Is it too Late to Buy Bitcoin? 2024 Analysis of What’s Next

Some have suggested that after an all-time high of $20,000, the ceiling of Bitcoin’s price must be near. Is this true? And if so, is it too late to buy Bitcoin?

Bitcoin, the popular internet currency, has been with us for 10 years now.

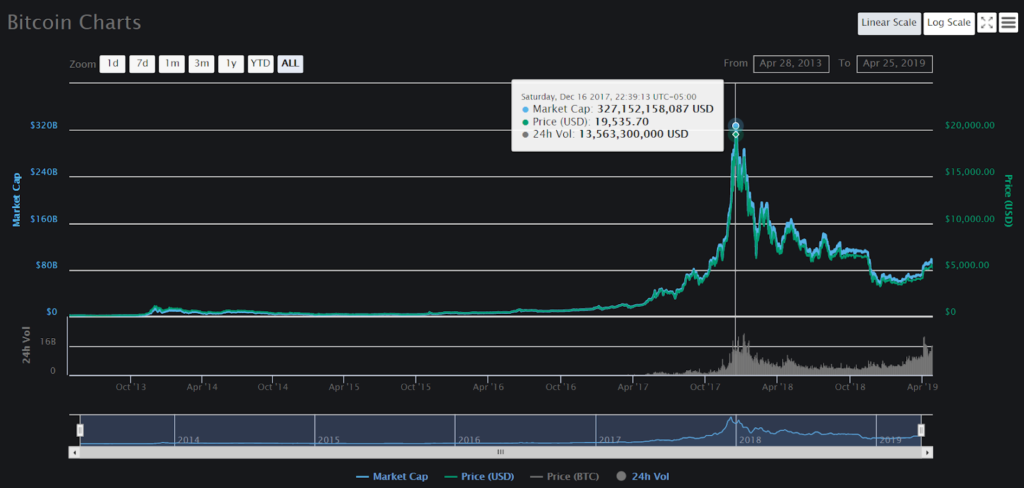

Having started with no price at all, it recently sold for twenty thousand dollars a unit, falling back down to a low of $3,132 USD.

Bitcoin has done this many times before and every time it finds its bottom price at a higher low.

In 2011, it went from $1 USD to $30 USD and back down to $2 USD in a span of a few months.

A couple of years after, it went, once again, from the same $2 USD, all the way to $260 USD. Then took a break back down at $60 USD and then took off like a rocket ship all the way to $1,163 USD.

Shortly after that, Bitcoin, fell back down to a low of $155 USD, from where it entered a 3-year bull market that took us to the $19,716 USD high at the end of 2018.

The recent low of $3,132 USD may be the lowest low of this new market cycle. If it is not, then the bottom price is most likely not far away.

Nobody knows for sure where the price will be in the future, and that applies to all markets, not just Bitcoin.

However, no matter how far down Bitcoin’s price goes, if you believe it can go higher, then making a speculative bet on its recovery might pay off handsomely.

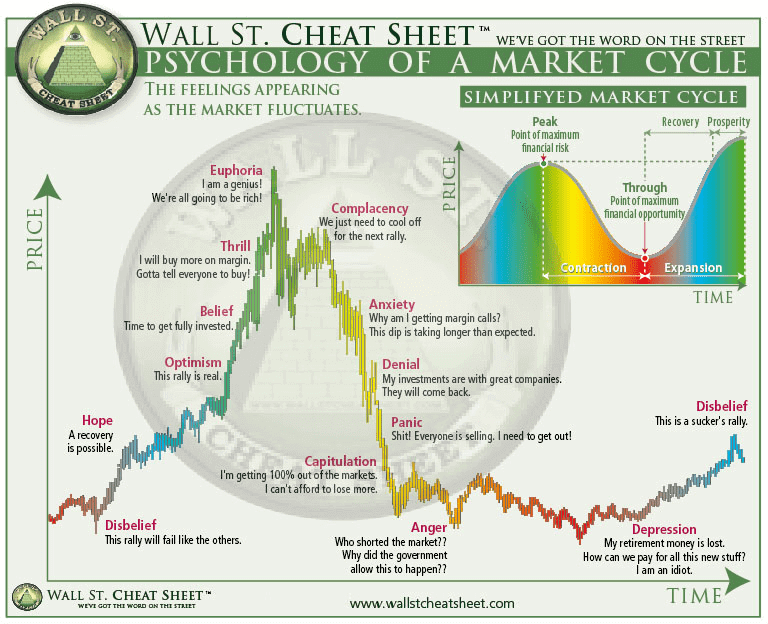

You may have noticed above that there is a pattern to how Bitcoin’s price moves.

