USDC vs. USDT: Differences Between USD Coin and Tether Explained

Heated debates on USDC vs USDT have been common in the crypto space for the last few years. In this article, we’ll break down this topic for you.

Table of contents

Key Takeaways

- The stablecoin market has been growing rapidly since 2020, with high demand for the ones backed by fiat currencies.

- USDC offers the best transparency among the stablecoins.

- USDT provides the best liquidity among the stablecoins.

High and unpredictable price fluctuations are not new to the crypto market. To prevent this volatility from affecting the value of their digital assets, traders and investors park their funds in stablecoins like USDC and USDT.

For example, converting tokens to stablecoins during a bear market can help to reduce the negative impact on one’s portfolio. Not just that, having stablecoins allows you to buy back crypto tokens once the market bounces back from its lows.

From October 2020 till April 2024, the stablecoin transfer volume has surged from $100 billion to over $1.6 trillion. This 1500%+ volume growth around 3.5 years strongly indicates the increasing demand for stablecoins.

USDC vs. USDT: An Overview

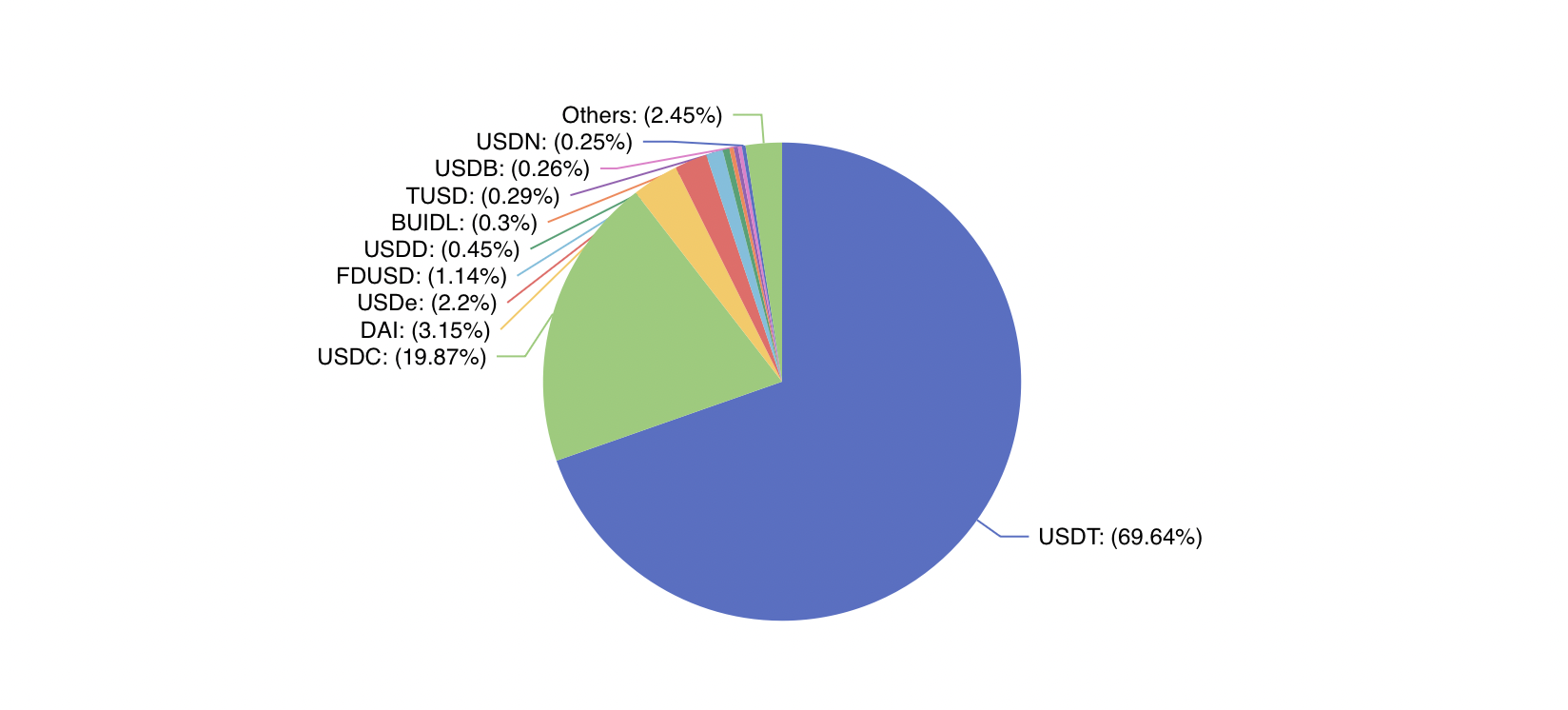

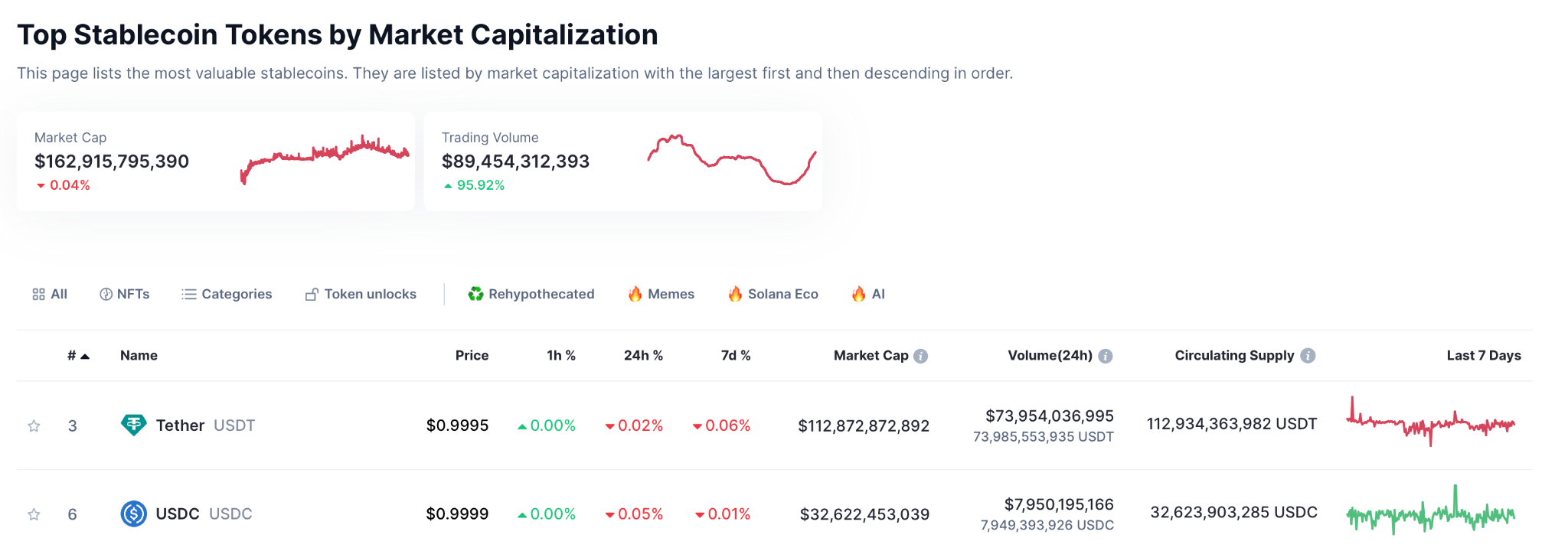

As of June 2024, the overall stablecoin market was valued at around $162 billion, out of which USDC and USDT constituted almost 90% of the valuation. Apart from USDC and USDT, the stablecoins with over $1 billion market cap are limited to DAI, FDUSD, and USDe.

Source: DefiLlama

Following the dominance and demand for USDC and USDT, a common question emerges: Which one is the best? In this article, we’ll analyze all the aspects related to USDC vs USDT to clarify any doubts or confusion you may have.

What is Fiat-Currency Backed Stablecoin?

