Litecoin Price Prediction – Getting Ready For A Breakout?

Litecoin has been relatively quiet in this rather eventful year for crypto. The popular cryptocurrency is still struggling to recover from the March bottom, while Defi projects are getting most of the attention of new investors.

For many, Litecoin is simply one big question mark. While the LTC foundation is releasing updates on a regular basis, the community is not as strong as it once was. When looking at the project, it is really hard to make a long-term prediction as many factors can affect its future.

In this article, we will take a look at LTC’s history and past performance, in order to set a realistic Litecoin price prediction for the upcoming bull market. We will also touch upon expert opinions and useful resources that you can use. Before we delve into our predictions, let’s briefly introduce Litecoin.

Table of contents

Understanding Litecoin

Litecoin (LTC) is a fork of Bitcoin’s protocol and proclaims itself as “the silver to Bitcoin’s gold.” Code-wise, Litecoin is nearly identical to Bitcoin with a few minor differences. Similar to Bitcoin, Litecoin utilizes Proof-of-Work (POW) for consensus and allows users to transfer value to one another without relying on any third parties.

Furthermore, the coin is seen as one of the most stable cryptocurrencies in the market, as it has performed well over the past 9 years and is consistently ranked in the top 10, according to market capitalization.

Who developed Litecoin?

Litecoin was created by computer scientist Charlie Lee in 2011, with the goal to improve upon Bitcoin’s bottlenecks (scalability & fees).

In 2013, Lee left a prominent position in Google and began working as an engineer at Coinbase. It was during this time that the exchange decided to list the coin he created. In 2017, the founder decided to leave his career at Coinbase and focus all his efforts on the development and adoption of Litecoin. He is currently the head of the Litecoin Foundation and remains active in the community.

What is Litecoin’s value?

Litecoin is the 7th most popular cryptocurrency at the time of this writing. It is available in more than 300 exchanges with multiple trading pairs, the most common of which are against Bitcoin (LTC/BTC) and Tether (LTC/USDT). The coin’s value is purely demand-driven, so its price is determined by the markets’ perceived value.

Aside from that, it is important to note that similar to Bitcoin, Litecoin experiences reward halvings every 4 years. The latest halving did not have a significant effect on the coin’s price, as did the previous events before that. The next Litecoin halving will occur in 2023, with block rewards decreasing from 12.5 to 6.25 LTC per block.

Useful links

Litecoin vs Bitcoin – What are the differences?

Even though Litecoin is based on Bitcoin’s code, it has several unique characteristics:

- Faster block confirmation – The Litecoin network confirms transaction blocks 4 times faster than Bitcoin, with the average completion time being 2.5 minutes. This means that transfers are completed quicker and the network is able to handle more transactions simultaneously.

- Total coin supply. Litecoin has a total of 84.000.000 coins, while Bitcoin has 21.000.000 coins. Note that this number refers to the maximum supply, and not the amount that is currently circulating the market.

- Hashing algorithm. Litecoin utilizes a more democratic POW algorithm known as Scrypt, while Bitcoin uses SHA-256.

- Different Public Addresses. Litecoin public addresses start with an “L” or “M”. Bitcoin addresses begin with “bc1”, “3” or “1”.

Analyzing Litecoin’s historic performance

While the past is no indication for the future, we can derive some useful information that will help us get a better understanding of where LTC is headed.

