Why Do Bitcoins Have Value?

No matter if you’re a crypto enthusiast or a beginner, everyone knows about Bitcoin and how valuable it can be. Since it was introduced in the early 2000s as the first digital currency, Bitcoin has become a store of value that many choose to invest in.

But here’s where it gets tricky – cryptocurrencies don’t have tangible value, so what exactly makes Bitcoin valuable, especially when it’s not physical currency? In this guide, we’ll dive into Bitcoin, its origin, and the increasing influence over financial markets.

Key Takeaways

- Bitcoin has a fixed supply of 21 million coins, and mechanisms like halving reduce new supply, creating scarcity similar to precious metals.

- Bitcoin operates on a decentralized network of nodes and miners, making transactions secure, transparent, and resistant to tampering.

- The more people and institutions use Bitcoin, the more useful and valuable it becomes as a medium of exchange and store of value.

- Bitcoin allows fast, borderless, and low-cost transactions, giving it practical applications beyond speculation.

- Trust, demand, technological innovation, and market sentiment all influence Bitcoin’s price and perceived worth.

Table of contents

What is Bitcoin?

Bitcoin is the world’s first decentralized digital currency, launched in 2009 by an anonymous entity known as Satoshi Nakamoto, resulting in huge media coverage. It was introduced with a famous whitepaper that explained in detail how this new digital currency would work.

Today, Bitcoin operates on its native peer-to-peer blockchain, which acts as a distributed and immutable ledger. The main purpose of Bitcoin’s blockchain technology is to record transactions, provide a network for them, and track every transfer.

Using the Proof of Work (PoW) consensus mechanism, every transaction on the Bitcoin blockchain creates a new bloc,k which is checked by validators by performing complex mathematical tasks. Once a transaction is confirmed, it’s added to the chain and from then on can’t be altered or changed in any way.

Bitcoin’s launch completely changed the financial scene. The global financial crisis of 2008 only fuelled peoples’ interest in an alternative financial system. Unlike traditional centralized banking systems, Bitcoin isn’t controlled by any government, central bank, or institution.

This independence raises a crucial question: why does Bitcoin have value? Its value stems from factors like scarcity, decentralization, utility, and growing recognition as a store of value or digital gold. To provide you with more background on Bitcoin’s evolution over a decade, here’s a brief rundown of key events:

- First real-world use of Bitcoin. In 2010, Laszlo Hanyecz used 10,000 BTC (around $25) to buy two pizzas, which made this the first Bitcoin transaction and marked the day as Bitcoin Pizza Day.

- Bitcoin’s first price surge. In 2017, Bitcoin’s value rose to $20,000 due to the growing interest from the public, leading to increased investments in the Bitcoin network from different investors.

- Institutional adoption. The COVID-19 pandemic boosted Bitcoin’s adoption as institutions looked for ways to curb inflation and economic uncertainty. The pandemic also led to the general public experimenting with cryptocurrencies.

- Legal recognition & regulatory developments. In 2021, some countries, including El Salvador, adopted Bitcoin as a legal tender, marking an important milestone in Bitcoin being recognized by a central authority.

Today, Bitcoin is the driving force behind many cryptocurrencies. Whenever the value of Bitcoin fluctuates, it affects the cryptocurrency markets. But before we delve into the question of what exactly makes Bitcoin so valuable, let’s define and explore what value means.

The Concept of Value

Essentially, value is something that represents the perceived worth we give to an asset, service, or even entity. Since the beginning of commerce and trade, prices have depended on scarcity, usability, and benefits.

Although this definition can vary from culture to culture, in finance, this foundational description of value has become widely accepted, influencing how fiat currency is valued. But more than that, this concept is a major playing factor in decision-making, investment strategies, and personal finance, shaping how individuals approach their financial goals and manage their resources.

