Advantages of Bitcoin as a currency and as an investment

Have you ever been asked, by friends or family, to explain the advantages of Bitcoin and why it makes a great investment?

If you started explaining its protocol, goals, and potential, chances are that people laughed it off, telling you that this experiment will not end well.

Then again, you might have people who listened to you during the previous bull market and are now looking at you with a passive-aggressive look, still unaware of Bitcoin’s true, long-term potential.

So let’s go all the way back.

We will explain Bitcoin and its main advantages in an easy to understand way, so you can get a better idea of its power and future potential.

Table of contents

What Is Bitcoin?

Bitcoin is a cryptocurrency designed to be exchanged and transferred without the involvement of any third party, such as banks or financial institutions.

Since its release in 2009, Bitcoin has led to intrigue and controversy, being a new currency form that could potentially replace centralized currencies that are managed by governments (USD, EUR, GBP) or commodity assets such as gold and silver.

What’s important to understand about Bitcoin is that transactions are processed through a private network of computers referred to as nodes, which are linked through a sharing program that is known as Blockchain.

On top of that, every time an individual sends Bitcoin, these nodes record the transaction on the Blockchain, which is also a transparent record of all transactions completed from each individual wallet.

And while all that may sound a little complicated in the beginning, once you get the grasp of it you will soon realize that buying and using Bitcoin can have its advantages.

Therefore, this article will analyze all the advantages of Bitcoin, both for usability purposes and as a long term investment.

5 Advantages of Investing in Bitcoin

Some of us already know that using Bitcoin in your daily life can offer an array of different benefits. These range from transaction speeds and lower fees all the way to the protection of your privacy.

Bellow, we will analyze the most important advantages of Bitcoin when seen from the perspective of usability.

Eliminates the risk of fraud

Possibly the most important Bitcoin advantage is that only you are responsible for your coins since no third party can control Bitcoin. Each transaction is final and there is no possibility to counterfeit or reverse a transaction after a purchase has been completed.

On the contrary, when using FIAT currencies and traditional financial institutions, you run the risk of credit card chargebacks and Paypal refund scams.

This is one of the most important advantages of Bitcoin, especially when it comes to merchants’ protection.

All in all, and since you are the sole individual who holds the keys to your Bitcoin wallet, the only way to become a victim of fraud is by consciously handing over your private keys or sending Bitcoin to another wallet.

With Bitcoin, it’s your responsibility to keep your money safe and the fact that it’s decentralized in its nature means no one can take it or freeze your account. Which of course is a massive benefit.

Bitcoin is a deflationary currency

Before explaining what a deflationary currency is, it may be useful to give a short intro on inflation and how it is hurtful in the long term.

Inflation occurs when the price of products and services increases and there is a corresponding decrease in the value of money.

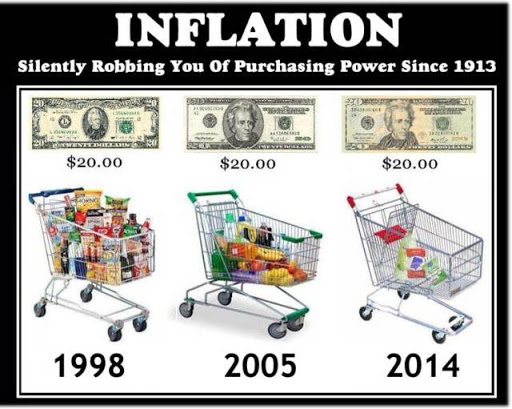

For example, one needs to take a look in the past to see how inflation works. The best way to illustrate this is with a shopping cart. In 1998, $20 could fill up a supermarket cart with a whole lot of things.

Then, in 2005, the same amount of money can only fill up about half of the shopping cart with groceries. This gradually continues until $20 seems like a very small amount of money to buy the essentials with.

Generally, when looking at the long term, inflation has a huge drawback. The financial value of one’s savings reduces over time, which can have a devastating effect on the savings of retirees.

