How to Protect Yourself From Dollar Collapse [2026 UPDATE]

The dollar has been the backbone of the global economy for decades, but what if that foundation starts to crack? A sudden collapse could shake everything from your savings to your daily expenses, leaving those unprepared in financially unstable situations.

The good news? You don’t have to wait for disaster to strike, even if it’s a hypothetical situation. In this article, we’ll walk you through the key risks of a dollar collapse and share practical, actionable steps you can take to protect your money and safeguard your financial future.

Key Takeaways

- A dollar collapse means a sharp loss in purchasing power, often driven by money printing and loss of trust.

- Although unlikely, it remains a real risk during major economic or geopolitical crises.

- Diversifying into assets like gold, Bitcoin, and real estate helps protect wealth.

- Dollar-cost averaging reduces investment risk, especially in volatile markets.

- Staying out of debt strengthens financial security during economic uncertainty.

Table of contents

What is a Dollar Collapse?

The collapse of the dollar itself refers to a significant decline in the value and purchasing power of the US currency. This can happen due to factors such as economic crises, excessive money printing, rising national debt, or geopolitical events.

Understanding the Background

Before 1971, the US dollar was tied to gold, the “gold standard.” People could deposit gold in banks and get paper certificates representing its value. These certificates worked like cash and could later be redeemed for actual gold, which created trust in the currency.

Then, in the early ’70s, President Nixon ended the dollar’s convertibility to gold. Suddenly, the world’s most powerful currency wasn’t backed by anything tangible, just public trust. The U.S. dollar’s status as the world’s reserve currency allows the U.S. to borrow at lower interest rates and run trade deficits without immediate consequences. Since then, the US has been able to print money freely, which some see as risky.

Why Do Currencies Collapse?

The stability of a currency is directly related to the trust of the public. A lack of faith in a certain currency (whether it is for stability or usefulness) leads to an eventual collapse.

And we can see this theme repeating in history. Since the early 1900s, several countries have experienced currency collapses. These events, known as currency crises, often result in a significant loss of value and competitiveness for the home country and its home currency.

Once a lack of faith starts to become prevalent, trouble arises. High inflation is a common trigger for currency crises, as it undermines confidence in the home currency and can accelerate a significant loss in value. And, at the moment, the US dollar is in an unfavorable position. To understand this statement, let’s explore the pros and cons of the US dollar.

Strengths of the USA Dollar

- It’s the world’s primary reserve currency and widely used in global trade and finance.

- The dollar’s dominance is supported by its use in dollar-based payment systems and as the primary currency for US Treasuries, making it central to international transactions and global financial stability.

- Foreign governments and global investors rely on the dollar for stability, often using the dollar index to assess its strength and guide investment and hedging decisions.

- Many other currencies are pegged to the dollar, highlighting its central role in the global economy.

- A stronger dollar makes imports and international travel more affordable, benefiting consumers.

Weaknesses of the USA Dollar

- The dollar is a fiat currency, backed only by government trust rather than gold.

- The U.S. prints more money than other countries, which can devalue the currency.

- Low interest rates and expansionary monetary policy can undermine confidence in the dollar and contribute to currency depreciation.

- Large public debt and the exposure of the banking system to US Treasuries increase the risk of instability if dollar holdings are reduced by foreign investors.

- Emerging markets relying on dollar reserves face higher costs and increased economic risk.

Dollar Dominance and Global Trade

The US dollar’s dominance in global trade is a cornerstone of its power as the world’s primary reserve currency. Central banks across the globe hold huge reserves of dollar-denominated assets, using the dollar as a trusted medium for international transactions.

However, the times and financial markets are changing. Emerging markets are growing rapidly, and with them comes a rising demand for alternative currencies in global trade. The Chinese renminbi, for example, is increasingly being used in international settlements, challenging the dollar’s long-standing supremacy.

That and interest rate differentials also play a crucial role, when US interest rates rise, the dollar becomes more appealing to global investors, but shifts in monetary policy can quickly alter these dynamics.

