Solana vs Cardano: Which is the Better Buy This Decade?

Cryptocurrencies have come a long way from their early days of being viewed as mere speculative assets. They now play a crucial role in the current financial system on a worldwide scale, with a number of cutting-edge blockchain-based enterprises competing for the public interest.

Solana and Cardano are two such initiatives that have been making headlines in the cryptocurrency world.

Both Solana and Cardano are extremely creative and ambitious blockchain-based projects that have been attracting a lot of interest from both investors and developers.

Solana is a fast blockchain that promises to give decentralized apps a scalable and effective foundation. In contrast, Cardano is a third-generation (self-proclaimed) blockchain that employs a novel proof-of-stake consensus algorithm and is renowned for its high levels of sustainability and security.

In this article on Solana vs Cardano, we will explore the nuances of each to help you make the right decision.

Table of contents

What is Solana?

Solana is a blockchain platform designed to host decentralized applications and transactions quickly at a low cost. Solana Labs, formed in 2018 by Anatoly Yakovenko and Raj Gokal, was introduced in March 2020.

Solana uses a novel consensus technique termed “proof-of-history,” which enables the network to keep transaction rates high without sacrificing decentralization. The platform is highly functional and implements a new, permissionless, and high-speed layer-1 blockchain.

The blockchain has its native cryptocurrency called SOL, which is used to pay for transaction fees and staking and gives holders the right to vote. Despite several significant disruptions, Solana has worked to establish itself as one of the top cryptocurrencies.

Overall, Solana is a potential platform in the market thanks to its design, technology, and application cases.

Interested to buy SOL?

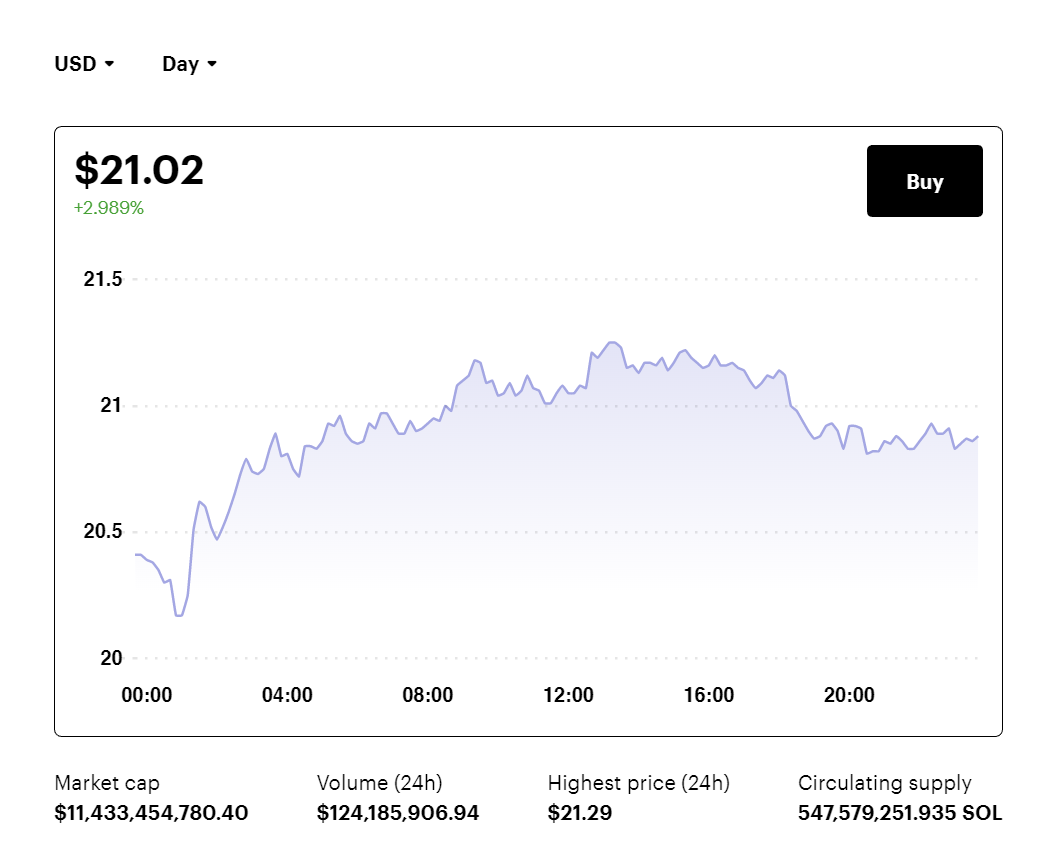

Check out Solana’s real-time price here.