Deflation, on the other hand, does the exact opposite.

One of the most important advantages of Bitcoin over fiat is the popular coin’s design that is programmed as a deflationary currency. Its total supply is restricted to 21million coins by the protocol.

This means that the more people that show interest and buy Bitcoin, the higher the price will rise to meet demands.

Adding to that, the rewards given to miners are reduced every 4 years through a process known as halving. This is an added measure of scarcity that may positively affect Bitcoin’s price in the future.

Low transaction fees

When Bitcoin reached its peak during the bull market of 2017, many people worried that the high transaction fees of the network would act as a negative catalyst, turning people away from adopting cryptocurrency.

How could one use Bitcoin as a payment method at their local coffee shop, if the transaction fees were higher than the price of your cappuccino?

During that time, the Bitcoin network had to confirm over 450,000 transactions per day which clogged the network.

As a result, the transaction processing time increased and so did the accompanying fees.

During its latest all-time high, Bitcoin’s median transaction fees reached a high amount of $34. As you may have guessed, these high-fees were counterproductive for new investors and defied Bitcoin’s purpose – cheap, transparent, and fast fund transfers worldwide.

Thankfully, the problem got solved with the introduction of the Lightning network. The fees required for Bitcoin transactions decreased drastically and the median transaction fee is currently lower than $0.02.

Adding to that, the bear market of 2018 saw a large number of investors (temporarily) leaving the industry, which resulted in additional decreases in the transaction fees.

At the moment of writing, the average transaction fee for a Bitcoin transaction is just under $0.18.

Easy to use in any situation

Another great benefit of Bitcoin is its functionality and usability around the world.

More and more people and businesses are becoming more friendly towards crypto payments and see the benefits of the network.

As such, you can spend and transfer your Bitcoins in a lot of different ways – eating at your local pizzeria, buying from reputable online stores, paying your internet bill and even your taxes.

Another way that highlights Bitcoin ease of use is the way p2p transfers happen. One does not need to manually input a lengthy 32-digit wallet address and use it to transfer money.

Instead, Bitcoin wallets include a feature which allows users to simply scan a QR code which is linked with a public address, in order to make a transfer.

No involvement of third parties

From all the advantages of Bitcoin, this is probably the most important one and the only one that sets it apart from all its competitors.

Bitcoin has no central authority. It is not controlled or influenced by the banking system, a government or any other financial institution.

In one word, Bitcoin is a decentralized currency.

And here is why we consider this to be one of the main advantages of Bitcoin:

- Since no financial entity controls Bitcoin, it is free of any and all national monetary policies.

For countries with high inflation on their national currency (e.g. Venezuela), the decentralized nature of Bitcoin can serve as a way to preserve one’s financial value. Individuals can simply exchange their FIAT issued currencies to Bitcoin and store it safely in a digital wallet. - If a bank faces foreclosure or bankruptcy, the funds of their customers may be affected. Conversely, a decentralized currency does not pose risks of this nature.

- Using decentralized currencies is as simple as obtaining and using a digital wallet. This fact makes Bitcoin a great solution for nations or people that have limited access to the banking system.

- Location-based exchange rates do not affect or alter a decentralized currency’s value. This means that purchases made in one location will not be devalued due to added costs or financial alterations in a country’s monetary values.

- Decentralized currencies prove that blockchain technology works and helps the technological revolution improve in the long term.

All these benefits because no-one rules over this asset.

Pretty amazing, huh?

Lack of control, in this case, is a major advantage.

Unbreachable and anonymous wallets

The advantages of Bitcoin do not stop at transaction and usability purposes. They also include methods of storage.

Bitcoin wallets are practically unbreachable. And by that, I don’t talk about the numerous apps and exchanges that hold your Bitcoin in their wallets. Many of these can actually access your coins.

Instead, we are talking about hardware wallets, such as Trezor or Ledger, as well as paper wallets.

