How to Make Passive Income With Cryptocurrency – 13 Ways

Cryptocurrencies are constantly evolving. Faster transactions, better features, improved roadmaps, and now, the ability to create an additional income source.

If you want to learn how to make passive income with cryptocurrency, you are in the right place.

This article will help you get a better understanding of the concept and show you how cryptocurrencies can earn you money on a regular basis.

Before we talk on how to make money off of cryptocurrency, let’s start with the basics.

Table of contents

- What is passive income?

- 13 Ways to make passive income with cryptocurrency

- Wrapping up

What is passive income?

Passive income defines recurring earnings that happen without any action taken on the part of the individual (passive). This means that your current assets or prior actions are now generating cash flow that needs no overview on your part.

Is it even possible to make a passive income?

The idea of passive income has been massively inflated by Youtube and the Social Media culture. Everyone has at least once come across posts that look like this:

Millennials, which form one of the biggest audiences for cryptocurrency, entertain the idea of passive income programs more than any generation before them.

But is it possible for everyone to start earning money on autopilot?

Well, the power of the internet gives everyone the opportunity to earn passive income with cryptocurrency!

But it is a little more complicated than 10-minute Youtube videos. If passive income was as easy as everyone describes it then we would all be world travelers and living off their favorite coin.

The truth is that crypto-based passive income requires some work to set up a system that works in your favor.

Therefore, in the next chapter, we will show you 12 realistic ways to earn passive income through crypto.

13 Ways to make passive income with cryptocurrency

Not many people are experienced, cryptocurrency investors. And even less understand how to earn passive income through it. Choosing one of the following options is a good place to start.

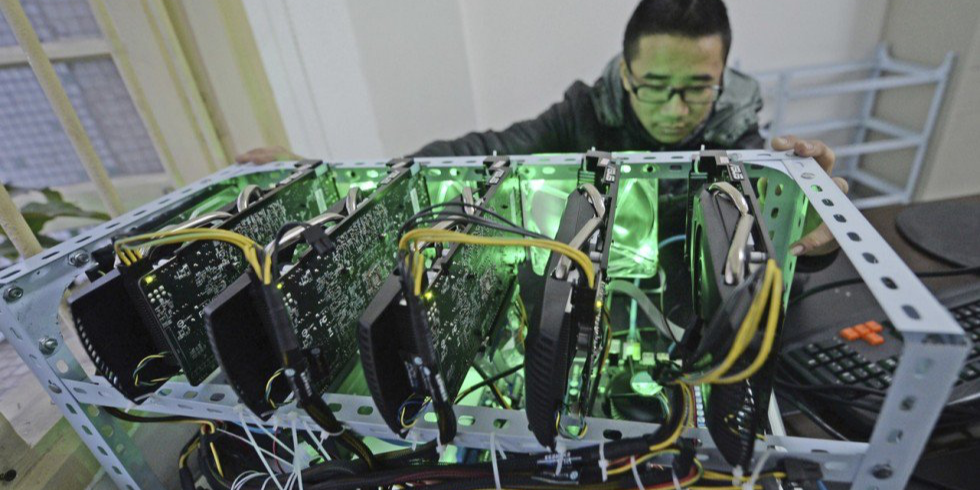

1. Cryptocurrency Mining

Want to know how much you can earn by “exploiting” the power of your computer? Mining cryptocurrency has been very popular ever since the early days of Bitcoin.

Before exchanges helped investors to buy and sell coins, mining was the only way one could use to obtain coins. Today, mining is still popular, with most miners being part of larger mining pools.

So, how can your computer earn passive income through BTC mining?

How to make passive income with mining

The process of cryptocurrency mining is one of the best ways to earn passive income. And here is a quick walkthrough of the steps you need to take:

- Decide which coin you want to mine by checking their specifications.

- Calculate your costs to determine if your investment will pay off.

- Purchase mining hardware that can support your operations.

- Install the open-source mining software that supports the coin you chose, and start mining cryptocurrency. Simplemining.net is a great choice.

How much do you need to invest?

Before you start, there are three expenses you need to keep in mind.

- The price tag of your miner ($200-$2000 depending on your needs).

- The cost of electricity (depends on the miner).

- Fees you need to pay when exchanging your coins for FIAT.

You will also need to make sure that your computer can support your miner or mining rig. If it doesn’t, you may need to upgrade your computer’s power supply or your Motherboard.

How much can you earn from Bitcoin mining?

Wondering how to earn money from Bitcoin mining? While you can setup a basic mining rig for approximately $3000, the more passionate often invest up to $10.000.

And while you may think this is a good idea, Bitcoin mining is not as rewarding as it once was. As of December 2019, BTC mining is not profitable for US citizens.

