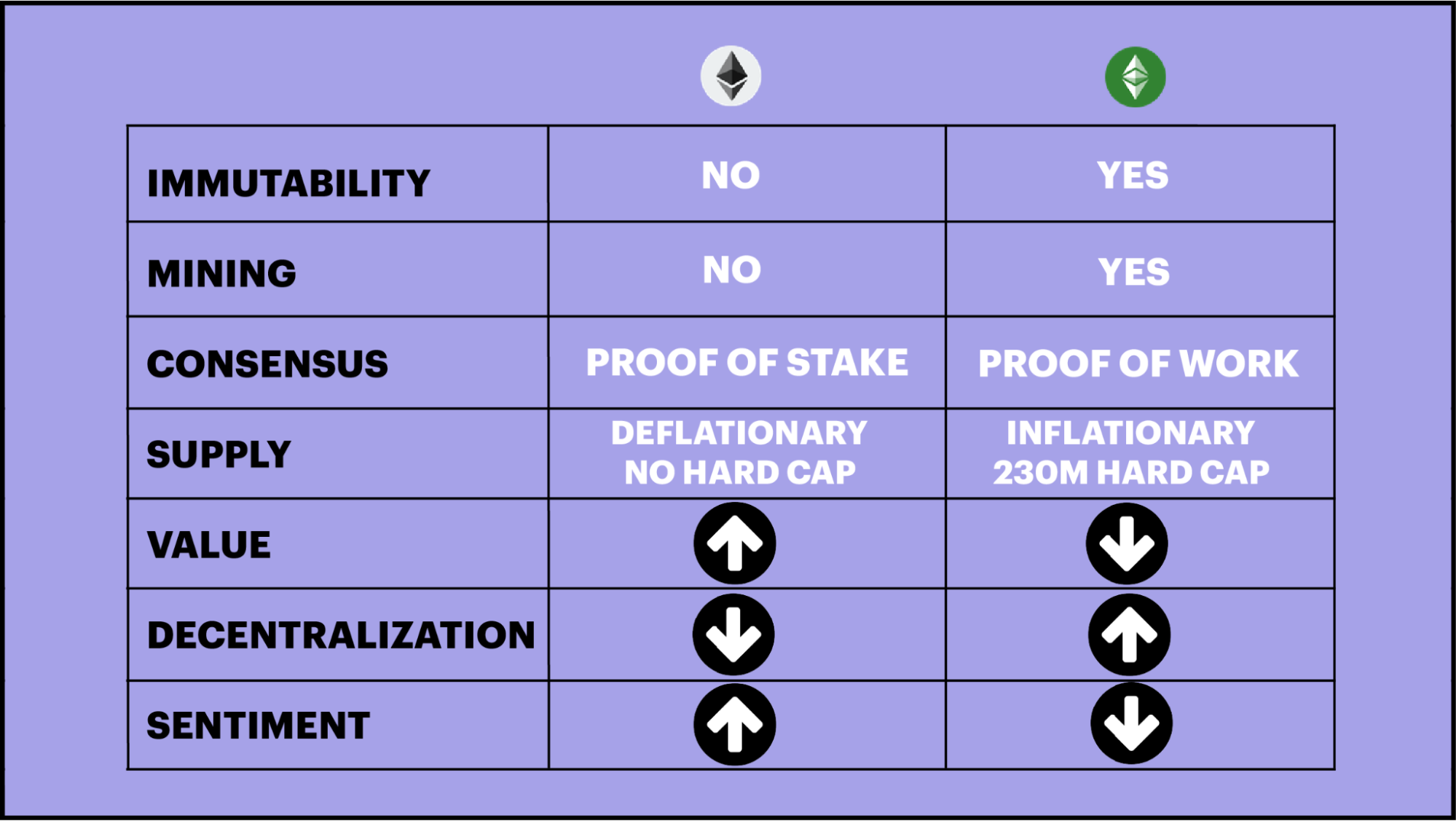

When talking about the difference between Ethereum and Ethereum Classic, there are several points to consider. Ethereum Classic still functions like the oldest version of the original Ethereum, which makes it different compared to Ethereum in multiple areas. The following table provides a good overview.

Immutability refers to the ability to alter or adjust prior transactions. The current version of Ethereum supports this functionality. On the contrary, Ethereum Classic does not due to its heavy emphasis on decentralization.