Price action

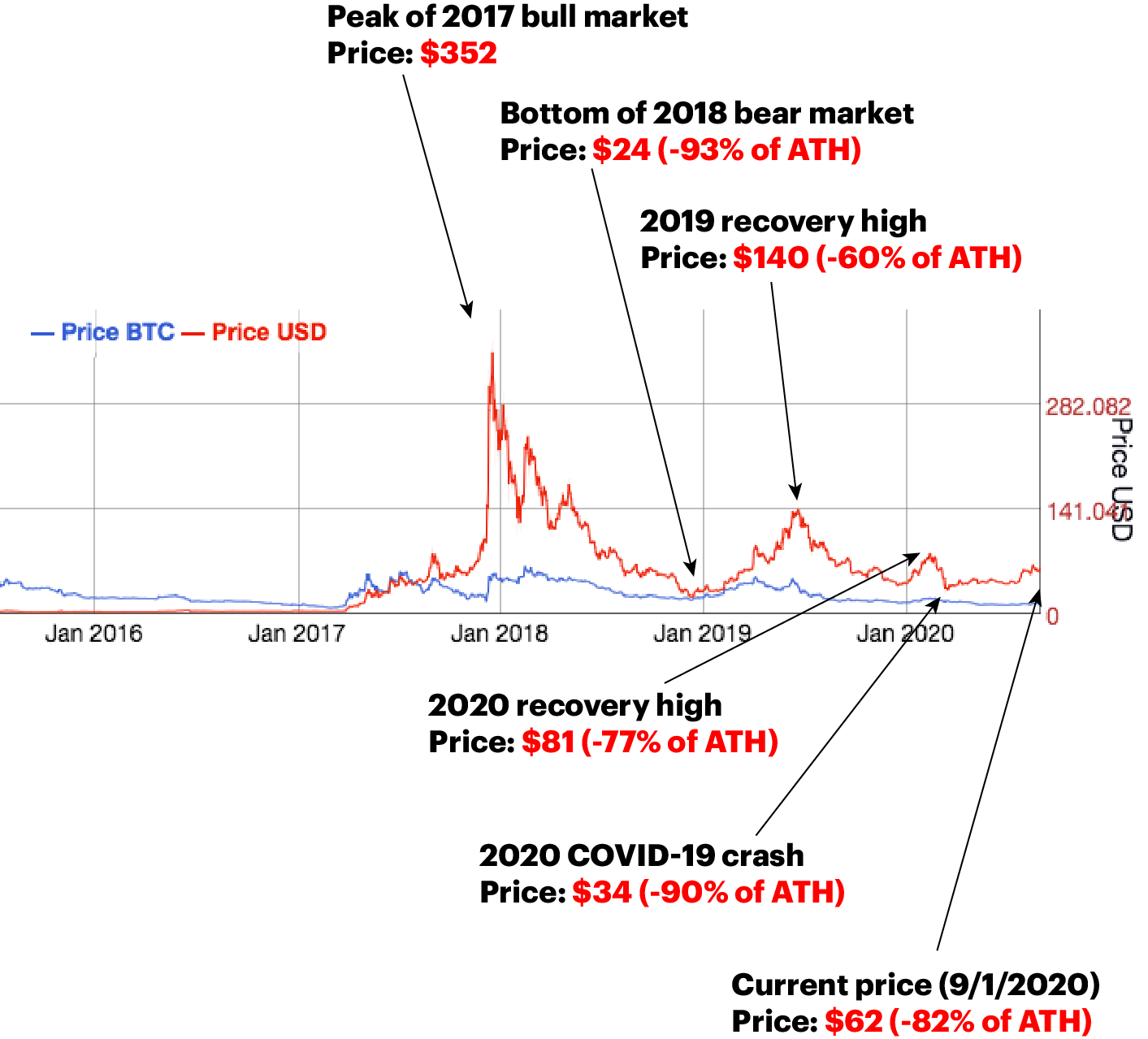

Similar to most cryptocurrencies, Litecoin has had very volatile price fluctuations over the last 3 years. Following its all-time high ($352), it gradually declines in value over the period of a year, until it finds a bottom at $24. It is during this time that the Litecoin community becomes less engaging in social media groups. Looking back, this happened for three reasons:

- The slow and steady price decrease

- Charlie Lee selling all his LTC holdings at peak price

- Interest shifting towards other cryptocurrency projects.

2018-2019

After the price bottoms out, the whole market experiences a recovery shortly after the December lows. Over the following 6 months, Litecoin experiences a 480% recovery back to $140, outperforming Bitcoin’s 337% growth over the same period.

2019-2020

From July 2019 to December of the same year, the whole market experiences a decline, and Litecoin follows suit. Note that, in August 2019, Litecoin undergoes a reward halving which has little to no effect on the price.