Since electricity costs and hash power differ depending on the location and setup, it is hard to give exact ROI numbers. What you can do, however, is to use a mining profitability calculator.

Enter details of your miner’s hashing power, power consumption, cost per kW, and the fee of your mining pool to see how much you should be earning.

If the earnings are below your expectations, consider mining less popular coins that can still offer decent returns. Here is a list of the latest trending options.

2. Staking

Staking is the process of locking up a certain amount of funds (coins) in your personal wallet, in exchange for a small amount of interest that is paid out monthly. This reward is also paid in digital currency.

How to make passive income with Staking

- Find out which coins have a POS (Proof of Stake) consensus model. These are the only coins that entail a staking mechanism.

- Discover the best staking coins through personal research. Check for lockup period, volatility, staking rewards, etc.

- Buy a certain amount of coins and store them away in your wallet. Note that some coins will require you to “freeze” your coins for a certain amount of time while others will start paying out rewards the moment your coins are stored.

To see the most popular staking coins in 2021, click here.

How much you need to invest

This will highly depend on the coin you choose to use for staking purposes.

- More popular cryptocurrencies (e.g. Tron) pay out an interest rate slightly higher than high-yield savings accounts (2-4%).

- Relatively popular coins (e.g. Tezos) tend to have rewards that match a return rate often seen in real estate or safe stock options (7-8%).

- Less popular or very undervalued coins (e.g. Decred, Icon) usually have higher staking rewards (15%+) but come with more investment risk.

3. Lending for margin trading

Cryptocurrency lending is the most popular way to earn interest on your crypto holdings. There are two different types of lending:

-

Interest-Bearing Crypto accounts

A crypto interest account is similar to a high-yield savings account in your bank. All you need to do is deposit your funds with companies like BlockFi and Celsius Network and start earning monthly interest payments. Annual returns vary between 6% and 8.6%.

-

Peer-to-peer crypto lending

Lending your coins to other people is also possible through most major trading platforms. We have previously explained how this method works, as well as the risks involved.

Peer to peer lending is usually reserved for a short period of time, meaning that your coins will only be used for a few weeks to months, usually for margin trading. As such the average annual returns tend to be higher, depending on the coin you choose to offer (10%+ p.a.).

How much you need to invest

The amount you choose to deposit depends on the returns you wish to receive. If you want to earn a considerable amount of money, you will obviously need to invest more.

- Keep in mind that, even though most platforms offer insurance on the funds you deposit, you will no longer be in control of your coins as soon as you lend them out.

- Less popular cryptocurrencies and exchange-based tokens offer higher MoM returns.

4. Running a Lightning node

The Lightning Network (LN) has caused an uproar of conversation, signaling instant payments for Bitcoin. In short, LN is a second-layer protocol that runs on top of a particular blockchain, allowing instant crypto transactions through its off-chain micropayment network.

Here is an example to help you understand:

- Normally, transactions made with BTC have one direction, meaning that if Person 1 sends BTC to Person 2, then Person 2 is not able to use the same payment channel to send Bitcoin back to Person 1.

- With the lightning network, however, channels can go in both directions, as long as the two participants agree on the transaction terms beforehand.

Lightning nodes offer liquidity and grow the size of the Lightning Network by using payment channels to lock up BTC.

How to make passive income through a lightning node

Setting up a lightning node can be a challenging process for less-technical individuals. Aside from that, the process is quite lengthy and complicated. If you want to learn more, read this post.

5. Affiliate programs

Most cryptocurrency platforms offer a reward to people that help them grow their user base. Through affiliate links and referral codes, you can introduce a particular crypto company to your social circle.

If you are an influencer or have a large following, these types of programs can earn you a lot of passive income. However, before you start promoting random products, make sure you do enough research to ensure that the products you promote are of high quality.

How to make passive income through affiliate programs

- If you want to explore the best sites for passive income referrals, make sure you check Paybis Referral Program. Many of our affiliates earn thousands of dollars per month doing little to no work.

- For other referral opportunities, check big exchange platforms and airdrop-related websites.

Among cryptocurrency affiliate program platforms, Olavivo stands out. It specializes in bridging the gap between advertisers and media partners, focusing on various niches including, but not limited to, crypto. Their model is designed to optimize affiliate marketing strategies, offering a transparent, performance-based system. This can be an excellent opportunity for those interested in leveraging their network to generate passive income through cryptocurrency-related products and services.

7. Running Masternodes

A masternode is similar to a web server but runs on a completely decentralized network. In short, it is a “full” node that supports POS blockchains by hosting an entire copy of the coin’s ledger to validate transactions.

Masternodes are not for the typical investors who are looking to make some passive income. These nodes require lots of technical expertise to set up, as well as a considerable amount of upfront investment.

