Chainlink Crypto Project – Why you Should Keep an Eye on it

As the market continues to recover, several new cryptocurrencies seem to experience huge growth in price and popularity. Among them is a project you have most probably heard of – Chainlink crypto. Its token, known as “LINK”, caused a massive buzz amongst traders and investors alike, helping it climb the ranks and claiming its spot in the top 10 cryptocurrencies by market cap.

But what exactly is LINK and what makes it so popular? In this article, we take a look at the fundamentals of Chainlink, its connection to the current DeFi hype, and what it means for investors.

Table of contents

- Introducing Chainlink crypto project

- Chainlink coin (LINK) recent price performance

- Why is there so much hype around Chainlink crypto?

- Does the current Chainlink price reflect its real value?

- Chainlink price prediction – How high can LINK go?

- Is it worth investing in Chainlink coin?

- How to create a Chainlink wallet

- Wrapping up

Introducing Chainlink crypto project

Chainlink is a decentralized Oracle network. It is built to support and enhance smart contracts, by allowing them to access real-world data. By solving this challenge, smart contracts are able to connect with external information to enhance both their effectiveness and security. Let’s explain this in more detail.

How does Chainlink relate to smart contracts?

For the less technical among us, smart contracts are blockchain-based agreements that execute based on a set of conditions that have been predetermined.

A good example to illustrate this is by looking at crowdfunding practices: if a number of ETH is placed into a smart contract by a particular date, the amount is released to the fundraiser – if not, then the amount returns to the donor. Since smart contracts operate on the blockchain, they are fully transparent and cannot be altered, increasing the level of trust among the participants.

For smart contracts to work, they require external information (off-chain data) to translate into the blockchain (on-chain information). The current limitations of smart contracts are primarily caused by the inability to create a common language between external data sources and blockchain-based smart contracts.

This is where Chainlink comes in. Decentralized oracle networks act as a middleman between the two parties, through a large number of nodes, making the process more reliable (more validation points) and completely transparent (blockchain). Through this process, users are able to create 3 types of smart contracts on the Chainlink network:

- Reputation contracts – determine an oracle provider’s authenticity and reliability

- Order-matching contracts – Deliver a requesting contract to Chainlink nodes and become responsible for their execution.

- Aggregating Contract – Validate data from specific oracles for more accurate results

What is the purpose of LINK token?

LINK fuels the Chainlink network in the following ways:

- To pay network fees when creating or requesting smart contracts.

- Deposit the tokens for staking purposes. The more you stake, the more likely it is to fulfill a request and thus receive the fees as a reward. This is only useful for node operators.

Additionally, you can buy, sell, and trade LINK tokens on most exchanges, and use your coins for a wide range of financial services (savings, exchange-based staking, etc.).