Things start changing in January of 2020, as the whole crypto market starts preparing for the upcoming Bitcoin halving. This recovery pattern is surprisingly similar to past Bitcoin halvings, and the media makes sure to point it out. With increased attention from the public, Litecoin’s price recovers back to $81.

The sharp price decline that follows is directly related to the COVID-19 pandemic, which has most investors turning to cash to protect themselves. The price finds a local bottom at $34 and has been struggling to recover ever since. Currently priced at $62, Litecoin has recovered proportionally less than most top coins in the top 10 list of CoinMarketCap.

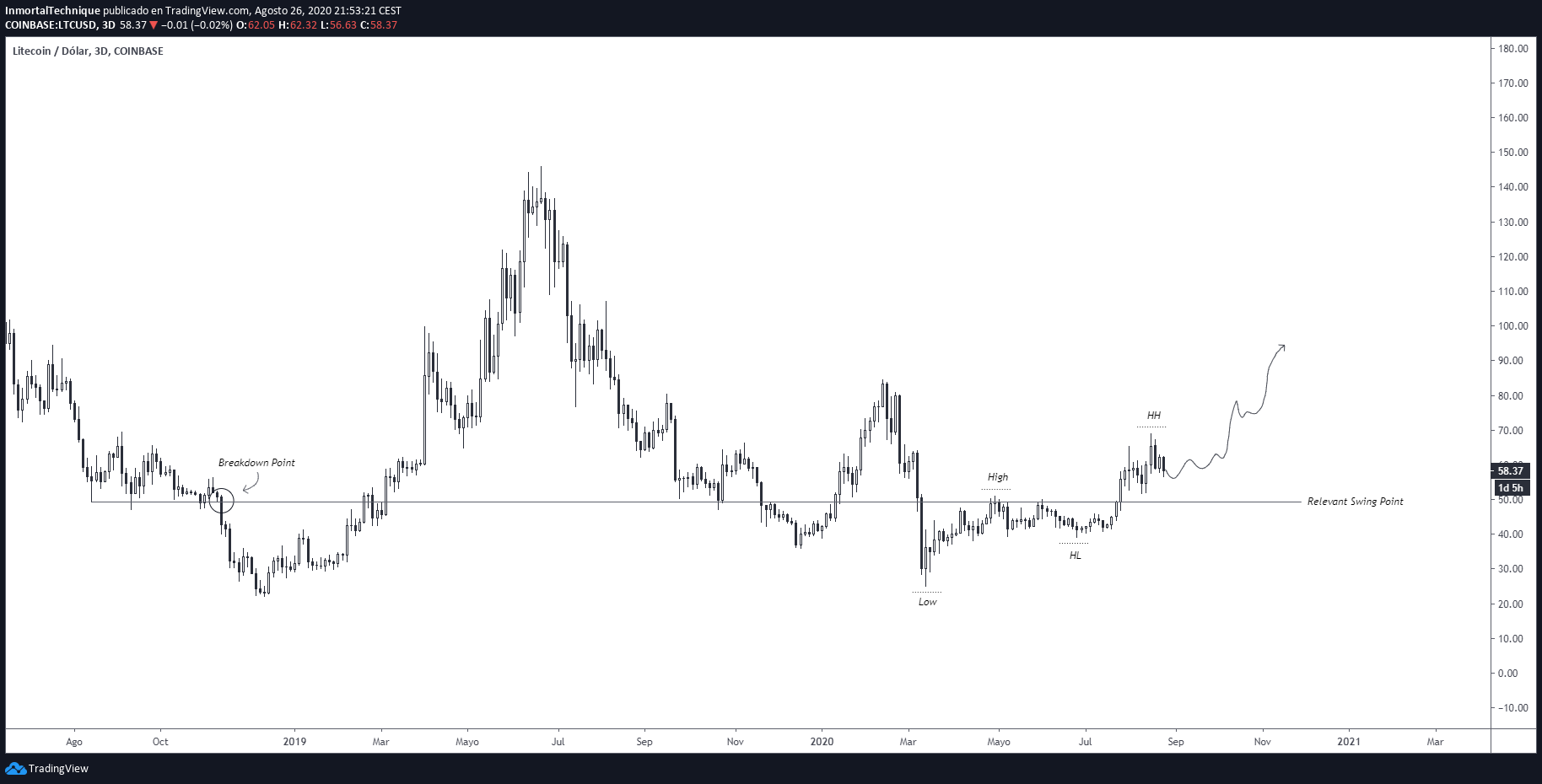

When measured on a metric scale, Litecoin has been making lower highs for the past 3 years. It is slowly reaching a consolidation point that will either lead to a breakout or another leg down.

Some Litecoin enthusiasts speculate that, if history is to repeat itself, this consolidation could lead to new all-time highs.

According to them, there is a possibility to see the price increase to $4500 per Litecoin by the end of 2021. We tend to disagree with this prediction, and we’ll explain why in the following chapters.

Transaction volume