What’s interesting, it is similar to the “Wall St. Cheat Sheet” chart. Bitcoin’s price correlates with market sentiment, expressing human emotions, such as disbelief, optimism, and euphoria as well as anxiety, denial, capitulation, and back to disbelief.

Nonetheless, Bitcoin has one major difference from the chart above. It has always “bottomed” at a much higher price than previous tops, usually touching the previous all-time high.

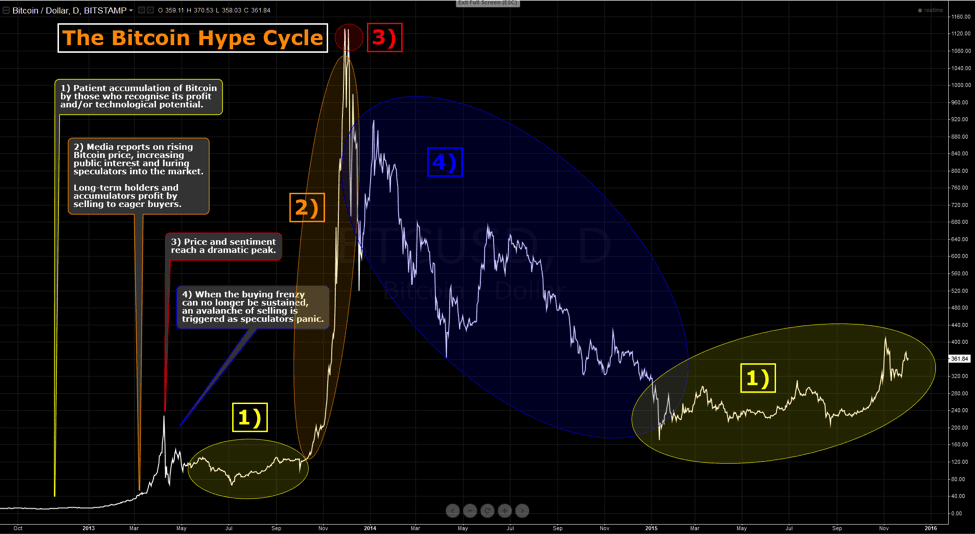

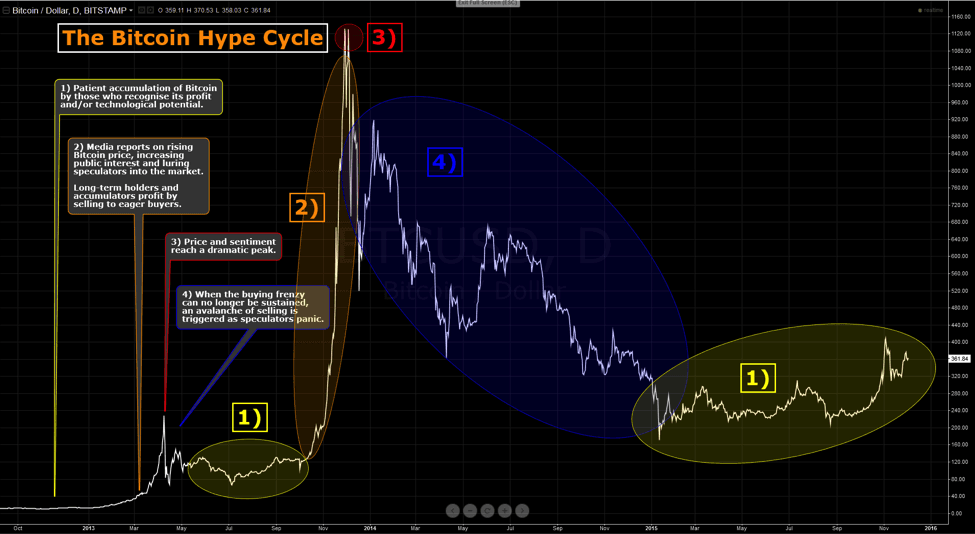

The following chart, known as the “Bitcoin Hype Cycle Chart”, does a great job of showing the different market stages Bitcoin goes through.