5 Reasons Dollar Could Collapse

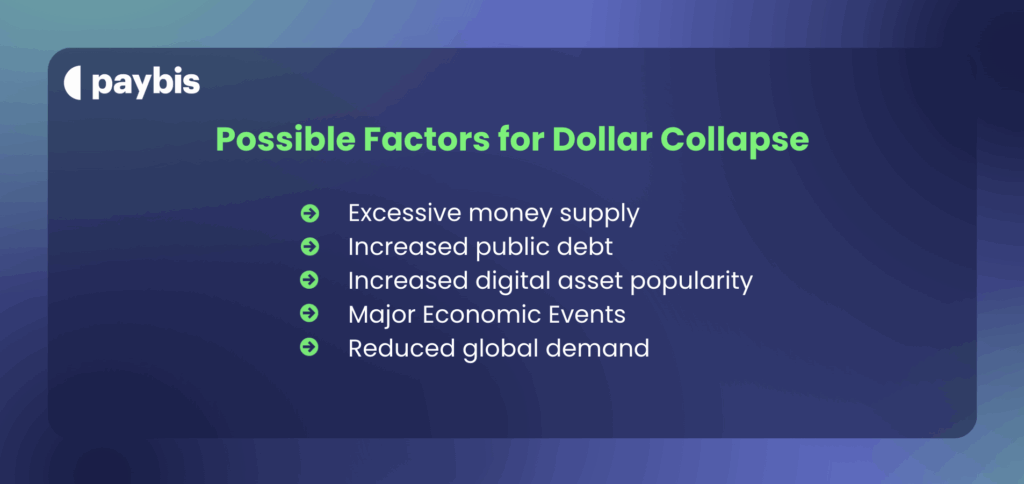

The US Dollar is one of the strongest currencies in the world. While unlikely, there is a non-zero probability of its collapse purely based on how fiat currencies function. Federal Reserve policies, interest rate differentials, and exchange rate risk are key factors that can influence the dollar’s stability.

Higher borrowing costs and concerns about dollar access can trigger shifts in global markets, while other central banks often intervene to stabilize the system during periods of stress. So, what could trigger an actual collapse of the US dollar? Let’s take a look at some of the most realistic scenarios.

1. Printing Money Non-Stop

The US has been printing its way out of financial troubles for the last half-century. And while most people were unaware that this is even possible, the COVID-19 pandemic exposed just how easy it is to create money out of thin air. From March until June 2020, the US printed more than $20 trillion and bankers are concerned that the amount won’t resolve the damage done to the economy.

This large-scale money creation can lead to high inflation and a sharp rise in prices, undermining confidence in the dollar. If the U.S. continues to run large public debt and the Federal Reserve maintains an accommodative monetary policy, it could trigger a loss of confidence, resulting in a vicious cycle of dollar selling, currency depreciation, and further inflation.

2. Giving Money Away for Free in the USA

During the COVID-19 pandemic, every adult US citizen received an “airdrop” of USD 1200. This cheque was meant to ease the difficulties created due to a nationwide lockdown. Such policies can strain the banking system and lead to higher borrowing costs, as increased Treasury yields raise US government borrowing expenses and can create wider financial instability.

During a dollar collapse, savings accounts, retirement funds, and investments denominated in dollars can lose value rapidly, and the Federal Reserve may raise interest rates to defend the currency, further increasing borrowing costs for individuals and businesses. Several countries followed suit, each offering stimulus cheques to citizens who were unable to work.

3. Other Currency Alternatives

Recent economic developments, including interest rate changes and fluctuating savings values, have prompted a broader discussion about the dynamics of the financial system. These changes have led some to explore different perspectives on wealth distribution and financial equity.

In response to these shifts, there’s an increasing public interest in exploring alternative financial solutions to safeguard personal assets. While Bitcoin is a relatively new and evolving financial tool, it serves as an example of the growing interest in systems that offer a different approach from traditional central bank-controlled frameworks.

