Bitcoin Price Prediction 2025

The surge in Bitcoin prices in the first quarter of 2025 is fueling bullish sentiment and many are speculating that it can surpass 100,000 by 2025.

But is the bull run really here or is this merely short-lived euphoria? We will focus on fundamental analysis, technical analysis, macroeconomic events, and institutional investments to try and get a glimpse of where BTC is headed in the foreseeable future

After the previous Bull Run the BTC prices took a major dump to $16k and many people thought that this was the end and not a good investment as it is not sustainable.

In 2021 Bill Gates said this while giving an interview to the New York Times:

“Bitcoin uses more electricity than any country except the top 10. This can’t be sustainable. I think regulation will come that will make it a lot less attractive as an investment.”

Fast forward to 2024, Bitcoin miners are increasing using renewable resources to keep the network up and running and institutional adoption of Bitcoin has made it even more of an attractive asset while reducing volatility.

Note: The analysis in this article is purely for educational purposes and may deviate significantly from reality. Further, past performance does not guarantee future results. Consult a qualified financial expert/investment advisor before make decisions based on independent third-party opinions/analyses.

Table of contents

Fundamental Analysis

Let’s analyze the fundamental core values of Bitcoin and see what major problems it is solving.

If you are familiar with the history of Bitcoin, you probably know that Satoshi Nakamoto released a whitepaper with a viable solution to a long-standing problem, often referred to as the Byzantine’s General Problem: the ability to transfer value between two parties without any intermediary, such as a bank or government.

Never has it been possible to instantly transfer value over long distances in a completely trustless manner. And, with the creation of Bitcoin, there was finally a breakthrough.

As Satoshi put it, the “peer-to-peer” electronic cash system essentially stands for the network’s ability to transfer value directly from “person to person”, without any involvement from third parties.

Bitcoin As A Digital Asset

For new investors, Bitcoin also serves another function – that of a new asset class. New BTC can be mined, just like any other precious metal. In this case, miners use strong computing power instead of shovels and pickaxes. But here’s the interesting part.

What makes Bitcoin different and stronger than precious metals, is its predetermined inflation/deflation schedule. There are only 21,000,000 Bitcoins available for mining, around 19 million of which have already been mined.

Every four years, the amount of Bitcoin rewarded to miners is reduced in half (halved), and the production of new Bitcoins will end by the year 2140.

From the beginning of 2024, we have seen big movements from major asset management companies like Black Rock and Fidelity who are investing billions of dollars into Bitcoin. This also indicates that the big players in the world are “Bullish” on Bitcoin.

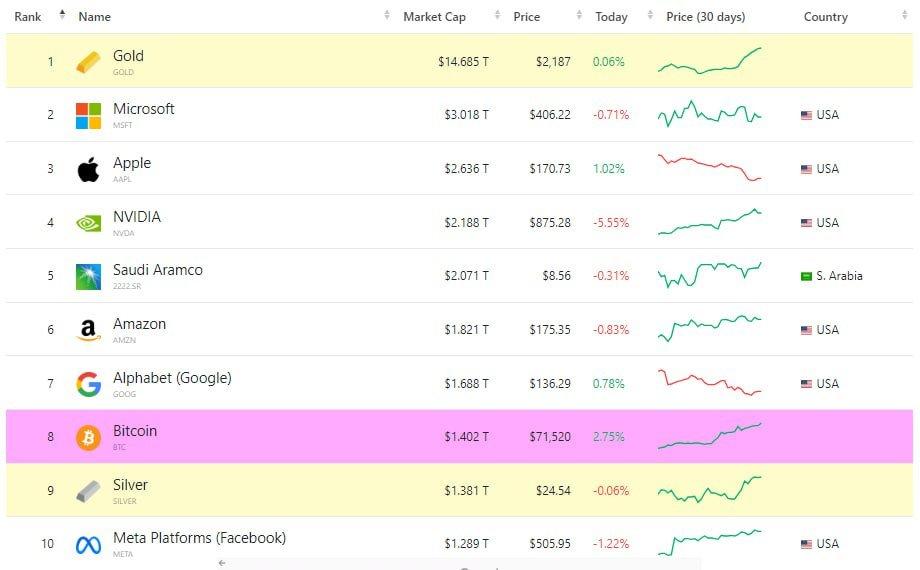

When Bitcoin reached its peak of $73,738 it also overtook silver to become the 8th largest asset by market capitalization with a total value of 1.4 trillion dollars.

Bitcoin overtaking Silver as a commodity set a media frenzy as the technology underlying Bitcoin is less than 2 decades old while Silver has been an actively traded commodity for centuries.

Technical Analysis

Past performance does not guarantee future results. But it can certainly help with making an educated guess. So, take this analysis with a grain of salt and do your research or consult a professional. Let’s begin by mapping BTC halving periods on the Bitcoin price chart.

Bitcoin halving is an inflation-easing mechanism when the reward for mining is cut in half. It follows the fundamental principle of supply and demand. Likewise, Bitcoin halving exists to alleviate demand-pull inflation. Baked into Bitcoin’s source code, it is scheduled to occur every 210,000 mined blocks, which takes about four years.

Based on the previous halving charts, Bitcoin always achieved an all-time high after a few weeks of the halving but in 2024 Bitcoin’s behavior was not usual because it hit its all-time high of $73,738 almost 1 month before the halving, and the reason for this behavior is the Bitcoin ETF’s approval.

To understand it better let’s first understand what is ETF and what role it plays in BTC’s price. ETFs are exchange-traded funds that track the value of a specific asset and trade on traditional market exchanges.