So, have a good look at it. Then ask yourself, where in Bitcoin’s market cycle are we now?

- One

- Two

- Three

- Or four?

Feel free to leave your answers in the comment section.

Table of contents

- That all sounds good, but how high can the price of Bitcoin really go?

- Bitcoin as a store of value and digital gold

- The power of Bitcoin’s network effects

- Is it too late to buy bitcoin 2024? – The bearish argument

- So, how long until a new ‘bull market’ begins?

- Last but not least, we should talk about the great Bitcoin ‘Halving’

- Let’s say I’m ready to buy, what’s the best way to do it?

- So, is it too late to buy Bitcoin?

That all sounds good, but how high can the price of Bitcoin really go?

Will Bitcoin ever reach a final high, and if so what might that be? Or is it already too late?

Great question. Let’s examine the possibilities.

As we have had a look at the bottoms and seen the past, we can now have a look at the future and see if we can find a new top.

To understand if it’s too late to buy Bitcoin and how high it’s price can actually go, we need to have some understanding of what this cryptocurrency is all about.

You will often hear that Bitcoin is internet money, that you can use to buy things online. And it is true, in a sense. It is a payment network and a currency in its own right.

Better yet though, it is a currency that does not require trusted third parties to function.

It lives on top of the internet, which allows it to surpass geopolitical boundaries, spreading across languages, cultures and nation states.

It moves like many other forms of digital information do today.

This means that, in theory, it could replace the largest national and international payment networks, such as Visa, MasterCard, and Paypal, among others.

So, if we add the stock market capitalization of the above-mentioned payment processors: Visa at $321.501B USD, MasterCard at $247,131B USD and Paypal at $125.847B USD, we get to a total market cap of about $820,326B USD Billion dollars.

At it’s latest peak price, Bitcoin reached $328,275B USD in market capitalization and currently sits at $100,367B USD.

Note: In this case, that’s only counting the top three western payment processors.

So, 800 billion or more is possible and has a decent likelihood of happening based on this use case alone.

That would set Bitcoin at a price of roughly $46,000 USD per coin.

Bitcoin as a store of value and digital gold

Bitcoin is often described as not just a payment network, but also as a store of value.

So what is a store of value and what can we compare it with??

The most relevant example, in this case, is gold itself.

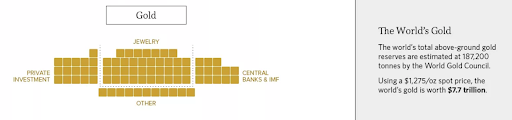

Gold today is believed to have a total market capitalization of $7.7 Trillion USD. This is a calculation based on the total amount of units in existence multiplied by the market price of each unit.

If Bitcoin were to reach the market cap of gold, as a new, global store of value, each Bitcoin would be valued at roughly $436,141 thousand USD.

On top of that, gold is not the only store of value that we can use for comparison.

Every fiat currency in the world can serve as a store of value and a medium of exchange, although some are a lot better than others.

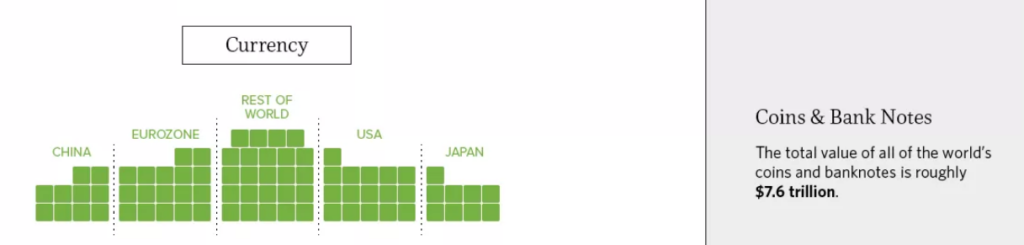

So, in this example, let’s take all of the world’s coins and banknotes including the US Dollar, which is the global reserve currency. At the end of the day, it’s just another financial market that Bitcoin could expand into.

One estimate sets the total monetary value of all coins and banknotes to be around 7.6 Trillion USD.

Have you ever wondered what the price of 1 Bitcoin would be if it were to replace the FIAT currencies?

The answer might surprise you because Bitcoin would be worth $430,477 USD.

Is it even possible?

