SushiSwap Price Prediction – Opportunity or Risky Trade?

DeFi has become a major driving force in the cryptocurrency market. Today, it provides investors with multiple opportunities to make passive income. Currently, it offers high APY yield farming and peer-to-peer lending.

One of the most popular yield farming platforms that emerged in the 2020 DeFi Summer was the controversial SushiSwap.

With a somewhat questionable reputation due to its turbulent journey, Sushi has been a project to keep in eye on. In this article we will attempt to provide you a plausible SushiSwap price prediction for the mid and long terms and try to assess whether the investment is worth the risk.

Activating hopium – Let’s explore the background of this interesting crypto project! If you are in a hurry to see our SushiSwap price prediction, head towards the last few chapters of this post!

Table of contents

What is Sushi?

SushiSwap, or simply Sushi, is an automated market maker (AAM) that provides smart contract token swaps in addition to a wide range of yield farming functionalities. Kinda like Uniswap (which it is a fork of), but then more versatile, as the protocol to be deployed on various blockchains and scaling solutions.

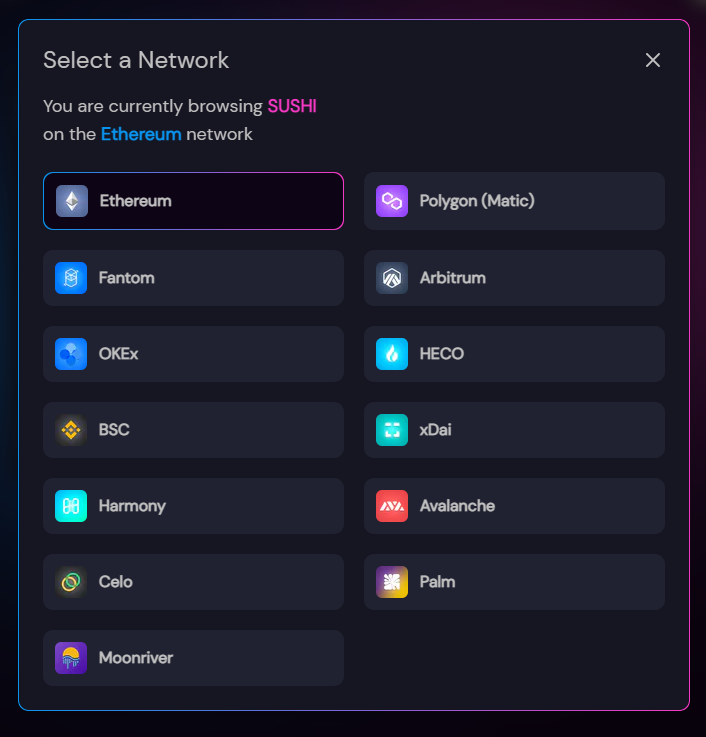

This means that, in addition to Ethereum, SushiSwap can be used with popular scaling solutions like Polygon or rising smart contract platforms like the Binance Smart Chain.

SushiSwap is considered one of the pioneering platforms of the DeFi space. Its success and controversies brought a lot of attention to the ecosystem and have put it into the mainstream investor’s radars. But why do investors still underestimate SushiSwap?

Well, this has a lot to do with the initial release of the platform back in August 2020. Let’s have a closer look at this event before we go further with our SushiSwap price prediction.

SushiSwap’s bumpy origins

There were three major events during the first weeks of SushiSwap’s existence that changed how DeFi protocols are viewed by investors and developers.

The Vampire Attack marketing ploy

SushiSwap was launched in August 2020, which was at the peak of the first major growth of the DeFi ecosystem. The project gained a lot of attention, mainly because of the nature of its launch. It quickly gained traction in the DeFi community by positioning itself as a direct competitor of Uniswap, another popular decentralized exchange (DEX).

To achieve this, the team behind Sushi employed a marketing strategy that is today commonly referred to as a “Vampire Attack”. The goal was to siphon liquidity from Uniswap into Sushi, by providing increased incentives for liquidity providers (LPs) to migrate their liquidity into Sushi.