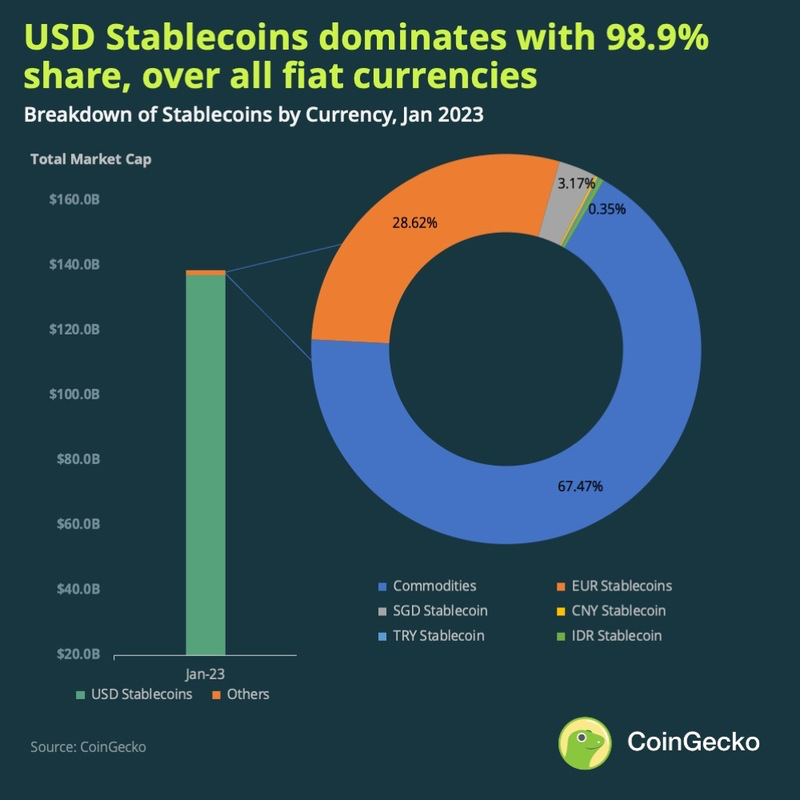

Fiat currency, or fiat-backed stablecoin, is one among different types of stablecoins where fiat currencies like the US dollar and euro are pegged. Here, the stablecoin issuers aim to maintain the unit value of the pegged traditional fiat currencies like 1$ for USD stablecoins, 1€ for EUR stablecoins, etc.

According to CoinGecko’s 2023 report, USD stablecoins constitute 98.9% of the total fiat-backed stablecoins valued at around $137 billion. EUR stablecoins, the second most available fiat-based stablecoin, are only valued at $414.7 million.

Source: CoinGecko

A company or entity mints fiat-currency backed stablecoins and supplies them through their platform or using crypto exchanges. Here, the financial reserves that back the stablecoins are held in regulated financial institutions in the form of cash, short-term deposits, cash equivalents, etc.

What are USDC Stablecoins?

USD Coin (USDC) is a US dollar-pegged stablecoin developed initially by an organization called Centre Consortium, which was founded by Circle and Coinbase in 2018. In August 2022, Centre Consortium was shut down, which provided Circle complete control over the governance and issuance of USDC tokens.

USD Coin is the second largest stablecoin based on USDC market capitalization after Tether. In March 2021, Visa allowed the usage of USDC to complete payment transactions with the support of its partner, Crypto.com.

History of USDC

- May 2018: Announcement of USD Coin stablecoin project.

- September 2018: USDC was officially launched on September 26, 2018.

- December 2019: USD Coin reached a market cap of $500 million.

- July 2020: Achieved a milestone of $1 billion within two years of its launch.

- February 2022: Surpassed $50 billion market capitalization.

- November 2023: The market cap of USD Coin fell below $24 billion from its highest market cap of over $55 billion in June 2022.

- February 2024: Discontinued USDC tokens on the TRON blockchain.

What are USDT Stablecoins?