Chainlink coin (LINK) recent price performance

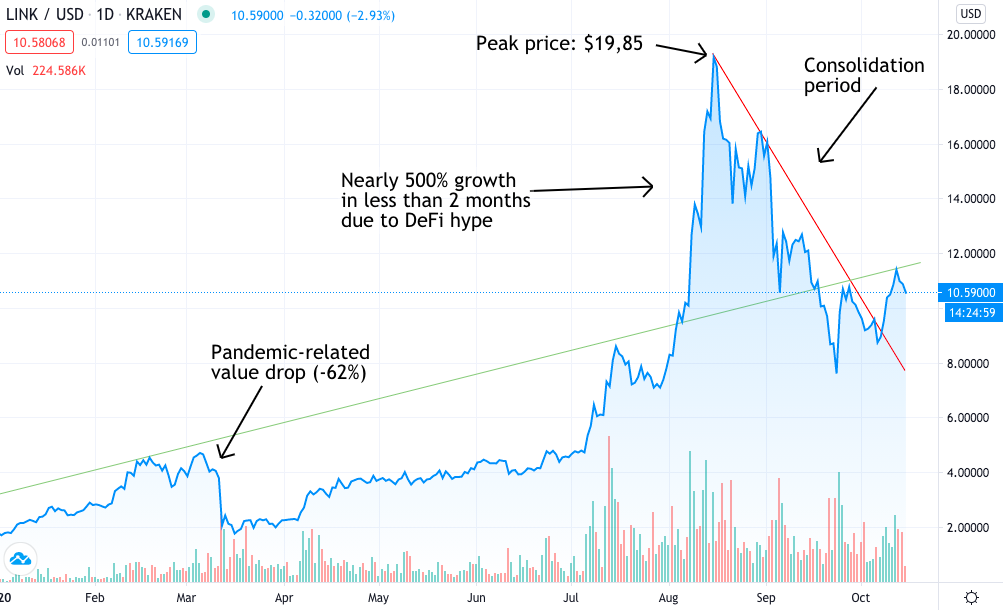

LINK has gone through a somewhat volatile period when looking at the past few months. After seemingly “exploding” in popularity, the token is now consolidating in the $10 area. The following graph offers a better overview of LINK’s performance in 2020:

By looking at the chart above, there are certain takeaways that are worth mentioning:

- Chainlink is on a long-term uptrend since November of 2019, increasing steadily in price despite its volatility over the summer.

- In the timeframe between March and July 2020, the token decreases in value and breaks the trend-line due to the pandemic-related market crash. It does, however, recover faster than most altcoins.

- From early July to mid-August we see a huge spike in trading volume, and LINK grows to a new ATH, only to drop shortly after. In the following chapters, we will delve into the reasons behind the price drop.

- LINK finds a local bottom at $8.40 in early October and has since caught up, once again, with its long-term uptrend.

Why is there so much hype around Chainlink crypto?

Chainlink is currently experiencing an uptrend due to the increase of popularity in DeFi and decentralized exchanges. The two are, after all, interconnected. Decentralized oracles are fundamental in the performance and longevity of decentralized exchanges since all trades are made through the use of smart contracts.

Due to Chainlink’s utility in the DEX space, we saw many exchange listings, a massive increase in popularity, and even the development of a loyal fanbase known as “LINK marines”. Adding to that, in August of 2020 when the market sentiment was at an all-time high, celebrity figures like David Portney discovered Chainlink and started promoting it aggressively to its millions of followers.

$link to the moon.

— Dave Portnoy (@stoolpresidente) August 15, 2020

This move naturally drove the hype to new heights and LINK’s price followed suit. At its peak, the popular cryptocurrency was worth $19.85.

Of course, for many experienced investors, peak hype signals overbought conditions. In late August, popular cryptocurrency traders took it to Twitter to argue that LINK had grown well past its intrinsic value, and new investors kept on buying the coin without understanding basic market dynamics.

LINK Marines are just new investors who don’t understand the game yet.

– They don’t know that 90% of the volume is fake.

– 70% of supply held by 9 whales.

– LINK will be below top 20 in a few months.

– LINK is a pump/dump 4chan meme.

— CryptoWhale (@CryptoWhale) August 20, 2020

This triggered a consolidation period, which caused the coin to lose 60% of its value in less than 40 days. Obviously, market sentiment plays a huge role when it comes to short-term price performance and, as the DeFi hype starts to flatten out, so does the demand for Chainlink crypto. But most crypto enthusiasts are not worried about the project’s future.

Is DeFi reaching a point of saturation?

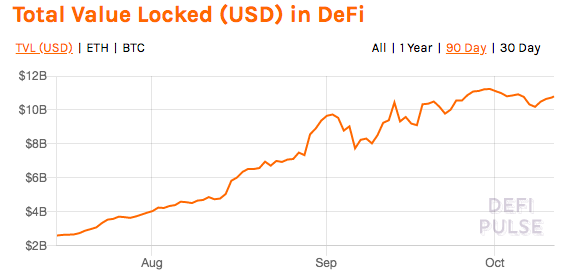

According to Defi Pulse, there is more than $10,8 billion locked in DeFi projects at the time of this writing. And, while this number is enormous by all means, the graph below indicates that we may be close to a saturation point.