Anyone providing liquidity to Uniswap receives the corresponding liquidity pool (LP) tokens to prove their participation in the protocol. Sushi created a reward system where investors could stake their Uniswap LP tokens into SushiSwap and receive high returns in SUSHI tokens for doing so. The rewards were incredibly appealing, providing APY between 200 and 1000% in SUSHI tokens in the first weeks of release.

Consequently, investors deposited tons of liquidity into Uniswap to get LP tokens and receive Sushi rewards. And because Uniswap didn’t have its own reward token at the time, SushiSwap provided better incentives than the original DEX.

Once investors were hooked on the reward system, it resulted in a massive migration of funds from Uniswap to SushiSwap, finalizing the vampire attack.

Chef Nomi’s rug pull

At this point, the Sushi protocol had amassed more than $1billion in locked funds. This was mainly thanks to the price of SUSHI skyrocketing to $15 after the Binance listing on the 1st of September 2020.

Everything seemed to be going great for the platform, as smart contracts were getting audited by respectable firms and receiving the green light on their security protocols. That’s when the unexpected happened.

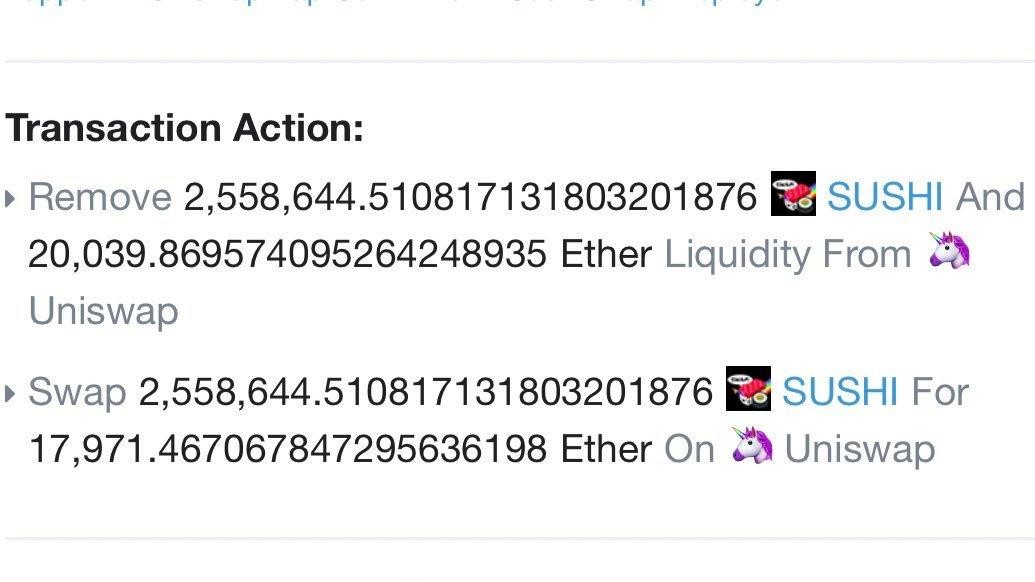

The anonymous creator of SushiSwap, Chef Nomi, then removed almost 50% of the SUSHI/ETH liquidity pool, initiating a rug-pull scheme. This was made possible by the “dev fund” coded in the smart contract protocol that allowed Chef Nomi to access 10% of all the liquidity locked into SushiSwap.

Nomi sold the 2.5m SUSHI tokens in his possession for ETH right away. In combination with the other 20k ETH that he drained from the LP, the entire rug-pull amounted to around 38k ETH (or $16 million at that time).

Interesting note: There is still speculation that the anonymous developer responsible for the sale is also one of the leading developers of BAND Protocol, a project sponsored and heavily supported by Binance.

Sam-Bankman Fried’s takeover

After the scam attempt, the obviously upset SushiSwap community was looking for potential solutions. The price of SUSHI plunged more than 90%, and DeFi investors lost trust in the project. However, there was an event that managed to resurrect the platform.