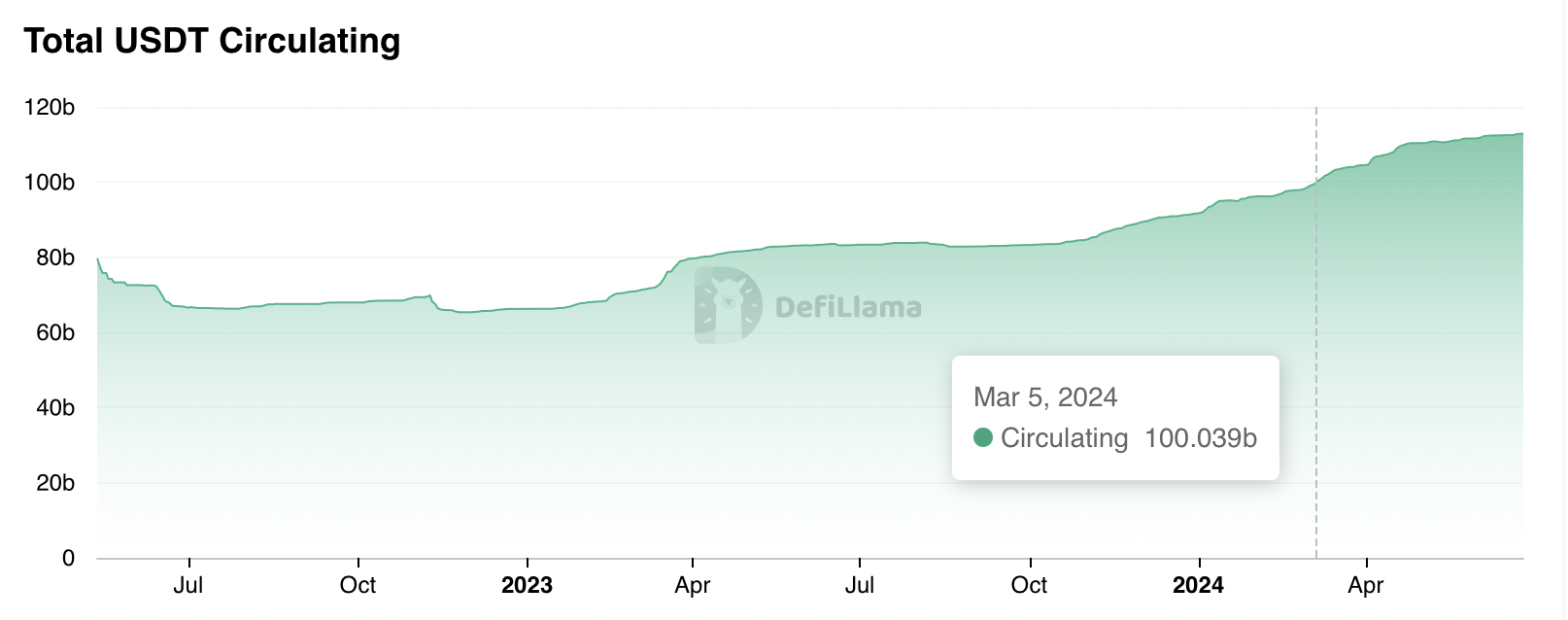

Tether (USDT) is a stablecoin that was launched in 2014 and pegged 1:1 with the US dollar to maintain its price close to one US dollar. USDT is also the first stablecoin to achieve the milestone of $100 billion in market cap in March 2024.

Source: DefiLlama

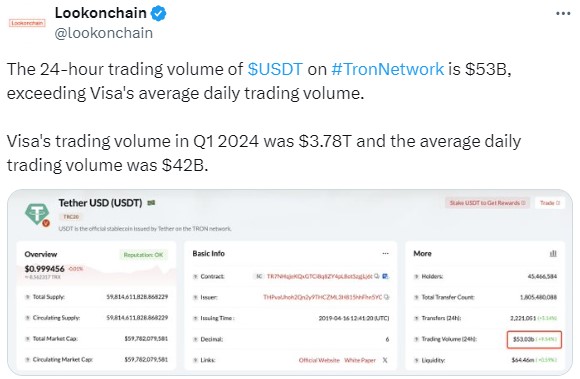

USDT is one of the crypto tokens most favored for transaction, storage, and access to dApps due to its stable nature. For example, on June 21, 2024, USDT on Tron surpassed the average daily trading volume of Visa.

Source: X

History of USDT

- October 2014: Originally launched as Realcoin by its founders Reeve Collins, Brock Pierce, and Craig Sellars.

- November 2014: Tether’s CEO Reeve Collins renamed their stablecoin to Tether (USDT).

- January 2015: USDT gets its initial listing on the Bitfinex exchange.

- April 2019: Tether Limited, along with Bitfinex exchange, faced a court order following an illegal $850 million loss cover-up.

- February 2021: Tether Limited and Bitfinex exchange agreed to pay a penalty of $18.5 million for their cover-up charges.

- April 2021: Tether reaches $50 billion market cap for the first time.

- October 2021: The Commodity Futures Trading Commission (CFTC) filed charges against Bitfinex and Tether for not maintaining 100% reserve assets as claimed and fined a penalty of $41 million.

- April 2024: Tether surpassed a $110 billion valuation on April 24, 2024.

USDT vs. USDC

Difference Between USDC and USDT

The major differences between USDC and USDT can be identified by comparing factors such as the following.

Market Dominance

Tether (USDT) was launched in July 2014, whereas USD Coin (USDC) was launched in September 2018. The earlier inception of Tether tokens, with over 4 years of existence in the market compared to USDC, has helped USDT to gain market dominance.