In order to better understand transaction volumes, we need to look at the performance of top exchanges. Just a few months ago, Binance reported its highest daily trading volumes ever, surpassing the volumes of late 2017.

Evidently, the demand to trade cryptocurrencies is increasing and, as a result, so does the media coverage.

Additionally, just a few weeks back, the founder of Binance, Chanpeng Zhao, mentioned that the exchange experienced an all-time high in terms of system traffic.

We are seeing ATH in terms of system traffic. Higher than Dec 2017. Should be interesting to see what happens next.

— CZ Binance (@cz_binance) August 17, 2020

The last time this occurred, the platform had to temporarily disable all new registrations to cope with the high demand and hire additional workforce.

Overall, it is clear that demand is increasing and we are entering a new bull market. The real question here is how this surge of interest reflects on Litecoin.

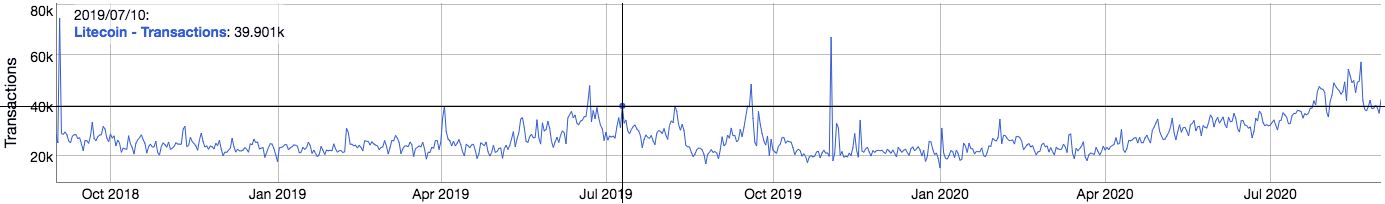

Litecoin’s daily transaction volume is currently higher than it was in the third quarter of 2019 when it’s price reached a peak of $140. More specifically, the average trading volume is 56% higher than in July 2019.

This could indicate an undervalued Litecoin since trading volumes are directly related to user demand.