Intrinsic vs. Extrinsic Value

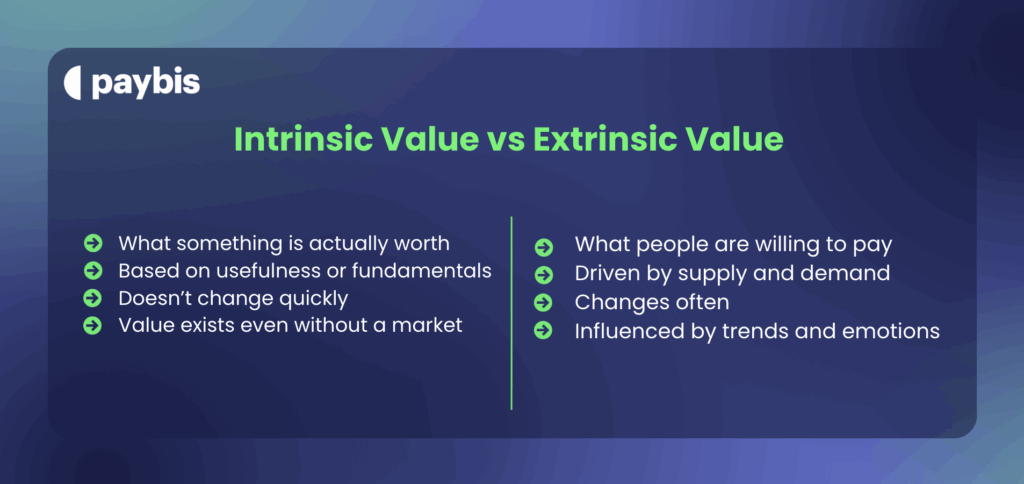

One thing that affects the general value interpretation in modern finance are the concepts of intrinsic and extrinsic value.

Intrinsic value is when the worth of an asset is based on its fundamental attributes. To put this into a more practical perspective, the value of traditional assets is dictated by cash flows, earnings, and tangible properties. For example, the intrinsic value of a company is often derived from its discounted cash flow (DCF) models.

Defining the intrinsic value of a digital asset is still highly debated. Most cryptocurrency holders and experts agree that the value depends on utility, technological blockchain innovation, and scarcity, which helps balance the supply and demand, particularly for Bitcoin. Bitcoin’s value is also influenced by market perception, trust in the system, user demand, and the network effects created by its widespread adoption within the cryptocurrency ecosystem.

In contrast, an asset’s extrinsic value comes from external factors like market perception, sentiment, and demand. It’s often also described as something that goes beyond the tangible benefits of intrinsic value. In traditional finance, extrinsic value is something that focuses on time, and volatility.

Cryptocurrencies rely heavily on extrinsic value as digital assets aren’t backed by anything tangible to begin with. That’s why market sentiment, community hype, and particularly fear of missing out (FOMO) play a significant role in cryptocurrency tokens.

Value Perception in Traditional Financial Institutions vs. Cryptocurrencies

Now that we’ve gone through the basics of value and how it’s perceived in finance, in the following section, we’ll explore what key features define value for traditional financial institutions and cryptocurrencies.

Most modern financial institutions focus on stability and predictability above all else. That’s why these institutions emphasize:

- Monetary worth.

- Return on Investment (ROI).

- Risk-adjusted metrics.

- Liquidity.

Fiat currencies derive much of their value from government backing, which enhances their credibility and stability by ensuring trust in the currency and supporting its use as legal tender. In contrast, cryptocurrencies generally lack government backing, which can impact their perceived value and contribute to greater volatility.

We’ve already established that cryptocurrencies lean on extrinsic value rather than intrinsic. While they can have very real value and earn substantial profits for some investors, it remains difficult to define the value of a digital asset. However, the most important aspects that influence the value of any cryptocurrency are:

- Utility value.

- Supply scarcity.

- Market sentiment and volatility.

- Technological innovation.

How Digital Assets Are Changing Value Perception

Bitcoin may have been the first to question traditional finance, but it did more than that – Bitcoin opened the door to new concepts and ideas. While traditional financial institutions value tangible assets, cryptocurrencies take it a step further by introducing a model that unites intrinsic technological innovation with extrinsic speculative and community-driven demand.

Unlike traditional currencies, which are widely accepted, recognized, and used as a store of value in everyday transactions, cryptocurrencies derive their value from a combination of technological features and market dynamics, leading to different patterns of acceptance and use.

It’s true that widespread crypto adoption faces multiple challenges. Even so, many companies have already started adopting crypto into their workflows as a way to open up new revenue streams and extend to new regions.

But beyond that, Bitcoin has quite literally revolutionized the concept of money and assets. In some ways even democratizing the space by allowing more people of diverse backgrounds to become investors and build wealth.

Not to mention the onset of crypto applications in different fields, including digital payments, which provide a modern and convenient means of transferring money electronically through bank accounts, digital wallets, or online banking systems.

