Zilliqa Price Prediction: A Little Shard of Metaverse

Constant innovation and improvement is one of the oldest stories in tech. Someone comes up with an innovative idea that receives widespread attention. Then, it turns out that the idea can be improved upon, so someone else releases their own, improved version of this invention. This, in turn, becomes a product in its own right.

This is also the story of Zilliqa (ZIL), the crypto project that bills itself as “the world’s first sharding-based blockchain.” What is sharding, what makes it so special, and, of course, what does this mean for Zilliqa price prediction? Let’s find out!

Table of contents

- Zilliqa and Sharding: A Brief Introduction

- Zilliqa Price History: Plenty of Opportunities

- Zilliqa 2024 Price Overview

- Zilliqa Price Prediction for 2025

- Zilliqa Price Prediction 2030: Powering a Blockchain-Based World

- Analysis Of The Best Zilliqa Price Prediction Tools

- Putting This All Together: Zilliqa Price Today

- Wrapping Up

Zilliqa and Sharding: A Brief Introduction

The blockchain is a simple yet elegant idea, as attested by its explosive adoption. Still, anyone who has actually tried using it can attest that it does come with its own growing pains.

Fortunately, the crypto world attracts plenty of developers who work hard to iron out these kinks, building some very successful crypto projects in the process.

One of these solutions is sharding, which aims to solve scalability issues. A blockchain consists of decentralized nodes or computers running together; there isn’t one single supercomputer powering it. These nodes process transactions and add them to a distributed ledger. Crucially, this ledger is shared across all the nodes of the blockchain. This way, everyone can always trace every transaction ever processed on this blockchain.

It works great with a smaller number of users. But, as this number increases, the network can experience delays – every node has to process all the transactions, and a larger network does not mean more speed. If there are too many transactions, this leads to delays.

One way to get around this is sharding. The blockchain is broken up into smaller groups or shards which then process transactions independently. This means that all the nodes don’t have to process all the transactions.

You can have a thousand nodes processing a hundred transactions at a time – or you can have ten shards of a hundred nodes, each processing a hundred transactions at a time. And, importantly, the shards still share data among themselves, thus maintaining the distributed ledger.

Not only does this solve the scalability issue – it actually benefits from size. A larger blockchain has more nodes, which means more processing power. This, in turn, would mean faster transactions and lower costs – a clear competitive advantage.

Zilliqa Price History: Plenty of Opportunities

Zilliqa Research, the company responsible for the development of the platform, was founded in 2017 by a group of researchers from the National University of Singapore. The network itself followed a few months later.

Now, Zilliqa started with the exact same combo crypto investors love. It had innovative and promising technology, it had some clear real-world applications and it had a team of experts. No wonder it attracted notable investor interest, and its initial coin offering (ICO) that ran from 27 December 2017 to 4 January 2018 raised USD 22 million.

This, in turn, created publicity when the coin hit the crypto exchanges: in May 2018, Zilliqa’s price spiked to USD 0.2. The ICO price was USD 0.0038, which meant some pretty nice and fast profits for diamond-hand investors.

Profits are there if you can take them: Zilliqa’s price history clearly has had plenty of opportunities. Chart: CoinMarketCap

The buzz died down eventually; by the end of the year, ZIL was below USD 0.02. It continued trending lower in 2019 but it caught a second wind in the middle of 2020, eventually starting another bull run. In April 2021, it peaked again at just below USD 0.24.

The subsequent price action was more in line with the overall bear market, but it still managed to surprise on the upside. In early April 2022, it spiked yet again to USD 0.17 amidst a general downturn in the crypto markets. By mid-2022, it was back at about USD 0.04.

You may always use our Zilliqa calculator to keep track of the latest price changes.

This means Zilliqa has another thing that crypto investors and enthusiasts love: plenty of price action, even in a sluggish market. Let’s turn to Zilliqa’s price prediction for 2022 to see what’s behind these moves.

Zilliqa 2024 Price Overview

We’ve said it before and we’ll say it again: if you’ve got the funding, bear markets are an excellent time to focus on development and churn out new features. This seems to be exactly what Zilliqa is doing: the reason behind its April spike was Metapolis, Zilliqa’s own take on the Metaverse.