Litecoin merchant adoption

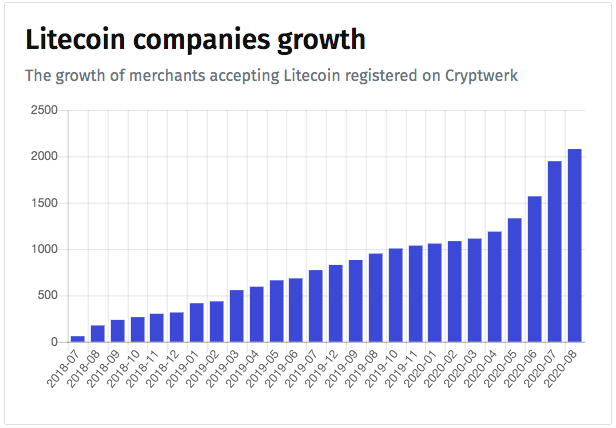

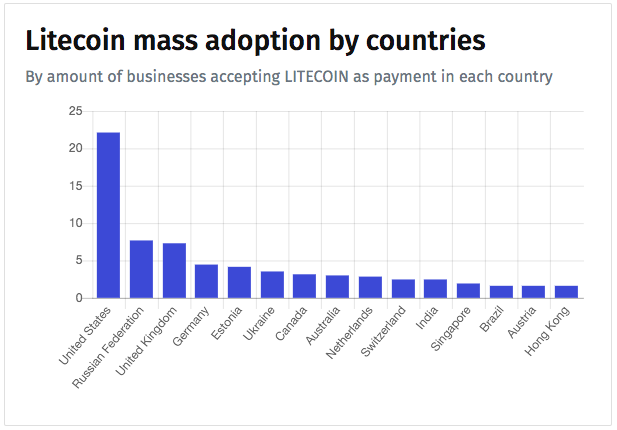

With the growth of the crypto industry, more and more merchants choose to support Litecoin payments in their (e-commerce)stores. In this section, we will refer to data gathered by Cryptwerk to analyze the adoption rate of Litecoin.

Over the past two years, the number of merchants that accept Litecoin (LTC) has increased dramatically. While, in 2018, only a handful of companies were open to Litecoin payments, today Cryptwerk’s directory lists more than 2000 stores.

What might also be interesting to check is the location of these stores. While most are located in the US, there is a large number of locations that are slowly starting to catch up.

Due to the growth of the market, we could see these numbers grow massively in the next 6-18 months. This should lead to a more balanced chart when it comes to locations and a further increase in demand.

Sentiment Analysis

We have previously talked about the importance of sentiment analysis when doing research. Knowing which channels to derive information from will help you understand whether the audience has a positive or negative viewpoint towards Litecoin.

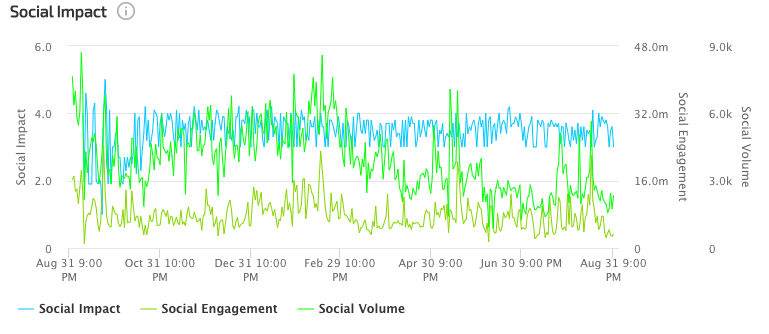

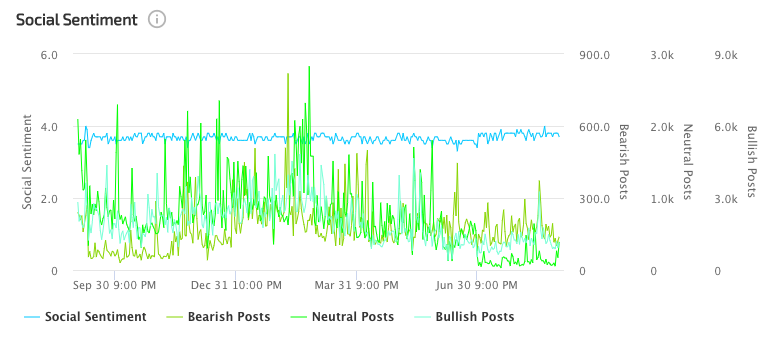

For this analysis, we used data from LunarCrush, one of the first platforms to automatically review the market sentiment for hundreds of cryptocurrencies. The data presented below derived from cross-checking 6 popular platforms where Litecoin users engage in conversations regularly (Twitter, Reddit, Google News, Shared Links, Youtube, and Medium).

Social impact is a score that measures the impact, engagement, and volume of social channels to indicate the level of awareness over time.

