Becoming a Bitcoin Miner – A Step by Step Guide

Bitcoin Mining is the backbone of the Bitcoin network. Without it, there would be no coins and no transactions. Aside from that, being a Bitcoin miner has also proven to be a very profitable “job”, helping some amass fortunes along the way.

Today, depending on your location and equipment, mining bitcoins in your free time can help you grow an additional source of income while helping the network improve and grow.

For that reason, this article will primarily explore Bitcoin Mining and how you can become a miner yourself, so you can start acquiring Bitcoin through utilizing this process.

Table of contents

How Bitcoin is Acquired

Bitcoin is the first, most popular and most valuable cryptocurrency. It has proven to be a great investment opportunity for your hard earned money and is even used as an alternative currency for online purchases.

Since its release in early 2009, it has been steadily gaining value over time. The first recorded traded value of Bitcoin was $0.03 and at the time of writing, it is worth more than $10.000. Bluntly put, this is a x300.000 gain in just over 10 years. Not a single asset in any market can claim such growth in such a short time span.

Therefore, it is no surprise that more and more people are starting to gain interest in acquiring some Bitcoin as either short or long term investments.

But where do new Bitcoins come from and how are they created? How can someone get access to this asset?

Well, there are two main sources to acquire Bitcoin. The first one is to purchase some of those already in circulation from a cryptocurrency exchange, like Paybis, for example. The second option is to participate in creating new ones! This appealing option for acquiring Bitcoin is called Mining.

If you’ve ever heard about cryptocurrencies, you must also have come across information about how they can be mined out of thin air using computers or other machines.

However, before we delve into more technical matters, let’s cover some basics and a short history of Bitcoin mining.

The Bitcoin Protocol

First of all, we need to understand what Bitcoin is and where it comes from.

Let’s start with a short explanation on how our traditional monetary system works and how Bitcoin differs from it.

For example, when we are talking about financial institutions and paper money (also known as fiat currency) the government decides when to print and distribute more of it. With a central authority like this, it is easy to put new money into circulation.

Moreover, if you want to transfer $50 from one person to another you just need to tell your trusted central authority, the bank, to do it. In this case they are the only ones that have the power to update the ledger that holds everyone’s balances in the system.

On the other hand, Bitcoin and the technology behind it, the Blockchain, were created to eliminate the reliance on this central authority.

Instead of a central bank, everyone that uses Bitcoin participates in updating the public ledger that is on the Blockchain network, where all of the Bitcoin transactions ever processed are stored.

In order to avoid giving someone too much power to update and manipulate the ledger, rewards of Bitcoin are given to people that will verify the transactions on the network. These people are called Miners.

Additionally, the network relies on these Bitcoin Miners to issue new coins that will become available on the network. Let’s find out how new Bitcoins are created and who can get access to them.

Bitcoin Mining – How does it work?

Even though the name might suggest shovels, spades, dirt and rocks, Bitcoin Mining refers to a fully digital process of creating new Bitcoins on the Blockchain network.

As opposed to our traditional monetary system, there’s no central government to issue new Bitcoins. Instead, it’s the Bitcoin miners that create the cryptocurrency, much like traditional miners “dig-up” gold and silver.

But how does it happen digitally, you might ask?

This is done by using special software on their computers, which are used to solve complex mathematical equations that form transaction blocks. Every time an equation is solved, the miners are rewarded with a certain amount of newly created Bitcoins for their efforts.

The process creates an incentive for more people to mine, putting more of the cryptocurrency into circulation. This is known as a Proof-Of-Work system.

Additionally, miners are essential to the ecosystem as they are the ones who approve the transactions of Bitcoin on the network. More miners means a more secure network and faster transactions.

So, all of this sounds great and appealing! Free money, right? Who wouldn’t want to be rewarded Bitcoins for running some software on their computer?

However, mining is far from being a simple venture. There are quite a few barriers that you need to be acquainted with before you start thinking of investing time and money into becoming a miner in 2019.

Mining difficulty and the evolution of hardware

As we mentioned before, the mathematical equations that need to be solved have an innate complexity to them. The Bitcoin network automatically changes the difficulty of the math problems, depending on how fast they are being solved.

Back in the early days, miners were able to solve these problems with the processors that were in their computers, the central processing units or CPUs. As more miners joined the network, the problems were adapted accordingly and made them more difficult to solve, putting the creation of new Bitcoins almost to a halt.