For many investors, the rapid growth of DeFi echoes the ICO bubble of 2017. Even if this were to be, there is one fundamental difference: Decentralized Finance is here to stay, and so are the projects that enhance its functionality. DeFi is, by all means, the future of our economy, and will most likely keep on growing in the next few years.

For that reason, we believe that Chainlink and other oracle projects will eventually outgrow their volatility and become increasingly important in the future of our economy. At the moment of this writing, the public is bullish about LINK’s short term price performance, and the project behind it is actively trying to prove us right. In a few short months, the project has partnered with financial giants like Google, Oracle, SWIFT, and more. This array of partnerships will continue as the world “warms up” to the use of smart contracts.

Does the current Chainlink price reflect its real value?

This question is rather hard to answer. Decentralized oracle crypto projects should generate more value and become more scarce than decentralized supercomputer projects (Ethereum, EOS, etc.) over the next 10 to 20 years. However, at the time of this writing, these types of “middleman” networks are still in their infancy.

Therefore, it’s safe to assume that the value of Chainlink tokens is fundamentally correct at the time of this writing. Its exponential growth in value during 2020 is unprecedented but understandable, given its fundamentals. In the future, we expect this trend to continue.

Chainlink price prediction – How high can LINK go?

Given the estimation that Chainlink will outperform Ethereum in the long term, due to its utility and importance, we expect its token to reach and possibly surpass the market cap of ETH. At the current size of Ethereum’s market cap, and given the limited amount of LINK tokens (350m), this would take LINK to $121 per coin. To give a more concrete prediction of LINK’s price, we have broken our forecasts into three categories:

Long-term LINK prediction

We do believe that LINK’s value will be even higher than Ethereum’s current market cap since the latest will grow in the next bull market as well. When looking at the long-term future (2025 possibly?), LINK’s price could be ranging between $600-$800 at its next peak. Keep in mind that this is simply an educated guess, and should thus be taken with a grain of salt.

Mid-term LINK prediction

On the contrary, when looking at LINK’s long-term uptrend, we derive to a different conclusion. If the current upward trend continues over the next few months, we could see Chainlink’s token reaching its prior ATH (±$20) by mid-July 2021. While this is a more conservative price scenario, it offers a more realistic glimpse of the mid-term potential of the coin’s value.

Short-term LINK prediction

By the end of the year, we could see LINK climbing back towards its all-time high, or continue a more stable growth pattern. When analyzing its current price patterns, we believe that the mid-term trend line offers a better price scenario. If it were to keep on growing based on its long-term trend, the cryptocurrency would reach $13.75 by year-end. That being said, hype and positive sentiment are not taken into consideration when making this prediction, so we are cautiously optimistic about higher price targets as well.

Is it worth investing in Chainlink coin?

Given the fact that oracle networks are still in their infancy (both in utility and price), it is safe to assume that they have a lot of room to grow. Therefore, it might be best to conduct some additional research on Chainlink and make an educated decision for yourself. If you decide that an investment is in your best interest, consider creating a wallet to store your coins safely. Check the following chapter to create your wallet in under 1 minute.

