Cardano vs Ethereum — Which One Will Last?

There are more than 21,000 cryptocurrencies today; some were created just as a fad, and others have exciting technology behind them. Many experts also agree that not all cryptocurrencies will stand the test of time – LUNC and FTT are prime examples of this.

Bitcoin was able to establish itself as the leader of the pack and is one of those projects that are most likely to outlast others, but there are many other cryptocurrencies that have gained popularity in recent years. Two of these are Ethereum and Cardano – both promise to shape the future of finance with blockchain.

Cardano and Ethereum have unique features and use cases, so deciding which one will become a significant player in the crypto space can take time and effort.

In this article, we’ll take a look at Cardano vs Ethereum 2.0; their differences, and which one is most likely to last.

Table of contents

What is Cardano?

Cardano was created in 2015 by an Ethereum co-founder. (image source)

Cardano is another blockchain-based platform founded in 2015 (and launched in 2017) by Charles Hoskinson, who is also one of the founders of Ethereum.

It is one of the largest cryptocurrencies by market cap (among the top 10) and is considered a more secure blockchain than Ethereum.

Cardano focuses on scalability, sustainability, and interoperability. It allows developers to build much faster and cheaper applications than existing solutions such as Bitcoin or Ethereum.

It has gained a lot of attention from the crypto space due to its focus on scientific philosophy, peer-reviewed research, and development for its smart contracts.

Cardano’s native cryptocurrency, ADA (named after the famous mathematician Ada Lovelace), is used to power transactions on the Cardano network.

Interested to buy ADA? Check out Cardano real time price here.

What is Ethereum?

Ethereum is an open-source software platform based on blockchain technology that allows developers to build decentralized applications (dApps). It was first conceptualized in 2013 by Vitalik Buterin and has since become the second-largest cryptocurrency by market capitalization.

Ethereum focuses on smart contracts, a computer protocol that facilitates the exchange of digital assets or money without needing third-party intermediaries.

By introducing smart contracts, Ethereum enabled developers to create and run applications such as decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs).

Ether is the native cryptocurrency used to power the Ethereum network. Hence, you should buy ETH to participate in the Ethereum network.

Check out Ethereum price here.

Cardano vs Ethereum 2023

Both Ethereum and Cardano are strong contenders in the crypto space, and both have their own unique features. So, let’s compare Cardano vs Ethereum based on founders, development team, community, tokenomics, and more.

Founders

Cardano

Cardano was founded by Charles Hoskinson, one of the co-founders of Ethereum. As per Input-Output Hong Kong, the company building Cardano, Hoskinson studied analytical number theory before moving on to cryptography. He also enrolled in a Ph.D. program before dropping out to work on Ethereum.

Hoskinson envisioned Ethereum as a for-profit project, while Vitalik Buterin, Ethereum’s primary contributor, insisted the network remain open-source and non-profit. As a result, Hoskinson set out to build Cardano as the “third-generation” blockchain.

Ethereum

Vitalik Buterin is the founder of Etheruem. (image source)

Vitalik Buterin and Gavin Wood, in late 2013 founded Ethereum. Buterin is a Russian-Canadian programmer and co-founder of Bitcoin Magazine. He was one of the early adopters of Bitcoin and has a strong background in mathematics, economics, and computer science.

Wood is an English programmer and was the former CTO of Ethereum. He is responsible for the development of Ethereum’s virtual machine, which provides a runtime environment for smart contracts.

Buterin’s vision was to create a global, open-source platform that provides developers the means to build and deploy Decentralized Applications (DApps) instead of relying on centralized entities, such as banks or governments.

Wood developed Ethereum’s programming language, Solidity — which allows developers to code smart contracts and decentralized applications.

Development Team

Cardano

The Cardano development team is currently led by IOHK (Input-Output Hong Kong). The company was founded in 2015 by Charles Hoskinson and Jeremy Wood and is dedicated to working on the Cardano blockchain.

They employ over 400 people, including developers, engineers, mathematicians, and cryptographers. The company also has ties to the University of Edinburgh, where they collaborate on research and development.