For certain masternodes, it is also required to hold a large amount of a particular token, making the process more expensive and the coins less liquid in the market. Similar to staking, masternodes tend to inflate the expected returns which can lead to a wrongful projection of breaking even. Therefore, it is very important to do your due diligence before you get started.

How to set up a masternode

Here is a quick video that explains how you can set up your own masternode:

How much can you earn from running a masternode?

There is not a “one-size-fits-all” answer to this question. Similar to staking, passive earnings depend on several factors:

- Which coin you choose to invest in

- The protocol that facilitates the Masternodes

- The fluctuating value of the cryptocurrency you choose

For example, you might want to invest in Dash. Here is how your earnings would look like:

- First, you would need to purchase 1000 Dash coins. At current pricing, this would set you back approximately $67.000 dollars.

- Based on historical patterns, the annual ROI for a Dash masternode amounts to 6.21%.

- As such, you should expect to receive approximately 62 Dash coins per year (± $4168)

8. Hard Forks

Hard Forks can be very rewarding. Since most cryptocurrency projects are open-source, any developer can use existing protocols to create new cryptocurrencies, by splitting a particular blockchain.

While not all attempts lead to popular new coins, some forks can lead to a massive amount of passive income for particular coin-holders. For example, back in 2017, Bitcoin Cash was directly forked from Bitcoin. All Bitcoin holders received 1:1 BCH coins for each Bitcoin they had in their wallet.

How to make passive income with Hard Forks

- Make sure you have a good overview of the upcoming forks, since most of the time you will need to enter additional information in your wallet(s) to be able to see your coins.

- Ensure you hold enough coins of the cryptocurrency the new coins will be forked from.

- Check their guidelines and requirements of where the coins need to be held to receive rewards.

- After the fork occurs, your wallet will instantly receive a number of coins relative to your holdings. To see and trade these holdings, revisit Step 1.

How much you need to invest

This is a highly individual choice, since no one really knows how forked projects will perform. Here are some personal recommendations which do not constitute financial advice:

- If the forked project’s founders are very experienced and popular in the crypto industry, chances of success are higher, thus you may want to invest more.

- If the forked cryptocurrency is not trying to solve an existing problem that the original cryptocurrency cannot solve, chances of success are lower. Investments in such coins have a higher degree of risk.

- Forked projects have a higher survival rate during positive market conditions and if an exchange listing is in sight.

9. Airdrops

Airdrops are another great way to earn passive income. It is the easiest way to earn free crypto. New projects simply give away free tokens to people that apply to receive them. All you need to do is give some of your personal data or sign up on their platform. While not completely “passive”, it can be a great stream of income for people who have some free time on their hands.

How to make passive income with Airdrops

- Sign up to receive alerts from platforms that support all the latest airdrops. You can choose from AirdropAlert, Airdropster, AirdropMob, and Bounties Alert.

- When new alerts start coming in, choose the airdrops that interest you and follow the instructions required to obtain free coins

- Hold onto your coins until some of the projects increase in popularity. Chances are that your coins will increase in value so you can sell them at a higher price point.

How much you need to invest

In this particular case, you will need to invest time instead of money.

- Airdrops that offer their native cryptocurrency will usually require ±10 minutes of your time.

- Airdrops that reward users in popular cryptocurrencies, like XRP, ETH, or BTC may have a more complex process. If not, payouts may take longer to complete.

10. Coin Burns & Buybacks

Certain cryptocurrencies will manipulate their circulating supply to intentionally decrease their supply. This is called a Coin Burn.

In more traditional markets, this process is referred to as a buyback – companies don’t “burn” their holdings here, but they artificially increase demand.

A popular cryptocurrency that undertakes Coin Burns is BNB. They buy back and remove a set number of coins from circulation on recurring timeframes. This decreases the total supply of Binance Coin.

#Binance‘s 11th $BNB burn is just around the corner!🔥

Guess how many #BNB will be burned this time?

Not sure what a coin burn is? Level up your knowledge on @BinanceAcademy:

🔥 https://t.co/nvr1WHYNvn pic.twitter.com/2xmyT4ArLf— Binance (@binance) April 15, 2020

How to make passive income with Coin Burns

Passive income is not always certain with Coin Burns. This is because, at this moment, the value of most cryptocurrencies fluctuates massively. If, however, a coin should see value growth through such a practise, there is no particular action you need to take.

Simply buy and hold a certain amount of coins in your wallet and wait for the burn to occur. After the event is concluded, you will be able to see if it had any impact on the coin’s price.

11. Blockchain-based content creation platforms

In 2020, we see another trend raising in popularity – that of content creation platforms that reward their users in cryptocurrency.