To answer this question, let’s see if Bitcoin could be used as a global currency.

Can Bitcoin become the only money we use?

Unlike other currencies, before Bitcoin, which are centralized through federal reserve banks, or confined to physical objects, Bitcoin is not controlled by any person, institution or governing body.

Furthermore, Bitcoin is money that can move around the world at the speed of light, through the veins of the internet.

It does not require a counterparty for its issuance, nor is it based on debt and credit, which creates tensions between nation-states, like in the current case of the USA and China.

Bitcoin, instead, stands alone as a bearer asset, as if it was a digital commodity discovered within the realm of mathematics.

This breakthrough in computer science can offer solutions to pressing geopolitical issues.

It can expand the reach of financial tools and services to people all over the world, many of whom are currently outside the reach of banks and the financial system.

All they need is a cell phone and an internet connection.

As Jack Dorsey, CEO of Twitter, has suggested recently:

“The world ultimately will have a single currency, the internet will have a single currency. I personally believe that it will be Bitcoin”

We already live in a world where anyone can hold and move money through their mobile phones, enter and exit their local currency at will and escape local inflation into a global, unmovable asset.

What will happen when everyone considers doing it?

How much could that be worth?

The power of Bitcoin’s network effects

Bitcoin isn’t just digital gold, nor simply a digital currency.

Bitcoin is an internet network in its own right and benefits from the very powerful “network effects”.

It has a dedicated infrastructure that rests on top of the internet known as Bitcoin nodes and Bitcoin miners.

Its users meet and gather around its use, building communities and companies. These companies facilitate the use of Bitcoin in its many forms and that in turn attracts more users.

As time goes by, Bitcoin adds new talent and resources to its distributed economy, growing the community and improving Bitcoin’s usefulness.

The power and value of network effects are very well understood in Bitcoin circles. It is a concept that was developed long before Bitcoin was born and that appears to explain Bitcoin’s exponential rises and remarkable growth.

To learn more about this, you can read upon the 7 network effects in Bitcoin that stack value to each other and are fundamental to understanding its success, as written by Tracey Mayer, an early adopter, investor and evangelist of Bitcoin.

Is it too late to buy bitcoin 2024? – The bearish argument

So what is the argument against Bitcoin’s success?

Is it possible that Bitcoin just disappears?

Well, nothing succeeds until it succeeds and there is always a chance that something can go terribly wrong, even if the possibility is minor.

Bitcoin is in its infancy still and, while it has grown tremendously, it still has a long way to go.

The day Bitcoin has satisfied all concerns will be the day that making a profit will no longer be feasible. The day Bitcoin has solved all concerns is the day it will be too late to profit.

Critics throughout Bitcoin’s history have made many negative predictions. Hundreds of obituaries have been written about Bitcoin, proclaiming it dead, despite watching it continue to grow and expand.

The most recurring critique Bitcoin has received is about its “scalability”. In other words, it’s Bitcoin’s capacity to handle the financial load of the whole world, let alone any major portion of it.

Bitcoin was created with high security in mind. It was created with plenty of redundancies designed to make it hard to kill and capable of surviving in the wild.

It was built to hold ground against hostile parties of many kinds, even hostile governments, and so far it has succeeded tremendously.

But there are certain costs to security. One of them is that it is simply not possible for Bitcoin to ‘scale on-chain’. What this means is that not everyone can use Bitcoin in the same way it has been used over the past decade.

Trying to scale “on chain” is projected to make the digital currency fragile and centralized, as the costs of running Bitcoin infrastructure would go through the roof and only affordable by big corporations in major ‘data centers’.

So how is Bitcoin supposed to scale?

Well, the good news is that Bitcoin is software and that means we can “program it”. Not everything has to be done “on-chain”.

In recent years an engineering innovation known as “The Lightning Network” became popular and has gained incredible momentum.

The Lightning Network is technically a “layer 2” solution on top of Bitcoin, structuring the coin’s development similarly to how the internet was built, in layers.

The first layer is thus concerned with optimal security, while the second layer with optimal scalability.

This innovation allows users to send Bitcoins for as low as a “satoshi” which is a small fraction of a penny while benefiting from the speed of instant communications that the internet allows us.

The Lightning Network innovation is akin to signing a check for a chosen amount of euros in your bank account and giving this signed check to whomever you are buying from, rather than sending them a direct deposit or a swift transfer.