- As far as impact and engagement are concerned, levels are relatively stable. This indicates that the community of Litecoin has seen little growth over the past year and that the engagement on social channels does not relate to price action.

- When it comes to the volume of posts, we can see a fluctuation that peaks in August 2019 (Litecoin Halving), January-February 2020 (start of local price recovery), and August 2020 (current time). If the spikes were to follow historical patterns, we could be getting ready to experience price fluctuations.

Social Sentiment is a score that indicates the overall positivity or negativity of Litecoin-related conversations on the web. In the last year, we can see that bullish posts are approximately 8-10x more than bearish posts (check vertical columns). This could be the result of a market recovery which seems to just be getting started.

Litecoin price prediction

Now that you know more about the past performance of Litecoin and how the market stands towards it, we can get into the main theme of our topic – giving a Litecoin price prediction.

Keep in mind that the estimations we make are pure speculation and simply based on historical patterns, paired with the assumption of increased demand. That being said, our assumptions could be proven right.

Litecoin EOY price prediction

At the moment of this writing, Litecoin has found support above its strongest breakdown point. If Bitcoin keeps recovering until the end of the year, we believe that Litecoin could make a move towards the upside, and realistically break the 3-figure pricepoint.

Long-term price prediction

When zooming out, Litecoin is approaching a decision-making point which will probably be reaching in the midst of the new bull market.

If it is to become true, the price would surge towards the upside with support levels at $140 and $352. Anything above that would put Litecoin in new price territories, searching for a new all-time high.

Note that the new peak price will highly depend on Bitcoin’s behavior. It has been previously observed that Litecoin follows Bitcoin’s dynamic price changes. If historical patterns were to repeat, and our Bitcoin prediction comes true, Bitcoin could reach a peak price of $2100-2200 (1 LTC = 0,021-0,022 BTC).

Using Logarithmic Regression

A theory that has gained popularity in the community is Benjamin Cowen’s Litecoin price prediction, which is based on logarithmic regression. According to him, Litecoin is clearly following historical patterns and is expected to do so in the upcoming bull market as well.

If this stands true, and the percentage of price gain repeats itself, he expects Litecoin to be priced at $1538. For reference, check Cowen’s Litecoin explanation video below:

Our prediction

Our Litecoin price prediction falls somewhere between the two options described above. We tend to believe that Litecoin will top out anywhere between $1538 and $2200 before moving down to consolidate. According to historical patterns, this growth phase could occur anywhere between 2023.

On the other hand, a negative scenario could occur as well. If the community moves away from Litecoin due to factors that make it no longer necessary in the market (e.g. the introduction of the Lightning Network), the coin’s liquidity and its price could suffer. If this scenario becomes true, Litecoin could remain stable during this bull market and even decline in price, as people move their money into more profitable options.

Conclusion

Litecoin has not received a lot of media attention over the last two years. Even though the coin is still in the top 10 by market capitalization, it is evident that the community is not as strong as it once was. This could affect its price negatively.

In this article, we analyzed the factors that could affect the future price of Litecoin. More specifically, we looked into the following:

- Past price action & technical analysis

- Transaction volumes

- Past market sentiment

- Merchant adoption rates

Based on the existing data, our Litecoin price prediction reflects two separate timeframes – one short-term (until the end of the year) and one long-term (until the end of 2021).

- By the end of the year we expect Litecoin to break 3 figures, hopefully reaching its previous ATH ($352-$384*)

- Before 2024, we expect to see Litecoin priced anywhere between $1580-$2200, following historic price patterns.

- We also speculate on a negative scenario where Litecoin would no longer be relevant. In this case, the price may remain stable or decrease in value while other coins grow.

As we are entering into a new bull market, it would be wise to allocate part of your portfolio towards Litecoin (LTC). To do so, head over to our exchange and invest in Litecoin using any of the payment methods available. We deliver the coins directly to your personal wallet to ensure maximum safety and efficient transactions.

Frequently Asked Questions

Do you want to learn more about Litecoin and all its applications? Make sure you read the following questions and answers to find out more.

How can I mine Litecoin?