What is Cardano?

Cardano is a blockchain platform designed to process transactions using a dedicated cryptocurrency called ADA.

Charles Hoskinson, an Ethereum co-founder, established it in 2015, and it went live in 2017. Third-generation Proof-of-Stake (PoS) blockchain platform Cardano exceeds Proof-of-Work (PoW) networks in terms of performance.

It is intended to be a versatile, scalable, and sustainable blockchain platform for smart contracts, enabling the creation of a variety of decentralized financial apps, new cryptocurrency tokens, games, and more.

In honor of Augusta Ada King, Countess of Lovelace, widely considered the first computer programmer, Cardano’s cryptocurrency is called ADA.

Cardano has a multi-layered blockchain ecosystem with distinct functions, which could improve its ability to scale over time.

Five phases make up the Cardano roadmap are:

- Byron

- Shelley

- Goguen

- Basho

- Voltaire

Cardano’s energy efficiency is one of its main benefits over other blockchain systems.

Cardano is intended to be developed in “eras” that are named after key figures in both computer science history and poetry. The Cardano platform’s primary goal is to support all types of transactions and develop into a more effective substitute for proof-of-work (PoW) networks. Cardano promotes itself as an alternative to Ethereum since both systems aim to create a linked, decentralized system and are utilized for applications like smart contracts.

Interested to buy ADA?

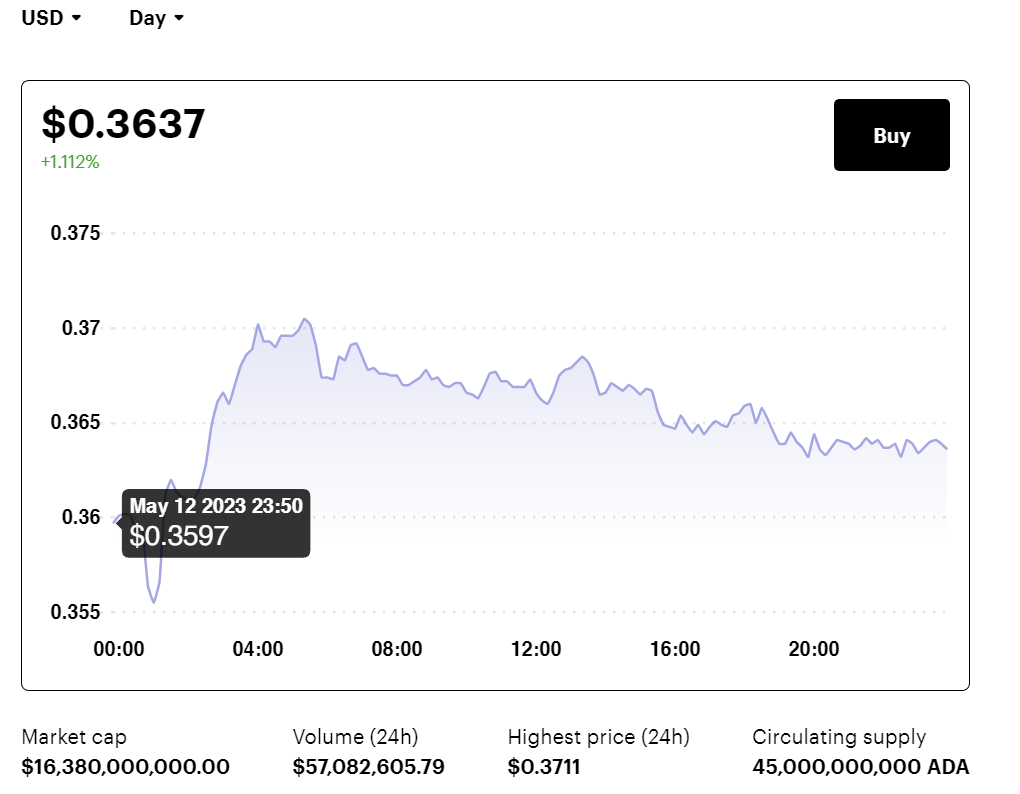

Check out Cardano price here.

