Liquidity Pool

Liquidity pools are smart contracts that hold reserves of multiple tokens, enabling decentralized trading, lending, and earning interest by pooling assets

Initially, DeFi platforms attempted to mimic traditional financial models, particularly the use of order books for trading. However, this approach soon proved to be impractical for the DeFi ecosystem.

Order books, commonly employed in traditional stock exchanges, were not a viable solution in the nascent DeFi landscape. The primary challenge lies in their inherent need for a substantial volume of buyers and sellers to maintain market efficiency. Further, they were very slow due to the nature of blockchains — this meant individuals with faster and more powerful computers could see the trades of those with slower computers and ‘front-run’ them.

Addressing this inefficiency, Bancor, an innovator in the DeFi space, proposed an alternative: a system of pooled liquid assets. This concept was revolutionary, introducing a new way that did away with the need for matching buyers and sellers in the traditional sense. Instead, it focused on creating a pool of assets from which trades could be executed, thereby ensuring constant availability of liquidity. This idea laid the groundwork for what would become a cornerstone of DeFi – liquidity pools.

These pools have since evolved to form the very fabric of decentralized trading, offering a more efficient, accessible, and fluid trading environment. It is in these liquidity pools that the essence of DeFi truly comes to life, allowing for seamless and decentralized trades.

In this article, we will explore what is a liquidity pool and how you can become an active participant in the DeFi ecosystem by joining a crypto liquidity pool.

Table of contents

What is a Liquidity Pool?

Liquidity pools are smart contracts that hold reserves of multiple tokens, enabling decentralized trading, lending, and earning interest by pooling assets.

At its core, a liquidity pool is a foundational component of the DeFi ecosystem, serving as a reservoir of funds locked in a smart contract. The concept is relatively straightforward yet innovative, addressing the liquidity challenges inherent in decentralized networks.

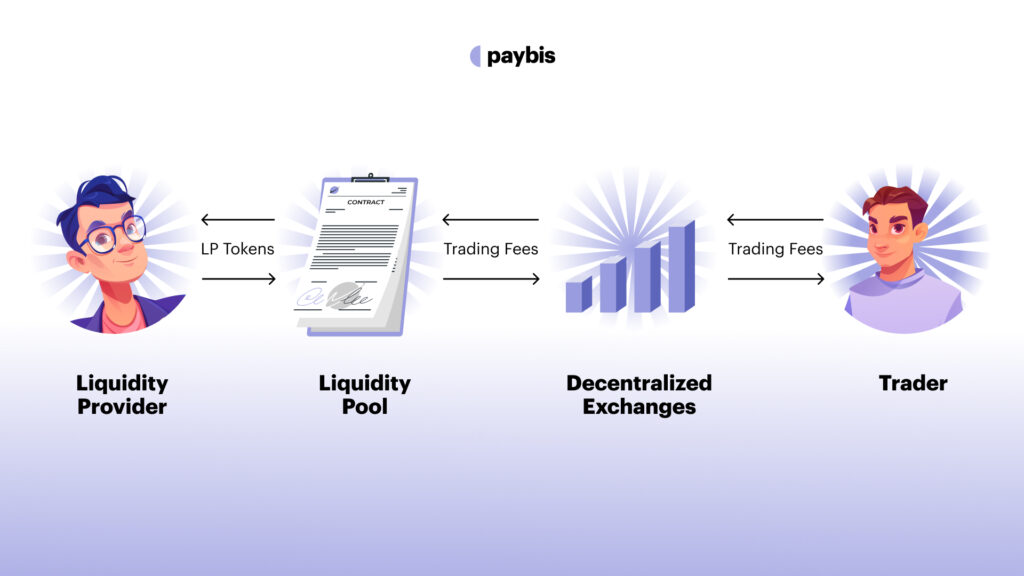

Liquidity pools function by aggregating funds from multiple participants, known as liquidity providers (LPs). These providers contribute assets to the pool, often in the form of cryptocurrency pairs, such as Ethereum, and a stablecoin like USDC (ETH/USDC). In return for their contribution, LPs receive liquidity tokens, which represent their share of the pool and can be redeemed for a portion of the trading fees generated by the pool’s activity.

The brilliance of liquidity pools lies in their ability to enable trading without the need for a traditional buyer-and-seller match.

When a user wishes to trade one type of token for another, they interact directly with the pool. The pool’s smart contract algorithm determines the price of the assets based on a mathematical formula, often involving the relative sizes of the two assets in the pool. This method, known as an automated market maker (AMM) model, ensures continuous and automated pricing of assets without the need for an order book.

Furthermore, liquidity pools play a crucial role in yield farming and staking, where users can earn returns on their staked assets. This aspect has become a significant draw for investors looking to maximize their holdings in the DeFi space.

How do Liquidity Pools Work?