The only way one can access his funds on these wallets is through a private key. This string of 32 random letters and numbers is only known to the owner of the wallet.

And here is what we mean with the word anonymous.

The only way for someone to know if a wallet address belongs to you is if you have gone through a whitelisting process.

This means that you have connected your Bitcoin wallet with your personal information, such as a governmental ID or other personal details.

Examples of this include:

- Coinbase (Exchange), which only allows you to buy Bitcoin after verification

- Shapeshift (Exchange), which allows trading only after creating an account and prompt users to go through ID verification, offering 100 FOX tokens for their effort.

Now, at no point do we imply that whitelisting is bad. In fact, it is necessary for mainstream adoption.

However, if you want to maintain a level or relative privacy, we recommend you store your funds on a wallet that has not been whitelisted.

Simplified International Payments For Merchants

Sending money overseas for products or services has troubled merchants for many years.

The traditional banking system is increasing its efforts to make these payments less costly but, for now, it can be considered a drawback. This is because the fees of the latest are high and the time of delivery is slower.

The same is not true with Bitcoin, however.

International payments are delivered with the same speed and fees as any other local payment, thanks to its borderless nature.

For that reason, more and more merchants start to accept payments in the form of cryptocurrency, paving the way for mainstream adoption and showing the advantages of Bitcoin to the world.

Smart contracts

Smart contracts came to popularity after the explosive growth of Ethereum.

But what exactly does the term mean?

Put simply, a smart contract is a mutual agreement that can be enforced through the blockchain.

Cryptocurrency users can develop self-enforced smart contracts by utilizing the Blockchain instead of using trust and/or legal measures to ensure that two parties adhere to the contract’s agreement.

Ethereum is currently the leading blockchain for smart contract development. Its network focuses on the creation and execution of smart contracts.

However, as the Bitcoin protocol improved, it has started to support smart contract as well.

And, while the functionality of those contracts is not as extensive and customizable as Ethereum, it does allow a relative degree of freedom when it comes to their customization.

Mobile payments are easier than ever

As Bitcoin increases in popularity, so does its ease of use. And nothing describes this better than mobile payments.

Users can exchange Bitcoin and other cryptocurrencies by simply downloading one of the popular wallet applications on their phones.

As mentioned above, transactions are as simple as scanning a QR code and you can even create scannable invoices that are fully customizable.

Bitcoin’s investing advantages

The advantages of Bitcoin exceed its use as a currency. Due to its deflationary nature, many investors choose to see it as an asset with tremendous growth potential. And here are the reasons why.

Bitcoin has bigger returns than any other asset in 2019

Many investors refer to Bitcoin as a risky and inappropriate investment.

However, in 2019, the most popular cryptocurrency has managed to outperform all traditional investment markets.

At the time of writing, Bitcoin’s price has increased a surprising 135% in 2019 and a total of 180% since its all-time low.

Compared to the stock market and other valuable assets, Bitcoin has given the best annual returns so far.

Aside from that, when comparing the returns of Bitcoin with those of early-stage “unicorn” startups, the digital currency wins in annual profits once again – at least for early investors.

Looking at the current situation in the market one can assume that the best is yet to come.

Many investors believe that the price of Bitcoin will increase due to its upcoming halving in 2020, and also because the current chart patterns indicate the beginning of a new bull market.

If historical patterns are taken into consideration, the big returns for new investors are in close proximity.

Easy access for new investors

There are approximately 4.4 billion individuals who have an internet connection but do not have access to traditional investment markets.

On the contrary, Bitcoin is an asset that can be obtained by anyone, as long as their country is supported by the exchange they want to buy it from.

Moreover, there is a low barrier to entry, which means that an investment can be as big or small as users can afford.

For underdeveloped and developing countries, these investing advantages of Bitcoin can introduce consumers of all financial levels to the world of investing.

This, in turn, brings us to the next point.

High adoption rates

Every day, people of different backgrounds discover how to use Bitcoin as a currency or store it as a valuable asset.