This meant that miners needed to find an alternative to the hardware they were using before, so they turned to their graphics card processors, the GPUs. Gaming graphics cards were known to be more capable at solving complex algorithms and miners started to use them massively to mine Bitcoins. However, GPUs do come with another problem, they consume a lot of electricity and generate a lot of heat in the process.

Soon, Bitcoin became even more popular and the mining difficulty skyrocketed. As a result, mining with GPUs became obsolete. The cost of electricity and the increasing number of machines needed was too high to be able to make any kind of profit.

Instead of GPUs, the first commercial Bitcoin mining machines hit the market. Known as ASICs (application-specific integrated circuits), these were intended for specific use, in our case, high efficiency Bitcoin mining. Still used today, this technology has made Bitcoin mining even faster, while at the same time, power efficient.

The Reward Halving

We briefly discussed that miners receive a “certain amount” of Bitcoins for solving a problem. Well actually, that amount is fixed, and hard-coded into the software.

In order to keep Bitcoin’s value increasing through time, its creator, Satoshi Nakamoto wanted to make it a deflationary currency, one that doesn’t lose value as time passes.

To do this, he hard coded the mining difficulty increase, but also something even more effective: the reward halving.

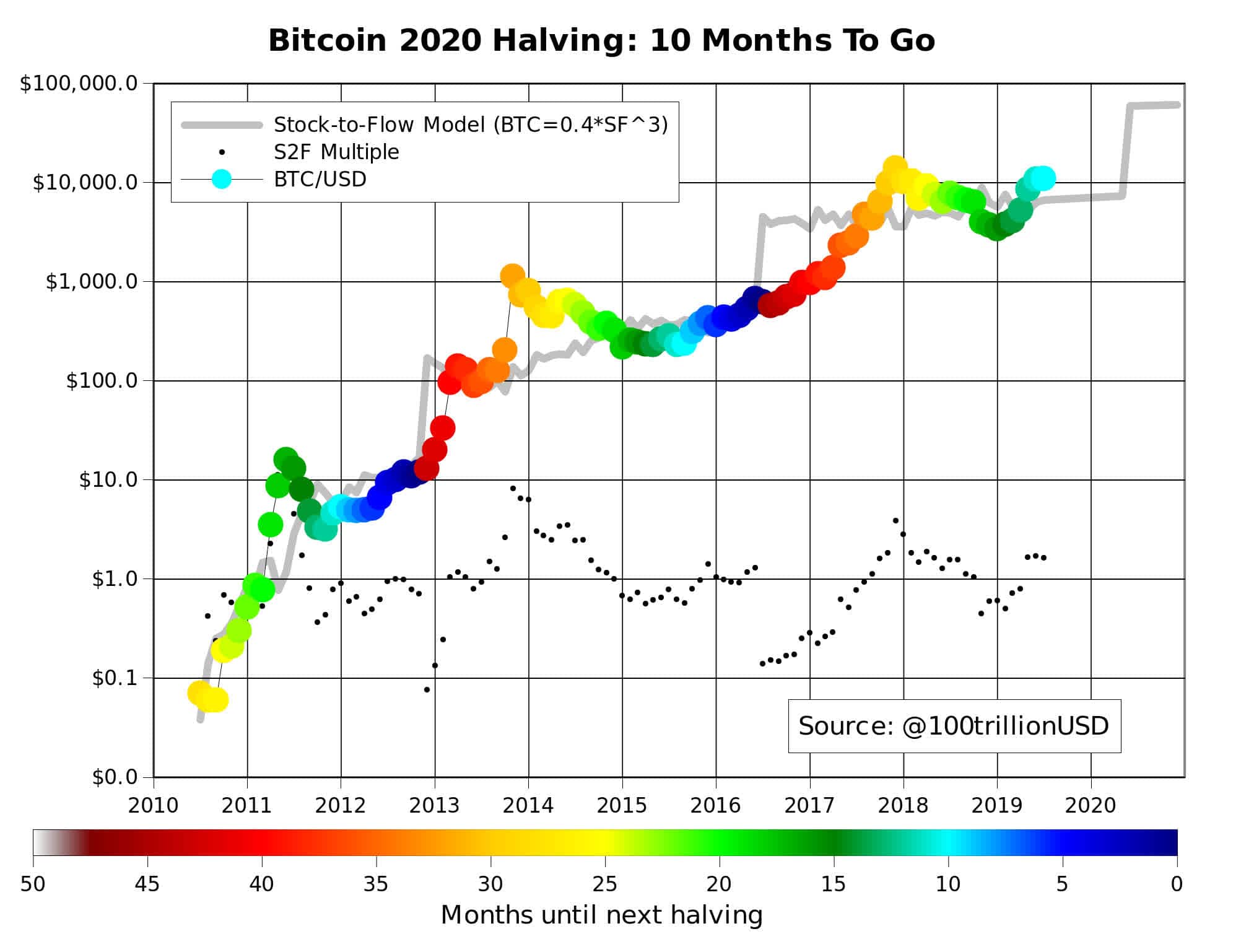

In fact, every 210,000 blocks (which is roughly 4 years), the number of Bitcoin that are rewarded for successfully mining a transaction block is cut by half. While, currently, miners receive 12.5 Bitcoin for each block they resolve, by the time of the next halving, this amount will drop to 6.25 rewarded coins.

This results in less and less new Bitcoins being issued over time, creating a feeling of scarcity.

Furthermore, when we take into account that 21 million is the maximum number of Bitcoins that will ever come into circulation, we have a recipe for success in deflationary economics.

Every aspiring miner needs to take in account that in May 2020, when the next halving occurs, the rewards will effectively be cut in half. But as history shows, this hasn’t proven to be a problem in the long run. By looking at historical patterns we can observe that Bitcoin’s price increases before and after each halving, making miner’s efforts still worth their while.

The roles of a Bitcoin miner

Before you go out shopping for your first mining machine, let’s go through the three main responsibilities a miner has towards the Blockchain and his Bitcoin-using peers:

- Issuing new Bitcoins – this is the simplest part. Solve the math problems, get Bitcoin.

- Confirming transactions – part of the computing power is dedicated to confirming transactions and get rewarded in return. This is done to prevent double spending of the same Bitcoin and making transactions irreversible.

- Securing the network – by their participation in the network, miners make it more difficult to hack. The more miners there are, the more secure the network is.

So now that you know what mining is and what it takes to be one, you are ready to discover what you need to invest to become one. As with all things, mining comes at a price, but we’re here to guide you through the process of making your first steps.

