How to Get M-Pesa Statement

M-Pesa stands out as a revolutionary mobile money service, particularly in Kenya, where it has transformed the way people handle transactions. From small-scale traders to large corporations, M-Pesa’s impact is widespread, making it a critical tool in the daily lives of millions.

Understanding how to effectively manage and review your M-Pesa transactions is key to maintaining financial health and transparency.

This article serves as a comprehensive guide on “How to Get MPesa Statement,” a vital aspect for any M-Pesa user.

If you want to learn How to Reverse MPesa Transactions, there’s a separate article for that.

Table of contents

- How to Get MPesa Statement

- Useful links

- How to Check MPesa Statement

- Step-by-Step Guide to Check Your M-Pesa Statement

- 3 Benefits of Regularly Checking Your Statement

- 3 Tips for Efficient Statement Management

- How to Get MPesa Full Statement

- Utilizing Your Full Statement

- How to Get MPesa Statement via Email

- How to Get MPesa Statement for Another Number

- How to Get MPesa Statement via SMS

- Requesting M-Pesa Statements for Different Durations

- Technical Aspects and Security in Accessing M-Pesa Statements

- Final Thoughts

- FAQ

How to Get MPesa Statement

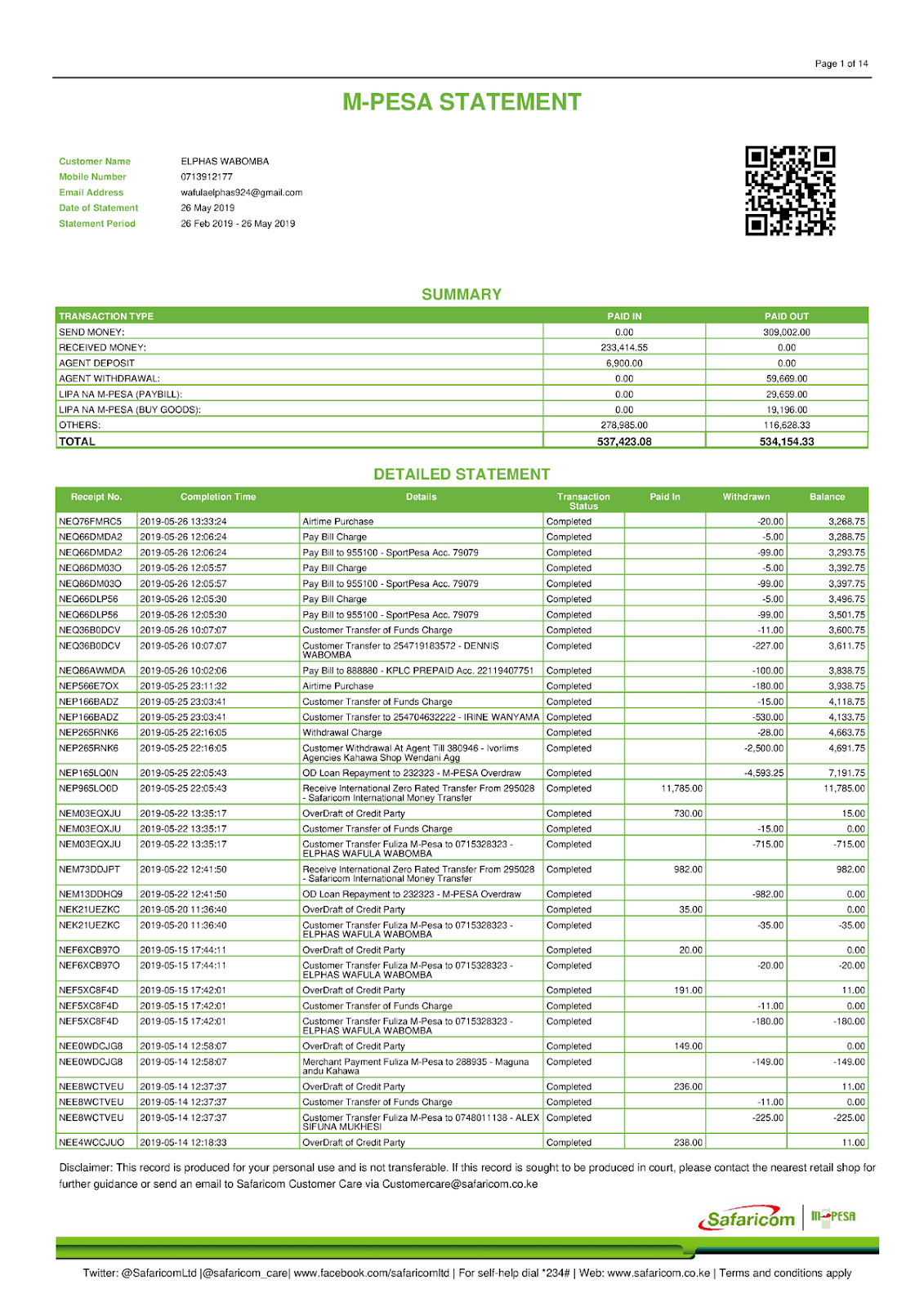

Navigating the world of mobile money can be overwhelming, but obtaining your M-Pesa statement shouldn’t be. A statement not only provides a clear view of your transaction history but also serves as an essential record for financial planning and accountability. Here’s how you can easily get your M-Pesa statement.

Understanding the Importance of an M-Pesa Statement

Before diving into the “how,” it’s crucial to understand why an M-Pesa statement is important. These statements offer a detailed record of all your transactions, including deposits, withdrawals, payments, and transfers.

For personal users, it’s a way to track spending and manage finances better. For businesses, it’s indispensable for accounting and reconciling transactions.

Steps to Get Your M-Pesa Statement

Accessing Via USSD

- On your phone, dial *234# to access the M-Pesa menu.

- Select ‘My M-Pesa Information’, then ‘M-Pesa Statement’.