Solana: Pros and Cons

Pros |

Cons |

| Solana can process a high number of transactions per second, handling up to 50,000 to 65,000, according to sources. | Many outages in Solana, which makes the platform down for several hours, even days. |

| Transactions on Solana can be conducted for a much smaller fee compared to other popular cryptocurrencies. The average cost is around $0.00025 per transaction. | Accused of not being decentralized enough. |

| Solana’s Proof of History technology and several other innovations have enabled it to achieve high levels of scalability | Known as an Ethereum killer but could not claim it. |

| Solana is interoperable with other blockchains. | Reliance on validators |

| Solana is a delegated staking blockchain, which allows SOL holders to delegate their stake to validators and earn rewards | |

| Supports custom applications and decentralized finance (DeFi) ecosystem |

Cardano: Pros and Cons

Pros |

Cons |

| Ethereum’s alternative and environmentally friendly. | Competitive field with more solutions offering more efficiency. |

| Has one of the first-mover advantages. | Still in development which makes it slow compared to others. |

| Has around 3,000 validators. | Has fewer transactions per second. |

| Big community support and group of highly reputable individuals building. | |

| Interoperable with other blockchains. |

A Brief Comparison: Cardano vs Solana

Criteria |

Cardano |

Solana |

Technology |

Cardano uses a proof-of-stake (PoS) consensus algorithm and supports smart contracts. | Solana uses proof-of-history (PoH) and proof-of-stake (PoS) consensus algorithms and supports smart contracts. |

Maximum Supply |

Cardano has a maximum supply of 45 billion ADA. | Solana does not have a maximum supply. |

Peer review |

Before being implemented, all of Cardano’s technology and updates are peer-reviewed. | Solana does not have a peer review system in place. |

Use Cases |

Cardano has the capability for smart contracts, DeFi, and NFTs. | Solana’s use case is largely in NFTs, with incredibly low transaction costs. |

Community |

Has over 4 million wallets created. | Has more than 2000 developers from around the world. |

Market Cap |

$8 billion and ranked number 9. | $12 billion and ranked number 7. |

Ecosystem and Price History

Cardano

- The Cardano token sale, also known as the ICO, took place in four stages from September 2015 to January 2017. During the ICO, approximately 26 billion ADA tokens out of the total supply of 45 billion were sold, raising roughly $62 million. The average price of a single ADA token during the ICO was $0.0024.

- Cardano’s ADA token has shown significant appreciation and experienced an all-time high of $3.09 as of September 2021. In terms of market capitalization, Cardano’s ADA token has consistently ranked among the most valuable cryptocurrencies and is listed as the world’s seventh-valuable cryptocurrency at the time of writing. The circulating supply of ADA tokens reached over 34 billion, nearing the coin’s maximum supply.

- With the release of Node 8.0.0, Cardano introduced a major update to its blockchain, laying the groundwork for the Conway ledger era. This update brings essential features that could impact the future of the ADA token, marking a significant advancement for the Cardano ecosystem.

- In addition, the Cardano ecosystem has seen the introduction of three active stablecoins: RUSD, IUSD, and DJED. These stablecoins, launched by Shareslake, Indigo, and Djed, respectively, have gained popularity, with over $1.8 million minted on DJED’s first day.

- Hydra, a layer 2 scaling solution, has been launched for Cardano. This, along with other significant updates, is expected to have a positive long-term impact on Cardano’s growth. However, Cardano faces competition from Ethereum, Tezos, Solana, and other blockchain platforms in the ongoing competitive battle.

Solana

- The Solana token sale started on April 5, 2018, and lasted until March 24, 2020. During the token sale, the price of Solana was $0.22 per SOL.

- Solana reached its all-time high price on November 6, 2021, when it was trading at $259.52 per SOL.

- Solana faced fourteen outages in 2022. One outage occurred in June 2022 when the production of new blocks on the network ceased due to a consensus failure, resulting in more than four hours of downtime. Another outage took place in October 2022, lasting nearly three hours and causing a halt in transaction processing. In September 2021, it experienced a significant outage that lasted for 18 hours. In May 2022, Solana suffered bots and NFT-related outage, a seven-hour outage due to a rush of bots attempting to mint nonfungible tokens (NFTs) on the network. The increased demand and activity led to the network going offline temporarily.

- The outages have had an impact on the price of Solana’s native token, SOL. Following the outages, SOL’s price experienced significant declines. For example, in May 2022, during a seven-hour outage caused by NFT minting bots, SOL’s price fell as much as 7.4%. In June 2022, SOL prices dropped by almost 12% in response to a network outage.

- Users have expressed frustration and concern as a result of Solana’s disruptions. The frequent outages have sparked criticism and outrage from the neighborhood. These pauses could lead users to believe the network is unstable. Solana’s co-founder has acknowledged the concerns.

- The relationship between Solana and FTX had an effect on the price of Solana in 2022, with a notable loss of 10% on a single day and a cumulative decline of 95% over the course of the year. Sam Bankman-Fried (SBF), the founder of FTX, was a strong supporter of Solana and held a sizable quantity of SOL tokens. However, Solana’s image suffered as a result of FTX’s demise and its connection to SBF’s businesses, such as Alameda Research. Token sales to FTX organizations were performed via Solana-related organizations such as the Solana Foundation, emphasizing the two companies’ strong links.