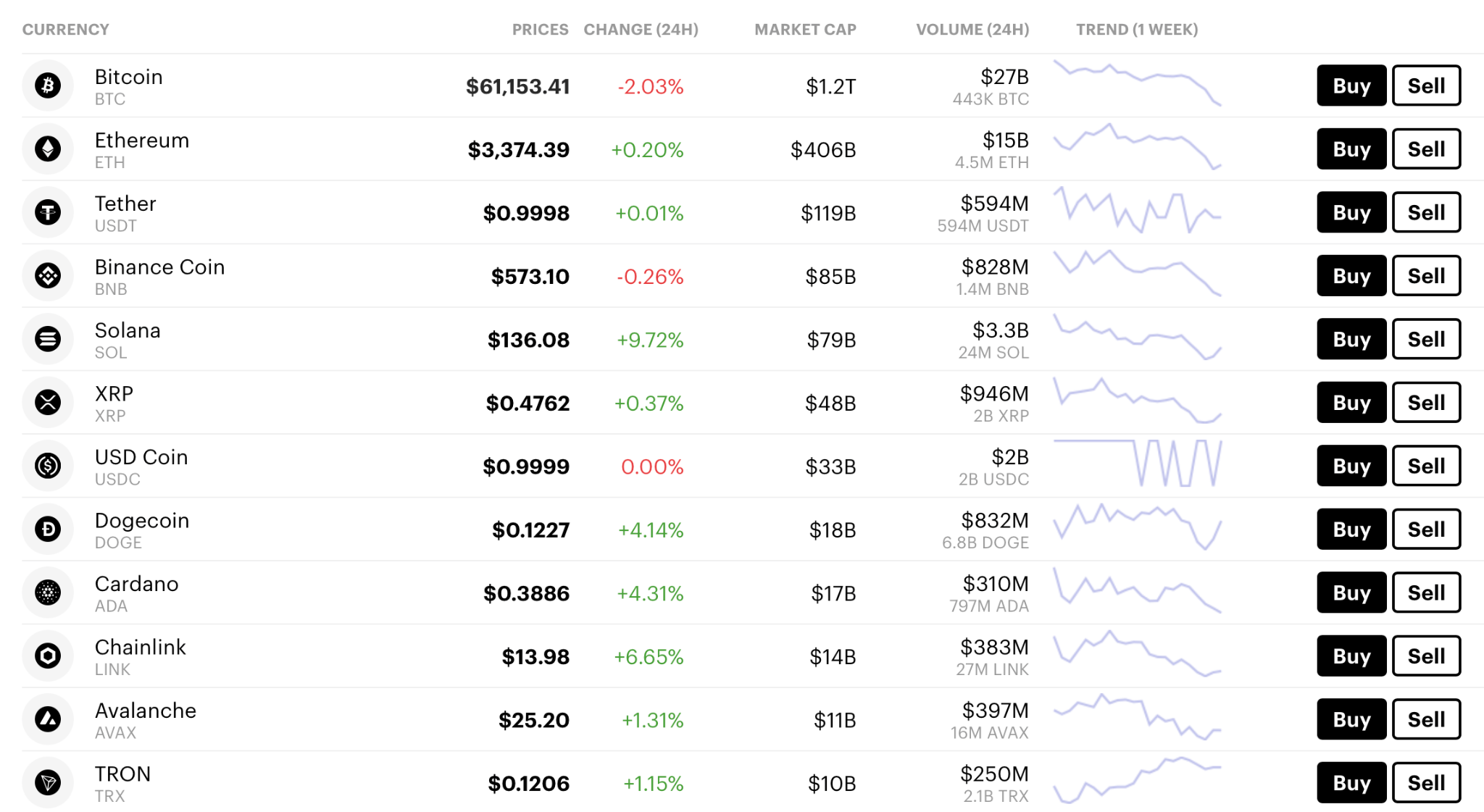

As of June 2024, the market capitalization of USDT exceeds $112 billion, compared to USDC’s market cap of approximately $33 billion. USDT dominates the total stablecoin market, representing nearly 68% of the market cap, while USDC accounts for about 20%.

Source: CoinMarketCap

Transparency

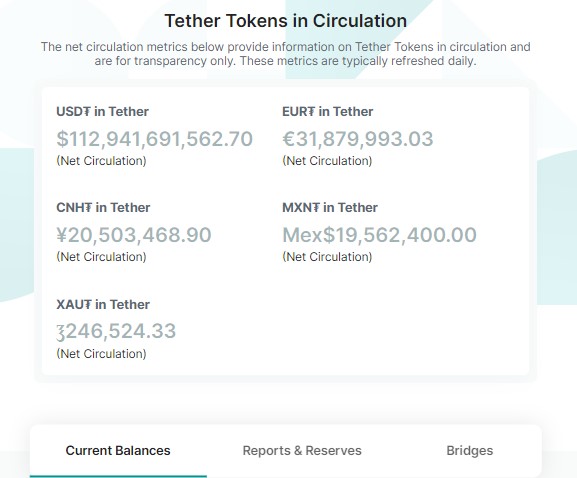

Tether has finally learned from its past asset reserve transparency-related criticisms. At present, all USDT assets, liabilities, net circulation, etc, are available on their website.