- Choose ‘Full Statement’ to proceed.

Via the Safaricom App

- Download and open the Safaricom app.

- Navigate to the M-Pesa section.

- Select ‘Statements’ and specify the period you need the statement for.

Via the M-Pesa Website

- Visit the official M-Pesa website.

- Log in using your credentials.

- Navigate to the statements section and follow the prompts to download your statement.

Frequency and Accessibility

M-Pesa statements can be obtained as frequently as needed. You can request a statement for the past month, three months, six months, or even a specific period as per your requirement.

Remember, the process is quick, user-friendly, and can be done from the comfort of your home or office.

Once you receive your statement, it’s advisable to save it for future reference. You can download and store it digitally or print it out for physical record-keeping.

Useful links

How to Check MPesa Statement

Looking for how to check MPesa statements?

Regularly checking your M-Pesa statement is as crucial as obtaining it. This practice not only helps in keeping a close eye on your transactions but also in detecting any unusual activity early.

Checking your M-Pesa statement is a straightforward process that can be done via multiple channels, providing flexibility and convenience. Whether you’re at home, at work, or on the go, accessing your statement is just a few taps away.

Step-by-Step Guide to Check Your M-Pesa Statement

Via USSD Code

- Dial *234# from your phone.

- Navigate to ‘My M-Pesa Information’ and select ‘M-Pesa Statement’.

- Choose ‘Mini Statement’ to view your recent transactions.

Through the Safaricom App

- Open the Safaricom app on your smartphone.

- Go to the M-Pesa section and select ‘Statements’.

- You can view your recent transactions or select a specific period for detailed statements.

Online Access

- Visit the M-Pesa web portal.

- Log in with your credentials.

- Choose the statement period you wish to view and access your detailed statement.

3 Benefits of Regularly Checking Your Statement

- Financial Awareness: Regularly checking your statement helps in maintaining a better understanding of your spending patterns and financial health.