Understanding the mechanics of liquidity pools is key to grasping their significance in the DeFi ecosystem. At their most fundamental level, liquidity pools are smart contracts that contain funds. These contracts facilitate trading by providing liquidity and are primarily used in automated market maker (AMM) platforms.

The Automated Market Maker (AMM) Model

The central innovation of liquidity pools is the AMM model.

Traditional market models rely on buyers and sellers setting orders for the price at which they’re willing to buy or sell assets. The AMM model, in contrast, eliminates the need for these order books.

Prices within a liquidity pool are determined by a predetermined mathematical formula based on the ratio of different tokens in the pool. This formula ensures that the total liquidity in the pool remains constant, allowing for instant trades regardless of the pool’s size or the order’s magnitude.

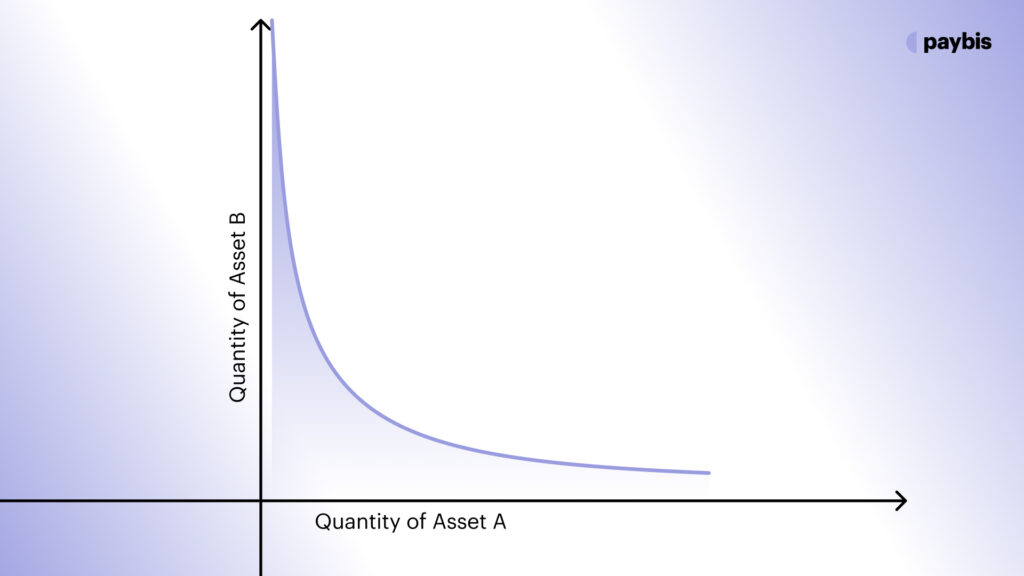

One of the simplest AMM formulas is the “Constant Product Formula”:

X*Y = K

In this formula:

X and Y represent the quantities of two different tokens in the liquidity pool.

K is a constant value, which means the product of X and Y must always equal K.

When someone trades in the pool, they change the quantity of X or Y, which automatically adjusts the price, ensuring the product remains constant. The formula balances the pool by adjusting prices based on supply and demand.

As more and more of Token A is bought, the amount of Token B required for subsequent purchases increases exponentially. This steep price increase as supply decreases is a natural deterrent against draining the pool. It becomes prohibitively expensive to buy large quantities of a token, especially as its supply in the pool diminishes. This mechanism ensures that while trades are facilitated, it becomes increasingly difficult and costly to deplete the pool, thus maintaining liquidity and preventing market manipulation.

In essence, the AMM model self-regulates through price, ensuring the pool’s sustainability even under high demand for a particular token.

You can visualize this with the help of the graph shown below. As one token reduces, the other increases.

Let’s see an example in action.

Suppose we have a liquidity pool with:

- 100 units of Token A

- 200 units of Token B

The Constant Product formula is X*Y = K. So here, K = 100*200 = 20,000.

Now, imagine someone wants to add 50 units of Token A to the pool. We need to find out how many units of Token B will be left to keep K constant.

After the trade, Token A in the pool = 100 + 50 = 150 units.

We calculate the new amount of Token B using the formula;

Token B = K/(New Token A)

Let’s calculate the new quantity of Token B.

After adding 50 units of Token A to the pool, the new quantity of Token B would be approximately 133.33 units. This ensures that the product X*Y=20,000 remains constant, in line with the Constant Product Market Maker model of the AMM.

Contribution to Pools and Token Exchange

Participants, or liquidity providers, add funds to these pools. In a typical scenario, a liquidity pool for two tokens (say, Token A and Token B) requires that liquidity providers contribute equal values of both.

In exchange, they receive Liquidity Pool Tokens (LPTs), representing their share of the total pool. These tokens can be redeemed later for a portion of the pool’s assets, including a share of the transaction fees generated by the pool.

The amount of pool tokens received is proportional to the contributor’s share in the total pool. For example, if you contribute 10% of the pool’s liquidity, you receive pool tokens that represent this 10% ownership.