Source: Tether

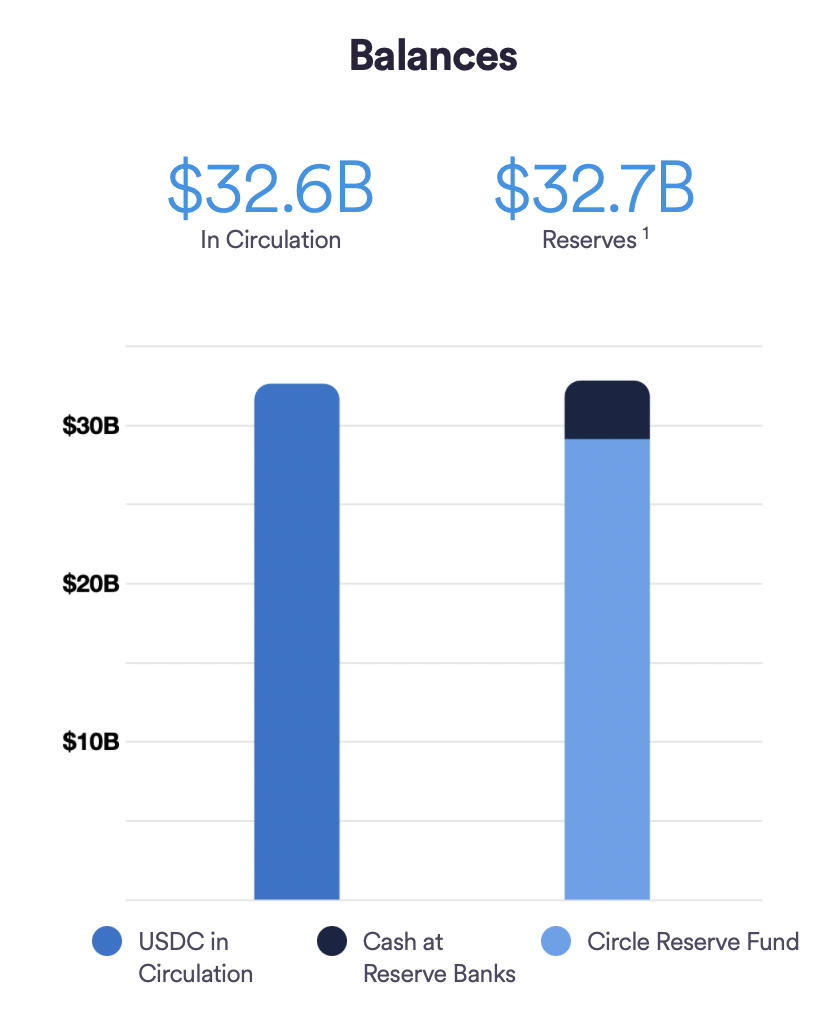

USDC has a good history when it comes to its transparency policies regarding the assets that back its stablecoin. The asset reserves composition, including the circulating value of USDC, reserve asset value, token issuance, and redemption, are provided on Circle’s website.

Source: Circle

Reserve Reports

An Italian-based independent third-party accounting firm, BDO Italia, prepares Tether’s reserve reports. These audit reports are published on their website at the end of every quarter.

Source: Tether

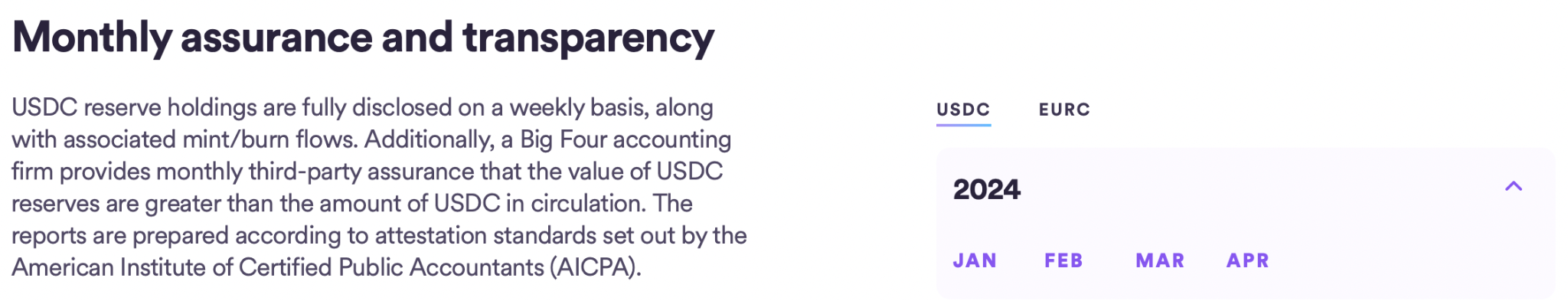

In contrast to USDT’s quarterly reports, USDC uploads its audit reports on a monthly basis. Deloitte, one of the Big Four accounting firms, conducts the audits for USDC following the American Institute of Certified Public Accountants (AICPA) standards.

Source: Circle

Reserve Holdings

Based on Tether’s report of March 31, 2024, its asset reserve exceeded its liabilities value by over $6.2 billion. USDT’s 84% of reserve breakdown is in cash, cash equivalents, and other short-term deposits, including US Treasury Bills.

According to Circle stablecoin’s report of May 30, 2024, the difference between

USDC in reserve and circulation is valued at around $51 million. The reserve assets of USDC are stored as cash in Circle Reserve Fund and regulated financial institutions, short-dated US Treasuries, etc.

Multi-Chain Support

USDT is available on 13 blockchains following its inclusion of Celo and Ton blockchains in 2024. However, Tether has ceased minting USDT tokens on Omni Layer, Kusama, and Bitcoin Cash SLP since August 2023.