- Security: It allows you to quickly spot any unauthorized transactions or discrepancies.

- Budgeting: By reviewing your statement, you can better plan and adjust your budget based on your spending habits.

3 Tips for Efficient Statement Management

- Set a regular schedule, like weekly or monthly, to check your statements.

- Utilize the M-Pesa app’s notification feature to get alerts for new statements.

- If you notice any unusual transactions, report them immediately to Safaricom customer service.

How to Get MPesa Full Statement

A full statement from M-Pesa is more than just a list of transactions. It is a complete financial document that records every transaction made over a specified period. This can include money sent, received, payments made, and charges incurred.

For a more comprehensive overview of your transactions, an M-Pesa full statement is the way to go.

Unlike a mini statement, which provides a brief snapshot of recent transactions, a full statement offers an in-depth look at your financial activity over a longer period.

Below is how to get MPesa full statement.

Steps to Obtain an M-Pesa Full Statement

Requesting Via USSD

- Dial *234# on your mobile phone.

- Navigate to ‘My M-Pesa Information’ and select ‘M-Pesa Statement’.

- Choose ‘Full Statement’ and follow the prompts to specify the period for which you need the statement.

Through the Safaricom App

- Open the Safaricom app on your smartphone.

- Go to the M-Pesa section, then tap on ‘Statements’.

- Select the option for a full statement and the desired time frame.

Online Request

- Visit the M-Pesa website and log in to your account.

- Navigate to the statements section and select ‘Full Statement’.

- Choose the period for which you need the statement and submit your request.

Receiving Your Full Statement

- Once requested, your full statement will be sent to your registered email address.

- Ensure your email is up to date in M-Pesa’s records for smooth delivery.

Utilizing Your Full Statement

- Budgeting and Planning: Analyze your income and expenditure patterns for better financial planning.

- Tax and Loan Applications: Use it as a supporting document for tax purposes or when applying for loans.

- Dispute Resolution: In case of disputes or discrepancies, a full statement can be a critical piece of evidence.

How to Get MPesa Statement via Email

Receiving your M-Pesa statement via email is not only convenient but also ensures you have a digital record of your transactions that can be easily accessed anytime.

This method is particularly useful for those who prefer to store financial documents in electronic form or need to share them with accountants or financial advisors.

Advantages of Email Statements

- Accessibility: Email statements can be accessed from anywhere, providing flexibility and convenience.

- Archiving: Easy to store and organize for long-term record-keeping.

- Environmentally Friendly: Reduces the need for paper, contributing to eco-friendly practices.

- Security: Maintains the confidentiality of your financial information.

Let’s look at how to get MPesa statement via email.

Setting Up M-Pesa Statement Delivery via Email

Activation Via USSD

- Dial *234# from your phone.

- Select ‘My M-Pesa Information’ and then choose ‘M-Pesa Statement’.

- Opt for ‘Full Statement’ and follow the prompts to register your email address.

Through the Safaricom App

- Open the Safaricom app on your device.

- Navigate to the M-Pesa section and select ‘e-Statement’.

- Input your email address and choose the frequency of the statements (monthly, quarterly, etc.).

Online Registration

- Visit the M-Pesa website and log into your account.

- Go to the profile settings and add your email address for e-statements.

- Specify the frequency and type of statement you wish to receive.

Receiving and Managing Your Email Statements

Once set up, M-Pesa will automatically send your statement to the registered email address according to the chosen frequency.

Ensure your email account is secure to maintain the confidentiality of your statement.

Create a dedicated folder in your email to archive these statements for easy retrieval.

How to Get MPesa Statement for Another Number

There are instances where you might need to access an M-Pesa statement for a number other than your own, such as for business accounts, family members under your care, or other legitimate reasons.

It is crucial to approach this with a clear understanding of the legal and privacy implications.