Token Supply

Cardano

“How many Cardano coins are there?” is one of the most asked questions by those wetting their feet in ADA.

The maximum supply of Cardano (ADA) coins is 45 billion. There are currently about 35 billion ADA coins in circulation, which means that there are approximately 10 billion ADA coins that have not yet been mined. The maximum supply of ADA coins will be reached in 2032.

Here are some inferences about how the supply of Cardano coins affects the ecosystem, investors, and developers:

- Ecosystem: The limited supply of ADA coins helps to create a sense of scarcity, which can drive up the price of ADA coins. This can make it more attractive for developers to build on the Cardano blockchain, as they know that there is a limited supply of coins that can be used to pay for their services.

- Investors: The deflationary nature ADA can also make it a more attractive investment for investors. This is because investors know that there is a limited number of coins that will ever be created, which can help to protect their investment from inflation.

- Developers: The capped supply of ADA coins can also make it more attractive for developers to build in the Cardano ecosystem, as it ensures that developers are compensated fairly for their work.

Solana

Are you wondering how many Solana coins are there?

As of May 2023, there is over 395 million SOL in circulation. Unlike ADA, Solana does not have a maximum supply. The Solana Foundation has stated that they believe that a fixed supply of coins can lead to inflation and centralization. By contrast, a variable supply of coins can help to keep the price of Solana stable and ensure that the network is always secure.

The Solana Foundation has also stated that they believe that a variable supply of coins can help to attract new users and businesses to the Solana ecosystem. This is because it reduces the risk of inflation, which can help to attract new users and businesses to the ecosystem.

Here are some inferences about how the supply of Solana coins affects the ecosystem, investors, and developers:

- Ecosystem: The inflationary supply of SOL coins can help to create a more stable and predictable environment for the Solana ecosystem. This potentially helps attract new users and businesses to the ecosystem rapidly.

- Investors: The inflationary supply of SOL should be balanced with the demand. If more SOL is minted than there is demand, the investors could see a negative ROI.

- Developers: As there is no cap on the amount of SOL minted, the developer community has a lot of room to grow and at a much higher pace. All new developers can be equitably compensated.

Consensus Mechanism

Cardano

The Cardano blockchain network uses the Ouroboros consensus algorithm, which was created to ensure security and scalability in a proof-of-stake (PoS) network.

The algorithm divides time into epochs, or 5-day intervals, with slots inside each. The slot is the length of a working shift, whereas the epoch is the length of a cycle. Slot leaders are tasked with suggesting new blocks to the network and validating transactions throughout each epoch.

Scalability, interoperability, and sustainability were the three main problems that were impeding the growth of the Ethereum network and were addressed by the Ouroboros system. The Computation Layer (CCL) and the Settlement Layer (CSL) were created by the Cardano developers to segregate the value of a transaction from its computational data.

Solana

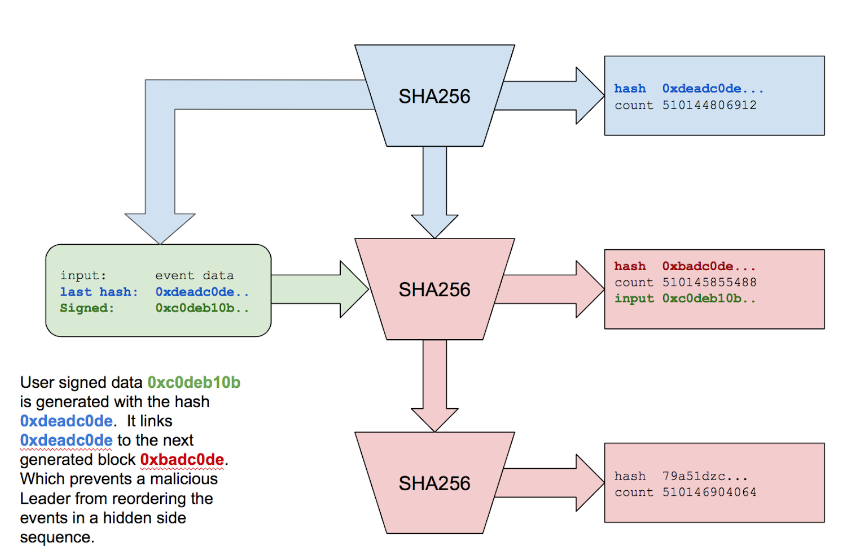

Proof of History (PoH) is a variation of the Proof of Stake consensus mechanism. It uses a time function to allow for near-instant transaction confirmation.