Chef Nomi granted control of SushiSwap to Sam Bankman-Fried (SBF), a major holder of SUSHI and the CEO of the FTX exchange and Alameda Research. SBF positioned himself as the handler of the ongoing migration and a savior of SushiSwap.

Additionally, he transferred the admin key to a multisig address, so that rug-pulls like the previous one could not happen in the future. And in a final plot twist, Chef Nomi returned the funds he received from the sale back to the liquidity pool. He then apologized to the community.

I have returned all the $14M worth of ETH back to the treasury. And I will let the community decide how much I deserve as the original creator of SushiSwap. In any currency (ETH/SUSHI/etc). With any lockup schedule you wish.https://t.co/QwFj5SeeuQ

— Chef Nomi #SushiSwap (@NomiChef) September 11, 2020

The combination of the vampire attack and the rug pull has polarized investors regarding SushiSwap’s viability. That said, the project has since gotten back to its feet under solid leadership. Without SBF, Sushi might have been a footnote in DeFi’s history. Instead, the community views it now as one of the most advanced DEX ecosystems on the market. Let’s explore its main features before we can proceed with our SushiSwap price prediction.

Sushi ecosystem capabilities

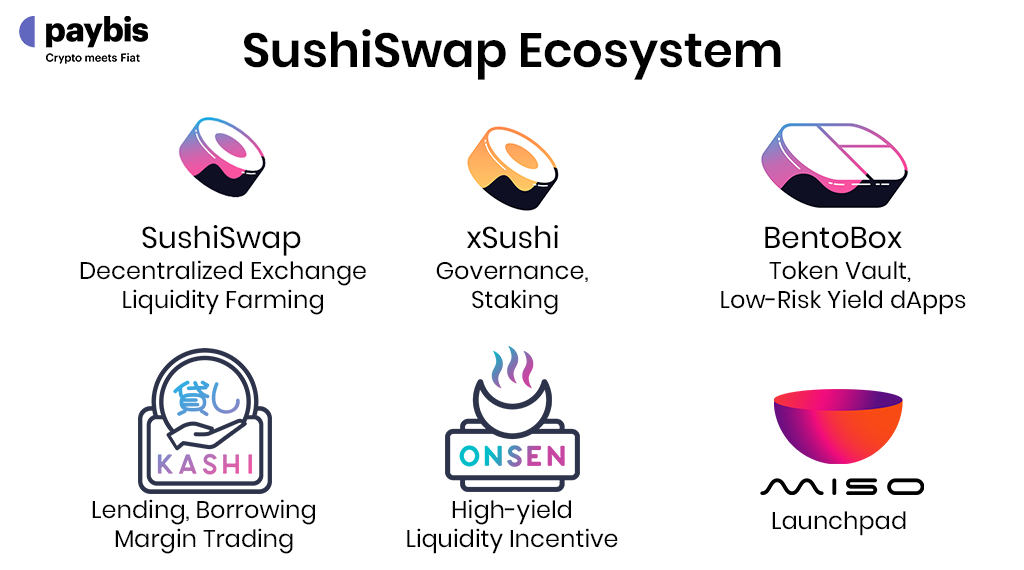

SushiSwap is more than just a decentralized cryptocurrency exchange. It provides a wide array of advanced financial instruments aimed at both developers and investors, including:

Multi-Chain AMM

Unlike most other decentralized exchanges that are focused on a single blockchain, SushiSwap is a multichain AMM. So, in addition to Ethereum, SushiSwap allows farming liquidity across a wide array of blockchains, exchanges, and layer 2 solutions.

SushiSwap is regularly deployed on new platforms, increasing its reach and profit opportunities

Investors can lock their funds in liquidity pools to provide liquidity for the swaps to be possible. For this service, they receive rewards in the form of SUSHI tokens, 0.25% of all the swap fees in that pool.