Why Does Bitcoin Have Value? Key Features

The advantages of Bitcoin are exactly what makes this cryptocurrency so valuable. One key factor is that bitcoin supply is fixed at a maximum of 21 million coins, which creates scarcity and plays a crucial role in its value.

Bitcoin’s price is influenced by a variety of factors, including demand, adoption, and market sentiment. They’re a unique combination of technology, economics, and even human behavior. Psychology has also always been one of the most prominent factors in value definition.

Additionally, Bitcoin transactions are recorded on a transparent, permanent ledger called the blockchain. Bitcoin is also a tool for secure, fast, and low-cost transactions worldwide.

This is especially true for cryptocurrencies as people’s perception of its value is also a driving force behind their success. But when considering why do bitcoins have value, it’s essential to look beyond perception and examine the most important Bitcoin features that make it valuable today.

Scarcity and Monetary Policy

One of the key concepts of creating Bitcoin was to have scarcity to balance supply and demand. That’s why Bitcoin has a limited supply of 21 million BTC. The finite supply helps to create a deflationary dynamic and avoid inflation.

By following this logic, the demand can grow with increased popularity and adoption, while the supply remains capped. This shows how carefully controlled scarcity can create perceived value, much like fiat currencies are backed by precious metals like gold.

Decentralization and Security

Bitcoin’s introduction into the long-standing traditional financial market also came with new technology – blockchains. Bitcoin operates on a completely decentralized network where transactions are verified by a global community of nodes and miners for total transparency and equality.

This not only changed asset flow, it helped create a safe and secure peer-to-peer network by focusing on developing a robust protocol, rather than relying on intermediaries like banks.

Utility in Bitcoin Transactions

Cryptocurrencies offer something that many financial institutions struggle with even today – fast, borderless, and direct transactions. This means that anyone with an internet connection can send and receive different amounts of funds worldwide at relatively low costs, especially when compared to banking systems.

Store of Value

The concept of Bitcoin being viewed as a store of value comes from its scarcity, security, and incredible resistance to inflation. This is what attracts major investors who are looking to diversify their portfolios and explore new wealth-building strategies.

It’s true that cryptocurrencies remain volatile, but over the years the trust in Bitcoin has grown, influenced by BTC having the potential to serve as a hedge against inflation and economic instability.

Global Acceptance

Bitcoin has grown significantly thanks to the interest from key investors, developers, and businesses. Some of the biggest companies that have adopted Bitcoin include Microsoft, PayPal, and Tesla. Companies are interested in adopting cryptocurrencies because it allows them to reach new potential audiences, especially in unbanked areas.

Innovative Technology

Bitcoin’s technology is open-source which attracts a lot of attention from the developer community, who both want to learn more about blockchain technology and enhance it. One of the key milestones for Bitcoin was when it integrated the Lightning Network for faster and less costly transactions. Moreover, while Bitcoin was launched as a peer-to-peer network, it became known as digital gold due to long-lasting trust and market interest.

Summing Up

Cryptocurrencies are changing the world, and Bitcoin kickstarted this change. While widespread adoption remains challenging due to the speculative nature and volatility of cryptocurrencies, the benefits of owning Bitcoin outweigh the disadvantages.

If you’re new to cryptos but would like to dip your toes, you can start with Paybis. We’re an established crypto exchange platform with a portfolio of different products, services, and a wide range of cryptocurrencies. So if you want to buy Bitcoin or any other cryptocurrencies, you can do that easily by choosing your preferred payment method. We’ll guide you throughout the process!

FAQ

How does Bitcoin generate money?

Bitcoin doesn’t actually generate money, at least not in the traditional sense. Value is created by facilitating and validating transactions on the blockchain by miners who receive a certain amount of BTC as a reward. Bitcoin’s value itself comes from market demand, its limited circulating supply of 21 million BTC, and utility.