This check is cryptographically signed, and the value it can unlock is mathematically verifiable with an internet connection.

The recipient then holds on to the check, which he can cash in at the bank by “settling it” on top of Bitcoin and paying a fee, exiting the Lightning Network.

Or, instead, hold on to it and use it to barter with others as you would with cash.

The drawback of the Lightning Network is that this “cryptographic check” should be verified against a live Bitcoin node that is online almost all of the time. Something that most cellphones can do today and which wallet services can facilitate.

The Lightning Network is a stupendous solution to the scalability problem, it liberates users from having to pay high fees to get ‘on chain’, lets them send and receive instantly without having to wait 10 minutes for confirmation and retains the decentralization that makes Bitcoin great.

However this layer two is still in its infancy and generally misunderstood by the public Most critics, I find are generally confused about what the Lightning Network is or how it is meant to work.

Much of this will be resolved as wallets and other applications of the technology mature and become adopted by the market.

The Lightning Network is a stupendous solution to the scalability problem. However, it is in its infancy and is generally misunderstood by the public. Most critics are generally confused about what the Lightning Network is or how it is meant to work.

So, how long until a new ‘bull market’ begins?

Well, as I write this article, many of my peers believe the bull market has already started, or at least that the lowest price in this cycle has been reached.

They assume that we are off to test new heights.

Only time can tell if they are right or wrong. For now, let’s have a look at one more chart to see if we can get a better idea of the timeframe.