Cardano’s development follows a rigorous scientific process based on peer-reviewed research. This ensures that the code implemented has high assurance and quality. However, it also means that Cardano will be much slower to roll out updates or new features.

Ethereum

The Ethereum Foundation, a Switzerland-based nonprofit organization, leads the Ethereum development team. The team comprises over 200 core developers and contributors from around the world.

The Ethereum Foundation’s mission is to promote and support research, development, and education to bring decentralized protocols and tools to the world.

The foundation has strong ties with academic institutions such as UC Berkeley, Stanford University, and ETH Zurich.

Ethereum focuses more on implementation after the majority of the community agrees to an Ethereum Improvement Proposal (EIP). While this approach speeds up the process of molding the network to changing times, it lowers code assurance and even increases the likelihood of soft and hard forks like that in the case of Ethereum Classic.

Architecture

Cardano

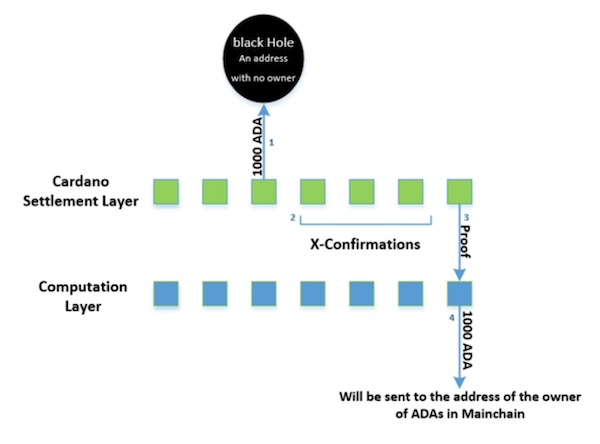

Cardano’s architecture has two layers:

- Settlement layer (SL)

- Computation layer (CL)

Cardano’s architecture can be classified into two layers. (image source)

The SL is responsible for handling transactions, while the CL oversees smart contracts.

The two layers are linked through a protocol called Ouroboros, which allows users to verify each other’s transactions without having to trust any third party. This time is divided into epochs, which are further divided into slots.

Each slot has a leader, selected through Ouroboros’ Proof-of-Stake (PoS) algorithm. Leaders are responsible for producing new blocks and validating transactions.

Currently, the architecture allows Cardano to process about 250 transactions per second. With the implementation of Hydra, a scaling solution analogous to the Bitcoin Lightning Network, Cardano could theoretically process over 1 million transactions per second.

Ethereum

Ethereum recently upgraded from a Proof-of-Work (PoW) consensus model to a Proof-of-Stake (PoS) consensus model, making it more environmentally friendly and lowering the inflation of the asset.

Soon, the network will undergo the proto-danksharding update, which will help lower transaction fees and increase throughput as more shards join the network.