On the other hand, Circle supports the minting of USDC tokens on 15 blockchains, including Ethereum, Solana, Base, and more. Circle also offered bridged USDC on Polygon PoS, which they discontinued in November 2023.

Token Redemptions

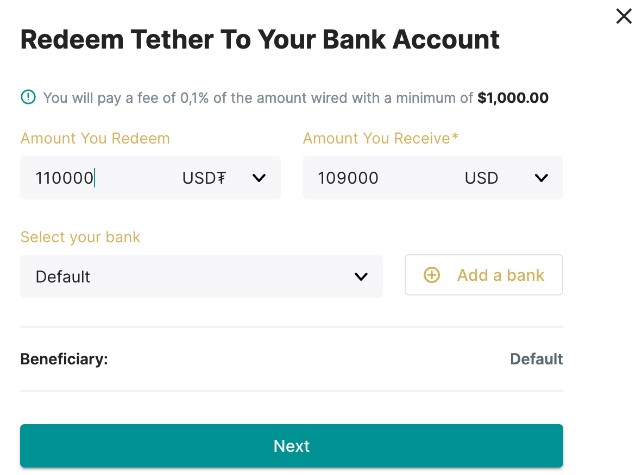

Tether provides a service to redeem USDT to underlying fiat currency into a user’s verified bank account through their website. However, here, the minimum redemption amount is set to $100,000 following Know Your Customer (KYC), Counter-Terrorist Financing (CTF), and Anti-Money Laundering (AML) verifications.

Source: Tether

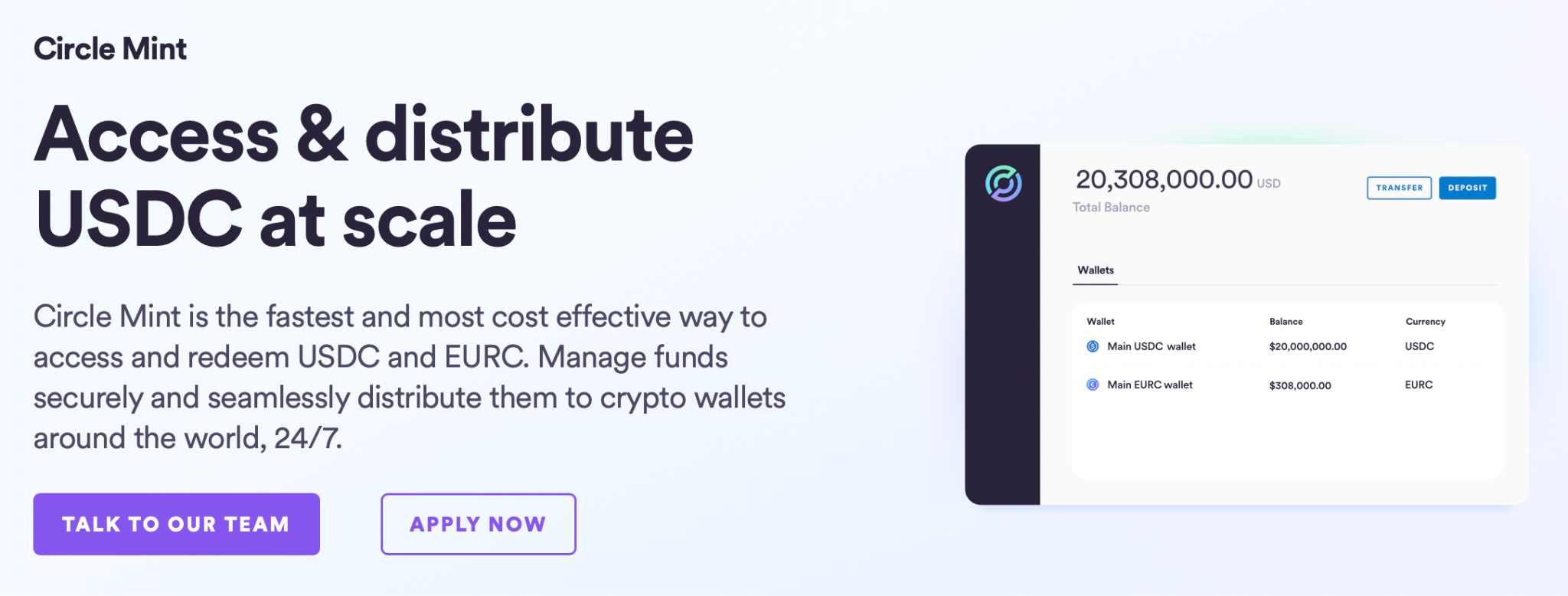

Circle used to provide USD redemption for retail consumers with a $100 minimum limit through bank wire till November 2023. At present, this service is only available for wholesale distributors, enterprise businesses, institutional traders, etc.