Legal and Ethical Considerations

- Consent: Ensure you have explicit permission from the owner of the other number to access their M-Pesa statement.

- Privacy: Be mindful of privacy concerns and handle any obtained information responsibly.

- Compliance: Adhere to Safaricom’s policies and local laws regarding financial data access and sharing.

Below are the steps on how to get MPesa statement for another number.

Steps to Obtain an M-Pesa Statement for Another Number

Obtaining Consent and Necessary Information

- Secure written consent from the account holder for record-keeping and compliance.

- Collect the necessary details such as the M-Pesa registered phone number and identification information.

Requesting via USSD (If You Have Access to the Other Phone)

- Using the other M-Pesa registered phone, dial *234#.

- Navigate to ‘My M-Pesa Information’ and select ‘M-Pesa Statement’.

- Choose the type of statement and follow the instructions to receive it on that phone.

Through the Safaricom App (If Linked to the Other Number)

- If the Safaricom app is set up with the other number, navigate to the M-Pesa section.

- Select ‘Statements’ and specify the period for the statement.

- Ensure that this action is done transparently and with permission.

Online Request via M-Pesa Website (With Account Holder’s Approval)

- With the account holder’s consent, log in to the M-Pesa web portal using their credentials.

- Follow the procedure to request a statement as detailed in previous sections.

How to Get MPesa Statement via SMS

For those seeking immediate and straightforward access to their recent M-Pesa transactions, obtaining a statement via SMS is an ideal option. This method is particularly useful for individuals who may not have regular access to the internet or prefer a more direct way of receiving their transaction information.

Benefits of SMS Statements

- Instant Access: Receive a summary of recent transactions almost immediately.

- No Internet Required: Ideal for situations where internet access is limited or unavailable.

- Simple and Convenient: Easy to use, especially for users who prefer basic mobile phone functionalities.

Let’s see how to get MPesa statement via SMS.

Steps to Get an MPesa Statement via SMS

Requesting a Mini Statement

- Dial *234# on your M-Pesa registered mobile phone.

- Navigate to ‘My M-Pesa Information’ and select ‘M-Pesa Statement’.

- Choose ‘Mini Statement’ to receive a summary of your five most recent transactions via SMS.

Understanding the SMS Statement

- The SMS will contain details of the date, amount, and type of each transaction.

- It may also include the balance after each transaction, providing a quick financial snapshot.

Requesting M-Pesa Statements for Different Durations

M-Pesa provides the flexibility to request statements for various durations, catering to the diverse needs of its users.

Whether you need a statement for a specific month, a half-yearly report, or a detailed account of transactions over several years, M-Pesa makes it possible. In this section, we will cover how to request MPesa statements for different time frames, specifically focusing on statements for 3 years, 6 months, and for a specific number.

Requesting M-Pesa Statements for 3 Years

Via USSD

- Dial *234# and go to ‘My M-Pesa Information’.

- Choose ‘M-Pesa Statement’ and then select ‘Full Statement’.

- Specify that you need a statement for 3 years when prompted.

Through the Safaricom App

- In the app, navigate to the M-Pesa section.

- Select ‘Statements’ and choose the option to receive a statement for 3 years.

Online Method

- Log in to the M-Pesa website.

- Go to the statements section and select the option for a 3-year period.

Requesting M-Pesa Statements for 6 Months

Via USSD

- Dial *234# and go to ‘My M-Pesa Information’.

- Choose ‘M-Pesa Statement’ and then select ‘Full Statement’.

- Specify that you need a statement for 6 months when prompted.

Safaricom App

- In the app, navigate to the M-Pesa section.

- Select ‘Statements’ and choose the option to receive a statement for 6 months.

Online Portal

- Log in to the M-Pesa website.

- Go to the statements section and select the option for a 3-month period.

Requesting M-Pesa Statements for a Specific Number

- This option is particularly useful for tracking transactions on a specific paybill number or for a particular service.