Whether it is for writing an article, making a video, or creating any other type of content, you can now get paid to do so.

How to make passive income with blockchain-based content creation platforms

- Find the platform of your preference. Start by doing a little research on the available options and make sure you check Cent and Coil.

- Register on the platform(s) you discovered. You may need to pay a monthly fee upon signing up.

- Start creating and publishing content.

- Every time someone reads or watches your content, you get paid.

How much you need to invest

- Membership costs on Coil and similar platforms start at $5 per month.

- Aside from that, you will need to invest some time upfront, in order to create the content that will earn you money passively.

12. Trading bots

Trading cryptocurrency can be very rewarding. However, it is also time-consuming. This is where trading bots come in. They automate actions that you would normally take as a trader, depending on the conditions of the market. This results in more consistent income with minimum user intervention.

How to make passive income with trading bots

- Start by doing some upfront research and choose a trading bot that suits your needs. We recommend using Cryptohopper or Haasonline as they have been in the market longer than any other bot.

- Start a paid subscription and choose the package that suits your needs

- Connect the bot to your trading account(s). Your bot should be a detailed guide on how to do this.

- Deploy the bot and start earning.

- Manage and adjust the settings of your bot regularly for optimal results.

How much you need to invest

Trading bots can be very expensive depending on the features they offer. Therefore, if you are not very versed in trading, this option might not be the best idea.

- The cost of trading bots can vary but is usually between $10-$200 per month.

- You will usually receive a sizeable discount if you fund the totality of your subscription in one payment.

13. Crypto collectibles

Digital collectibles based on the blockchain are also a great way to earn passive income. Each collectible can become more valuable through time and personal effort, as you can “level up” similar to video games.

How to make passive income with Cryptocurrency collectibles

Start by researching and buying either one of the two collectibles listed below.

- CryptoKitties is a game that features digital collectible cats on the ETH blockchain. Users can purchase, breed, and sell these kitten avatars, often for a significant amount of money. This is because each one is unique and can’t be replicated.

- Etheremon collectibles are very similar to CryptoKitties. Each monster has a unique, blockchain-backed identity and can be bought or sold for ETH.

How much you need to invest

The price of crypto-collectibles varies depending on their uniqueness, age, and level. Some of the most expensive CryptoKitties have been sold for as much as 600 ETH on their official website.

Due to the huge discrepancy in price, It is really hard to give a set range, and we recommend that you research each option by yourself.

Wrapping up

You now got a basic introduction on how to make passive income with cryptocurrency. Some of the methods we discussed require some upfront work, while others do not require any active involvement.

In summary, here are the options we looked at:

- Cryptocurrency mining

- Staking

- Lending for margin trading

- Running a Lightning node

- Affiliate programs

- Hard Forks

- Airdrops

- Coin Burns & Buybacks

- Blockchain-based content creation platforms

- Trading bots

- Crypto collectibles

We expect to see a lot more options becoming available in the future, as this is still an early time in the crypto industry. Many people want to know how to make money with cryptocurrency, and the opportunities keep on growing.

For now, start exploring the options we briefly discussed, and use the one that works best for you. Before you know it you will have multiple new streams of income.

FAQ

What’s the fastest way to earn Cryptocurrencies?

The fastest way to earn crypto is either through mining or staking it. While mining as some significant upfront costs, Staking is usually cheaper and more efficient to start with. As such, you may consider using this option first. If you have the ability to invest a large amount of money but little to no time, you can also lend your coins to exchanges. These will use your coins for margin trading and pay you a monthly fee.

How do I generate passive income with Bitcoin?

There are many ways to earn passive income with Bitcoin, most of which were discussed above. For more detailed information on the different ways, you can use to earn crypto on autopilot, make sure you read this post. That being said, if you still want to know how to make more passive income with cryptocurrency, make sure to read all the points in the post above.

Do cryptocurrencies pay dividends?

Cryptocurrencies are not like Stocks. A coin is not a share of the company, and thus dividends are not really the right term to use in this case. The one thing that comes closest to it is staking rewards, which are monthly payouts given to loyal holders of a particular coin.

How can I get 1 Bitcoin for free to start making passive income?

Here are the best ways to earn you first Bitcoin

- Invest a small amount in the market and start trading responsibly

- Use all your earning opportunities to raise a small capital and follow the market trends

- Participate in as many Airdrops and Bounties as you possibly can until you raise enough funds.

How do I start a new Cryptocurrency?

Looking for more unusual ways on how to make passive income with cryptocurrency? Creating new cryptocurrencies is getting more and more popular. We have previously explained all the steps you need to take in order to create an ERC-20 token. Make sure to read that post to get a better understanding of the process.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info