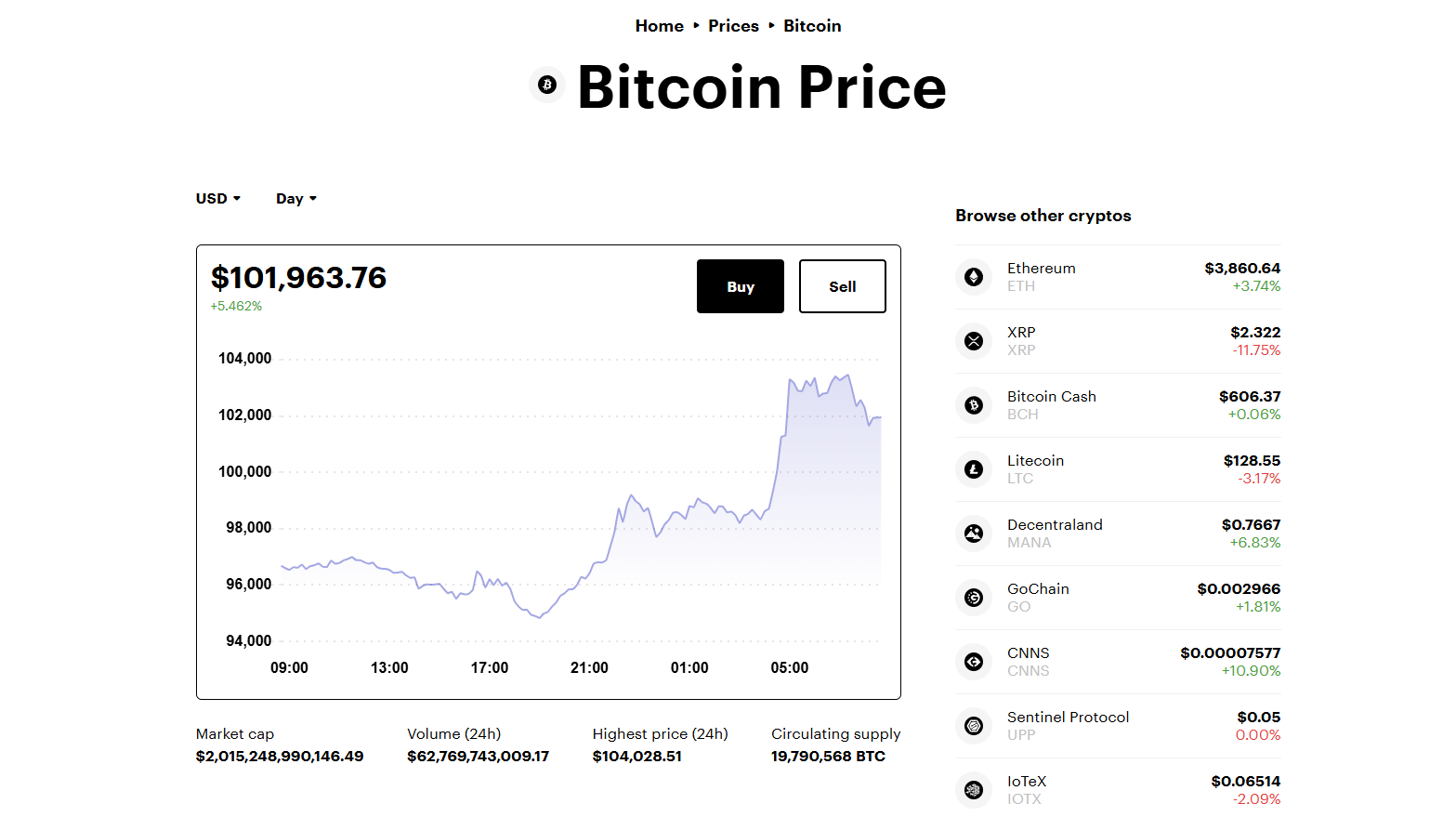

How much is 1 Bitcoin worth?

As you may well know, the value of cryptocurrencies is affected by strong price fluctuations, and the Bitcoin price is no exception. However, in the beginning of December 2024, a single Bitcoin was worth around $96,000. Notably, on December 5th, Bitcoin’s price rose to $100,000.

What is Bitcoin backed by?

Unlike the US dollar or other fiat money, digital currencies aren’t backed by any physical asset, government, central banks, or institution. Instead, Bitcoin’s purchasing power comes from the underlying technology of Bitcoin – its decentralized nature and Bitcoin’s scarcity, which greatly influences its worth.

Why does Bitcoin have any value?

The short answer is that Bitcoin has value because people perceive it as valuable. This was created by scarcity as Bitcoin’s total circulating supply is capped at 21 million BTC. Additionally, Bitcoin’s security, innovative technology, and the ability to send and receive cross-border payments makes this cryptocurrency popular and valuable for crypto enthusiasts and investors.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info