- The process involves specifying the number in question when prompted during the statement request process on any of the platforms mentioned above.

The Importance of Diverse Time Frames

- Long-Term Financial Planning: Longer duration statements, like for 3 years, are invaluable for in-depth financial analysis and planning.

- Short-Term Tracking: A 6-month statement is useful for recent financial reviews and short-term budgeting.

- Specific Transactions: Statements for a specific number can be crucial for businesses or individuals monitoring transactions related to a particular service or paybill number.

Technical Aspects and Security in Accessing M-Pesa Statements

When dealing with financial data, particularly while accessing M-Pesa statements online or through mobile devices, understanding the technical aspects and ensuring security is paramount.

Password Security and Management

- Creating a Strong Password: Use a combination of letters, numbers, and special characters. Avoid common words or easily guessable information like birthdays.

- Regularly Updating Passwords: Change your M-Pesa PIN and app passwords periodically to enhance security.

- Keeping Passwords Confidential: Never share your M-Pesa PIN or passwords with anyone.

Online Safety When Accessing Statements

Secure Internet Connection

- Avoid using public Wi-Fi networks when accessing your M-Pesa account online.

- Opt for a secure, private internet connection to prevent data breaches.

Phishing and Scam Awareness

- Be cautious of emails or messages asking for your M-Pesa credentials.

- Safaricom will never ask for your password or PIN via email or SMS.

Regular Monitoring

- Regularly check your account for any unauthorized transactions.

- Report any suspicious activity immediately to Safaricom.

Utilizing the Safaricom App

- App Security Features: The Safaricom app is equipped with security features like encryption to protect your data. Ensure you download the app from official stores like Google Play Store or Apple App Store.

- App Updates: Keep the app updated to the latest version for enhanced security and new features.

- In-App Statement Access: Use the app to access your statements as it provides a secure and direct way to manage your M-Pesa transactions.

Final Thoughts

M-Pesa’s functionality extends beyond just transaction history and statements. It integrates various features and services that enhance the user experience, making financial transactions smoother and more comprehensive.

With Paybis, you can use Mpesa to conveniently top up your cryptocurrency wallet. For first time users, we have decided to waive the Paybis fee so they can get the best bang for the buck.

FAQ

Can I have two M-Pesa accounts?

Yes, you can have two M-Pesa accounts, but each account must be linked to a unique mobile number. Safaricom allows one M-Pesa account per registered phone number. This means you can have multiple accounts if you have multiple phone numbers, each registered under your name. It’s important to adhere to Safaricom’s terms and conditions for each account.

Can Safaricom freeze your M-PESA account?

Safaricom can freeze an M-Pesa account under certain circumstances. These include suspicion of fraudulent activities, violation of terms and conditions, or as per regulatory requirements. If an account is involved in unauthorized transactions or activities that go against Safaricom’s policies, it may be subject to suspension or freezing to ensure the security of the user’s funds and compliance with legal standards.

Which country invented M-Pesa?

M-Pesa was first launched in Kenya in 2007 by Safaricom and Vodafone. It was initially devised as a system to allow microfinance-loan repayments to be made by phone, reducing the costs associated with handling cash. The service rapidly evolved to become a mobile money and financial service platform, revolutionizing digital finance, particularly in Kenya and Tanzania, and later expanding to other countries.

What are the risks of M-Pesa?

While M-Pesa is a secure and convenient platform, there are risks associated with its use, similar to any financial service. These include:

- Phishing Scams: Users may receive fraudulent messages or calls attempting to deceive them into revealing sensitive information like PINs.

- Erroneous Transactions: There is a risk of sending money to the wrong recipient if not careful.

- Account Hacking: If account details are not kept secure, there’s a risk of unauthorized access.

- Compliance Risks: Non-adherence to regulatory requirements can lead to account suspension.

Users are advised to practice caution, regularly update their security details, and familiarize themselves with safe M-Pesa practices to mitigate these risks.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info