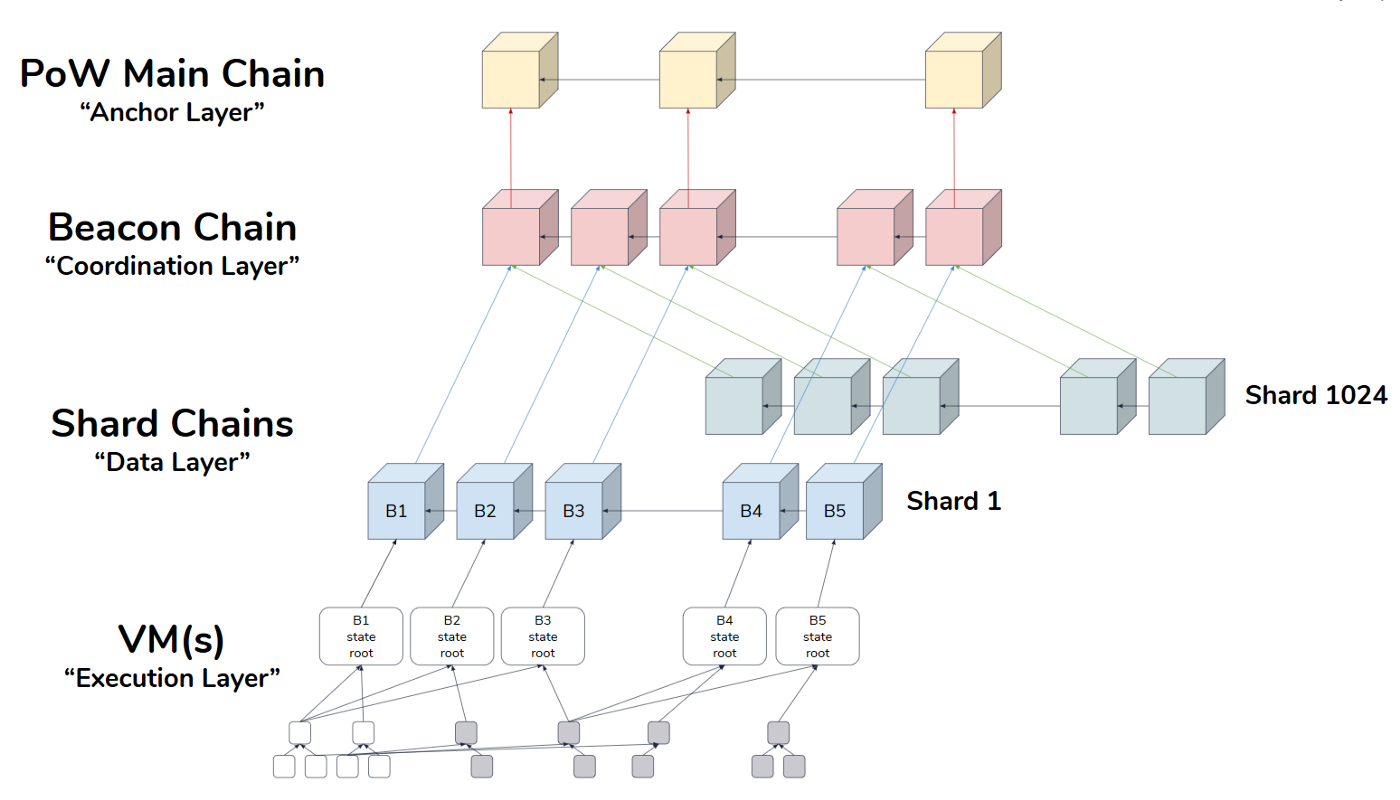

The Ethereum architecture can be broadly divided into four layers:

- Anchor layer

- Coordination layer (a.k.a. Beacon chain)

- Data layer (a.k.a. Shard chain)

- Execution layer

Etheruem’s architecture can be classified into two layers. (image source)

The first 64 shards that would be added to the network will connect to the beacon chain, which is responsible for verifying transactions. The beacon chain also serves as the primary communication channel between the shards, allowing them to stay in sync, remain secure and process about 100,000 transactions per second.

On-chain Assets

Cardano

Digital assets on Cardano are of the same type as the ADA coin. Therefore, there is no smart contract requirement to create or interact with these assets. As a result, the transaction fees are low.

Further, Cardano’s Babel Feed mechanism allows paying transaction fees in user-defined tokens (assets). This is unseen in most chains, including Ethereum, where transaction fees are paid only using the network’s native token.

Ethereum

On Ethereum, new digital assets are created using smart contracts. These tokens must adhere to the ERC (Ethereum Request for Comments) standards. ERC-20, ERC-721, and ERC-1155 are some popular asset types on the Ethereum network.

Transacting with these assets requires users to pay network fees, which is done in Ether (ETH). However, ETH by itself does not conform to any ERC standard.

To create a token on the Ethereum network, developers must deploy smart contracts. Once live, the smart contract can no longer be altered by anyone, including the creator.