Is mining profitable?

There’s no short answer to this question, as it depends on a lot of factors. Before you buy your first piece of hardware in order to start mining Bitcoins yourself, you will need to find out by yourself if mining is profitable for you.

Some people believe that they can quit their job the day they invest in some mining hardware, but it’s not that simple.

First of all, you must understand that Bitcoin mining is a very competitive space. Its rising value has made it very difficult for the individual miner to make a profit given the difficulty mining has reached today. If you want to make any kind of money by mining, you will probably have to join a Mining Pool. This is network of miners that combine their processing power in order to solve blocks in a more realistic time frame. Your rewards, in this case, will depend on the amount of work you contribute to the probability of solving a transaction block.

Efficient mining rigs that don’t consume a lot of electricity and still yield some Bitcoin in return are expensive and require a considerable initial investment. Even the good ones consume quite a lot of power, so you need to factor in the price of electricity in your region.

Nevertheless, if you follow some good guidelines and play your cards right, mining can become a good source of passive income. If you factor in that Bitcoin’s price is most likely going to rise even more in the future, there’s still a decent incentive to become a miner even a bit late in the game.

The Hardware

We covered the fact that CPU and GPU mining is a revolved era.

Trying to mine with either of these is still possible, but you will make less than one cent per month and the process might damage your computer in the long run. In short, not profitable at all anymore.

Another option for starting with Bitcoin Mining is using a USB miner hardware. These are small ASIC devices that you can connect to your USB drive. Even though they are quite inexpensive (ranging from $30 to $150) Bitcoin’s algorithm has become so difficult to solve that the processing power these devices provide won’t get you very far. The best ones will yield you about $5 a month, so we can unfortunately conclude that these too, have become obsolete.

Choosing the right Bitcoin miner hardware

ASICs were introduced in 2013 and it seemed like every couple of months a new, better machine was put out on the market. Luckily, three years later, the hardware race slowed down quite a bit, as we’ve reached a technological barrier in miner development. Even though new machines are still coming out, you can invest in one without fear that it will be outdated quickly.

When choosing your ASIC miner, there are three main factors to consider:

- Power consumption : How much power does the miner require? This is very important as your electric bill will be a deciding factor if your mining is profitable or not.

- Hashrate: This is the measure of your miner’s performance. The higher the hashrate, the better the odds are that it solves a bitcoin block.

- Efficiency: Since miners use a large amount of electricity, you want to buy one that converts the most amount of electricity into Bitcoins.