Worth noting is that SUSHI tokens obtained through liquidity mining go through a vesting process, where:

- ⅓ of the tokens are redeemable immediately.

- ⅔ of the tokens are claimable on a weekly basis after an initial lock period of 6 months.

Profit-sharing mechanism with SushiBar

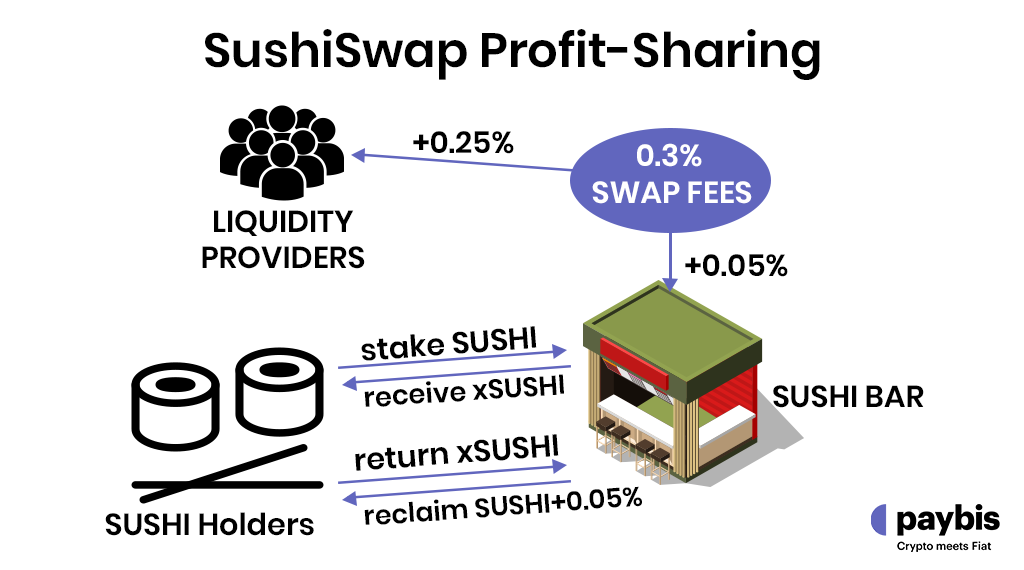

Like Uniswap, SushiSwap charges 0.3% in transaction fees whenever you swap tokens on its platform. However, instead of distributing the entirety of these fees to liquidity providers, SushiSwap does the following:

- It rewards liquidity providers with 0.25% of the fees.

- It distributes the other 0.05% to the SUSHI token holders that stake their tokens in the SushiBar smart contract.

The main advantage of this mechanism is that, as the volume of trades on SushiSwap increases, the collective earnings for SUSHI holders increase as well.

xSUSHI token

When staking SUSHI in the SushiBar, investors receive xSUSHI tokens. These conserve their governance rights on the platform (e.g. voting in new liquidity pairs) and can be used for providing liquidity for yield farming in the xSUSHI/ETH pool.

Moreover, xSUSHI holders receive rewards from the fees in the Onsen program. And finally, when redeeming their SUSHI tokens for xSUSHI, users receive the aforementioned SUSHI rewards obtained from swap fees in the SushiBar.

Onsen accelerator program

Onsen is a liquidity incentive program that provides increased rewards to liquidity providers for select tokens. Projects that are figured in the Onsen “menu” are allocated a certain number of SUSHI in order to offer high yields to liquidity providers.

This way, smaller projects can make their tokens easily obtainable by investors without having to increase the tokens in circulation.

Bento Box

Bento Box is a smart contract that acts as a vault for certain tokens. By depositing them in a vault, investors can gain extra yields. The difference from other yield farming methods on Sushi is that Bento Box vaults use low-risk strategies. These usually include lending, flash loans, or SushiBar staking to provide investors with steady passive income.

Kashi Lending

Kashi is the lending and margin trading platform deployed through Bento Box. The main difference between Kashi and other DeFi lending platforms is that it uses isolated risk calculations. This way, if a lending pair drops significantly in value, the other markets will remain unaffected, which considerably reduces the risk of this platform.