While past performance doesn’t guarantee future results, reviewing Bitcoin price predictions can help inform your long-term investment strategy during economic uncertainty.

4. Economic Events That Could Trigger Dollar’s Collapse

Geopolitical uncertainty is always an issue. A dollar collapse could trigger a shift towards a multipolar monetary system, fundamentally altering the global financial system and global finance. The potential of the next financial crisis could be the turning point in the global economic order.

The real question is what kind of event could act as the tipping point. World wars, pandemics, and an uncontrolled money-printing mentality could all trigger the collapse of the US dollar.

5. Foreign Countries Drop the US Dollar

A full dollar collapse could happen if global confidence in it erodes. Rising geopolitical tensions and economic worries are pushing central banks to diversify their holdings, moving some assets into currencies like the Chinese renminbi and Swiss franc. The growth of China’s gold market reflects this trend, as countries seek alternatives to reduce reliance on the U.S. dollar and gain more financial independence.

In total, foreign countries own more than $6 trillion in U.S. debt. China and Japan own the majority of this debt. If they decide to drop their holdings, they could cause a global panic, which would lead to a major recession.

How to Prepare for the Collapse of the Dollar?

The U.S. dollar currently holds the status of the world’s reserve currency. To prepare for the US dollar collapse, you need to understand the mechanics behind it. The stability of most currencies lies in one crucial factor: the trust placed in them by the public. When confidence wanes for whatever reason, public opinion becomes less optimistic, and a currency collapse becomes increasingly likely.

- Diversify your investments: Spread your savings across different asset types like gold, silver, Bitcoin, bonds, real estate, and select collectibles, to reduce risk, protect purchasing power, and stay resilient during economic uncertainty.

Getting started is straightforward – you can buy Bitcoin with your bank account through platforms like Paybis that offer secure, regulated transactions. - Buy using the Dollar Cost Averaging (DCA): Invest small, fixed amounts regularly over time to reduce the impact of market volatility, lower risk, and build long-term positions without trying to time the market.

- Avoid going into debt: Minimize or pay off debt to reduce dependence on banks and protect yourself from financial stress during economic downturns.

What Happens If the US Dollar Collapses?

If the U.S. dollar were to collapse, it would lead to significant economic and financial consequences, both domestically and globally, given the dollar’s role as the world’s primary reserve currency. The impact would be multifaceted.

The collapse of the dollar would have profound implications for the international monetary system, potentially accelerating the move toward a more multipolar financial system and reducing U.S. geopolitical influence:

- Global Economic Turbulence: Since many international transactions are conducted in U.S. dollars, its collapse would create chaos in global markets. Countries holding large amounts of U.S. dollars in their reserves could see the value of their reserves plummet, leading to economic instability.

- Inflation in the U.S.: A collapse of the dollar would lead to hyperinflation in the United States. The cost of imported goods would skyrocket, severely impacting consumers and businesses.

- Interest Rates: The U.S. would likely face soaring interest rates, making borrowing more expensive. This could lead to a credit crunch, affecting investments, consumer spending, and overall economic growth.

- Investment Shifts: There would likely be a significant shift in global investment. Investors would seek safer assets, potentially leading to a rise in the value of other currencies, gold, cryptocurrencies, or other commodities. Beyond Bitcoin, you can diversify with Ethereum and other cryptocurrencies to spread risk across different blockchain ecosystems.

- Trade Imbalances: U.S. exports would become cheaper, potentially benefiting U.S. exporters. However, the cost of imports would rise dramatically, affecting supply chains and consumer prices.

- Geopolitical Consequences: The U.S.’s geopolitical influence, which is partly underpinned by the dollar’s dominance, might diminish. Other currencies, like the Euro or the Chinese Yuan, could gain prominence.

- Debt Repayment Challenges: The U.S. government and American entities with debt denominated in foreign currencies would find it more expensive to service their debt.

Understanding the advantages of Bitcoin as a decentralized asset helps explain why it’s considered a viable alternative during currency crises.