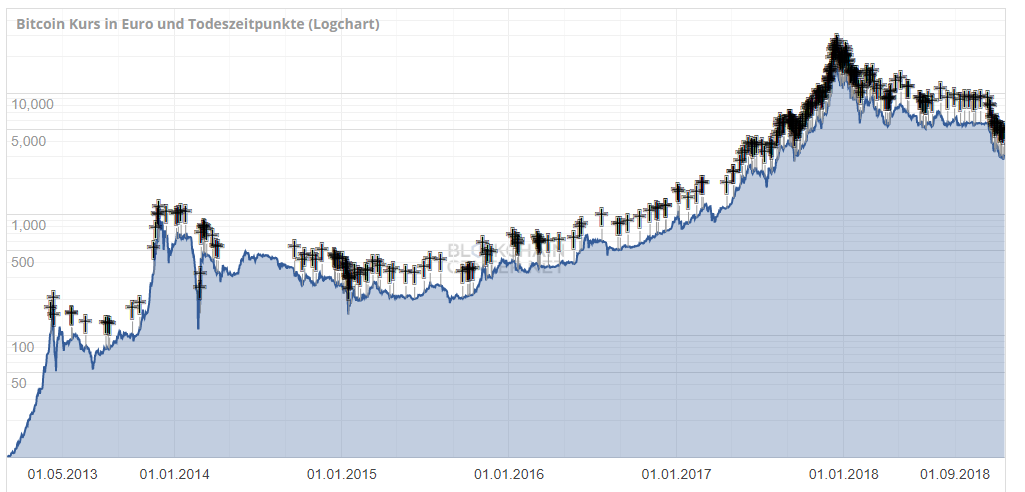

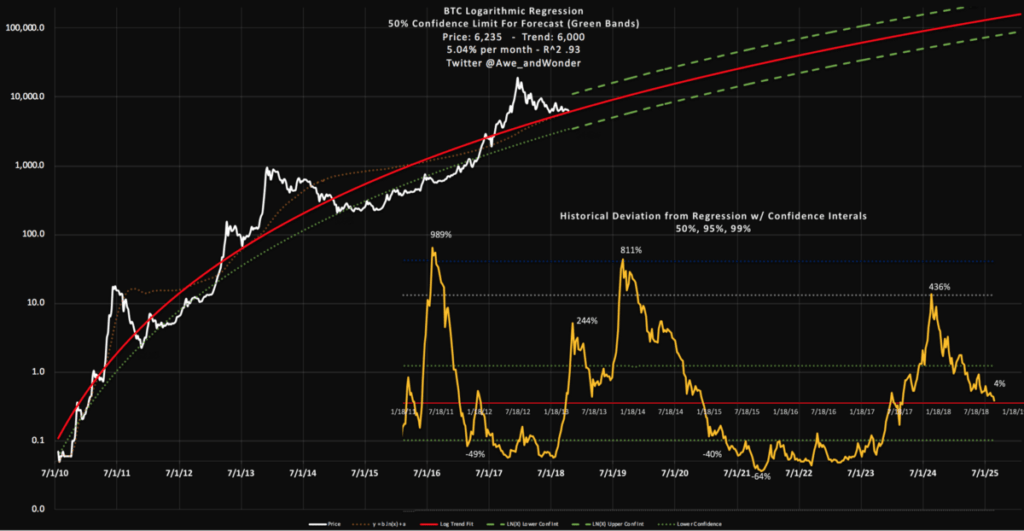

This is a long term logarithmic chart that measures Bitcoin’s price in exponents rather than linear numbers.

You’ll see that the range on Y-axis goes from $0.1 USD all the way to $100,000 USD.

The green dotted line correlates to the “bottoms” of the price after Bitcoin moves exponentially up and corrects to a higher low.

In this chart, every year, the log trend becomes more vertical, which suggests that the next 2 or three waves will take longer than the previous waves, and won’t be quite as spectacular in their profitability.

It is true that anyone who got into Bitcoin during previous waves and did not sell will have a hard time ever making anywhere near the same profits as the early adopters.

Nevertheless, it’s not too hard to imagine how high the next Bitcoin wave might go or how long it might take when looking at this chart.

You’ll also notice this particular chart is a few months behind. Today, the price is a lot closer to the dotted line than seen above.

So, if we bounce from the support trend that the green line implies we’ll start making a slow rise to a new all-time high.

Then, assuming a slowly strengthening bull trend occurs, like the one seen in previous years, Bitcoin’s price should reach $100,000 USD somewhere near 2022.

This is actually a conservative estimate and not the all-time high, just a 20x from the bottom price.

One only needs to check the previous bull markets, where Bitcoin’s price grew more than 100 times from the bottom of a bear market to its new all-time high.

For example, when it went from $155 USD mid-2015 to nearly $20,000 USD by the end of 2018.

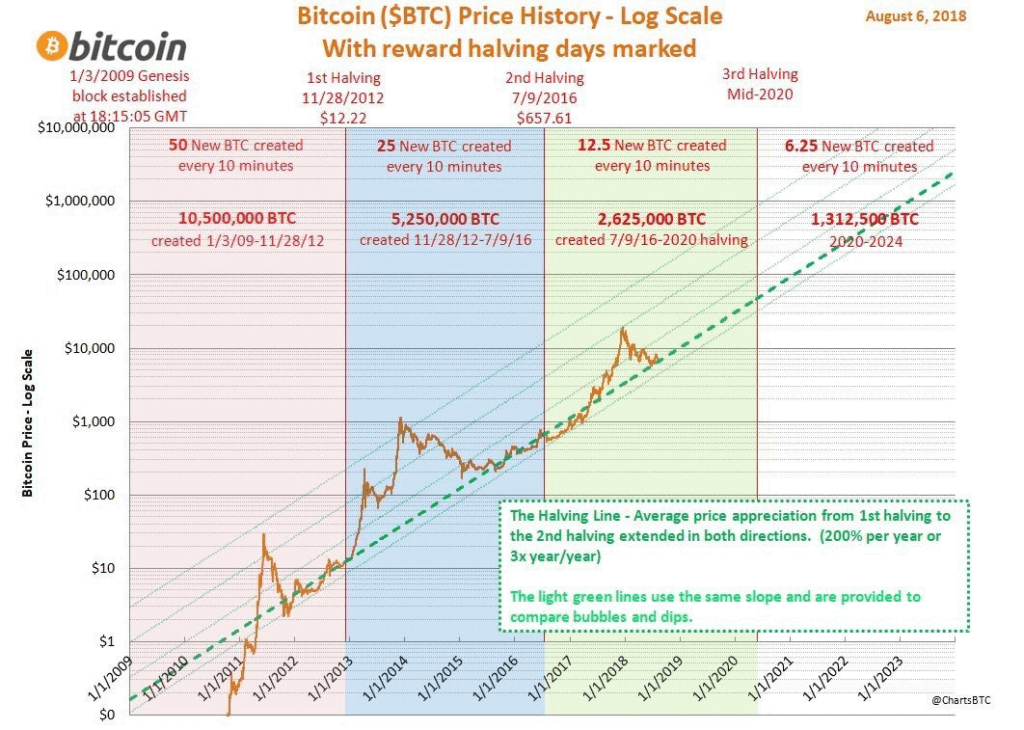

Last but not least, we should talk about the great Bitcoin ‘Halving’

One of the beautiful things about Bitcoin is that we know exactly how many coins exist at any given time.