By holding pool tokens, liquidity providers are exposed to both the risks (like impermanent loss) and rewards (transaction fees, liquidity mining rewards) associated with liquidity provision.

LPTs can sometimes be traded or staked in other protocols, providing additional liquidity and utility to liquidity providers.

Useful links

What Does DeFi Look Like without Liquidity Pools?: The Importance of Crypto Liquidity Pools

The absence of these pools would lead to a lack of liquidity, making it difficult for users to execute trades swiftly and at reasonable prices. This scenario could lead to wider bid-ask spreads, higher slippage, and potentially a less favorable trading environment. Moreover, without liquidity pools, the innovative yield farming practices that have become a hallmark of DeFi would not exist.

Another critical aspect is the impact on decentralized exchanges (DEXs). DEXs rely heavily on liquidity pools to facilitate trading. Without these pools, DEXs would struggle to provide efficient trading mechanisms, which could hamper their growth and the overall accessibility of DeFi.

Liquidity pools don’t just facilitate transactions and yield farming; they are also vital for maintaining market efficiency through arbitrage.

Arbitrage is the practice of taking advantage of price differences between markets or platforms. In the DeFi space, these opportunities frequently arise because of the decentralized and fragmented nature of the ecosystem. Liquidity pools play a pivotal role in this. Without liquidity pools, the DeFi ecosystem would lose a critical mechanism for price correction and market efficiency.

Liquidity Pool Use Cases

Liquidity pools in the DeFi ecosystem are not just platforms for trading and earning yield; they serve a variety of use cases that contribute to the robustness and versatility of the decentralized finance landscape.

Token Swaps

The most common use case for liquidity pools is enabling decentralized token swaps. Users can exchange one cryptocurrency for another without the need for a traditional exchange or intermediary, benefiting from the liquidity provided by these pools.

Yield Farming

Liquidity pools are central to yield farming, where users stake or lend their assets to earn rewards. These rewards can be in the form of transaction fees or tokens from the respective DeFi platform, offering an attractive avenue for passive income.

Price Discovery

In traditional markets, price discovery involves buyers and sellers interacting to determine the price of an asset. Liquidity pools automate this process through their AMM algorithms, which set prices based on the current ratio of assets in the pool, facilitating efficient and decentralized price discovery.

Lending and Borrowing

Some liquidity pools are integrated into lending platforms. Users can deposit their assets into these pools, which are then available for borrowing by others. Lenders earn interest, while borrowers gain access to funds without selling their assets.

Portfolio Diversification

Certain types of liquidity pools, like those on Balancer, allow users to create pools with multiple assets in varying proportions. This facilitates portfolio diversification within the DeFi ecosystem, enabling users to spread their risk across different assets.

Synthetic Assets and Derivatives

Liquidity pools also support the creation and exchange of synthetic assets and derivatives. These are complex financial instruments that replicate the value of other assets, allowing users to gain exposure to a wide range of markets without owning the underlying asset.

Governance and Community Participation

Many DeFi platforms use liquidity pools to facilitate governance. By staking tokens, users gain governance rights, allowing them to participate in decision-making processes of the platform, such as proposing or voting on changes.

Conclusion

In essence, liquidity pools are not just a convenience; they are a necessity for the healthy functioning of the DeFi ecosystem. They enable efficient trading, incentivize liquidity provision, and facilitate yield farming.

If you are just getting started with crypto and want to learn more, check out more articles at paybis.com/blog, and go from a crypto beginner to a web3 mastermind.

FAQ

Are liquidity pools profitable?

Potentially, yes. Profits come from transaction fees and rewards but depend on market conditions and the specific pool’s performance.

What are the risks of liquidity pools?

Liquidity pools are not without their risks. Some of them are:

- Impermanent loss

- Smart contract vulnerabilities

- Market volatility

- Regulatory changes

- Pool composition risk

- Exit scam risk

- Liquidity risk

Can anyone create a liquidity pool?

Yes, on many DeFi platforms, anyone can create a liquidity pool, though it requires technical knowledge and an initial liquidity provision. You can use Paybis to get initial liquidity.

How do I start a liquidity pool?

Choose a DeFi platform, define the token pair, set the pool’s parameters (like fees), provide initial liquidity, and deploy the pool’s smart contract.

Are liquidity pools safe?

Safety varies; they’re subject to smart contract risks, market volatility, and platform integrity. Diligent research and risk assessment are essential.

Which liquidity pool has the highest APY?

The highest APY fluctuates and depends on market conditions and pool dynamics. Check current DeFi platforms for up-to-date APYs.

Liquidity pool vs order book - which is better?

For DeFi, liquidity pools are generally better due to their simplicity, automated pricing via AMMs, and continuous liquidity, aligning well with the decentralized and often lower liquidity nature of DeFi markets.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info