Wrapping Up

While most economists state that it’s difficult to predict whether or not the US dollar can collapse, it’s not exactly an impossible event either. Even if it’s a hypothetical situation, it’s still important to know what to do, how to diversify your assets, and ultimately, protect yourself from potential global financial crisis.

Staying informed and proactive ensures that, even in uncertain times, your financial security remains strong, because preparation today is the best defense against the uncertainties of tomorrow.

FAQ

Will the gold price go up in 2026?

Most analysts expect gold prices to rise or remain elevated in 2026, with forecasts ranging roughly from $4,400 to $5,000 per ounce. Growth is expected to be driven by central bank purchases for global trade, geopolitical uncertainty, and safe-haven demand. However, strong economic growth, a stronger U.S. dollar, or rising interest rates could limit gains or cause short-term corrections.

What is the strongest currency in the world?

Some commonly recognized strong fiat currencies include the US Dollar, the Euro, the British pound, and the Japanese yen. However, this can change, as what can be considered a strong currency depends on its stability, economic performance, and global demand.

What happens to gold when the Dollar falls?

When the US dollar drops, gold prices often rise since gold is seen as a safe haven and a hedge against inflation. Foreign investors tend to buy gold when the dollar weakens, but the relationship isn’t always predictable.

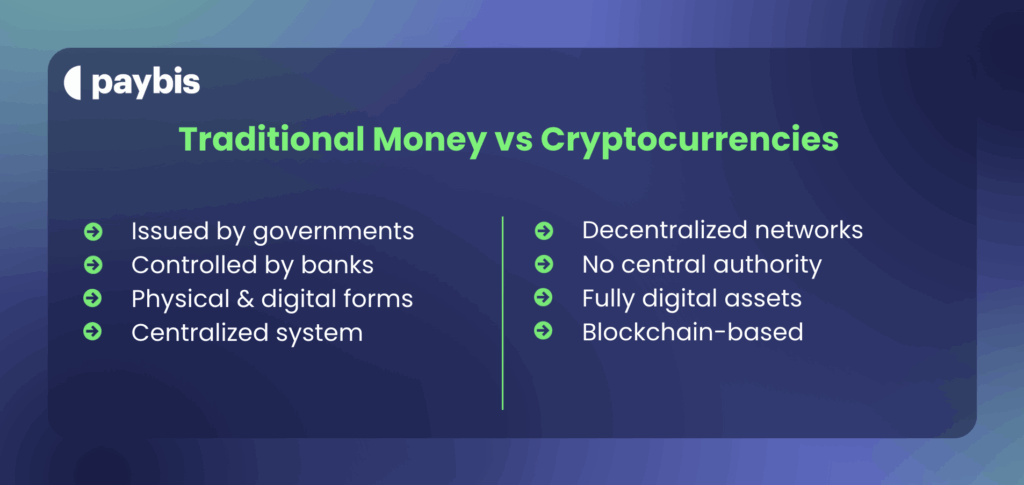

Why crypto instead of fiat?

Cryptocurrencies have several perks over traditional money. They’re decentralized, giving you more control over your funds, and use strong encryption for added security. They’re fast and efficient, and can also serve as investment opportunities, helping diversify your portfolio and hedge against inflation.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info

![How to Protect Yourself From Dollar Collapse [2026 UPDATE]](https://paybis.com/blog/wp-content/uploads/2020/06/How-to-Protect-Yourself-From-Dollar-Collapse.jpg)

I cannot find the Krone on Fidelity . NKR , KR , etc does not show the Norwegian Krone .

Several digital wallet apps allow you to exchange your currency (mostly apps that offer debit cards aimed towards travelers). Fidelity doesn’t seem to be the best option for this type of trading.

Would Malaysia currency be simular to Norway banking if usd is converted to there currency

We can’t know this for sure as each government takes independent decisions. That being said it would be wise to store some of your wealth in Bitcoin to protect yourself in case of a potential economic collapse caused by massive inflation of the US dollar.