Litecoin utilizes Scrypt, a memory-hard algorithm that makes mining more ”democratic”. More specifically, it is, by design, resistant to ASIC miners. In 2014, however, ASIC manufacturers managed to develop Scrypt ASIC miners that were more powerful than CPUs and GPUs, thus dominating the market.

To mine Litecoin currently, you will need to purchase an ASIC miner. These can be purchased new or used, with the latest being a cheaper option. Once that is done, you will need to calculate the profitability using websites like WhatToMine and ASICMinerValue. Make sure you add all additional expenses, like electricity, fees, etc.

What is MimbleWimble?

Early last year, the founder of Litecoin posted a series of tweets reflecting on the importance of privacy when it comes to cryptocurrency transactions.

Fungibility is the only property of sound money that is missing from Bitcoin & Litecoin. Now that the scaling debate is behind us, the next battleground will be on fungibility and privacy.

I am now focused on making Litecoin more fungible by adding Confidential Transactions. 🚀

— Charlie Lee [LTC⚡] (@SatoshiLite) January 28, 2019

MimbleWimble is exactly that – a feature that will increase the privacy of Litecoin transactions later this year. After the integration of MimbleWimble’s privacy features, users will have the ability to choose whether they want to implement the attribute in their transaction or not.

While the project was set to roll out in September, the Litecoin foundation did not manage to collect enough funds to meet the deadline in time. As such, the project may be delayed until the end of the year.

What is the best way to store Litecoin?

Litecoin is stored in LTC wallets, which come in different forms (online, hardware, desktop, etc.) Similar to Bitcoin, if you lose access to the private key or backup phrase to your Litecoin wallet, your coins will become inaccessible. If this happens, it is unlikely that you will ever be able to recover your funds.

Knowing this, it is important that you create a strategy to minimize the risk of losing your private keys. If possible, purchase and use a hardware wallet (Trezor or Ledger) and store your coins in cold storage. Next, store the backup phrase offline, in a safe location that only you know of. Finally, make sure you are using up-to-date antivirus software and never click on suspicious links.

It is important to remember that, due to the permissionless and decentralized nature of cryptocurrencies, you are acting as your own bank. This means that you are fully responsible for your coins and their safety. Therefore, make sure you create several copies of your private keys and store them safely.

Is it still worth to invest in Litecoin?

With the extreme price volatility that cryptocurrencies experienced over the past year, many people feel hesitant to invest. As we already explained in the article above, all the analyses presented here can only be used to speculate. A concrete prediction can, unfortunately, not be made.

To answer the question presented above, you would first need to define whether you want to hold on to your coins in the long run or use them for position/swing trading. If the second option is more like you, then it may be better to invest in cryptocurrencies that are more “trendy” in this phase of the market.

On the other hand, if you plan to hold onto your Litecoin for the long term, and are willing to wait for all the planned upgrades, it may be wise to invest at least a small portion of your portfolio. Once that is done, you can make your own Litecoin price prediction and plan accordingly.

While not mentioned in this post, it might be good to learn more about technical analysis and try to create a plan to eventually cash out. Not doing so could lead to a situation where you will make decisions based on your emotions rather than logic. We have created a guide to help new investors take their first steps in crypto trading.

Where can I learn more about Litecoin?

One of the most common complaints of new investors is the inability to find trustworthy resources. And who can blame them? Most influencers and educators are highly biased and present selective research based on their private holdings.

That being said, the best Litecoin resources are not hard to find. All you need is a good introduction to all the different elements that may have an effect on the price. The options below should help you educate yourself and find all the information you need:

- The Lite School

- Latest Litecoin Statistics (to make your own Litecoin price prediction)

- Litecoin Nodes

- Litecoin Halving Countdown

- Introduction to Litecoin (paid resource)

- Charlie Lee’s Twitter account

- Litecoin’s Medium channel

____________________________________

*Price fluctuates depending on the exchange that is used. The most reliable ATH price (that we use for our Litecoin price prediction) is on the price-tracking website CoinMarketCap. According to the source, the price peaked at $352.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info