ADA vs ETH

Staking Mechanism

Cardano

While both Cardano and Ethereum are based on a PoS model, there are some significant differences in the way staking is handled.

While staking is aimed at incentivizing the honest participation of validators in a PoS-based consensus network, there is no slashing (a form of penalty imposed on malicious actors in the network) in Cardano.

Users can also withdraw staked ADA at any time – there is no lock-up period. According to Cardanoscan, more than 25 billion ADA is staked, which accounts for over 55% of the maximum supply.

Cardano has one of the largest numbers of staking pools. This is because the protocol lowers staking rewards as the number of ADA staked in a pool rises. Thus, validators are incentivized to create new pools, and delegators are encouraged to stake in different pools.

Ethereum

Staking on Ethereum requires users to lock up their ETH for a specific period. The minimum staking amount is 32 ETH, and the rewards depend on the amount staked.

In addition to slashing, Ethereum also has a concept called ‘inactivity leakage,’ which penalizes inactive validators. That means validators need to be online and actively participating in the network in order to receive staking rewards.

The Ethereum network currently has over 15 million ETH staked.

The number of staking pools is much less compared to Cardano. For perspective, over 70% of staked ETH is concentrated in just five pools.

Tokenomics

Cardano

Cardano has a fixed supply of 45 billion ADA, which is created through the minting process. Of this, about 31 billion ADA was pre-mined by IOHK.

From the 31 billion ADA, about 26 billion was sold in ICOs, and about 2.5 billion remained with IOHK. The remaining 2.5 billion coins were unevenly distributed to EMURGO and the Cardano Foundation.

Ethereum

Unlike Cardano, Ethereum does not have a maximum supply of ETH. Thus it is inflationary. However, Ethereum’s gas-burning mechanism (proposed in EIP-1559) can render inflation negative (deflationary) as network activity increases.

The Ethereum Foundation pre-mined 72 million of the initial ETH supply. About 83% of the initial supply was later sold in ICOs. Currently, the total circulating supply of ETH is just over 122 million.

Concluding Ethereum vs Cardano

To conclude the Ethereum vs Cardano debate, it is safe to say that both are popular smart contract platforms and offer different features, advantages, and drawbacks.

Cardano is more beneficial when it comes to staking rewards because it offers higher rewards and no lock-up period. Meanwhile, Ethereum’s gas-burning mechanism could trigger “Flippening,” according to some.

There is no surefire way to say which of the two projects will stand the test of time. If you wish to invest in ADA or ETH, please do your own research and consider buying from Paybis when you are ready.

FAQ

Can Cardano replace Ethereum?

It’s hard to say whether or not Cardano can replace Ethereum. Ethereum has a much larger user base and is more established, while Cardano is still in its early days. However, Cardano does have some advantages over Ethereum, such as its unique proof of stake algorithm and its focus on security.

At this point, it’s probably a better idea to buy Ethereum vs Cardano. Ethereum is more established and has a larger user base, so it is likely to be more stable and have a higher value in the future. However, if you are interested in Cardano, it may be worth keeping an eye on it – it has the potential to become a major player in the cryptocurrency market.

Where does Cardano shine over Ethereum?

Cardano shines over Ethereum in a few ways. For one, Cardano has a more sustainable design and is intended to be more scalable than Ethereum. Additionally, Cardano uses a unique proof of stake algorithm that is designed to be more secure and efficient than Ethereum’s current proof of work algorithm. Finally, Cardano is also backed by some of the world’s leading experts in blockchain technology.

As such, it is quickly gaining ground on Ethereum as the go-to platform for launching new cryptocurrency projects for the masses. Therefore, you could buy ADA and hold it for the long run if you believe in its technology.

Where does Ethereum shine over Cardano?

Ethereum shines over Cardano because it has a more developed infrastructure, making it better suited for enterprise applications. For example, Ethereum has a more mature development community and offers more features such as smart contracts.

Another reason to buy ETH is that it is backed by a large and well-established company, whereas Cardano is still in its early stages of development. As such, Ethereum is likely to be more reliable and secure in the long run.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info