PoH is used to establish the order of transactions on the blockchain and involves a time delay function that creates an auditable record of the sequence of transactions.

Based on hashing timestamps, the algorithm uses a cryptographic hash function.

In the first step, PoH hashes a timestamp using a cryptographic hash function. The hash is then verified by Solana’s nodes, which check that each hash in the chain is valid and that the time elapsed between each hash is correct.

By creating a verifiable time source that enables nodes to process transactions in parallel without needing to communicate with each other.

Governance

Cardano

The governance structure includes Cardano Improvement Proposals (CIPs), which are formal ways of proposing ideas and changes to the protocol. While not binding, they are an essential component of Cardano’s governance.

The network also has a Constitutional Committee responsible for overseeing governance actions and ensuring that the Constitution is respected.

Cardano’s governance system is designed to distribute power and control more evenly among network users. The governance structure includes governance tokens that give more weight to users with more stake in the network.

Additionally, the network has a series called “A Spotlight on Stake Pools” that showcases the work of different stake pool operators, incentivizing others to join open-source practices.

Solana

Solana governance protocol is a DAO (Decentralized Autonomous Organization) where developers can start building at zero to low cost, vote on purpose, and SPL governance programs provide tools, integrations, and resources.

Conclusion

Solana stands out for its ability to process a high number of transactions per second at low fees, making it ideal for applications like NFTs and decentralized finance. However, it has faced concerns about centralization and occasional outages.

Cardano, known for its energy efficiency and focus on peer-reviewed development, aims to be an alternative to Ethereum and supports smart contracts, DeFi, and NFTs. While it has a strong community and impressive roadmap, Cardano is still in development and has fewer transactions per second compared to Solana.

Both, Solana and Cardano are competing blockchain projects with their own strengths and weaknesses. Solana excels in transaction speed and low fees, while Cardano emphasizes sustainability and peer-reviewed development. Understanding their differences can help investors and developers make informed decisions in the dynamic cryptocurrency landscape.

FAQs

-

Is Cardano a good investment?

Cardano’s recent events, such as the launch of the layer 2 solutions Hydra and increased adoption prospects, make it a promising investment. Whales accumulating ADA tokens and positive price predictions by experts further support its potential. However, thorough research is essential before investing, considering the inherent risks involved.

-

Is Solana a good investment?

Solana, currently ranked among the top 10 cryptocurrencies on CoinMarketCap, experienced a significant loss in value following the FTX scandal, dropping by about 95%. However, it is slowly recovering and currently trading at $21. Its future performance depends on factors like user and developer adoption, partnerships, and its investment in artificial intelligence tools. Partnering with Circle to integrate USDC with its blockchain could potentially increase Solana’s value.

-

Is Cardano or Solana better?

Solana and Cardano offer unique features, making them preferred investment strategies based on personal choice. If you are looking for a platform that is incredibly fast and has very low transaction fees, then you can consider to buy Solana. If you are looking for a platform that is scalable, secure, and energy-efficient, then Cardano may be a good choice for you. Ultimately, the best way to decide which platform is right for you is to do your own research and compare the two platforms in more detail.

-

Is Solana the same as Cardano?

No, Solana and Cardano are not the same. While they are both blockchain platforms, they have different designs, features, and goals.

Solana is a high-performance blockchain platform that focuses on scalability and fast transaction speeds. On the other hand, Cardano is a blockchain platform that emphasizes security, sustainability, and scalability.

While both projects have gained attention in the cryptocurrency space, they have different approaches and technologies.

-

How to buy Cardano?

Paybis is a reliable and secure platform for buying Cardano. We offer competitive prices and a variety of payment methods. You can buy ADA with a credit card, debit card, bank transfer, or a variety of other payment methods.

Sign up today and start buying Cardano.

-

How to buy Solana?

To buy Solana (SOL), you can use a fiat to cryptocurrency ramp like Paybis. Paybis is a reliable and secure platform that allows you to buy SOL with a variety of payment methods, including credit cards, debit cards, and bank transfers.

To buy SOL on Paybis, you will need to create an account and verify basic information. Once your account is verified, you can place an order.

-

Should I buy Cardano and Solana at the same time?

If you are looking to diversify your portfolio and reduce your risk, then buying both Cardano and Solana could be a good option. No matter what you choose, Paybis has got you covered with a wide range of check out options and 24×7 customer support.

Ultimately, the decision of whether or not to buy Cardano and Solana at the same time is up to you. Do your own research and make a decision that you are comfortable with.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info