Zilliqa has ambitions far beyond being a one-trick pony. It’s betting big on NFTs – and it’s aiming far beyond monkey jpegs. It has both tools and marketplaces to mint, promote, and sell NFTs. It has even launched a Creator Fund, a USD 10m initiative to “support art and innovation in the NFT and Metaverse space”.

Could Zilliqa build a better Metaverse than Meta? Screenshot: Facebook

This brings us to Metapolis. Zilliqa is doing some of the innovation itself: Metapolis is a business-oriented virtual environment that calls itself “Metaverse-as-a-Service” (MaaS).

If you’ve been keeping an eye on the enterprise IT sector, you might have noticed that as-a-service solutions have been all the rage for a while now. Various aaS include, but are not limited to, software, network, IT, content, and, of course, blockchain – in fact, we’ve covered a BaaS platform before.

The idea behind aaS is simple: a company takes a product, bundles it with all the maintenance and support that is necessary to keep it running, and sells it as a turnkey solution. The customer then only has to subscribe to the service; they don’t have to install the product and keep dedicated staff at hand.

Zilliqa takes a bold bet that Metaverse will not only take off but become so popular that all the hot brands will rush to get on it. And, when they do, their choices won’t be limited to building their own offerings from scratch or going on Facebook’s – sorry, Meta’s – version of it; they’ll also have the Metapolis.

So now we know what Zilliqa is doing in 2022: working on new stuff. While it does, major news announcements may well move the ZIL price again, but any such spikes in a bear market will probably be short-lived. What about longer-term estimates, say, Zilliqa price prediction 2025?

Zilliqa Price Prediction for 2025

Metaverse may be the butt of many jokes, particularly because of Mark Zuckerberg’s cartoonish attempts at it, but it underscores one important thing about Zilliqa. Having one innovative feature, such as sharding, is great. Still, if all you have is one feature it’s easy to lose your advantage.

That’s another age-old tech story: some intrepid upstart comes up with a brilliant new feature and builds a successful product. An established industry leader, however, copies the feature and muscles the upstart out of the market – think Snapchat or Clubhouse.

No doubt the Zilliqa team is perfectly aware of this, so it aims to build Zilliqa as the ultimate developer-friendly platform.

We already mentioned the NFT fund. It has its own smart contract programming language called Scilla that claims to be “safe by design”. The platform comes with extensive and user-friendly documentation, encouraging would-be developers. They can even apply for funding from Zilliqa’s investment arm Zilliqa Capital – that’s right, Zilliqa is so well funded that it can afford to fund its own developers.

All this clearly looks ambitious and suggests the team behind Zilliqa is in it for the long run. So how has it been doing?

At the time of writing, the Zilliqa ecosystem directory lists just below 200 projects. These include NFT collections and decentralized finance platforms, but it also has offerings that are markedly less common in the crypto world, such as a fitness app and a marine fuel consumption monitor – all built on the Zilliqa blockchain.

To sum it all up, 2025 can prove to be one of the most important years for all cryptos. As the new US president steps into office, launching his own meme coin, the crypto market dynamic starts to change. While it’s difficult to say how the market will respond, as of January 29, 2025, a single Zilliqa traded for USD 0.01787 at a market cap of USD 347.85M as reported by CoinMarketCap.

Zilliqa Price Prediction 2030: Powering a Blockchain-Based World

Of course, the projects still remain small, but they show notable ambition. Remember: we mentioned early on that a key feature of blockchain is that it consists of decentralized nodes; there isn’t a single supercomputer or server farm powering it.

It works, but, in practice, this means that blockchain transactions can get somewhat sluggish – as anyone who has tried to buy Bitcoin can attest.

Well, Zilliqa wants to build a blockchain that hosts entire VR worlds, tracks ship all over the world, and monitors the health of thousands of users – all in real time. Sharding is key to its ambitions: it would provide the necessary computing power, and the larger the network, the more computing power it would have.

How much larger could it get? An early position paper, in addition to the usual suspects such as token trading dApps and decentralized exchanges, mentions a more unusual use that harks back to the academic background of Zilliqa’s founders: high-performance scientific computing.