The top 3 ASIC miners in 2019

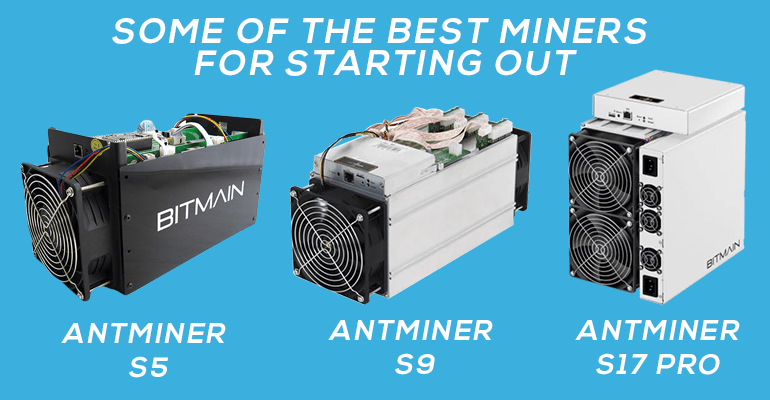

1. Bitmain Antminer S5

Features:

- Hash rate: 1155 Gh/s

- Power consumption: 590 W

- Price: $300-600 used

Even though the S5 is no spring chicken, it’s still a very efficient miner. Its processing power might be a lot lower than the newer S17pro and S9, but so are its starting price and power consumption. A good starting point for beginner miners that won’t break the bank or skyrocket the electricity bill.

2. Bitmain Antminer S9

Features:

- Hash rate: 14 TH/S

- Power consumption: 1400W

- Price: $2500 new – $500-1000 used

The S9 is considered the flagship of Bitmain, as it provides excellent hashrate and efficiency. A bit on the pricey side when it hit the markets, it can now be found for less than $1000 on different websites like Ebay

3. Bitmain Antminer S17 Pro

Features:

- Hash rate: 54 TH/S

- Power consumption: 2400 W

- Price: $4500 new – $1800-2500 used

The best miner at the moment is also the most expensive one. If you are persistent, you can find some deals online for used S17s but keep in mind that you will most likely be paying above the $2000 mark for this piece of hardware.

Before you commit to purchasing one, you can use this handy calculator. This way, you can find out how much profit you can expect from your mining activities.

This list is not exclusive, of course, as there are many brands and models out there. We’ve picked these three miners as they represent a good picture on what you can expect when investing in this type of hardware.

Once you make your choice and purchase your machine, you are ready to start mining. But before you get disappointed on how slow you are making progress by yourself, it might be time to join a Mining Pool.

Joining a mining pool

Pooling has become the preferred method of gaining profit through Bitcoin mining. As we briefly covered earlier, mining pools are networks of Bitcoin miners that join their efforts to solve blocks faster and then divide the rewards between the participants. But how do you choose the best one for you?

Well, there are a few key points that you need to evaluate before joining one:

-

Reputation

Mining in a pool that has a good reputation will ensure that the platform is stable and payments are steady and delivered in a timely manner.

-

Profitability

It is important to join a pool that has a good percentage of hashing power in the Bitcoin network. This represents the likelihood of a pool to mine a high number of blocks, and thus profit from it. Additionally, be sure to check out how much the pool will charge you for their service.

-

Ease of use

Having an accessible dashboard and an intuitive interface is a key feature. You will be monitoring a lot of data and statistics, and what you observe will be important on a day to day basis.

-

Transparency

This is one of the initial concerns of any user when joining a mining pool. Is the hash rate power data correct? Are the efforts provided by everyone well documented and is everyone getting their due when the payroll comes?

-

Support

Problems may arise at some point, and having a fast and effective support is important. After all, every pool charges a fee, so you are paying for this service. In case something goes wrong, you should be provided with appropriate customer assistance.

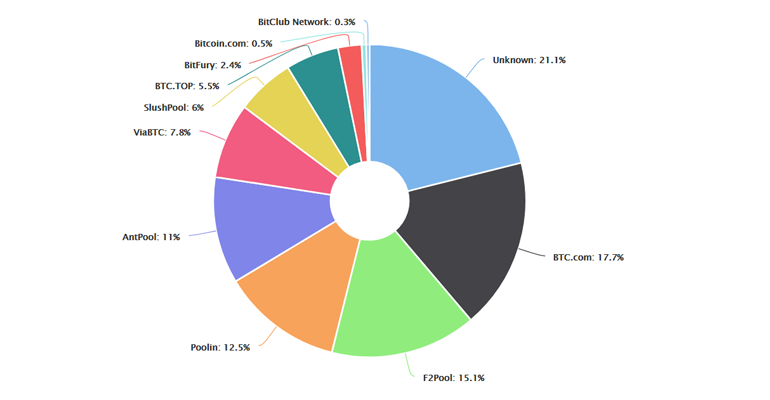

Once you start browsing for a Bitcoin mining pool to join you shouldn’t be surprised to see that most of them are based in China. Admittedly, this country rules above the others in terms of possessing the largest number of mining pools.