In the case of Bitcoin ETF’s approval, investors have the freedom to invest in Bitcoin without having to go through the hassle of using cryptocurrency exchange while providing leverage to its price. After the Bitcoin ETF’s approval billions of dollars have come into the market helping Bitcoin to reach its all-time high even before the halving.

According to the previous charts of halving it is expected for Bitcoin’s price to increase significantly in the peak of the Bull Run which usually starts after the halving.

Macroeconomic Events

Inflation and Interest Rates

Bitcoin’s correlation with traditional assets has increased in recent years. During the high inflation period of 2022, Bitcoin’s price did not demonstrate the inflation-hedge qualities its proponents often cite.

The Federal Reserve has been raising interest rates aggressively to combat inflation. As of April 2024, the target range stands at 5.00% – 5.25%. Higher interest rates make safer assets more attractive, potentially drawing capital away from riskier assets like Bitcoin.

Geopolitical Tensions

The ongoing Russia-Ukraine conflict has injected significant uncertainty into global markets. During periods of heightened geopolitical risk, investors often exhibit a “flight to safety” behavior, selling off riskier assets like Bitcoin in favor of assets like gold or US Treasuries.

Specific events within geopolitical conflicts can trigger sharp volatility spikes in the cryptocurrency market. News of sanctions, escalations, or potential resolutions can cause significant swings in Bitcoin’s price.

De-dollarization

There is a growing trend among some nations to reduce their reliance on the US dollar as the primary reserve currency. This de-dollarization effort could lead to a decrease in demand for the US dollar.

If the US dollar loses its dominance, some investors and nations may turn to alternative stores of value or mediums of exchange. Bitcoin, with its decentralized nature and limited supply, could potentially benefit from this shift, should the trend accelerate.

Institutional Investments Into Bitcoin

Increase In Institutional Adoption: We have already discussed that major financial institutes and corporations like BlackRock and Fidelity are investing heavily in Bitcoin which suggests a growing confidence in the overall cryptocurrency world. This could lead to a wider investor base and potentially higher prices.

For instance, Belarusbank, the largest bank in Belarus is considering setting up a cryptocurrency exchange. With more authorized adoptions like these, Bitcoin could soon become the new normal, glaring upon the fiat currencies.

If governments establish clear regulations for the cryptocurrency market, it could legitimize Bitcoin and attract more institutional investors leading to a positive impact on price.

In recent times we have an example of El Salvador, how this country is bullish on Bitcoin and is daily buying one Bitcoin. This initiative has pushed the nation’s Bitcoin holdings to a substantial total of 5,690 BTC worth around $400 million.

The approval of spot Bitcoin ETFs sends a strong signal of institutional approval. These ETFs, directly backed by Bitcoin, offer a streamlined and regulated way for institutions to invest in the cryptocurrency. The SEC’s approval provides the regulatory clarity and comfort that many institutions require, removing significant barriers to entry.

This ease of access through familiar investment vehicles like ETFs eliminates the need for institutions to grapple with the complexities of cryptocurrency exchanges and digital wallets.

The embrace of spot Bitcoin ETFs by institutions is likely to boost demand and potentially add stability to the notoriously volatile Bitcoin market. This institutional interest further legitimizes Bitcoin as an asset class, paving the way for greater mainstream acceptance.

Useful links

Bitcoin Price Prediction for 2025

The beginning of 2025 started off strong. With the tumultuous launch of the US president-elect’s launch of the TrumpCoin and MelaniaCoin, the crypto markets were literally shaken. The initial Trump Bump which boosted Bitcoin’s value even further from an all-time high of $100,000 registered on December 5, 2024, to $109,114.88 post-election on January 20, 2025.

However, the crypto market remains divided as it’s not become even more difficult to predict how Bitcoin’s price will change throughout 2025. Binance predicts that the price of Bitcoin will stabilize around $95,000, with minimal fluctuations.

Conclusion

Bitcoin’s trajectory in 2024 and beyond appears promising, but it’s important to remain cautiously optimistic. While the recent bullish surge is fueled by factors like institutional adoption, ETF approvals, and growing confidence in Bitcoin’s fundamentals, challenges and uncertainties remain.

The evolving macroeconomic landscape, regulatory developments, and geopolitical events will continue to influence Bitcoin’s volatility. It’s crucial to remember that the cryptocurrency market is still maturing, and even experts offer widely varying price predictions. Before making any investment decisions, conduct thorough research, understand the risks, and consult a financial advisor.

The Paybis blog will continue to provide useful education surrounding Bitcoin, cryptocurrencies, and blockchain.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info

I think this is among the most significant info for me. And i am glad reading your article. But should remark on some general things, The site style is ideal, the articles is really nice : D. Good job, cheers

“Im thankful for the blog.Much thanks again. Really Great.”

Well that is true every financial expert or not expert in financial they predict their own analysis and opinion about bitcoin price reach in the future. For me my own prediction and view of bitcoin for the year 2020 for the reality 30,000$, 100,000$ is so very obvious is too expensive mor etear to wait before they can reach. And according from the article came from the op share I also agree bitcoin is the solution of worldwide problem.

Годнота спасибо

Интересный пост

Verrygood

I’ve found it a little difficult to find computer parts without having to buy whole computers and tearing them apart myself. . I want to start my own business using the computer parts, but where can I get the computer parts (the small parts)? I have tried my local recycle center and no success.. I’m on the verge of contacting an established computer craftsperson and cosigning to their business. . . Anyone with ideas or advice?.