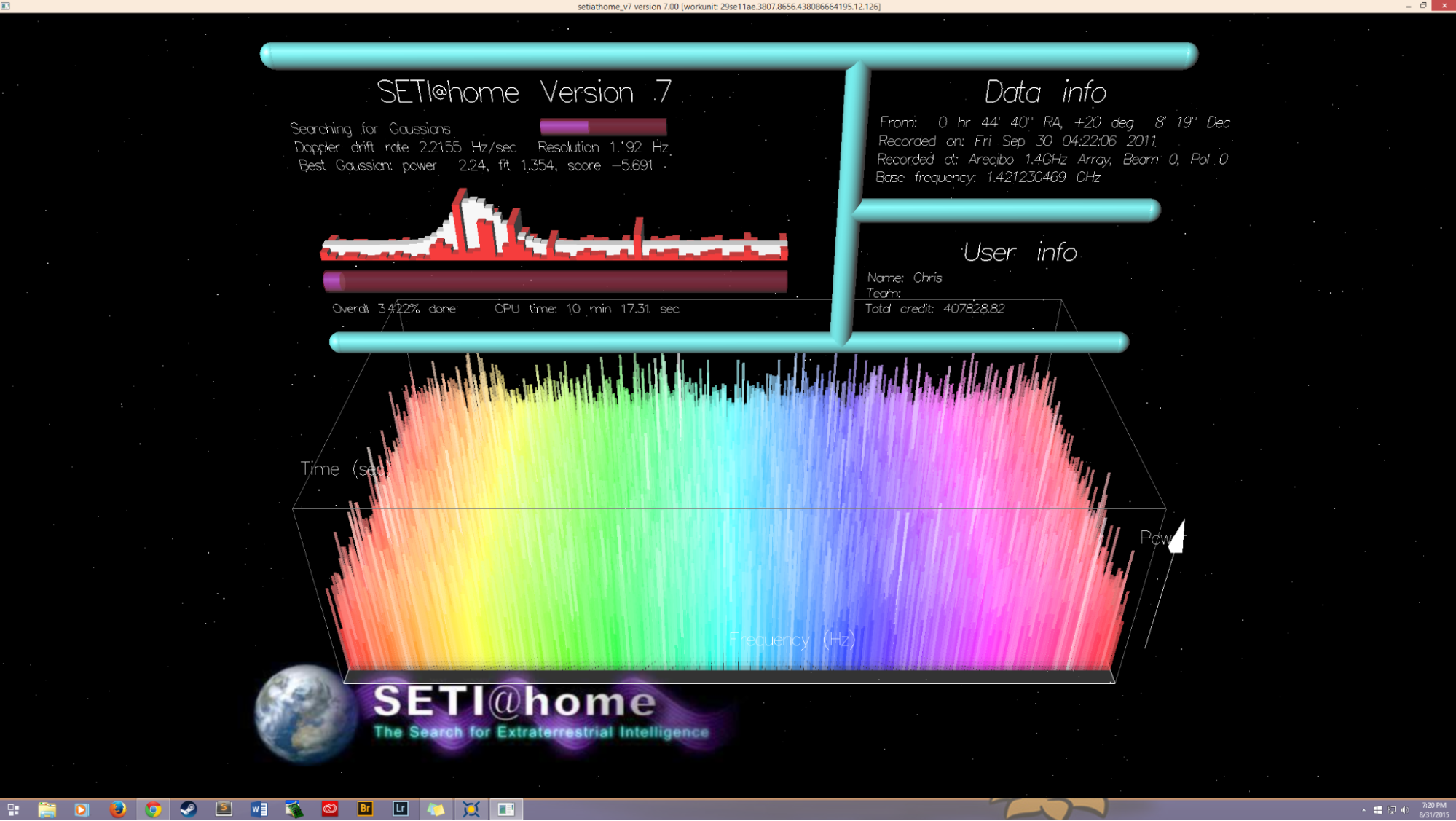

There have been a number of distributed computing projects, like the search for extraterrestrial intelligence (no dice so far, in case you were curious). They work much like Zilliqa’s sharding: a large network of computers – or nodes – process their own chunks of data, which are shared across the network to get the final result.