Mining is no longer possible for Ethereum since it is no longer a PoW blockchain. Ethereum Classic, on the other hand, is still mineable. Once again, Ethereum Classic wins on the decentralization aspect.

Ethereum uses a PoS consensus mechanism which makes it energy-efficient while offering passive income to holders. Ethereum Classic uses PoW consensus which makes it more democratic.

Ethereum does not have a hard cap but its annual inflation cannot surpass 4,5%. The number, however, no longer matters since the Merge, as it turned Ethereum into a deflationary asset. Ethereum Classic, on the other hand, has a steadily growing circulating supply until a hard cap of 230 million is reached.

As for the token’s value and the sentiment of investors, Ethereum takes the lead. When it comes to decentralization, however, Ethereum Classic is the winner.

Ethereum Classic vs Ethereum – Best investment choice

It’s time to compare Ethereum vs Ethereum Classic for their profit potential. Both seem to have a positive sentiment, especially given the current market conditions. However, only one can be the strongest long-term. And, in our opinion, Ethereum (ETH) wins! Note that our decision is based on the facts mentioned in the chapters above and should not be taken as financial advice.

Ever since the Merge, Ethereum has been producing 92,8% fewer tokens than it initially did. Paired with the recent EIP-1559 upgrade, this makes Ethereum deflationary by a large margin. In fact, when looking at the daily issuance before and after the Merge, one could say that it equals three simultaneous Bitcoin halvings. While most expect the price action to turn bullish within 12-16 months (as usually happens after BTC halvings) investors can benefit from a seemingly undervalued ETH. You can check the current value by using the Ethereum calculator.

The above conclusion does not mean that ETC is a lost cause. There is still strong bullish sentiment for Ethereum Classic given the recent events. Since now miners will have to look for other solutions to fuel their efforts, ETC seems like a tested and proven alternative to focus on. The added interest of miners could act as a catalyst that will improve its value in the long term. Emma Newbery, editor of Fool.com seems to think so as well. In a recent article, she pointed out that most miners could choose ETC for mining, highlighting Vitalik Buterin’s endorsement of the chain for this purpose shortly before the Merge.

Until now, the prediction seems to be coming to fruition. Shortly after the Merge, the hashrate of Ethereum Classic nearly doubled, according to information found on 2Miners.com. Will the trend hold?

Wrapping up

You should now have a better understanding when it comes to Ethereum vs Ethereum Classic. While both are risky investment opportunities, their history clearly indicates that Ethereum is not only the winner but also likely to be the longest-lasting survivor. While highly decentralized in its nature, Ethereum Classic doesn’t have the necessary sentiment or security to justify it as the better choice.

With the recent Ethereum Merge, we do see more ETC interest from miners, which could prove to be a good indicator for its future growth. However, this fact alone is not enough. Hence, if you decide to invest in Ethereum Classic, make sure you are aware of the risks involved.

FAQ

Is Ethereum Classic a better alternative to Ethereum?

While we do not provide investment advice, it is easy to see that the sentiment surrounding Ethereum is more positive than that of Ethereum Classic. Given the progress, adoption, and contribution towards Ethereum, most would agree that the latter is a better investment choice.

That said, Ethereum Classic does seem undervalued, especially now that it is no longer possible to mine ETH. Those with high tolerance to risk might want to use the Ethereum Classic calculator to see how many tokens they could buy with the amount they wish to allocate for their next investment. As you can see, therefore, the ETC vs ETH investment thesis is not only based on fundamentals but also on risk assessment.

Why is the price of Ethereum Classic so cheap?

Ethereum Classic is relatively cheap due to the circumstances that led to its development. Following the DAO hack, the creators and core developers of Ethereum agreed to consider the newly forked token as the real Ethereum. As a result, investors decided to only buy Ethereum which originated from the new chain. The old token, Ethereum Classic, kept a smaller investor base, which in turn decreased daily trading volumes and mining activity. As a result, it is now considered to be a “spin-off” of the original Ethereum, thus lowering its value.

What is the current value of Ethereum Classic?

The price of ETC is fluctuating on a daily basis. You can see the current price by checking the Ethereum Classic price page on Paybis. While on the page, you will also find numerous additional indicators and charts that can help you make better investment decisions.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info