The adoption rate of Bitcoin will likely increase even more due to the following reasons:

- More people are currently building companies upon the technology of Bitcoin (blockchain)

- Buying and using Bitcoin is becoming easier day by day

- More merchants are accepting cryptocurrency as a form of payment

- All the other advantages of Bitcoin, as explained above, increase its popularity and use

All in all, one could stop wondering if mainstream cryptocurrency adoption is underway and start observing how we may already be well underway.

The right question to ask then would be when we will experience the results of this adoption and how these will translate into financial returns.

General optimism in the market

Bitcoin’s expected price recovery has caused an uproar of positive reactions from the public. Not only does it lead to more investors joining the market, but it also increases existing investors’ expectations for the future.

General optimism, which in this case stands for positive market sentiment, has always been one of the main advantages of Bitcoin since it tends to lead the coin’s price to new highs.

Don’t believe me?

Take a look at Bitcoin’s history and see how, every time influential people or powerful institutions recognized its potential, the price acted accordingly.

Cryptocurrency traders also rely on market optimism to estimate price action. A positive outlook on a bottomed market is a strong sign of recovery.

Are we currently in the early stages of a bull run?

We talked both about the increased adoption rates and the positive market sentiment surrounding the market.

We also mentioned how easy it is to access the cryptocurrency market and take part in it.

All this information, paired with the current recovery of the market, points clearly towards one direction. And that is the beginning of a new market cycle.

Of course, we cannot know with certainty whether or not the low price of $3200 was the ultimate bottom of the latest market cycle, but we can assume that we will not see Bitcoin drop any lower for the time being.

The majority of Bitcoin investors are currently optimistic, excited and prepared for what is coming next.

And while this is nothing more than a speculation, there is a good chance that the upward trend will continue and take Bitcoin’s value to new highs.

Quick Summary

If you made it this far, you now know the benefits of Bitcoin, and how these can serve you.

Remember that the general population is still in the discovery phase. It will still take some time before they understand the positive impact cryptocurrencies can have on society.

Therefore, next time someone in your social circle asks if Bitcoin is a worthwhile investment, point them to the following advantages:

14 advantages of bitcoin as a currency

- Bitcoin eliminates the risk of fraud

- As a deflationary currency by design, its value increases over time

- It has much lower transaction fees compared to FIAT currencies

- It is very easy to use (you could demonstrate this step)

- There is no involvement from third parties

- Its wallets are unbreachable and anonymous by design

- Bitcoin simplifies international payments – a great benefit for merchants

- As of recently, Bitcoin also utilizes Smart Contracts.

- Mobile payments are very easy to perform

- Bitcoin has given bigger returns than any other asset in 2019 (and over its lifetime)

- The cryptocurrency market offers easy access for new investors

- Mainstream adoption is already underway with the expectation to increase even further

- Currently, there is a general optimism when it comes to Bitcoin and the cryptocurrency market in general

- Last but not least, there are signs that point towards a new bull market

All the above, combined with lessons learned through Bitcoin’s 10 years of history, lead to one immutable conclusion.

Bitcoin is here to stay!

One thing we are almost certain about is that the upside potential for Bitcoin is vast. And that is thanks to the higher rates of adoption and its prominent, upcoming events.

Therefore, it is a good idea to stack up on some Bitcoin and HODL for the time being.

Keep in mind that this is our personal opinion and we are not financial analysts. You have probably heard over and over that performing your own research is crucial – and we insist on it, too.

In our blog, you can find a lot of educational material for Bitcoin and cryptocurrencies in general. This should be a great start for your own research process.

We hope you enjoyed the contents and that you got lots of value from it.

Are you are ready to buy Bitcoin? You can easily do so with Paybis.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info

Wow interesting, easy and reliable love it and I think its the best way of investment.Keep up the good work I really appreciated! I read and understood thanks!

Insightful nuggets for new investors like me.

Thank you for your kind words. Make sure you check out the other posts on our blog as well to find more useful info.