Distributed computing was pioneered by projects such as SETI@home – while they did not find little green men, they proved the viability of the concept. Screenshot: SETI@home

Zilliqa would provide this kind of decentralized computing power to a large number of projects – and who knows what they could find. Dogecoin’s “to the Moon” is clearly a worthy ambition, but Zilliqa could take a peek at distant galaxies.

Analysis Of The Best Zilliqa Price Prediction Tools

Now we get to the part where we try to put some numbers on these future estimates. It’s always a tricky endeavor, especially if you consider that Zilliqa has seen some unexpected spikes before. Therefore, as always, take these with a grain of salt.

- Wallet Investor sees little potential for ZIL, noting that it may reach an average of USD 0.00228 by early 2025;

- DigitalCoinPrice is an order of magnitude more optimistic, predicting that ZIL could reach USD 0.0391 by 2025;

- Price Prediction is the most bullish of the three, as it puts the 2025 ZIL price between USD 0.0272 to USD 0.0317.

The usual caveat applies: these are just starting points, not guarantee that the price will reach this point. Given the rather wide range of these predictions, your own research is as important as ever.

Putting This All Together: Zilliqa Price Today

So what to make of it? Let’s try looking at the things that Zilliqa has going for it – and consider what could hold it back.

First things first: Zilliqa is packed with things crypto investors absolutely love. It has innovative technology, it has a strong team, it has deep pockets that allow it to weather crises, it has attention-grabbing products and it works hard to attract developers – with reasonable success. Throw in its propensity for bull runs, and you see why crypto enthusiasts would take notice.

It is betting big on things like NFTs and Metaverse, which may or may not turn out to be an advantage in the long run. On one hand, Metaverse could become the default mode of online communication for the vast majority of people. On the other hand, it still has a long way to go – and, to be fair, it may not get there at all.

You may also appreciate Zilliqa’s somewhat academic bent – vast computing power for research projects would certainly be a boon to the general public. If you like your cryptos to have real-world applications, Zilliqa certainly has them.

But, of course, it’s not all smooth sailing.

For starters, crypto projects have often been accused of being solutions looking for problems, and this criticism can definitely be leveled against some of Zilliqa’s products.

Then, Zilliqa is far from being the only crypto to do the things it aims to do. Competition is fierce, sharding is not the only way to improve blockchain performance, and, even if it were, Zilliqa isn’t the only platform to employ it.

Wrapping Up

And, while none of this constitutes investment advice, you may want to consider when exactly to buy Zilliqa, should you choose to do so. This token has spiked before; historic performance is not indicative of future results, but it still serves as a useful reference. Therefore, it may be a good idea to keep your FOMO in check the next time it shoots up – but, of course, you do you.

As always, stay tuned for more insights – or check our blog archive for more inspiration. The final decision is always up to you, but we’re happy to point out some things to consider.

FAQ

Can Zilliqa disappear at one point?

Zilliqa appears to be in it for the long run. It has a team of experienced professionals, it has funding, and it even has funding for developers who want to create apps on the platform. This does not mean that it indeed will succeed, but at least it has the potential to do so.

Is Zilliqa a good investment?

This is up to you; we do not provide investment advice. It’s got its fundamentals in check; it has a strong team, innovative technology and flashy products, to name just a few. It also has its own issues to overcome. The final decision is always your own.

Can Zilliqa reach USD 1?

Again, we don’t provide investment advice – and we definitely don’t try to predict certain price points. Technically, this should well be within ZIL’s reach, and it’s even conceivable how it could happen – a successful product could spark massive publicity and a strong price spike. Still, there is no guarantee that this will happen.

Is Zilliqa an underrated token?

Maybe; this is up to you to decide. Consider its current market cap and compare it with ZIL’s fundamentals. How does it hold up – and does it have room for growth? Or, you may also decide that it’s actually overrated.

Is Zilliqa a Metaverse token?

Metaverse may put Zilliqa in the news, but it’s far from being the only thing ZIL has going for it. Its core technology and selling point is sharding, which – at least in theory – allows it to harness a large amount of computing power.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info