We compiled a list of some of the best and most renowned Bitcoin mining pools:

Best Bitcoin Mining Pools

1. BTC.com (China)

BTC.com is a public mining pool that mines more than 15% of all the blocks.

2. Antpool (China)

Antpool is the mining pool of hardware manufacturer Bitmain, that provides users with a slick interface and is great for beginners.

3. SlushPool (Czech Republic)

Despite not being the largest one, Slushpool still remains one of the best and most popular mining pools. It is also the first-ever mining pool.

4. F2Pool (China)

Another chinese mining pool, this one is one of the pioneers. Founded in 2013, it has become one of the leaders in the industry

5. Poolin (China)

Started by the founders of BTC.com, it has become quite large considering it has been operating only since 2017.

These five mining pools have proven to be reliable throughout the years. There are a lot of others out there, so be sure to read some reviews and do some research to see which one fits you the best.

Well, that’s about it. Once you become a member of a mining pool you will start receiving Bitcoin. There are a lot of parameters to take into account when starting your mining adventure but if you manage to remember the basics, you will be fine.

Cloud mining – An alternative mining method

If you aren’t ready to invest your money into mining hardware just yet, you might try out another method, which is cloud mining.

Cloud mining means a host company owns Bitcoin mining hardware and runs it at a warehouse. You pay that company and rent out some of the hardware. Based on the amount of hash power you rent, you will earn a share of payments from the cloud mining company for any revenue generated by the hash power you purchased.

Unfortunately, these companies have turned out most often than not to be scams. Promising good returns, a lot of these companies have disappeared with no trace of the users’ money or blocked accounts arbitrarily locking funds indefinitely.

For example, most of these companies, even the legit ones, have contract clauses that allow them to lock your user account if the fees are higher than the profits for a given number of days.

Additionally, there are quite a few mentions of large scale phishing hacks where, instead of getting Bitcoin in return, users lose all their holdings.

Nevertheless, some of them have been proven to be authentic, but we can’t stress enough that this type of mining is the riskiest of all.

Here’s a short list of some Cloud mining companies you might want to consider:

1. Bitcoin Pool

Bitcoin.com is offering this cloud mining service. It aims to provide the most competitive clouding mining service and even provides users with mobile apps to follow the progress in real time.

2. Hashnest

Hashnest was launched in 2014 by Bitmain, which is a world-renowned manufacturer of ASIC mining hardware. Bitmain also operates one of the largest mining pools in existence: Antpool. Combined with the photos of a handful of data centers on the Hashnest website, this is persuasive proof that the company is legitimate.

3. Hashing24

The company appears to have no data centers of its own, rather, it has partnered with big name providers such as BitFury to lease hashpower to customers.

Note: Please keep in mind that cloud mining is not a recommended method, and you will be better off buying your Bitcoin from an exchange outright.

Conclusion

Mining might not be as profitable as back in the day, but it can still be a good source of

Bitcoins if you are careful and know what you are doing. Just remember to keep your expectations realistic, and it the long run, it just might pay off.

Granted that the best and fastest way to acquire Bitcoins is to purchase some from an exchange like Paybis, mining can still be a fun and lucrative endeavor.

Quick Recap on what we learned:

- Mining is one of the most important activities in the Bitcoin ecosystem.

- It allows for the creation of new Bitcoins

- Secures the Blockchain by making it difficult to attack by hackers

- Confirms the transactions in the network

- Bitcoin is created through a proof-of-work system, where miners are rewarded newly created Bitcoins for solving mathematical problems.

- The network automatically adapts depending on the difficulty of the mathematical problems. They become more complex, depending on the timeframe necessary to solve them.

- Every four years, there is a halving of block mining rewards. The next “halving” will occur in May 2020

- There are only 21 million Bitcoins in existence.

- To ever be able to realistically make a profit from mining Bitcoin you must:

- Purchase ASIC mining hardware

- Join a mining pool that supports Bitcoin mining

- Cloud mining is a risky alternative to buying your own mining hardware. Instead you “rent” hashpower from mining companies and rely on them to pay you Bitcoins.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info