How to create a Chainlink wallet

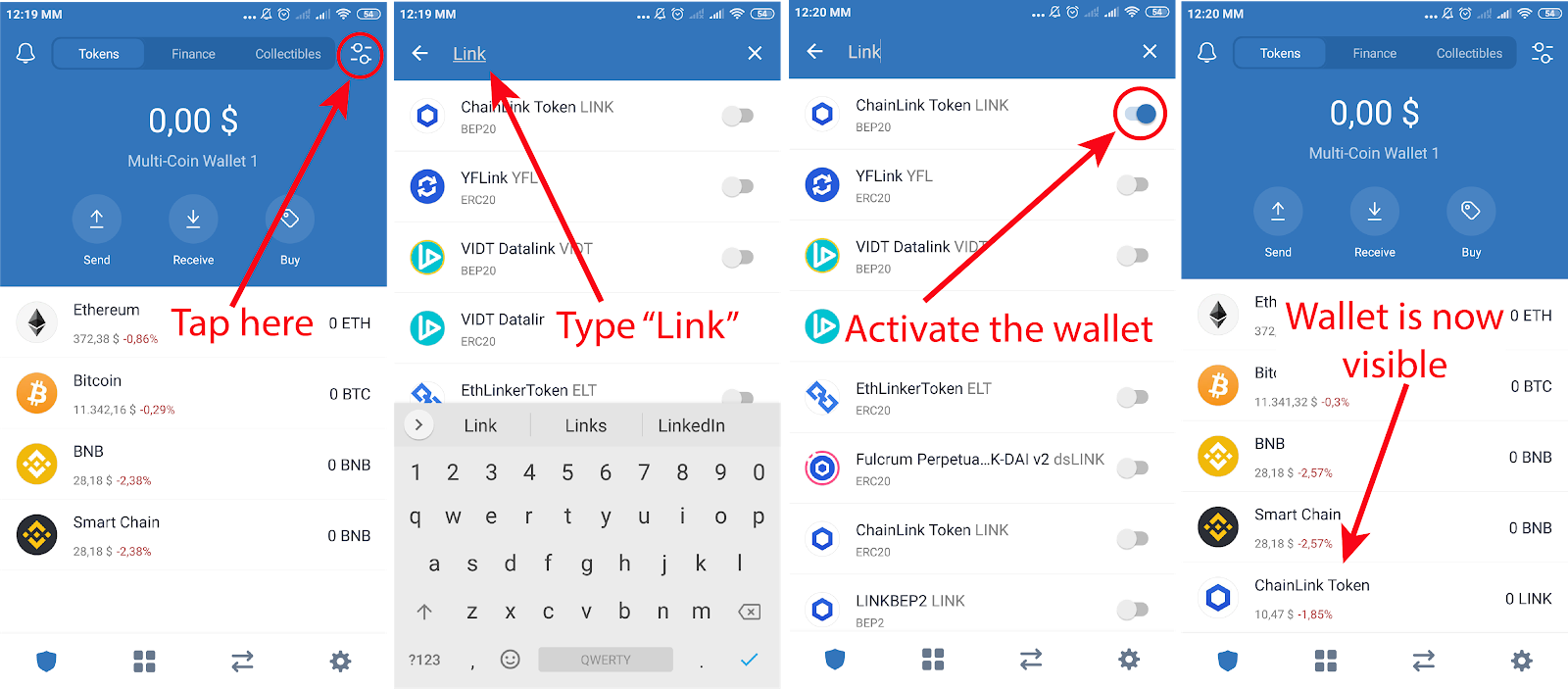

There are many options when it comes to creating Chainlink crypto wallets. However, one of the easiest options in the market, and a great one for beginners, is Trust Wallet. Simply download the app on your smartphone and follow the guidelines below:

- 1st Step: Open Trust Wallet after its installation is completed and tap on the “Settings” icon on the top-right corner.

- 2nd Step: Type “Link” in the search bar to add Chainlink to your wallet options.

- 3rd Step: Activate the wallet by tapping on the button found on the right side of your selection.

- 4th Step: You can now return the dashboard. Once there you should be able to see your Chainlink wallet. Simply tap on the wallet to request, receive, or send Link tokens.

Useful links

Wrapping up

You should now have a better idea about Chainlink and its long term potential. Here is a shortlist of the things we looked at:

- What Chainlink crypto is and how it aims to support the world of decentralized finance.

- LINK’s historic price performance and what it means for the market sentiment.

- Why Link’s value dropped after its meteoric rise.

- Our Chainlink price forecast.

- Whether or not you should invest in LINK.

- How and where to store your Chainlink crypto.

If you wish to delve deeper into the technical aspects of Chainlink and learn more about the importance of Oracles for smart contracts, make sure you check out the following Medium channel and follow LINK-related hashtag closely on Twitter and other social media platforms.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://go.payb.is/FCA-Info

Excellent article, thanks for the info

Thank you for reading!