Miso Token Launch

Finally, SushiSwap proposes a token launchpad, similar to the one on Binance. On Miso, investors can participate in auctions and acquire new, promising tokens that will provide high yields on the platform.

Additionally, SushiSwap provides developers with smart contract templates that allow them to create new tokens in a simplified manner. This allows investors to have peace of mind, as the tokens they purchase have been created using audited smart contracts.

We can conclude that the combination of the various features with the increased trading volume makes SushiSwap one of the highest-earning DeFi projects available.

Sushi Historical price action

Before we provide you with technical analysis for the SushiSwap price prediction, let’s examine the SUSHI token price action since its release. Past price fluctuations can help us understand how the SUSHI token reacts to fundamental changes and market cycles.

On the chart above, we can notice the first 2000% price surge of the SUSHI token that followed the Binance listing on the 1st of September 2020. However, this price increase was followed by a sharp decline following the rug pull orchestrated by Chef Nomi.

After consolidating for a couple of months at the $0.5 level, SUSHI entered a parabolic bull run at the beginning of 2021. Its price increased 5000%, reaching an all-time high of $23.3 in April.

The subsequent market crash didn’t allow SUSHI to stay on this level and prices declined by 75% in the following months. Once the market started to recover, SUSHI closely followed. An interesting observation is that the price has been closely following Fibonacci retracement levels and using them as support and resistance ever since.

SushiSwap price prediction 2021

With all of that in mind, we can now give it our best to provide the most accurate SushiSwap price prediction for 2021. In addition to our technical analysis below, we can presume the DeFi ecosystem resumes its growth in the following weeks.

If the SUSHI price continues the current trend we can expect it to make at least 150% gains by the end of the year. If the bullish trend is conserved, the price could reach as high as the previous all-time high of $23. Candles could break this level and find support for another leg up in 2022.

In case of a bearish event, the price of SUSHI could return to the previous support of $10 per token.

SushiSwap price prediction 2025

Making a SushiSwap price prediction for 2025 can be challenging in a volatile environment like the cryptocurrency market. However, we can safely assume that by the middle of 2024, we would have entered another bullish cycle, thanks to the Bitcoin halving.

Additionally, we can also presume that SushiSwap will be deployed on a wide range of blockchains. This should increase its trading volume and therefore, the rewards for token holders and its perceived value on the market.

During the bear market between 2022 and 2024, we could see SUSHI trending between $40 to $60. That said, in 2025, we should see another price surge that could bring SUSHI above the $150 mark.

SushiSwap price prediction today – Expert’s opinions

When making a SushiSwap price prediction, it’s always important to consult other expert’s points of view to see how we compare to them.

- WalletInvestor hopes to see SUSHI at around $20 by the end of this year. The website remains bullish in the long term and expects the SUSHI token to reach $67 by 2026.

- CoinQuora is quite bullish on SUSHI and sets the price at $23 in their ShushiSwap price prediction for 2021. For 2025, their analysts hope to see SUSHI reach $250, which is higher than our Sushiswap price prediction.

Useful links:

Wrapping up

All in all, SushiSwap is one of the strongest DeFi projects at the moment, even though its valuation doesn’t reflect this strength. It’s very likely that many still underestimate Sushi because of the controversies surrounding its launch. However, it’s a fact that the marketing tactics of SushiSwap made the whole DeFi ecosystem much more popular.

Its wide array of features, shared earnings and high-yield farms allowed us to make the following SushiSwap price prediction:

- SushiSwap price prediction 2021 – $15 to $25.

- SushiSwap price prediction 2022-2024 – $40 to $60.

- SushiSwap price prediction 2025 – $150 to $200.

With increased trading volume in the following years, the earnings of the SushiSwap exchange should continue to rise. This should attract even more users, which should, in turn, increase the value of the SUSHI token in the long term.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info