Source: Circle

Similarities Between USDC and USDT

Along with varied differences between USDC vs USDT, these two leading stablecoins also have some similarities:

Underlying Asset

Both USDC and USDT tokens are pegged at 1:1 to the value of the US dollar, allowing them to maintain a price of approximately $1. Moreover, these stablecoins undergo a minting and burning mechanism to balance the tokens in circulation and reserves.

Tether and Circle ensure that at least 100% of the reserve assets are kept in comparison with the circulating supply of Tether and USD Coin, respectively.

High Liquidity and Accessibility

USDC and USDT, being the top stablecoins that have been successful for years in the crypto space, have good liquidity in the market. For example, the monthly trading volume of Tether and USD Coin in June 2024 is around $1,093 billion and $103 billion, respectively.

These stablecoin giants are available for trading and investing on popular crypto exchanges like Binance, Coinbase, Curve, etc. Not just that, exchanges offer a wide range of trading pairs for USDC and USDT tokens like BTC/USDT, ETH/USDC, TON/USDT, USDC/USDT, etc.

Use Cases

Both USDC and USDT tokens can be used for:

- Hedging: During a bear market, investors can swap their digital assets, including volatile cryptocurrencies, for USDT and USDC tokens to limit value depletion.

- Trading: Investors and traders can use the liquid USDC and USDT tokens to trade to avoid high price slippage.

- Payments: USDT and USDC can be used to complete payment transactions on supported platforms.

- Global Transactions: USDC and USDT tokens facilitate instant cross-border transactions with lower fees.

USDC vs. USDT: Major Depegging Incidents

USD Coin (USDC) Depegging Incidents

- March 2023: The collapse of Silicon Valley Bank, where Circle had around $3.3 billion reserve assets backing USDC, led to the de-pegging of USD Coin. The price of USDC fell 13% on March 11, 2023, to hit $0.87 and later returned to $0.99 in two days.

Source: TradingView

- January 2024: The price of USDC momentarily fell three times on Binance on January 03, 2024, following a massive crypto market sell-off based on negative rumors around SEC’s Bitcoin ETF approval. The USD depeg occurred between 12:10 and 12:21 UTC, going as low as $0.74, and recovered back to around $1.

Source: TradingView

USDT Depegging Incidents

- May 2022: USDT depegged to a low of $0.92 on Kraken on May 12, 2022, due to a sell-off due to the collapse of stablecoin TerraUSD. However, the price went back to around $1 within a day.

Source: TradingView

- November 2022: The price of USDT fell to around $0.97 on numerous exchanges, including Coinbase, on November 10, 2022, following the FTX issue. Fortunately, the price returned to its normal price in the next few trading days.

Source: TradingView

USDT vs. USDC Price

USDT and USDC have succeeded in maintaining prices close to one US dollar for the vast majority of their time since their launch in 2014 and 2018, respectively. However, there were times when these stablecoin coins failed to maintain their peg by falling or surging their price above $1.

According to the CoinMarketCap comparing the data of USDT vs USDC price:

- USDT recorded its all-time high of $1.22 on February 25, 2015, and created an all-time low of $0.5683 on March 02, 2015.

- USDC had its all-time high of $2.35 on November 16, 2021, and on March 11, 2023, this stablecoin created its all-time low of $0.8774.

Conclusion

Tether and USD Coin undoubtedly dominate the stablecoin market, leading to debates and discussions on USDC vs USDT among crypto community members. Both these stablecoins went through several depeg incidents but strongly regained back to their $1 price level.

USDT is a good option for those who are looking for more liquid and adopted stablecoins. On the other hand, transparency and regulation seekers can use USDC tokens.

FAQ

USDC vs USDT: Which is better?

It depends on your requirements; you can opt for USDT for better liquidity and USDC for faster reserve asset updates.

Is USDC safe?

USDC is safe, considering its transparency policies and regulated asset backup. However, these factors don’t offer 100% safety assurance.

Is USDT safe?

At present, USDT offers 100% transparency related to its asset reserves, which are regularly audited. We cannot assure USDT is completely safe as it has been depegged numerous times in the past.

Is USDT the same as USDC?

No, USDT and USDC are two different stablecoins issued by Tether and Circle, respectively. Even though they are fiat currency pegged stablecoins valued at around $1, they are not the same ones.

Is USDC better than USDT?

When it comes to transparency, USDC is better than USDT. For example, USDC conducts audits on a monthly basis, whereas USDT audits are performed on a quarterly basis.

Is USDT equal to USDC?

No, even though most of the time, the value of both USDT and USDC is close to $1, the values are not always the same. For example, when the price of USDT is $0.9997, the price of USDC at the same time might be $1.0002.

How to change USDC to USDT?

You can use the “token swap” features that are available on crypto exchanges to convert USDC to USDT. To execute this swap feature, you need to have enough USDC tokens in your connected crypto wallet.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info