Better yet, we know how many there will exist in the future, and when there will be no more!

‘Miners’ provide security to the network in exchange for freshly minted Bitcoins.

This is how its security is funded. Every few years the amount of Bitcoins paid out to miners gets ‘halved’, reducing in half the amount of new coins entering the market.

This has been very strongly correlated with the strengthening bull markets in Bitcoin as you can see below.

The reason being that, after every halving, fewer Bitcoins can be sold on the market, reducing in half the amount of new sell pressure that can exist.

Today, 12.5 Bitcoins are minted and rewarded to miners every 10 minutes. That is $68,387 USD every 10 minutes, some of which may be used to pay off electricity bills and other, mining-related costs.

Once the next halving occurs in 2024, the stage will likely be set for a great new bull run.

This kind of projection and the above analysis is why many successful entrepreneurs, traders and money managers believe Bitcoin can go as high as $500,000 USD within 5 years.

Not bad, when we are sitting at the $45,000 USD range for only one Bitcoin.

Let’s say I’m ready to buy, what’s the best way to do it?

Now, perhaps you are ready to get some Bitcoin.

You believe that it is probably going to increase in value and that it’s worth a bet.

Great!

Welcome aboard!

Making that decision is the first step, but understanding the actual buying process is also very important.

Many new people simply decide how much they want to buy, save up the cash and get it in one purchase, assuming the prices are still at the levels they hoped to buy at.

The first problem they face is Bitcoin’s volatility, which is more turbulent than other assets.

So, buying in one big lump sum today means you will absorb 100% of the volatility going forward, and it is possible some of that will be to the downside in the short-term.

If you are comfortable with the price you paid – that’s great.

But what if the price decides to go down? Or if it skyrockets to new highs?

Either way, you are in for quite a ride.

However, there’s arguably a better way to go about this.

There is a strategy that helps you minimize your exposure to volatility, and delivers you an average price, rather than a fixed price, reflecting the value of Bitcoin the day you bought it.

It’s called dollar-cost averaging and it is a pretty simple way to buy.

You can start by setting a target of how much you are ready to invest and spread that out into multiple purchases. For example, every 2 weeks for the following 4 months.

At this rate, you will accumulate Bitcoin at an average price of all your purchases, instead of buying at the top of a short term rally and seeing your investment sharply correct for a few weeks thereafter, as is sometimes the case.

The flip side, of course, is that you won’t benefit from the opposite scenario either.

Nevertheless, the greatest benefit of this strategy is the peace of mind that is achieved by not spending too much time looking at charts and prices, which can easily turn into an emotional rollercoaster.

In this way, you are more likely to get an optimal price, compared to any other single price point.

The same strategy can be used to sell your Bitcoin when the bull market is in full exponential euphoria.

Dollar cost averaging works beautifully to get in and to get out of any long term investment.

So, is it too late to buy Bitcoin?

By now you know enough to make an informed decision.

No matter what your takeaway is, we tried to show you both sides of the coin:

- Why it could too late to buy Bitcoin

- And why it’s just the beginning of Bitcoin’s domination

Now that we know that we are still very early in the market what are some good practices to remember? Let’s check:

Best time of the day to buy Bitcoin

The crypto market is open 24 hours per day, 365 days per year. There are no limits due to the coin’s decentralized global nature.

Best way to buy Bitcoins

Now it’s your turn to decide and share with others whether it’s too late or just the right time to buy Bitcoin. If you believe that right now is the best time, go ahead and buy Bitcoin in a fast and convenient way.

From that point, and until the price sees a significant increase, Hodl on.

This article is written by Juan Galt. Juan has been a researcher, journalist, and educator in the Bitcoin & Blockchain industry since 2014. He has been published in major publications, such as BitcoinMagazine, Cointelegraph, New.btc.com, and Bitcoin.com. Today he focuses on fast-tracking new crypto adopters through the learning curve, teaching them industry standards of digital security, privacy, and investment at ByoVault.com.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info

I couldn’t refrain from commenting. Perfectly written! It’s very simple to find out any matter on net as compared to books.